February 16, 2010

Global Market Comments

February 16, 2010

Featured Trades: (CHINESE YUAN),

(CYB), (PLATINUM), (PPLT), (EWT)

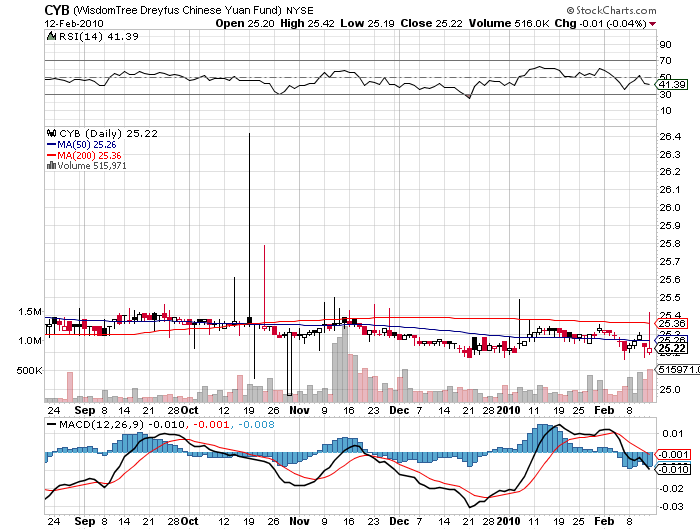

1) The Chinese Yuan is just begging for a home run. Any doubts that it is a huge screaming buy should have been dispelled last week when news came out that China had displaced Germany as the world's largest exporter. The Middle Kingdom shipped $1.2 trillion in goods in 2009, compared to only $1.1 trillion for Deutschland. The US has not held the top spot since 2003. China's surging exports of electrical machinery, power generation equipment, clothes, and steel were a major contributor. German exports were mired down by lackluster economic recovery in the EC, which has also been a major factor behind the weak euro. Sales of luxury Mercedes and BMW cars, machinery, and chemicals have cratered.

Two back to back interest rate rises for the Yuan, and a snugging of bank reserve requirements to 16% by the People's Bank of China, have stiffened the backbone of the Yuan even further. That is the price of allowing the Federal Reserve to set China's monetary policy via a fixed Yuan exchange rate. Is it possible that Obama's stimulus program is reviving China's economy more than our own?

The last really big currency realignment was a series of devaluations that took the Yuan down from a high of 1.50 to the dollar in 1980. By the mid nineties it had depreciated by 84%. The goal was to make exports more competitive. The Chinese succeeded beyond their wildest dreams. There is absolutely no way that the fixed rate regime can continue. There are only two possible outcomes. An artificially low Yuan has to eventually cause the country's inflation rate to explode. Or a global economic recovery causes Chinese exports to balloon to politically intolerable levels. Either case forces a major revaluation. Of course timing is everything. It's tough to know how many sticks it takes to break a camel's back. Talk to senior officials at the People's Bank of China, and they'll tell you they still need a weak currency to develop their impoverished economy. Per capita income is still at only $5,000, a tenth of that of the US. But that is up a lot from $100 in 1978. Talk to senior US Treasury officials, and they'll tell you they are amazed that the Chinese peg has lasted this long. How many exports will it take to break it? $1.5 trillion, $2 trillion, $2.5 trillion? It's anyone's guess. One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. In fact, the desire to prevent foreign hedge funds from making a killing in the market is a not a small element in Beijing's thinking. The Chinese Central bank governor, Zhou Xiaochuan, says he won't entertain a revaluation for the foreseeable future. The Americans say they need it tomorrow. To me, that means about six months. Buy the Yuan ETF, the (CYB). Just think of it as an ETF with an attached lottery ticket. If the Chinese continue to stonewall, you will get the token 2.2% annual revaluation the swaps have been discounting. Since the chance of the Chinese devaluing is nil, that beats the hell out of the zero interest rates you now get with T-bills. If they cave, then you could be in for a home run.

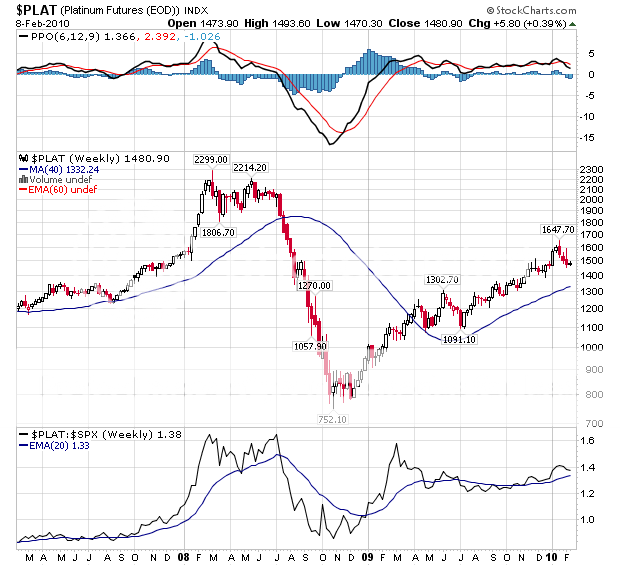

2) Since you've been romancing gold, you should check out platinum, her younger, racier, and better looking sister who wears the low riders. The white metal had a 67% pop last year, compared to the more sedentary 44% appreciation seen in gold. While gold made a hard fought all time high, Pt has to rise a further 50% from here just to match its 2008 high of $2,200, suggesting that some catch up play is in order. I have always been puzzled by the fact that platinum is 30 times more rare than gold, but at $1,480 an ounce, it trades at a mere 30% premium to the barbaric metal. You have to refine a staggering 10 tons of ore to come up with a single ounce of platinum. The bulk of the world's 210 tons in annual production comes from only four large mines, 80% of it in South Africa, and another 10% in the old Soviet Union. All of these mines peaked in the seventies and eighties, and have been on a downward slide since then. That overdependence could lead to sudden and dramatic price spikes if any of these are taken out by unexpected floods, strikes, or political unrest. While no gold is consumed, 50% of platinum production is soaked up by industrial demand, mostly by the auto industry for catalytic converters. No lesser authority than Jim Lentz, the CEO of Toyota Motors Sales, USA, told me he expects the American car market to recover from the current 11 million units to 15-16 million units by 2015. That's a lot of catalytic converters. Jewelry demand for platinum, 95% of which comes from Japan, is also strong, as the global pandemic of gold fever spreads to other precious metals. You can trade Platinum futures on the New York Mercantile Exchange, where a margin requirement of only $6,075 for one contract gets you exposure to 50 ounces of platinum worth $75,000, giving you 12:1 leverage. Email me at madhedgefundtrader@yahoo.com if you want to learn how to do this. For those who like to get physical, the US mint issues Platinum eagles from 1997-2008 in nominal denominations of $100 (one ounce), $50 (?? ounce), $25 (1/4 ounce) and $10 (1/10th ounce) denominations. Stock traders should look at the ETF (PPLT).

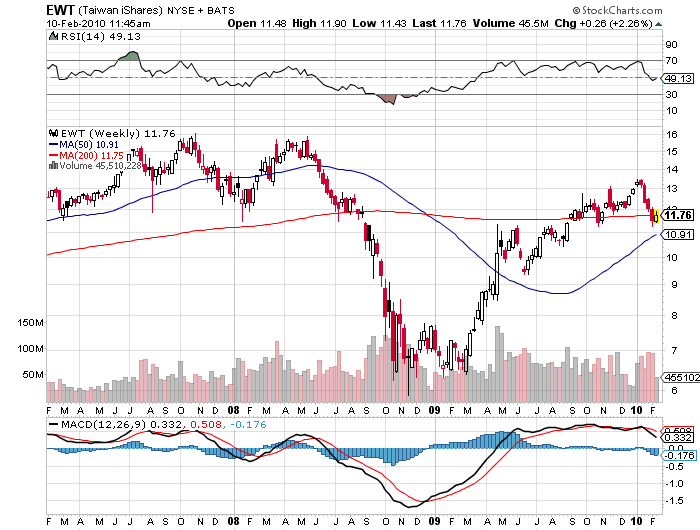

3) The handful of Chinese army officers I huddled with in the underground bunker all stared intently at their watches. Three, two, one, and then KABOOM! At exactly 12:00 noon, the blast of distant artillery sent a five inch shell screaming over our heads and exploded into the hill above us. The ground shook under our feet, causing dust to drift down from the concrete ceiling above us.?? It was 1976, and The People's Republic of China just let lose its daily symbolic protest against its errant rebellious province, known locally as the Republic of China, and to you and me, as Taiwan. Fast forward 34 years later and the Middle Kingdom is sending salvos of money raining down on that prosperous island. Last year, China Mobile (CHL), the world's largest cell phone company, bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represented the first ever direct investment from China into Taiwan. The move could trigger a takeover binge by big Chinese companies of their offshore cousins. It was only a few years ago Taiwanese businessmen suffered long prison terms for just visiting, let alone investing in China, which they have done in a major, but surreptitious way, for 30 years. Readers of this letter are well aware of my aggressive recommendations to buy emerging markets China and Taiwan since the beginning of 2009. Now you have another reason to buy both. Closer ties between China and Taiwan auger well for the stock markets of the two high growth countries. The iShares MSCI Taiwan fund ETF (EWT) at one point were up an impressive 125% from the March lows, so if you see a substantial dip it might be a good idea to double up. I guess Beijing figured out that if you can't beat them, buy them. The proxy takeover bid is mightier th

an the sword.

'A statistical model built around a normal distribution when applied to markets can be a very dangerous thing,' said David Kelly of JP Morgan.