February 10, 2010

Global Market Comments

February 10, 2010

Featured Trades: (SPX), (SDS), (BERNIE MADOFF), (CIA), (DBA), (MOO), (MON), (MOS), AGU), (POT)

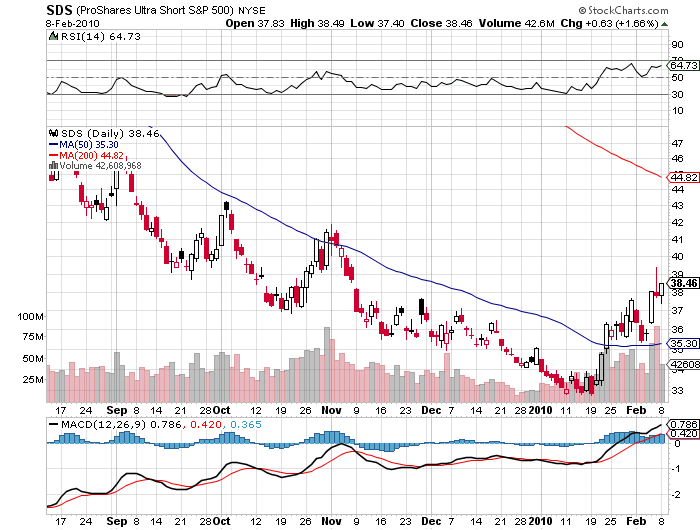

1) Note to self. Don't do your midnight pee next to the bear box. They're called that for a reason. And I'm sorry that my shouting at the hungry, six foot tall black bear standing in front of me, no doubt attracted by my Cheetos, hot dogs, and marshmallows, woke up the campers at the 57 surrounding sites. Of course it was too dark to find my bear spray. My ursine challenger eventually saw the merit of my logic that the neighbor's bacon stuffed ice chest was more appealing than me, and lumbered off into the darkness. I have successfully avoided a bear of a different sort this year, those of the stock market kind (see my January 4 Annual Asset Allocation Review piece entitled 'I'd Rather Get a Poke in the Eye with a Sharp Stick Than Buy Equities'). Never have I seen such a disconnect between the markets and the real economy. All of a sudden the world has gotten expensive. Stock prices have been levitated by vapor in a faith based rally. Cost cutting, not sales growth, has artificially boosted earnings above subterranean forecasts. Commodity prices have soared because of stockpiling and speculation, not consumption. Puzzled CEO's of many stripes are seeing no recovery in their businesses whatsoever. I have used the big up days to sell short dated out-of- the-money calls which, mercifully, expired worthless. That's because I keep my favorite quote from John Maynard Keynes pasted to my monitor, 'Markets can remain irrational longer than you can remain liquid.' Sure we're going down more, but zero interest rates won't let us crash. Date that SDS position, a 200% leveraged bet that the S&P 500 is going to fall, but don't marry it.

2) I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who had just lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky's Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the Bank of New York. This is a particularly bitter pill for Dr. Greenspan to take, because he is an internationally known authority on Ponzi schemes, and just published a book entitled Annals of Gullibility-Why We Get Duped and How to Avoid It. It is a veritable history of scams, starting with Eve's subterfuge to get Adam to eat the apple, to the Trojan Horse and the Pied Piper, up to more modern day cons in religion, politics, science, medicine, and yes, personal investments. Madoff's genius was that the returns he fabricated were small, averaging only 11% a year, making them more believable. In the 1920's, the original Ponzi promised his Boston area Italian immigrant customers a 50% return every 45 days. Madoff also feigned exclusivity, often turning potential investors down, leading them to become even more desirous of joining his club. For a deeper look into Greenspan's fascinating, but expensively learned observations and analysis, go to his website at www.stephen-greenspan.com.

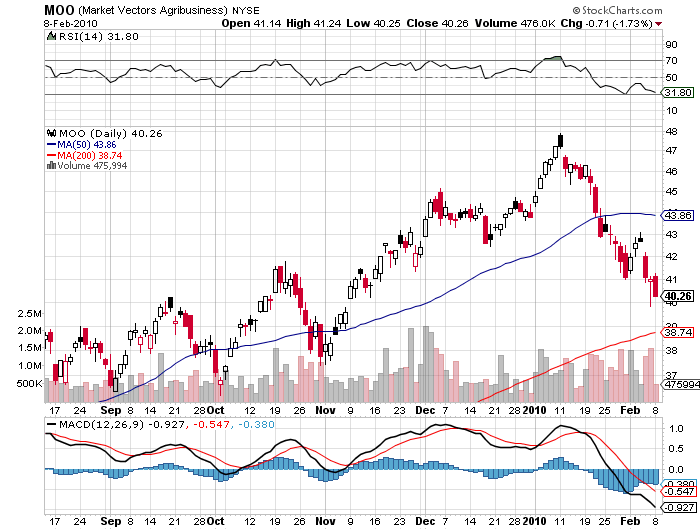

4) Lunch with the Central Intelligence Agency is always interesting, although five gorillas built like brick shithouses staring at me intently didn't help my digestion. When Panetta passed through town on his way home to heavenly Carmel Valley for the holidays, I thought I'd pull a few strings in Washington to catch a private briefing. The long term outlook for supplies of food, natural resources, and energy is becoming so severe that the CIA is now viewing it as a national security threat. About one third of emerging market urban populations are poor, or about 1.5 billion souls, and when they get hungry, angry, and politically or religiously inspired, Americans have to worry. This will be music to the ears of the hedge funds that have been stampeding into food, commodities, and energy, since March. Panetta then went on to say that the current monstrous levels of borrowing by the Federal government abroad is also a security issue; especially if foreigners decide to turn the spigot off and put us on a crash diet. I was flabbergasted, not because this is true, but that it is finally understood at the top levels of the administration and is of interest to the intelligence agencies. Job one is to defeat Al Qaeda, and the agency has had success in taking out several terrorist leaders in the tribal areas of Pakistan with satellite directed predator drones. The CIA could well win the war in Afghanistan covertly, as they did the last war there in the eighties, with their stinger missiles supplied to the Taliban for use against the Russians. The next goal is to prevent Al Qaeda from retreating to other failed states, like Yemen and Somalia. Cyber warfare is a huge new battlefront. Some 100 countries now have this capability, and they have stolen over $50 billion worth of intellectual property from the US in the past year. As much as I tried to pin Panetta down on who the culprits were, he wouldn't name names, but indirectly hinted that the main hacker-in-chief was China. I thought Panetta was incredibly frank, telling me as much as he could without those gorillas having to kill me afterwards. I have long been envious of the massive budget that the CIA deploys to research the same global markets that I have for most of my life, believed to amount to $70 billion, but even those figures are top secret. Panetta's final piece of advice: don't even think about making a cell phone call in Pakistan. I immediately deleted the high risk numbers from my cell phone address book. Better take another look at the Market Vectors agricultural ETF (DBA), their agribusiness ETF (MOO), as well as my favorite ag stocks, Monsanto (MON), Mosaic (MOS), Potash (POT), and Agrium (AGU). Accidents are about to happen in their favor.

'The next Pearl Harbor will be a cyber attack,' Said Leon Panetta, Director of the CIA.