The Pivot has started.

Not by the Fed, which is not expected to begin lowering interest rates by the summer or fall.

It's the stock market that has pirouetted, from bear to bull last October. The higher stocks rise in this miraculous, coming-from-nowhere rally, the more credibility this rally gains.

If a new bull market has well and truly begun, then there are an awful lot of portfolios out there that have the wrong stocks. Repositioning this late in the game could take the indexes to new all-time highs by yearend.

Some portfolio managers are whistling past the graveyard right now.

The Fed pivot may also take place ahead of schedule. The marketplace has shaved the February 1 interest rate hike from 50 basis points to only 25, which explains stocks’ recent virility.

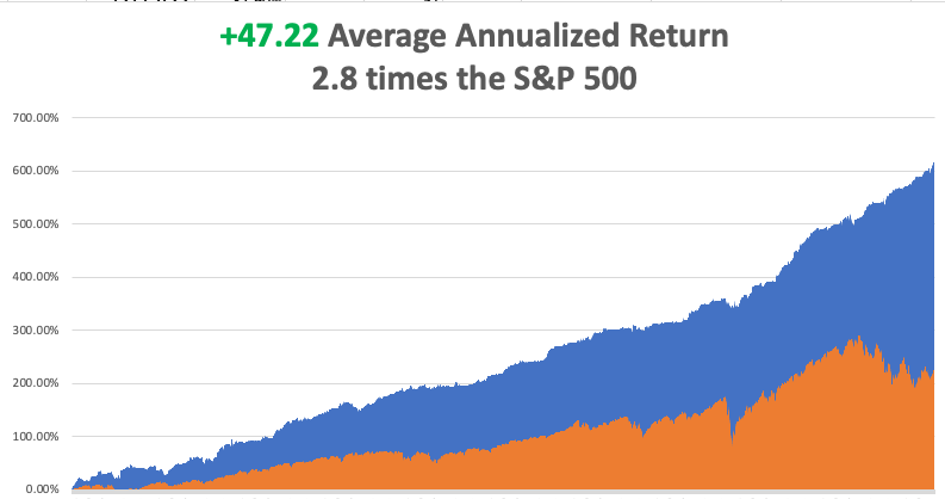

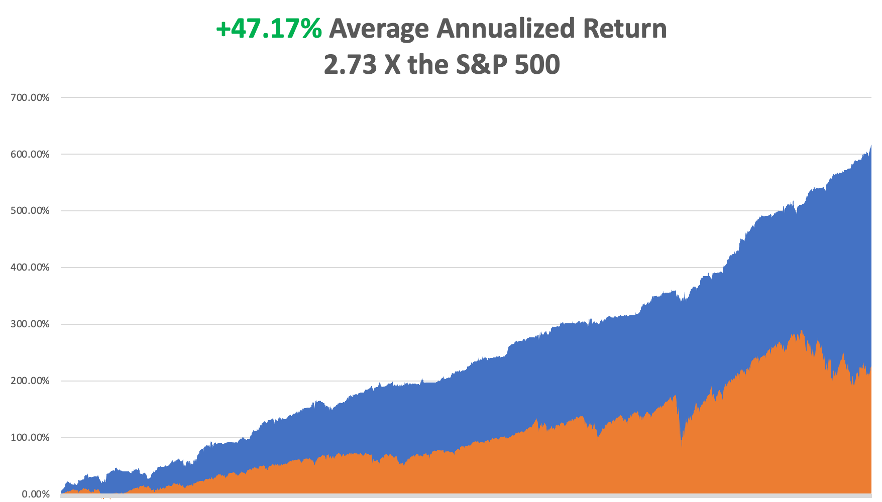

My trading performance certainly shows the possibilities, which so far has tacked on a robust +20.65%. My 2023 year-to-date performance is the same at +20.65%, a spectacular new high. The S&P 500 (SPY) is up +1.86% so far in 2023.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 15 years ago. My trailing one-year return maintains a sky high +107.27%.

That brings my 15-year total return to +617.84%, some 2.8 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +47.22%, easily the highest in the industry.

Last week, I rode into the Friday options expiration with my 5X weighting in bonds, as well as additional longs in (TSLA), (GOLD), (WPM), and (BRK/B). Both my remaining positions are profitable, including longs in (TSLA) and (OXY) with 80% cash for a 20% net long position.

Stocks are not the only asset class on a tear because of an earlier than expected Fed easing.

Precious metals have been going virtually straight up. For the first time since the US went off the gold standard 50 years ago, gold (GLD) outperformed the S&P 500 in Q4, and silver (SLV) did even better.

Not only does gold benefit from falling inflation and interest rates, the end of the Fed’s quantitative tightening (QT) will provide a further steroid shot as well.

Sanctions against Russia and China have sent central bank purchases of the barbarous relic to new all-time highs. And you might speculate that the possible Russian use of nuclear weapons is also driving your gold northward, but you would be wrong. You may find this shocking, but Ukraine has their own nukes and if Russia attacked, Moscow would be radioactive that week.

The bottom line here is that the yellow metal could well remain strong all year and be a top performer.

Bonds continued their on again, off again rally. The prospects of falling interest rates pushes them up and then fears of a summer default push them back down again, some $2.50 for the (TLT) last week.

One thing is certain. If the Treasury is pushed into default the Fed definitely WILL NOT be raising interest rates. They won’t need to crush the economy. The House of Representatives will be doing their job for them.

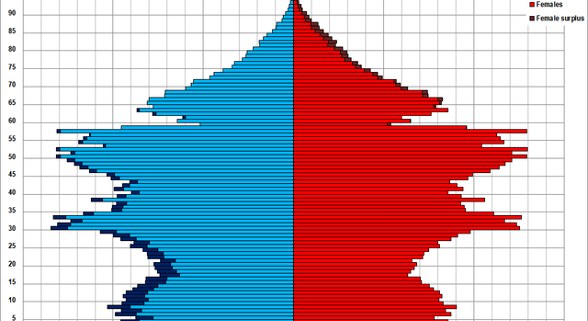

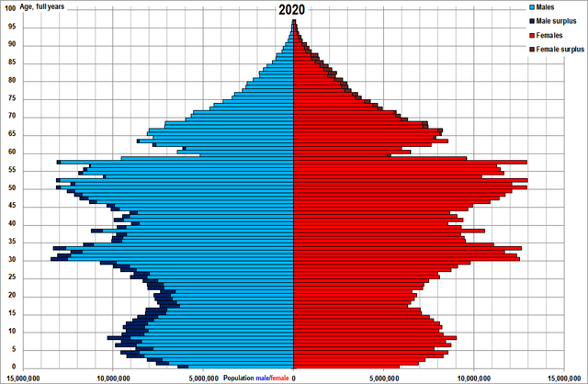

The least appreciated piece of news last week was the report that China’s population fell for the first time in 50 years, thanks to a massive famine. I remember it like it was yesterday as I was there. Believe me, there are no substitutes for food. It took me a king’s ransom and some banned western books just for me to procure a single egg.

This will affect us all as there will be a sudden shortage of customers in the global economy in about 20 years. You may think that 20 years is a long time off, but the best run companies will start planning and investing for this now.

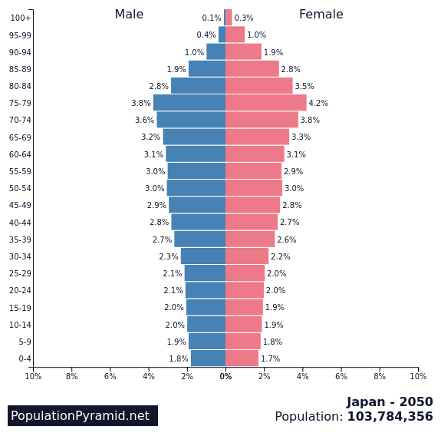

If you don’t think a shrinking population is bad for business, just ask Japan, where they’re not making Japanese anymore. Japan has suffered the worst performing stock market for the last 32 years and is still showing a negative return.

That was a nice bail!

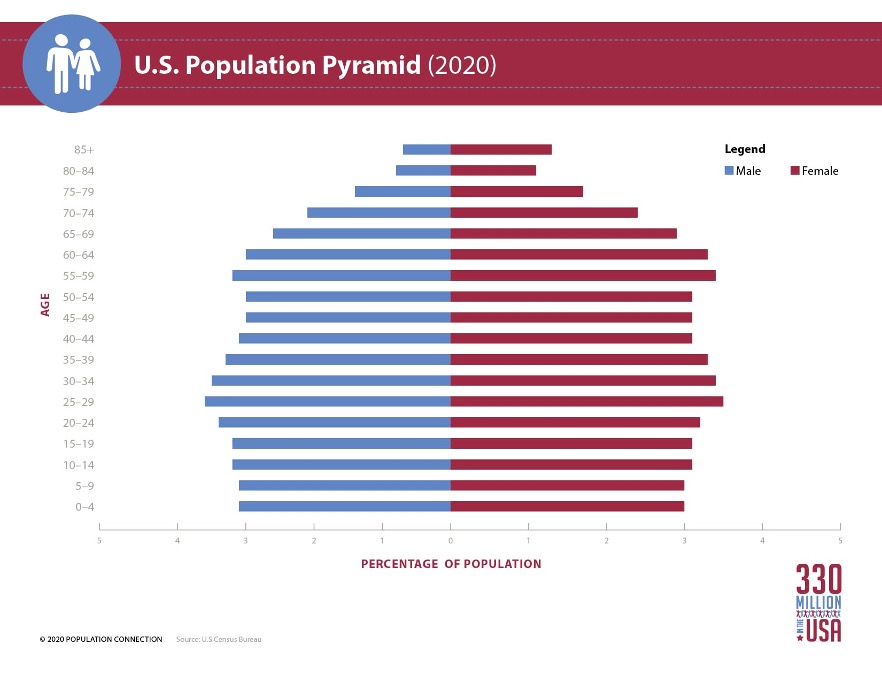

Remember, demographics is destiny. Check out the population pyramid charts below.

The Fed May Retreat to 25 Basis Point, in their February 1 rate hike, according to a Reuters poll. It might explain why stocks have been so hot in January.

Treasury Secretary Warns of Coming US Bond Default, saying the government runs out of money by June. Bonds plunged $2.00 on the news. The House of Representatives need to raise the debt ceiling before then, or the Treasury will cease paying interest on the $31.4 trillion national debt. This is for money already spent by administrations going back to the 1980’s. Rising interest rates have already taken America’s debt service from 5% to 10% of the total budget.

This Year Won’t Be as Bad as Last, or so hope the bulls that have been piling into stocks since January 3. The weakness in tech stocks actually understates the ballistic moves in value, metals, and financial stocks, which Mad Hedge is long. Things are better than they appear. That’s what six months of deflation will do.

China Reopening Accelerates and may well head off a global recession. Letting everyone get covid and achieving heard immunity turned out to be the key. It’s demolished the entire January selloff scenario.

Wholesale Prices Drop 0.5% in December versus an expected 0.1% in another big step toward the unwind of inflation. The energy sub index fell by 7.9%. I am looking like a 4% inflation rate by yearend.

Builder Sentiment Rose 4 Points in December according to the National Association of Homebuilders. It’s the first positive data point for housing in ages. Could this be the beginning of the big turn?

Mortgage Rates Plunge to 6.04% for the 30-year fixed, sparking a 28% gain week to week. A massive rally in the bond market is the big incentive, taking ten-year Treasury bonds to 6.37%, a new five month low. Inventory remains low. Mortgage rates could easily shed another 100 basis points by summer just on falling to the traditional premium over Treasuries, which is why housing stocks like (LEN), PHM), and (KBH) have been on fire.

Business Inventories up 0.4%, right in line with expectations. Retail Sales are falling, as is Consumer Spending. Department store sales were down 6.5%, once unimaginable to see during the Christmas season.

Netflix Blows it Away with 6.7 million new subscribers., taking the stock up 7%, and 125% from the May low. It’s proof that the FANG’s are not dead yet and that the predicted Q4 earnings shortfall may be overstated. CEO Reed Hastings semi-retires. Don’t touch (NFLX) as this train has left the station. There are better fish to fry.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, January 23 nothing of note is announced. Baker Hughes (BKR) reports earnings from the oil patch.

On Tuesday, January 24 at 8:45 AM EST, the S&P Global PMIs for December is out. Johnson & Johnson (JNJ) and Microsoft (MSFT) report earnings.

On Wednesday, January 25 at 7:30 AM, the Crude Oil Stocks are announced. Tesla (TSLA) and Boeing (BA) report earnings.

On Thursday, January 26 at 8:30 AM, the Weekly Jobless Claims are announced. Retail Sales for November are printed. We also get US Q4 GDP. Visa (V) and Intel (INTC) report earnings.

On Friday, January 27 at 5:30 AM, the Personal Income & Spending for December is disclosed. American Express (AXP) and Chevron (CVX) report earnings. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, I didn’t know what to expect when I landed on the remote South Pacific Island of Yap in 1979, one of the Caroline Islands, but I was more than pleasantly surprised.

Barely out of the Stone Age, Yap lies some 3,000 miles west of Hawaii. It was famed for the ancient lichen covered stone money that dotted the island which had no actual intrinsic value.

The value was in the effort that went into transporting them. With some cylindrical pieces larger than cars, geologists later discovered that they had been transported some 280 miles by outrigger canoe from the point of origin sometime in the distant past. Since Yap had no written language, there are no records about them, only folktales.

I often use the stone money of Yap as an example of the arbitrariness of fiat money. Who’s to say which is more valuable; a 500-pound piece of rock or a freshly printed $100 Benjamin from the US Treasury?

You decide.

The natives were a gentle and friendly people. They wore grass skirts purely for the benefit of Western visitors. They preferred to walk around as nature made them.

There was no hotel on the island at the time, so I was invited to stay with a local chief (picture below).

One of my hosts asked if I was interested in seeing a Japanese zero fighter. Yap wasn’t invaded by the US during WWII because it was bypassed by MacArthur on his way to the Philippines. The Japanese troops were repatriated after their war, but most of their equipment was left behind. It was still there.

So it was with some anticipation that I was led to a former Japanese airfield that had been abandoned for 35 years. There, still in perfect formation, was a squadron of zeroes. The jungle had reclaimed the field and several planes had trees growing up through their wings.

The natives had long ago stripped them of anything of value, the machine guns, nameplates, and Japanese language instruments. But the airframes were still there exposed to the elements and too fragile to move.

During my stay, I came across an American Peace Corp volunteer desperate for contact with home. A Jewish woman in her thirties, she had been sent there from New York City to teach English and seemed to have been forgotten by the agency.

I volunteered for the Peace Corps. myself out of college, but it turned out they had no need of biochemists in Fiji, so I was interested in learning about her experience. She confided in me that she had tried wearing a grass skirt to blend in but got ants on the second day. We ended up spending a lot of time together and I got a first-class tour of the island.

Suffice it to say that she was thrilled to run into a red-blooded American male. I wish I had taken a picture of her, but the nearest color film processing was back in Honolulu, and I had to be judicious in my use of film.

The highlight of the trip was a tribal stick dance put on in my honor around an evening bonfire among much yelping and whooping. It was actually a war dance performed with real war clubs and their furiousness was impressive.

I had the fleeting thought that I might be on the menu. Cannibalism had been practiced here earlier in the century. During the war when starvation was rampant, several of the least popular Japanese soldiers went missing, their bodies never found. When men come screaming at you with a club in the night, your imagination runs wild.

Alas, I could only spend a week on this idyllic island. I was on a tight schedule courtesy of Air Micronesia, and deadlines beckoned. Besides, there was only one plane a week off the island.

It was on to the next adventure.

A Few New Friends

Large Denomination Stone Money

My Accommodation

A Neglected Japanese Zero

China

Japan

US