I love walking around Saint Marks Square in Venice.

You have five different bands playing classical music all at the same time, the musicians dressed in white dinner jackets. Couples holding hands are enjoying the high point of their lives, making out in every corner. African immigrants are selling odd flying toys. The line at the gelato stand is a mile long.

I’ve been doing this since 1968, and my grandfather before me in 1917, and every year it’s just as intoxicating.

Only the clouds of pigeons are gone from the old days, poisoned by the Commune of Venice out of existence. I guess they were a health hazard.

The three-hour bus trip to Cortina d’Ampezzo was nothing less than hair-raising. The driver tore along roads that were maybe four inches wider than the bus, with precipitous 500-foot drops over the side. As we rose into the Dolomites, the scenery became increasingly impressive.

There used to be a cog railway that made this route the famous “Blue Train.” It was torn down in 1963 when it could no longer compete with the automobiles of a rising Italian middle class and is now a bike path. When this happened in Switzerland the government poured in massive subsidies to keep the trains running, which are now major tourist draws.

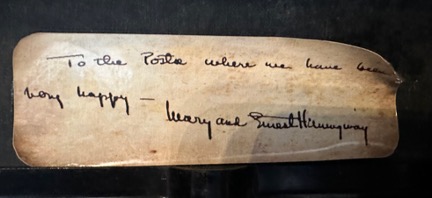

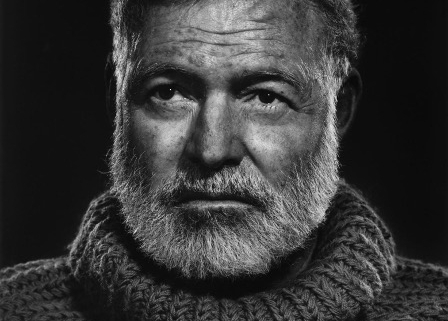

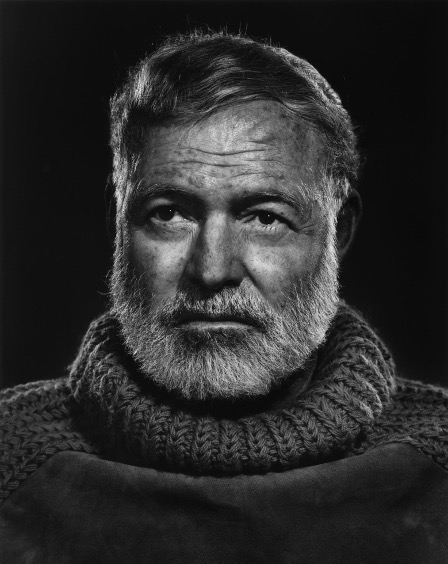

Once in Cortina, I checked into a suite that Earnest Hemmingway occupied for several months. He left behind a battered Royal portable typewriter which I used to send you a trade alert. Hopefully, some writing skills rubbed off on me.

I made the pilgrimage to Cortina to find the grave of my great uncle, a first lieutenant in the Italian army who died here in WWI. I hired a guide who took me along the front lines, and we picked up spent bullets and rifle parts at every turn. Abandoned telephone lines and barbed wire still dangled from the trees after 106 years.

On another day, I made the pilgrimage to the top of Little Lagazuoi, a massive 2,000-foot stone edifice turned into a fortress by the Austrian defenders. It is riddled with miles of tunnels so they could fire down on the Italians with devastating effect. Two reenactors dressed as Austrian and Italian soldiers gave me some local history and even let me inspect their guns.

After a week my story had gotten out and the whole town was looking for the grave of my lost lieutenant. But no luck. Out of one million Italian soldiers lost in the Great White War there we only 10,000 graves. The rest are missing in action.

On my free day, I decided to climb the most challenging of the surrounding Dolomite peaks, the Grand Torri of the Cinque Torri, or “Five Towers”. My guide interviewed me carefully first to make sure I was not just another American who had gone insane and was going to take him down with him.

My experience?

The Matterhorn seven times, Mt. Fuji in Japan four times, Mt. Whitney in California twice, and oh yes, Mt Everest, but only up to 22,000 feet where I ran out of oxygen. “Then let’s climb the Grand Torri,” said Stefano, my guide, with enthusiasm.

I have not engaged in technical rock climbing for 50 years. But it’s just like riding a bicycle, you never forget, right? Well, maybe. One problem is that I had gained 40 pounds since the last time I climbed.

Two hours later found me outfitted with a helmet, harness, and a heavy 80-foot rope clinging to a bump the size of a grape on a shear limestone face 200 feet off the ground. Stefano shouted that there was a better handhold a meter to the right. I couldn’t see it because of the curvature of the mountain face, so Stefano said “Jump”. Jump I did, and miraculously my bare hand caught the alleged outcrop.

The really hilarious thing is that while I was doing this a crowd of hikers accumulated at the base. Every time I made a death-defying leap they applauded and shouted “Bravo.”

How embarrassing!

After nine pitches we made it to the summit. I took plenty of pictures and videos along the way. But to do so I had to hold my iPhone 14 pro in my teeth while I switched from holding the rope with my right hand to my left. At a certain point, I decided I had enough video for the day and quit while I was ahead of the game and still possessed a phone.

Getting down was yet another challenge. Abseiling requires quite a leap of faith as you must lean back perpendicular to the mountain and then walk down backward as Stefano paid out a rope. One slip can lead to disaster. But an hour later I was back at the bar sharing a celebratory beer with my guide.

The next day, I rented a car and drove across the Italian Alps on the narrowest roads imaginable. But that is a story for another day.

TO BE CONTINUED.

Sending a Trade Alert from Earnest Hemingway’s Typewriter

WWI Italian Bunker

Spent Austrian Bullet

Rifle Inspection

Machine Gun Nest

My Guide Stefano

Was this Such a Great Idea?

Made it to the Top

The Celebratory Beer