Chinese Chip Makers Closer Than You Think

Just the other day, CEO of Nvidia told the media, “China is not behind...This is a country with great capabilities. 50% of the world's best AI researchers are Chinese.”

So it’s not a surprise that Huawei is about to debut a new AI chip and will continue to foray into higher value-added products and stand toe-to-toe with the United States for technological supremacy.

Remember Huawei?

They were brutally banned from installing the best American chip technology, but like a boomerang, they have come back with even more ferocious ambition.

The Huawei chip called the Ascend 910D is still at an early developmental stage, and a series of tests will be needed to assess the chip’s performance.

Huawei hopes that the latest iteration of its Ascend AI processors will be more powerful than Nvidia’s H100.

Huawei has emerged as China’s champion in a technology field where the U.S. remains ahead. The Shenzhen-based company has developed some of the country’s most promising substitutes for Nvidia’s AI chips. It is part of Beijing’s effort to groom a self-sufficient semiconductor industry.

This year, Huawei is poised to ship more than 800,000 Ascend 910B and 910C chips to customers, including state-owned telecommunications carriers and private AI developers such as TikTok parent ByteDance.

Despite manufacturing bottlenecks, Huawei and several Chinese chip firms have already been able to deliver some products comparable to Nvidia chips and are inching closer to Nvidia’s level of expertise.

Old versions of Huawei chips have struggled to live up to their hype. The 910C was marketed to clients as comparable to Nvidia’s H100, but engineers who have used the two chips said Huawei’s performance fell short of its rival.

Huawei faces challenges in producing such chips at a significant scale. It has been cut off from the world’s largest chip foundry, Taiwan Semiconductor Manufacturing. China’s closest alternative, Semiconductor Manufacturing International, is blocked from purchasing the most advanced chip-making equipment.

Even though Chinese chips have been overhyped and fail to deliver, I do believe it is only a matter of time before they reach the same level of Nvidia.

If you remember what the first Chinese smartphones looked like, and compare them to what they are now, and you will understand that once the weight of the government supports these goals, many of them are met.

Just look at another example like EVs, Chinese EVs are some of the top EV products in the world, and they produce them for just a fraction of a Western-made EV.

This trend is here to stay, and with the Chinese government subsidizing the operation to push it over the line, many Western countries will have a hard time beating the Chinese on price and performance.

Silicon Valley innovation has slowed down considerably, and one of the obvious side effects is the Chinese catching up on the latest cutting-edge tech.

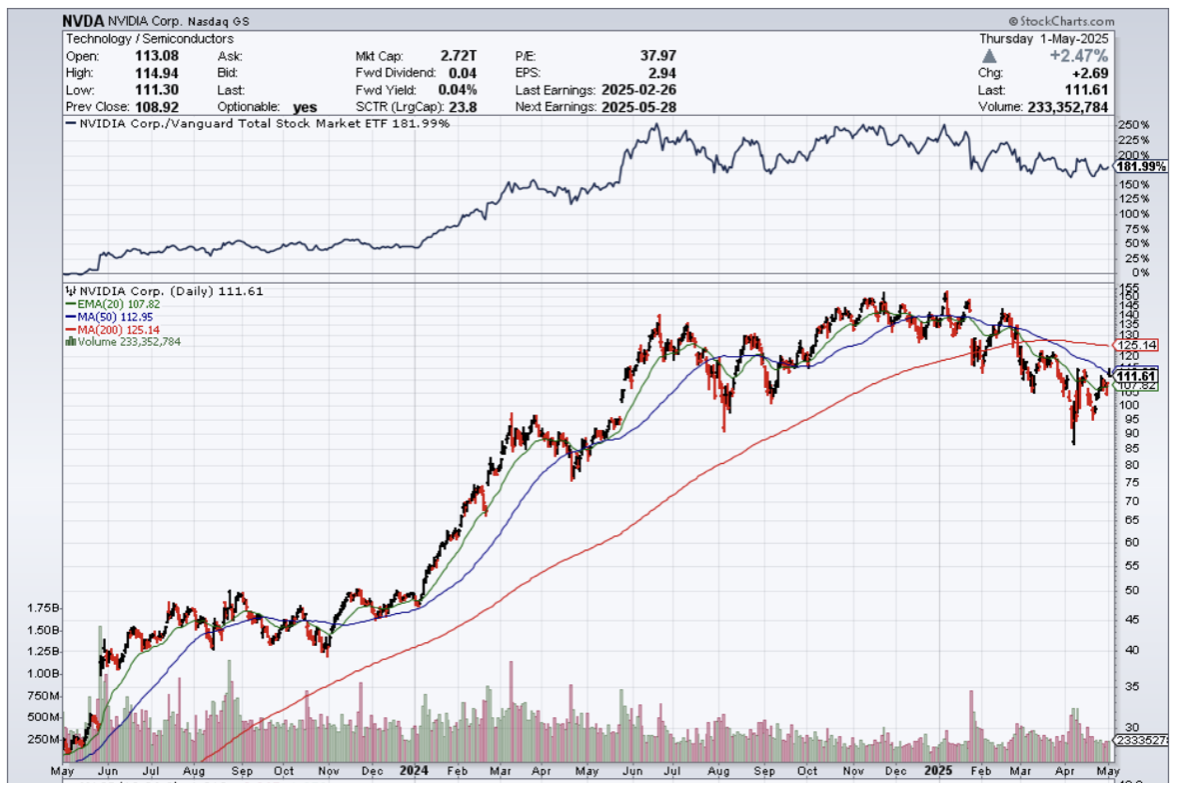

Some of this is reflected in the price of Nvidia’s stock, which has zig-zagged sideways for around the year.

Naturally, some of the stock’s weakness has to do with the volatile foreign trade policies, but a big portion of this is Chinese competition in high-end tech products.

There is a chance that we will continue to see this sideways price action in the stock, and at the very minimum, the era of breakaway growth is over for Nvidia.