Global Market Comments

March 1, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAKE UP CALL),

(TLT), (JPM), (BAC), (C), (MS), (GS),

(JNJ), (AAPL), (FB), (AMZN), (GOOGL)

Global Market Comments

March 1, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WAKE UP CALL),

(TLT), (JPM), (BAC), (C), (MS), (GS),

(JNJ), (AAPL), (FB), (AMZN), (GOOGL)

This was the week the stock traders learned there was such a thing as a bond market. They know this because it was bonds that completely demolished their stock trading books.

Suddenly, markets went from zero offered to zero bid. Many strategists labored under the erroneous assumption that ten-year US Treasury yields would never surpass 1.50% in 2021. Yet, here we are only in March and it’s already topped 1.61%. It’s become the one-way trade of the year.

The bond market seems to be discounting an imminent runaway inflation rate. But at a 1.4% annual figure, it's nowhere to be seen, not with 20 million unemployed and Main Streets everywhere looking like ghost towns.

I still believe that technology is evolving so fast, hyper-accelerated by the pandemic, that it will wipe out any return of inflation. I will not believe in inflation until I see the whites of its eyes, to paraphrase Colonel William Prescott at the Battle of Bunker Hill.

Of course, it is I who has been screaming from the rooftops about the coming crash of the bond markets, since March 20. Being short the bond market has been one of my most profitable trades of 2020 AND 2021. If I am annoyed by anything, it happened too fast, depriving me several more round trips a slower crash would have permitted.

When you have to own stocks, make them financials (JPM), (BAC), (C), which benefit from rising rates. Their loan rates are rocketing while their cost of money is fixed at the Fed overnight cost of funds at 0.25%. Trading volumes at the brokers (MS), (GS) are through the roof, especially for options traders.

It is all a perfect money-making machine. At least, the stock market thinks so.

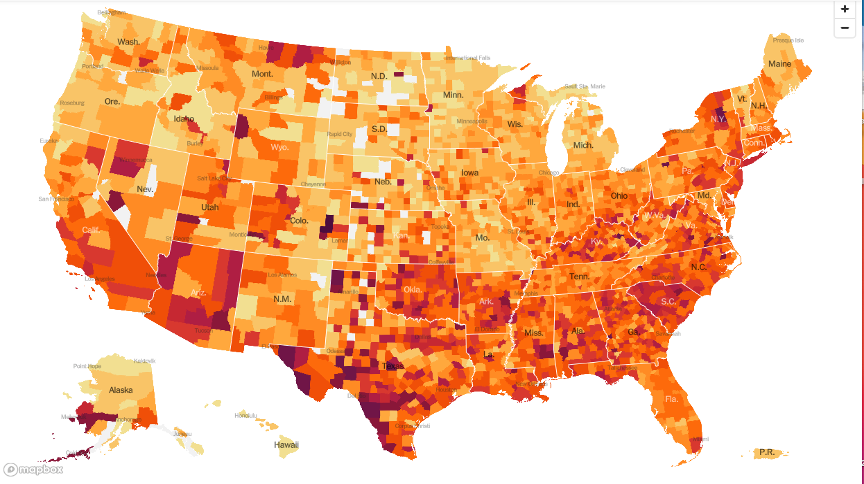

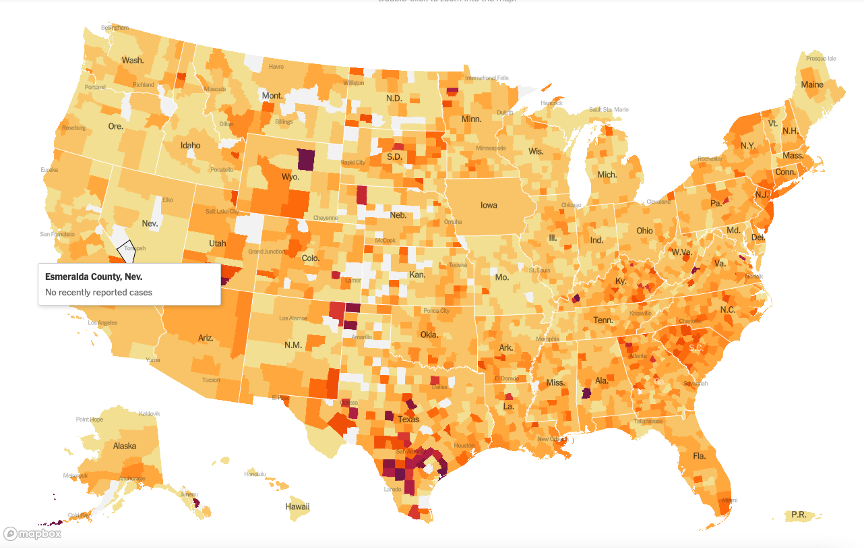

I’ll tell you something that markets are not paying attention to at all, and it is the tremendous improvement in the pandemic. Since January 20, news cases have cratered from 250,000 a day to only 70,000, down 72%. The best-case scenario which markets discounted by near doubling in 11 months is happening.

With the addition of the Johnson & Johnson (JNJ) vaccine, some 700 million doses will be available by June. We could be back to normal by summer, at least in the parts of the country that don’t believe it is still a hoax.

This breathes life into the blockbuster 7.5% GDP growth scenarios now making the rounds. I think people have no idea how hot the economy is really going to get. Labor and materials shortages may be only three months off, but with no inflation.

So, what does all this mean for the markets? It all sets up the normal 5%-10% correction that I have been predicting. If you have two-year LEAPS on your favorite names, hang on to them. We are going much higher.

I went into the Monday selloff with a rare 100% cash position. The 20% I have now in commodities I picked up on puke out, throw up on your shoe capitulation days.

The barbell is still the winning strategy.

Domestic recovery stocks have been on fire for six months, with small banks up a ballistic 80%. Big tech has gone nowhere. But their earnings are still exploding, in effect, making them 20% cheaper over the same time period.

It’s just a matter of time before markets rotate back into tech and give domestic recovery a break. Think (AAPL), (FB), (AMZN), and (GOOGL). That is where the smart money is going right now.

The bond auction was a total disaster. The US Treasury offered $62 billion worth of seven-year US Treasury bonds, double the amount a year earlier. At a 1.95% yield and no one showed. Foreign participation was the worst in seven years. The bid-to-cover ratio was pitiful. Over issuance by the government crushing the market? Who knew? Imagine how high interest rates would be if the Fed wasn’t buying $120 billion a month of bonds?

The insanity is back, with GameStop (GME) doubling in the last 15 minutes of the month. Nobody knows why. It was why stocks tanked at the close on Thursday, scaring away real investors in real stocks. (GME) has become an indicator of all that’s wrong with the market.

Copper demand is rocketing, says Freeport McMoRan (FCX) CEO Richard Adkerson. That’s why he is opening three new US mines this year, adding 250 million pounds in annual output. Biden’s ambitious EV plans are the trigger. You can’t build an EV without a lot of the red metal. The world’s largest copper producer has become a major climate change and ESG play.

NVIDIA blows it away, with sales up a blockbuster 66%. Demand from gamers locked up at home was overwhelming. Purchases by bitcoin miners were through the roof. Even demand from the auto industry was up 16%, even though card sales aren’t. Too bad they picked the wrong day to announce, with the stock off 8.2%. (NVDA) is the one tech stock I would buy on dips.

Fed says business failures will continue at record pace, mostly occurring among small, unlisted local businesses. Biden’s $1.9 trillion rescue budget will come too late for many. Unemployment could stay chronically high for years, as the Weekly Jobless Claims are suggesting.

Housing starts fell in January, down 6.0% to 1.58 million units. A much smaller drop was expected. Rising land and lumber costs are cutting into the economics of new construction. Home prices are going to have to accelerate to suck in more supply. Housing Permits for new construction soared by 10.4% last month, so the future looks bright for builders.

Tesla (TSLA) crashed, down $180 in two days. We have just suffered a perfect storm of bad news about Tesla. Interest rates have been soaring, bad for all tech in the mind of the market. Competitor Lucid Motors announced a SPAC valued at $11 billion. And Elon Musk said Bitcoin looked “high” after investing $1.5 billion. Get ready to buy the dip, but not yet.

Quantitative easing to continue, says Fed governor Jay Powell, even if the economy improves. The $120 billion in bond-buying remains, even if the economy improves. He’s doing everything possible to create inflation.

Panic hits the crypto markets, dragging down technology equities with them. The two have been trading 1:1 for four months. Bitcoin suffered an eye-popping 25% plunge from $58,000 to 43,600. The tail is now wagging the dog. All risk-taking may have spiked with the Friday options expiration. Watch Bitcoin for a tech stock revival and vice versa. Stocks have earnings multiple support. Crypto doesn’t. I’ll buy Bitcoin when they post a customer support number.

Australian dollars soars as predicted, from $58 to $79 in 11 months. We could hit parity in 2022. The Aussie is basically a call option on a synchronized global economic recovery. End of the pandemic will also bring a resumption of massive Chinese investment in the Land Down Under. Keep buying the dips in (FXA).

Case-Shiller explodes to the upside, up 10.4% in December. It’s the hottest read in seven years for the National Home Price Index. Phoenix (14.4%), San Diego (13.0%), and Seattle (13.6%) were the strongest cities. The flight from the cities continues.

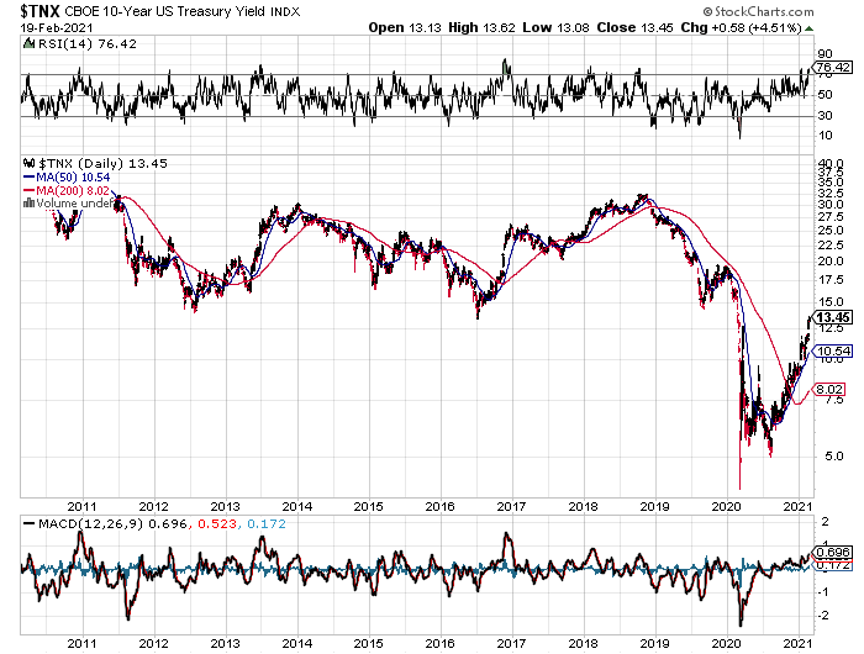

(TLT) breaks $138, surpassing my end 2021 target of a 1.50% ten-year US Treasury yield. So, I lied. My new yearend target is now $120, which would take ten-year yields to 2.00%. With a $1.9 trillion rescue budget about to kick in after the $900 billion that passed in December, the economy and demand for funds are about to rocket. Better hurry up and buy that house before mortgage rates rise out of reach.

Weekly Jobless Claims sink to 730,000. I can’t believe that 730,000 is now considered a good number, compared to 50,000 a year ago.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch closed out with a 13.28% profit in February after a blockbuster 10.21% in January. The Dow Average is up a miniscule 1.1% so far in 2021.

This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 23.49%. After the February 19 option expiration, I am now 80% in cash, with longs in (XME) and (FCX).

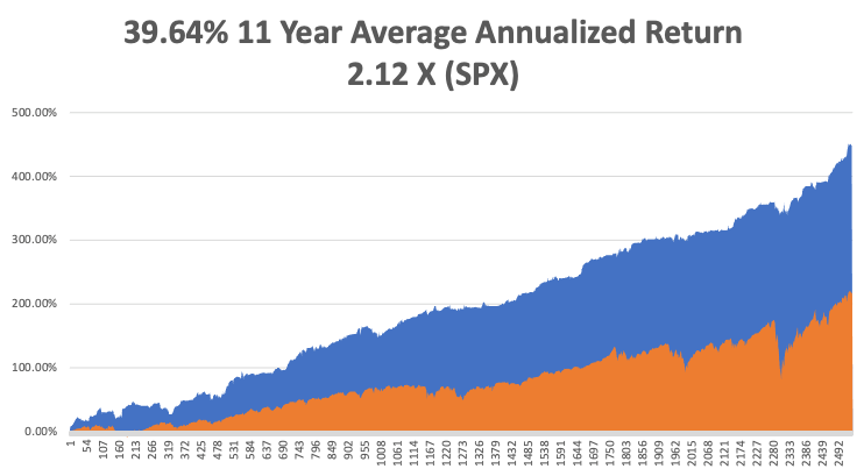

That brings my 11-year total return to 446.04%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 39.64%.

My trailing one-year return exploded to 93.48%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 103.31% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 28 million and deaths topping 510,000, which you can find here.

The coming week will be a boring one on the data front.

On Monday, March 1, at 10:00 AM EST, the ISM Manufacturing Index is out. Zoom (ZM) reports.

On Tuesday, March 2, at 9:00 AM, Total US Vehicle Sales for February are announced. Target (TGT) and Hewlett Packard (HPQ) report.

On Wednesday, March 3 at 8:15 AM, the ADP Private Employment Report is released. Snowflake (SNOW) reports.

On Thursday, March 4 at 9:30 AM, Weekly Jobless Claims are printed. Broadcom (AVG) and Costco (CSCO) report.

On Friday, March 5 at 8:30 AM, The February Nonfarm Payroll Report is announced. Big Lots (BIG) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, the deed is done, I got my first Covid-19 shot, pure Pfizer.

The Marine Corps failed to deliver, as only active duty are getting shots. Washoe County ran out. Incline Village said I couldn’t get a shot until July. My own doctor had no clue.

Then I got an automated call from the doctor who did my stem cell treatment on my knees five years ago. They belonged to a large group that had my birthday in their system and my number came up on the first day the under ’70s opened up.

Going there was a celebration. Everyone was thrilled to death to get their shot. It was like winning the lottery. Our little local hospital operated with machine-like efficiency, inoculating 1,300 a day. It was a straight drive in, dive out. It was an “all hands-on deck” effort, with everyone from the board directors to the billing clerks manning the needles. It took longer to buy a Big Mac than to get my shot.

To make sure I didn’t pass out, I was sent to a holding area, where a person was assigned to each car. I got the CEO and grilled him relentlessly on his business model for 30 minutes.

I haven’t felt this good since I got my polio vaccine sugar cube in 1955.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

January 20 Infection Rate

March 3 Infection Rate

Global Market Comments

February 26, 2021

Fiat Lux

Featured Trade:

(REVISITING THE GREAT DEPRESSION)

(EXPLORING MY NEW YORK ROOTS)

Global Market Comments

February 25, 2021

Fiat Lux

Featured Trade:

(TAKING A LOOK AT THE ROM)

(ROM)

(BRING BACK THE UPTICK RULE!)

Global Market Comments

February 24, 2021

Fiat Lux

Featured Trade:

(LONG TERM ECONOMIC EFFECTS OF THE CORONA VIRUS),

(ZM), (LOGM), (AMZN), (PYPL), (SQ), CNK), (AMC), (IMAX), (CCL), (RCL), (NCLH), (CVS), (RAD), (WMT)

The world will never be the same again.

Not only is the old world rapidly disappearing before our eyes, the new one is breaking down the front door with alarming speed. In short: the future is happening fast, very fast.

To a large extent, long-term economic trends already in place have been given a turbocharger. Quite simply, you just take out the people. Human contact of any kind will be minimized. I’ll tick off some of the more obvious changes.

All San Francisco Bay Area counties are still living under a “shelter in place” order. All schools have now been closed for a year. In March 2020 the local high school managed to get the first weekend of their annual musical “Titanic” done, but not the second.

All travel is banned except to gain essential necessities. Most bars and restaurants have been closed indefinitely, except for takeout. Some cities are issuing $1,000 fines for failure to wear a mask. The kids have turned into white, pasty zombies after staring at laptops for 12 months.

To say that we are merely fatigued from a yearlong quarantine would be a vast understatement. Climbing the walls is more like it.

As I write this, US Covid-19 deaths have topped a half million and cases have surpassed 28 million. China peaked at 4,000 deaths with four times our population. The difference was leadership issue. China welded the doors of Covid carriers shut. Here said it was a big nothing and would “magically” go away.

The magic didn’t work.

In the meantime, you better get used to your new life. You know that home office of yours you’ve been living in? It is now a permanent affair, as your employer figured out that they can make more money and earn a high stock multiple with you at home.

Besides, they didn’t like you anyway.

Many employees are never coming back, preferring to avoid horrendous commutes, lower costs, and yes, future pandemic viruses. GoToMeeting (LOGM) and Zoom (ZM) are now a permanent aspect of your life.

Commerce will change beyond all recognition. Did you do a lot of shopping on Amazon (AMZN) like I do? Now, you’re really going to pour it on.

Amazon hired a staggering 500,000 new distribution and delivery people in 2020 to handle the surge in business, the most by any organization since WWII. I can’t believe the stock is only at $3,200. It is worth double that, especially if they break up the company.

The epidemic really hammered the mall, where a fatal disease is only a sneeze away. Mall REITs are only just starting to crawl off the floor and may never again reach their old highs, no matter how much they promise to pay you in yield.

And how are you going to pay for that transaction? Guess what one of the most efficient transmitters of disease is? That would be US dollar bills. Something like 50% of all US paper money already tests positive for drugs, according to one Fed study.

Take paper money in change and you are not only getting contact from the salesclerk, but the last dozen people who handled the money. You are crazy now to take change and then not go swimming in Purell afterwards. Personally, I leave it all as a tip.

Contactless payments deal with this nicely (PYPL), (SQ), two of the top-performing stocks since April. People pay by swiping their iPhone wallet, or are simply scanned when they walk in the store, as with some Whole Foods shops owned by Amazon.

Conferences? A thing of the past. All of my public speaking events around the world have been cancelled. Webinars now rule. They offer lower conversion rates but include vastly cheaper costs as well. I can reach more viewers for $1,000 on Zoom than the Money Show could ever attract to the Las Vegas Mandalay Bay for $1 million.

At least I won’t have 18 hours of jet lag to deal with anymore. I’m sure Qantas will miss those first-class ticket purchases and I’ll miss the Champaign.

Entertainment is also morphing beyond all recognition. Streaming is now the order of the day. Disney+ (DIS) was probably the best-timed launch in business history, earning enough to cancel out most of the losses from the closure of the theme parks. Again, this has been a long time coming and the other major movie producers will soon follow suit.

Movie theaters, which have been closed for a year, may also never see their peak business again (CNK), (AMC), (IMAX). The theaters that survive will do so by only accumulating so much debt that they won’t be attractive investments for a decade.

The same is true for cruise lines (CCL), (RCL), (NCLH). But that won’t forestall dead cat bounces that are worth a double in the meantime, as they are coming off of such low levels. No vaccination, no cruise.

Exercise is changing overnight. All gyms and health clubs are now closed, so working out will become a solo exercise far away on a high mountain. I have already been doing this for 30 years, so a piece of cake here.

Friends with yoga classes are now doing them in the living room, streaming their instructors online. The economics of online yoga classes are so compelling, with hundreds attending online classes, that the old model may never come back.

If you are having trouble getting your kids to comply with social distancing requirements, have a family movie night and watch Gwyneth Paltrow and Cate Winslet die in Contagion. It has been applauded by scientists as the most accurate presentation of the kind of out-of-control pandemic which we may now be facing.

It is bone-chilling.

As for me, I have my stockpile of food and will be self-quarantining for the foreseeable future. I am at the top of five lists to get vaccinations, but so far all I have received is a ton of special offers from CVS (CVS), Rite Aid (RAD), and Walmart (WMT)

Stay healthy.

Global Market Comments

February 23, 2021

Fiat Lux

Featured Trade:

(THE UNITED STATES OF DEBT),

(TLT), (TBT), ($TNX)

Global Market Comments

February 22, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TIME FOR A BREAK)

(GME), (TLT), (FB), (AMZN), (AAPL), (XME), (FCX), (MS), (GS), (BLX), (KO), (AMD)

I know you’re not going to want to hear this. I might as well be trying to pull your teeth, lead you down a garden path, or sell you a high-priced annuity.

But there is nothing to do in the market right now. Nada, diddly squat, bupkis, and for all you Limey’s out there, bugger all.

For during the first six weeks of 2021, we have pretty much squeezed all there is out of the market.

Not only did we nail the timing and the direction, we also got the lead sectors, financials, brokers, chips, and short bonds (MS), (GS), (BLK), (AMD). We also chased the Volatility Index (VIX) down from $38 to a lowly $20, baying and protesting all the way.

That enabled us to extract a 28.29% profit so far in 2021, the best return in the 13-year history of the Mad Hedge Fund Trader. The only other time you see numbers this high is when Ponzi schemes get busted. And not a dollar of this was earned from the really marginal plays like Bitcoin, SPAC’s, GameStop (GME), or pot stocks.

If I feel like I did a year’s worth of work during the first seven weeks of 2021, it’s because I have, issuing 60 trade alerts since January 1.

However, bonds (TLT) are reaching the end of their current leg down. The 1.34% yield we saw on Friday is suspiciously close to the 1.36% yields we saw during the 2012 and 2017 market double bottom.

So, there may be some wood to chop around these, levels, possibly for weeks or months.

This is important because a collapsing bond market has been the principal driver of the winning trades of 2021, such as in banks, brokers, money managers, and other domestic recovery plays.

And when one side of the barbell goes dead, what do you do? You buy the other side. FANGs are just completing a six-month “time” correction where they have gone absolutely nowhere. So, Facebook (FB), Amazon (AMZN), and Apple (AAPL) may be getting ready for a roll.

One other sector that might keep running is the SPDR Mining & Metals ETF (XME), and Freeport McMoRan (FCX). That’s because it's not just us buying metals to front-run a recovery, it’s the entire world. What do you think a $2 trillion infrastructure budget will do to this area?

New lows for bonds, as the ten-year US Treasury yield hits 1.26%, up 38 basis points since January 1 and a one-year high. 1.50% here we come! Ever hear the expression “Don’t fight the Fed”? All financials are off to the races, where we were 60% long. Biden’s $1.9 trillion rescue package will be 100% borrowed and take total US borrowing to a back-breaking 55% of GDP. I hate to sound like a broken record but keep selling rallies in the (TLT), buy (JPM), (BAC), (GS), (MS), and (BRK/B) on dips.

Volatility index hit a one-year Low, which is what you’d expect at the dawn of a decade-long bull market in stocks. The (VIX) may flat line here for a while before the next out-of-the-blue spike.

The Nikkei Stock Average topped 30,000, for the first time in 31 years, Yes, it’s been a long haul. I was heavily short in the initial 1990 meltdown from 39,000 to 20,000 and many fortunes were made. The top marked the end of the Japanese company’s ability to copy their way into leadership. After that, rapidly advancing technology made copying too slow to compete in a global economy.

A midwest storm upended energy markets, with oil popping $8 to $67 and gas deliveries spiking from $4 to $999. It would have gone higher, but the software only provided for three digits. Electricity prices are all over the map. Some 4 million Texas customers are without power. Fracking has ground to a halt. Windfarms are frozen solid. If you are a net producer (as I am), you are in heaven. The turmoil is expected to be gone by the weekend. It’s another high price paid for ignoring global warming.

Weekly Jobless Claims soared, to 861,000, casting a dark cloud over the economic recovery. The news took a 300-point bite out of the Dow. Illinois and California saw the biggest gains. We are not out of the woods yet.

SpaceX was valued at $74 Billion, according to an $850 billion venture capital fundraising round this week. However, Elon Musk’s rocket company won’t go public until men are landed on Mars. The company is also the launching pad for its Starlink global WIFI project, which will cost at least $10 billion to build out. Blowing up rockets is not a good backdrop for an IPO.

Cash is still pouring off the sidelines, with equity mutual funds attracting some $7.8 billion last week. As long as this is the case, which could be for years, any market corrections will be limited. Strangely, bond funds are still pulling in money too, some $5.7 billion. It’s called a liquidity-driven market, silly!

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

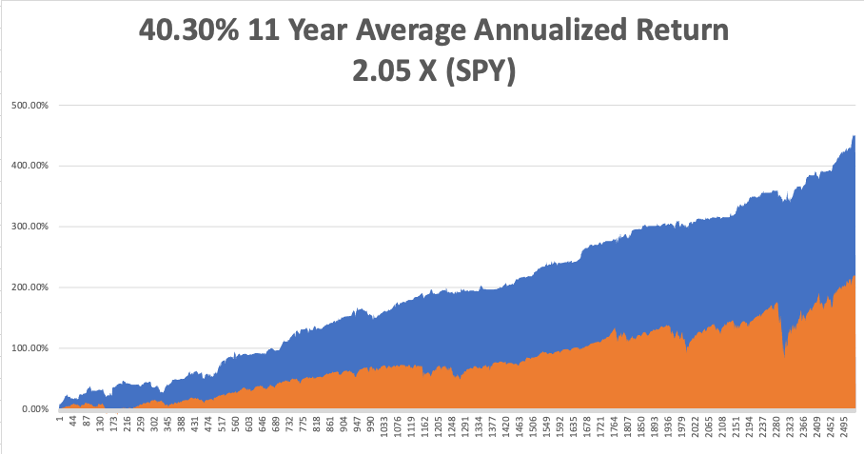

My Mad Hedge Global Trading Dispatch earned an amazing 17.27% so far in February after a blockbuster 10.21% in January. The Dow Average is up a trifling 2.92% so far in 2021.

This is my fourth double-digit month in a row. My 2021 year-to-date performance soared to 27.28%. After the February 19 option expiration, I am now 80% in cash, with a single long in Tesla (TSLA) left.

That brings my 11-year total return to 450.03%, some 2.05 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an Everest-like new high of 40.30%.

My trailing one-year return exploded to 94.09%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 109.00% since the March 20, 2020 low.

We need to keep an eye on the number of US Coronavirus cases at 28 million and deaths approaching 500,000, which you can find here. We are now running at a heart breaking 3,000 deaths a day. But that is down 35% from the recent high.

The coming week will be a boring one on the data front.

On Monday, February 22, at 8:30 AM EST, the Chicago Fed National Activity Index is out. Zoon (ZM) reports.

On Tuesday, February 23 at 9:00 AM, the S&P Case-Shiller National Home Price Index for December is announced. Square (SQ) and Intuit (INTU) report.

On Wednesday, February 24 at 8:30 AM, New Home Sales for January are printed. NVIDIA (NVDA) reports.

On Thursday, February 25 at 9:30 AM, Weekly Jobless Claims are printed. US Durable Goods for January and Q4 GDP are out. Salesforce (CRM), (Moderna (MRNA), and Airbnb (ABNB) report.

On Friday, February 26 at 8:30 AM, US Personal Income and Spending are published. DraftKings (DKNG) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, if you want to see what it is like to work at Amazon, watch the movie Nomadland. It’s an artsy Francis McDormand film made with a $4 million budget about the end of life, which I caught over the weekend on Hulu.

It covers a contemporary trend in US society where retirees with no savings move into RVs and live off the grid, working occasionally to earn gas money. They raved about it in Europe.

If I don’t keep those trade alerts coming, that could be me in a couple of years.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 19, 2021

Fiat Lux

Featured Trade:

(FEBRUARY 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(USO), (XLE), (AMZN), (SPY), (RIOT), (T), (ZM), (ROKU), (TSLA), (NVDA) (TMQ) (TLRY), (ACB), (KO), (XLF), (AAPL) (REMX), (GLD), (SLV), (CPER)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.