The Potential Normalization of 2022

The last 2 years haven’t been a walk in the park for tech traders.

Before March 2020, the bull market and the trading patterns that followed were largely predictable.

Sure, there were our run-of-the-mill selloffs, but nothing like the Covid selloff of 2020.

Then the ensuing reversal that took us to new highs was a sugar high Fed-induced bounce that we are still buoying from, and that boost is largely wearing off.

As we near the end of 2021, it’s hard to believe that it’s been almost 2 years since the daily trading headline became a health care-driven headline.

There is the growing consensus that in the latter part of 2022, a synchronized global recovery story will emerge as the strongest plausible scenario.

This means that day-to-day business conditions which include international travel could revert back to what we had prior to March 2020 or a competing version of it.

I won’t get into the vaccine semantics of it, but a moderate health solution is only positive for tech stocks.

The “shelter at home” tech trade of 2020 was a one-off drawn-out event, and with normalization around the corner, we will return to the catalysts that originally drove tech shares — earnings growth, revenue growth, and financial engineering.

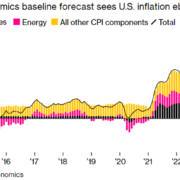

The lingering effects of this latest variant could start to wind down by early spring which will give way to the world of higher interest rates and costlier financing, but higher interest rates solving the inflation crisis.

Naturally, many things could side-swipe this scenario like another covid variant deadlier than the ones spreading around now.

If there is some iteration of normalization involved next year, a tech stock that will squarely harvest the gains from its strategic position at the intersection of the internet and remote working is accommodation sharing platform Airbnb (ABNB).

Airbnb will blast off from the biggest developing trend in the global economy today: workplace flexibility.

Like with Zoom (ZM) video conferencing tech making it possible to work from home. Airbnb makes it possible to physically work from any home, anywhere, and anytime.

While it’s not fair to draw a direct correlation from workplace flexibility to increasing Airbnb profits, it is clear that the company is poised to grow alongside the Web 3.0 revolution which will focus on decentralization, openness, and greater user utility.

As this new iteration of the internet takes hold and continues to spread, Airbnb's unique business structure will result in revenue produced from the sheer number of workers doing staycation remote working adventures.

This is a real thing.

Workers now go somewhere for a month then change their location to take in a different environment.

Riding this ongoing revolution and the steady reopening of global travel, Airbnb posted record revenue of $2.2 billion during its third quarter, which was 36% above Q3 2019.

If you want to look at the red-headed stepchild of the accommodation sharing platform services, then take a look at Booking.com (BKNG).

It’s not nearly as useful a platform as Airbnb and their exorbitant commission becomes quite prohibitive to hosts and users.

No wonder they do not grow their host volume like Airbnb.

Airbnb’s products also sell itself with the name of the company becoming a verb, while Booking.com is still reliant on spam-like internet searches using Google search to ramp up engagements.

This turns into an expensive marketing spend while Airbnb spends minimal to attract the next incremental customer.

ABNB shares have experienced a recent 20% pullback on the omicron threat, and I believe it’s a good time to start dollar cost averaging here into ABNB shares in the case that a bigger travel load 6 months from now follows through.

The upside to ABNB shares could be quite large if the business world somewhat normalizes next year because this scenario isn’t priced into ABNB shares yet.