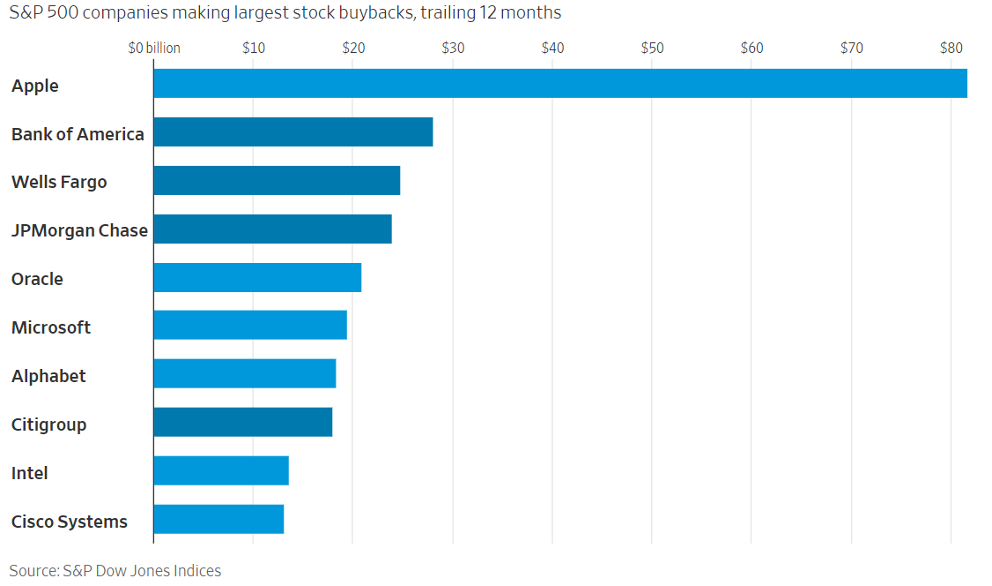

Can't Get Enough of Tech Buybacks

Another part of the tech bull case that gets overlooked is the more than $700 billion in buyback authorizations that could manifest itself in tech shares in the near term.

Right now, that buyback authorization is holding steady at $500 billion but primed to grow.

This powerful combination of shareholder returns and continuous strong earnings are likely meaningful catalysts that could take us to higher highs in technology stocks later in the year.

Certainly, we have seen a massive rotation back into growth stocks the last few weeks that have buoyed tech shares.

The likes of PayPal (PYPL) are bouncing off technical weakness.

Just take a look at Apple which is the buyback alpha male of the S&P this year and trailing 12-months.

When you consider that apart from the dividends and buybacks, they generate over $110 billion in free cash flow, it’s hard not to like the stock.

Apple itself has authorized $90 billion in buybacks and the company is the biggest in the world.

Yes, the stock underperforms sometimes, but don’t overthink this name.

Apple is easily a $170 stock with no sweat.

The iPhone maker repurchased $19 billion of stock in the March quarter, bringing the total for the past fourth quarters to around $80 billion.

Luca Maestri, the company’s chief financial officer, said in a conference call that “we continue to believe there is great value in our stock and maintain our target of reaching a net cash neutral position over time.”

That is code for many buybacks in the near to medium term and investors must love it.

Apple had $83 billion of net cash at the end of the quarter.

Apple’s aggressive stock buyback plan is one reason that Berkshire Hathaway CEO Warren Buffett is so interested in the company.

Berkshire (BRK.A and BRK.B) holds a 5% stake in Apple and is one of its largest investors.

The same thing is happening at other tech firms.

Google repurchased a record $11.4 billion of stock in the quarter, up from $8.5 billion a year earlier, and Facebook (FB) bought back $3.9 billion, triple the total a year ago.

Apple’s share count declined by almost 4% year-over-year and by over 20% since the end of 2016.

With its elevated repurchase program, Alphabet is slicing into its share count, which fell almost 2% year-over-year in the March quarter. The buybacks are comfortably exceeding Alphabet’s ample issuance of stock compensation to employees. Alphabet authorized an additional $50 billion of stock repurchases.

Facebook’s buyback program hasn’t dented its share count, which was little changed year-over-year at 2.85 billion.

Microsoft (MSFT) is making more headway, with its buyback reducing its share count by nearly 1% in the past year. Microsoft bought back about $7 billion of stock in the March quarter and $20 billion in the first nine months of its fiscal year ending in June.

Apple and Microsoft also return cash to holders through dividends, although both now have yields under 1%. Alphabet and Facebook don’t pay dividends.

Although buybacks have not yet reached pre-health crisis levels, the trend seems to be heading in that direction.

Tech firms are ratcheting up the buybacks, meaning they are comfortable expending that cash in the current economic climate as opposed to holding onto it as reserves or using it for R&D.

There is always unpredictability in the economic environment, but these tech stocks are saying, things are a lot better than 2020 and there are many CFOs out there pulling the trigger on dividends, buybacks, and reducing share count which is a highly bullish signal to the rest of the tech market.

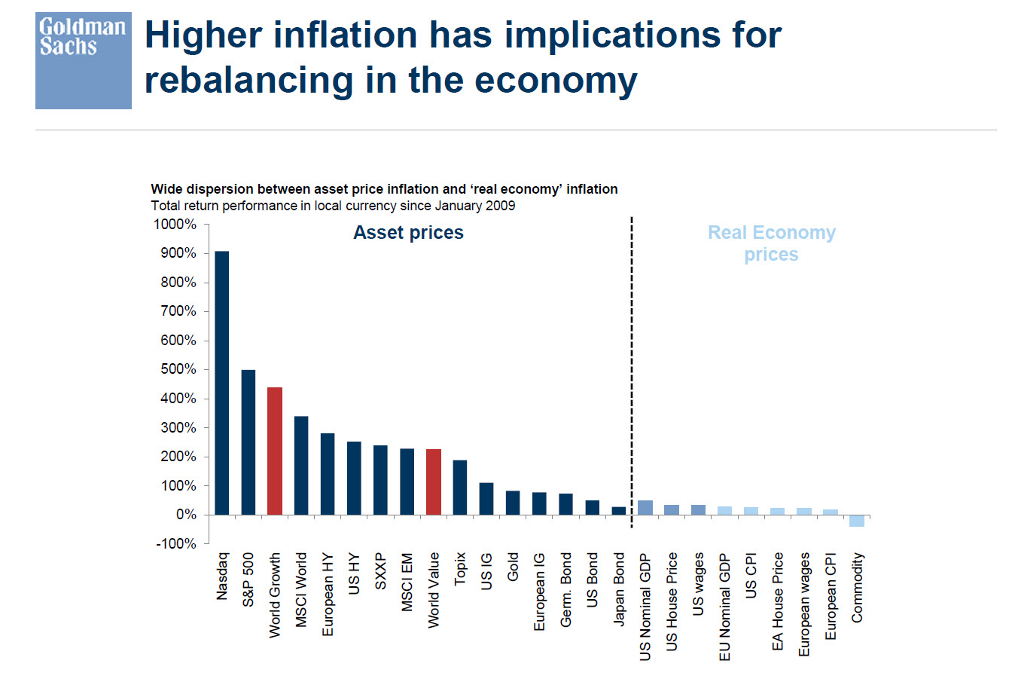

Since 2009, asset inflation has gripped global equity funds everywhere and the most convincing winner in terms of asset classes has to be the Nasdaq index which has experienced a 900% return during that 12-year time span.

You must believe that buybacks are just another reason why this overperformance of 900% has happened.

Tech is still where almost all earnings’ growth resides and that capital flow is being recycled into shareholders’ pockets and catalyzing tech CFOs to execute financial gymnastics by reducing share count.

It’s hard to discount that strength which is why there are always buyers on the dips whether that buyer is a domestic pension fund, short-term speculator, a multibillion-dollar family office, or a foreign hedge fund.