Not a day goes by without a reader asking me what is the next stock ten, hundred, or thousand bagger. After all, I nailed the 295X move in Tesla (TSLA) starting in 2010.

Can’t I do better?

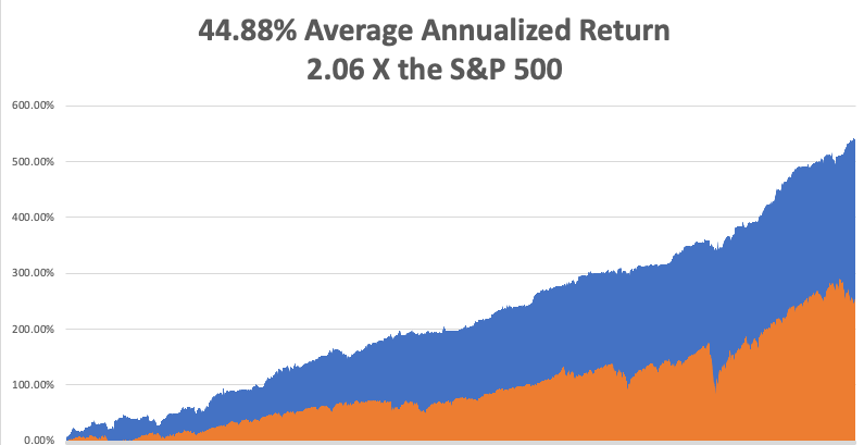

Well actually, I can, which is the purpose of the Diary of a Mad Hedge Fund Trader. There are many potentially Google (GOOG), Amazon (AMZN) and Apple (AAPL) sized opportunities out there today. It’s just a matter of time they become public and investable.

One thing I will tell you today is that they will have some or all of the following gale force tailwinds below. These will turbocharge the value of everything you own now, as well as anything new you might pick up going forward.

The future is happening fast!

1) People are Getting Richer, as the middle-income population continues to rise worldwide. That means more customers for everything, and astronomically greater earnings for the companies inventing and selling them. Every day goods and services (finance, insurance, education, and entertainment) are being digitized and becoming fully demonetized, available to the rising billion on mobile devices. Thank the convergence of high-bandwidth and low-cost communication, ubiquitous AI on the cloud, growing access to AI-aided education, and AI-driven healthcare.

2) And they are Communicating with Each Other More. The deployment of both licensed and unlicensed 5G, plus the launch of a multitude of global satellite networks (Starlink, OneWeb, Viasat, etc.), allow for ubiquitous, low-cost communications for everyone, everywhere, all the time––not to mention the connection of trillions of devices. And today’s skyrocketing connectivity is bringing online an additional 3 billion individuals, driving tens of trillions of dollars into the global economy and into the pockets of shareholders. Thank the convergence of low-cost space launches (Space-X), hardware advancements, 5G networks, artificial intelligence, a new generation of materials science, and exponentially surging computing power.

3) Your Lifespan Will Increase by at Least Ten Years. A dozen game-changing biotech and pharmaceutical solutions (currently in Phase 1, 2, or 3 clinical trials) will reach consumers this decade as covered by the Mad Hedge Biotech & Healthcare Letter (click here for the link). Technologies include stem cell supply restoration, senolytic or age-related medicines, a new generation of Endo-Vaccines, GDF-11, and supplementation of NMD/NAD+, among several others. And as machine learning continues to mature, AI is set to unleash countless new drug candidates, ready for clinical trials. Thank the convergence of genome sequencing, CRISPR technologies (CRSP), AI, quantum computing, and cellular medicine.

4) More Capital for Everything Will Become Abundant. Over the past few years, humanity hit all-time highs in the global flow of seed capital, venture capital, and sovereign wealth fund investments. It is expected to continue its overall upward trajectory. Capital abundance leads to the funding and testing of "crazy" entrepreneurial ideas, which in turn accelerate innovation. Already, $300B in crowdfunding is anticipated by 2025, democratizing capital access for entrepreneurs worldwide. And even during a pandemic (2020), the world deployed more venture capital than ever before, handily beating out the last high-water mark in 2019. Thank global connectivity, dematerialization, demonetization, and democratization.

5) Distribution is Becoming Vastly Easier. The combination of Augmented Reality (yielding Web 3.0, or the Spatial Web) and 5G networks (offering lighting fast 100Mb/s - 10Gb/s connection speeds) will transform how we live our everyday lives, impacting every industry from retail and advertising, to education and entertainment. Consumers will play, learn and shop throughout the day in a newly intelligent, virtually overlaid world. This is where technologies like SpatialWeb.net, Vatoms (new digital connections between products and customers), and Apple’s (AAPL) next-generation AR & VR headsets will shine. Thank hardware advancements, 5G networks, AI, materials science, and surging computing power.

(6) Everything is Getting Smarter: The price of specialized machine learning chips is dropping rapidly with a rise in global demand. Imagine a specialized $5 chip that enables AI for a toy, a shoe, a kitchen cabinet? Combined with the explosion of low-cost microscopic sensors and the deployment of high-bandwidth networks, we’re heading into a decade wherein every device becomes intelligent. Your child’s toy remembers her face and name. Your kid's drone safely and diligently follows and videos all the children at the birthday party. Appliances respond to voice commands and anticipate your needs. Thank AI, 5G networks, and more advanced sensors.

(7) Artificial Intelligence is Getting Smarter than We are. Artificial intelligence will reach human-level performance this decade (by 2030). Through the 2020s, AI algorithms and machine learning tools will be increasingly made open source, available on the cloud, allowing any individual with an internet connection to supplement their cognitive ability, augment their problem-solving capacity, and build new ventures at a fraction of the current cost. Thank global high-bandwidth connectivity, neural networks, and cloud computing. Every industry, spanning industrial design, healthcare, education, and entertainment, will be impacted.

(8) AI is Becoming a Service: The rise of “AI as a Service” (AIaaS) platforms will enable humans to partner with AI in every aspect of their work, at every level, in every industry. AI’s will become entrenched in everyday business operations, serving as cognitive collaborators to employees—supporting creative tasks, generating new ideas, and tackling previously unattainable innovations. In some fields, partnership with AI will even become a requirement. For example: in the future, making certain diagnoses without the consultation of AI may be deemed malpractice. And try trading stocks today without AI behind you. Thank increasingly intelligent AI, global high-bandwidth connectivity, neural networks, and cloud computing.

(9) Software Will Become an Integrated Part of Our Lives. As services like Alexa, Google Home, and Apple Homepod expand in functionality, such services will eventually travel beyond the home and become your cognitive prosthetic 24/7. Imagine a secure software shell that you give permission to listen to all your conversations, read your email, monitor your blood chemistry, etc. With access to such data, these AI-enabled software shells will learn your preferences, anticipate your needs and behavior, shop for you, monitor your health, and help you problem-solve in support of your mid- and long-term goals. Thank increasingly intelligent AI, neural networks, and cloud computing.

(10) Energy Will Become Effectively Free when compared to today’s all-in costs. Continued advancements in solar, wind, geothermal, hydroelectric, small nuclear, and localized grids will drive humanity towards cheap, abundant, and ubiquitous renewable energy. The price per kilowatt-hour will drop below 1 cent per kilowatt-hour for renewables, just as storage drops below a mere 3 cents per kilowatt-hour, resulting in the elimination of fossil fuels globally. And as the world’s poorest countries are also the world’s sunniest, the democratization of both new and traditional storage technologies will grant energy abundance to those already bathed in sunlight. We are also on the cusp of many breakthroughs in fusion power at nearby Lawrence Livermore Labs as capital, new materials, and entrepreneurs pour in this arena. Thank materials science, hardware advancements, AI/algorithms, and improved battery technologies.

I just thought you’d like to know.