In terms of the stock market, “A vaccine is more important than the stimulus,” said David Kostin, chief equity strategist at Goldman Sachs.

Global Market Comments

October 5, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or IS HISTORY REPEATING ITSELF?)

(SPY), (INDU), (DIS), (TLT)

In 1919, President Woodrow Wilson traveled to Europe to negotiate the end of WWI and the Versailles Treaty. Midway through the talks, he suffered a major stroke and was hustled back to the US in an American battleship, the USS George Washington.

The Spanish Flu pandemic was underway, killing millions, so it was thought best to keep the whole matter secret. The president’s wife essentially ran the country for the last three years of Wilson’s administration, claiming to represent the president’s wishes.

This was the history that flashed through my mind when I learned of President Trump’s Covid-19 infection on Thursday night. The presidential election is now effectively over. All fundraising has ceased. It is now an open question whether Trump can even live until the November 3 election. He is, after all, a high-risk patient. Any remaining public campaign events on which the president thrived is out of the question.

The minute the president got sick, media coverage has been wholly devoted to Covid-19. That was not in the Trump plan. Not at all.

The London betting markets soared from a 60% chance of a Biden win to 90% minutes after the Covid-19 news broke. The only question is the extent of the landslide. This election won’t go anywhere near the courts or the Supreme Court, as the stock market has been pricing in. If there is another big gap down, you should be picking up stocks by the bucket load as fast as you can.

Fund managers who thought Trump had a chance of returning will spend this weekend pouring over Biden’s economic policies. All investment decisions will now be made based on the assumption that these will be the policies in force for the next 4, 8, or 12 years.

Think:

higher taxes

more economic stimulus

big infrastructure spending

more quantitative easing

grants to state and local municipalities

no inflation

low-interest rates

more alternative energy subsidies

the return of the Paris Climate Accord

more regulation of the oil industry

end of the trade wars

rejoining the NATO alliance

Oh, and the huge technological advancements and the burgeoning profit opportunities that have emerged in response to the pandemic? We get to keep those.

That is great news for long-term investors. All of this combined is very pro-investment and pro stock market. It firmly solidifies my own Dow target of 120,000 in a decade and another Roaring Twenties and coming American Golden Age. Now, we even have the trigger.

That explains why the market made back a hefty 500 points in hours, even turning positive on the day for a few fleeting moments. On a six-month view, the upside risks are far greater than the downside ones. An S&P 500 of $3,500-$3,700 by yearend is within range, up 6%-12% from here.

The September Nonfarm Payroll Report bombed, coming in at 661,000, well below expected. The headline Unemployment Rate is at a historically high 7.9%. The U-6 real “discouraged worker” jobless rate is at 12.6%. Leisure & Hospitality was the big winner at 318,888, Healthcare gained 107,000, and Retail posted 142,000. Local Government lost a staggering 232,000 jobs and towns run out of money.

US Q2 GDP came in at a horrific negative 31.4% in the final read, the worst in US history. It’s a tough economic record to run for office on. The first Q3 GDP read will not be released until October 29, five days before the presidential election, and should be up huge.

US Capital Goods hit a six-year high, up 1.8% in August. July was revised upward as well. The boost may be short-lived as stimulus money runs out.

Office Rents won’t recover until 2025, says commercial real estate leader Cushman & Wakefield. Some 215 million square feet of demand has been lost due to the pandemic. Many knowledge-based workers are never coming back to the office.

Pending Homes Sales hit a record high in August, up a mind-blowing 8.8% from July and a staggering 24.5% YOY. Hot housing markets are seeing 11%-20% YOY price increases. The northeast saw the biggest gains. This trend has another decade to run. Buy before they run out of stock.

Case Shiller rose 4.8% in July as its National Home Price Index shows. Phoenix (9.2%), Seattle (7.0%), and Charlotte (6.0%) were the price leaders. A stampede to the suburbs fueled by record-low interest rates is the main driver. Look for these trends to continue for years.

Consumer Confidence soared in September, from 84.8 last month to 101.8. Those who have money are spending it. Those who don’t are waiting in lines at food banks, disappearing from the economy. New York bankruptcies surged 40%. If you haven’t spent the past decade investing in your online presence or yourself, you’re toast.

Disney (DIS) laid off 28,000 to stem hemorrhaging losses at its theme parks, hotels, and cruise line. It will take a year to come back. Clearly, their recent $78.3 billion purchase of 21st Century Fox movie and TV studios last year was poorly timed, just before the pandemic, and they borrowed massively to close it. And they had a major presence in China! It’s one of the biggest mass layoffs since Corona began to decimate the economy.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch pushed through to a new all-time high last week on the strength of a position that I kept for a single day. All I needed was the 700-point dive in the Dow Average in 24 hours to realize half the maximum profit in my short (SPY) position. When the market offers me a gift like that, I take it, no questions asked. I am back to a rare 100% cash position, waiting for a bigger dump to buy.

The risk/reward in the market now is terrible. I believe we have to test the 200-day moving averages before it’s safe to go back in with the indexes and single stocks.

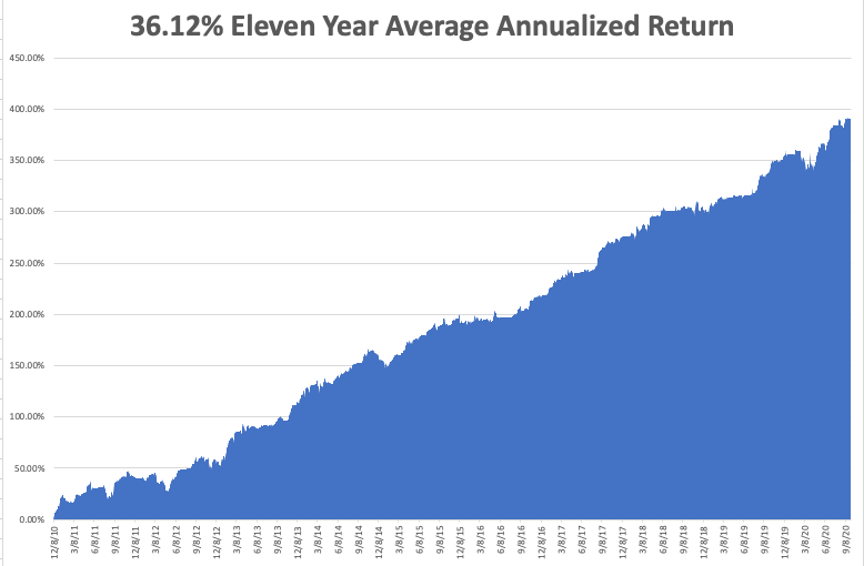

That takes our 2020 year-to-date performance back up to a blistering +35.46%, versus a loss of 2.87% for the Dow Average. October shot out the gate at +0.96%. That takes my 11-year average annualized performance back to +36.12%. My 11-year total return returned to another new all-time high at +391.37%. My trailing one-year return popped back up to +51.82%.

The coming week will be a dull one on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, now at 210,000, which you can find here.

On Monday, October 5 at 10:00 AM, the ISM Non-Manufacturing PMI Index for September is released.

On Tuesday, October 6 at 9:00 AM EST, the JOLTS Job Openings for August is published.

On Wednesday, October 7 at 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out. At 2:00 PM EST, the Fed Minutes from the last Open Market Committee Meeting six weeks ago are disclosed.

On Thursday, October 8 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, October 9, at 2:00 PM The Bakers Hughes Rig Count is released.

As for me, I’m headed up to Lake Tahoe again to escape the thick clouds of choking smoke in the San Francisco Bay Area. Also, the polls for the presidential election in Nevada open on October 17 and I have to VOTE!

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Is History Repeating Itself?

No Smoke Here

Global Market Comments

October 2, 2020

Fiat Lux

Featured Trade:

(SEPTEMBER 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(NVDA), (AMD), (JPM), (DIS), (GM), (TSLA), (NKLA),

(TLT), (NFLX), (PLTR), (VIX), (PHM), (LEN), (KBH), (FXA), (GLD)

Below please find subscribers’ Q&A for the September 30 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Which is a better buy, NVIDIA (NVDA) or Advanced Micro Devices (AMD)?

A: NVIDIA is clearly the larger, stronger company in the semiconductor area, but AMD has more growth ahead of it. You’re not going to get a ten-bagger from NVIDIA from here, but you might get one from Advanced Micro Devices, especially if a global chip shortage develops once we’re out the other side of the pandemic. So, I vote for (AMD), and did a lot of research on that company last week. You can find the report at www.madhedgefundtrader.com but you have to be logged in to see it.

Q: Do you have any thoughts on the JP Morgan Chase Bank (JPM) spoofing cases, where they had to pay about a billion in fines? Is this a terrible time to invest in banks?

A: No, this is a great time to invest in banks because this is the friendly administration to banks now; the next one will be less than friendly. On the other hand, an awful lot of bad news is already in the price; buying these companies at book value or discount of book like JP Morgan, it's a once in a lifetime opportunity. All the bad behavior they’re being fined on now happened many years ago. So yes, I still like banks, but you really have to be careful to buy them on the dip, just in case they stay in a range. If you stay in a range, you’re buying them call spread, you always make money. The bigger drag on share prices will be the Fed ban on bank share buybacks but that may end after Q4.

Q: Is it time to buy Disney (DIS) after they laid off 28,000?

A: This is a company that practically every fund manager in the company wants to have in their portfolio. However, it could be at least a year before they get back to normal capacity in the theme parks, meaning customers packing in shoulder-to-shoulder. So, it could be another wait-for-a-turnaround, buy-on-the dip situation for sure. This company is so well managed that you’re always going to have to pay up to get into the Mouse House. By the way, my dad did business with Disney during the 1950s so we got Disneyland opening day tickets and I got to shake Walt Disney’s hand.

Q: How desperate is General Motors (GM) in buying the fake Tesla (TSLA) company, Nikola (NKLA), who've been exposed as giant frauds? Is GM hopeless?

A: Yes, the future is happening too fast for a giant bureaucracy like General Motors to get ahead of the curve. The fact that they’re trying to buy in outside technologies shows how weak their position is, and of course, it’s a great way to get stuck with a loser, as Tesla selling out to anyone. The Detroit companies are all stuck with these multibillion-dollar engine factories so they can’t afford to go electric even if they wanted to. So, I expect all the major Detroit car companies to go under in the next 5 years or so. Electric cars are already beating conventional internal combustion engines on a lifetime cost basis and will soon be beating them, within 3 years, on an up-front cost basis as well.

Q: Will Netflix (NFLX) pass $600 before the year's end?

A: I’m expecting a monster after-election rally to new all-time highs in the market and Netflix will be one of the leaders, so easy to tack on another hundred bucks to Netflix. That’s one of my targets for a call spread if we can get in at a lower price. And if you really want to be conservative, buy 2-year LEAPS, two-year call options spreads on Netflix, and you’ll get an easy 100% return on those.

Q: Who will win, Trump or Biden?

A: Neither. You will win. I am not a member of any political party as I would never join any club that would stoop to have me as a member. Groucho Marx told me that just before he died in the early 70s. Don’t ask me, ask the polls. Suffice it to say that the London betting polls are 60%-40% in favor of Biden, having just added another 5% for Biden after the debate. My expectation is that Biden picks up another point in the opinion polls in all the battleground states this weekend. So, Biden will be up anywhere from 6-10% in the 6 states that really count.

Q: What will the market impact be?

A: It makes no difference who wins. The mere fact that the election is out of the way is worth a 10% move up in the stock market.

Q: Should we keep the January 2022 (TLT) 140/143 bear put spread?

A: Absolutely, yes. That’ll be a chip shot and we in fact should go in the money on those number sometime next year. A huge cyclical recovery will create an enormous demand for funds and crowding out by the government will crush the bond market.

Q: Do you think it would be better to wait a week or two to lock in refis on home loans?

A: I think we are at the low in interest rates in the refi market. Even if the Fed lowers interest rates, banks aren’t going to lower their lending rates anymore because there's no money in it for them. It’s also taking anywhere from 2-4 months to close on a loan, as the backlogs are so enormous. If you can even get a loan officer to return a phone call, you’re lucky. So, I wouldn't be too fancy here trying to pick absolute bottoms; I would just refi now and whatever you get is going to be close to a century low.

Q: Why so few trade alerts?

A: Well, very simple. We only do trade alerts when we see really good sweet spots in the market. There aren’t sweet spots in the market every day; you’re lucky if you get 1 or 2 in a month. Then we tend to pour in and out of the market very quickly with a lot of alerts. There is no law that says you have to have a position every day of the year. That buys the broker’s yacht, not yours. You should only have positions when the risk reward is overwhelmingly in your favor. That is not now when our market timing index is hugging the 50 level. At 50, you actually have the worst possible entry point for new trades, long or short, so I’d rather wait for it to get away from that level before we get aggressive again. We have gone 100% invested multiple times in the last two months and made a ton of money. So, you just have to wait for your turn to get a sweet spot, and then you’ll make a very quick 10% or 15% in the market. Patience is rewarded in this business.

Q: Would you wait for the election because of the high implied volatility?

A: No, I would not wait. The game is to get in at the lowest price before the election. When the implied volatilities drop after the election, the profits you can make on these deep out of the money LEAPs drop by about half. Thank the volatility while it’s here because it’s creating great trading opportunities now, not in two months after the volatility Index (VIX) has collapsed.

Q: What about Zoom (ZM)?

A: As much as Zoom has had a 10-fold return since we recommended it a year ago, it looks like it wants to go higher. The Robinhood traders just love this stock; it’s a stay at home stock, stay at home is lasting a lot longer than anyone thought. Zoom is just coining it on that.

Q: Is the best outcome a Biden presidency and a Republican Senate?

A: No, that is the worst outcome. When you have a global pandemic going on, you don’t want gridlock in Washington. You want a very active Washington, controlled by a single party that can get things done very quickly. That is not now, which is possibly a major reason that we have the highest Covid-19 death rate in the world. It’s because Washington is doing absolutely nothing to stop the virus; the president won’t even wear a mask, so yes, you need one party to control everything so they can push stuff through. If it works, great, and if not then you kick them out of office next time and let the other guys have a try.

Q: Will property markets be up 20% by the end of the year?

A: If you live in a suburb of New York or San Francisco, then yes it will be up that much. For the whole rest of the country, the average is more like 5% gains year on year. In the burbs of these big money-making cities, prices are going absolutely nuts. My neighbor put his house up and it sold in a week for a $1 million over asking. So, the answer to that is yes, hell yes.

Q: Can you explain why the IPO market is suddenly booming now?

A: A lot of these companies like Palantir (PLTR) have been in development for 20 years, and prices are high. On valuation terms, we are at dot com bubble peaks now. That is the very best time to take your company public and get a huge premium for your stock. When the world is baying for paper assets, you print more of them.

Q: What is the best way to play real estate?

A: Buying the single home building companies like Pulte Homes (PHM), Lennar Homes (LEN), and KB Homes (KBH).

Q: What is your Tesla overview in China?

A: Tesla’s already announced that they’re doubling production of the Shanghai factory, from 250,000 units a year to 500,000. They built the last one in 18 months. It would take (GM) like 5 years to build something like that.

Q: Why has gold (GLD) lost its risk-off status?

A: It’s now a quantitative easing asset—like tech stocks, like bitcoin, and the stay at home stocks. It is being driven much more by QE-driven speculators flush with free cash than anyone looking for a flight to safety bid. When this group sells off, gold drops as well. The only risk-off asset right now is cash. That is the only “no risk” trade.

Q: What does reversal in lumber prices tell you?

A: Lumber was another one of those QE assets—it tripled. But you have this monster increase in new home building, huge demand for new homes in the suburbs, huge import duties leveled by the Trump administration on lumber coming from Canada. Also, a lot of people are getting COVID-19 in the lumber mills. So, they’re having huge problems on the production side in lumber, as a result of the pandemic.

Q: Are there any alternative ways to buy the Australian dollar besides (FXA)?

A: You go into the futures market and buy the Australian dollar futures. That is an entirely new regulatory regime so can be a huge headache. It requires you to register with the Commodities Futures Trading Commission, which is the worst of all the major regulators, but that is an alternative. If you’re an individual and not regulated instead of being a professional money manager, then it’s much easier.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Summit of Mount Rose

“The Fed only knows two speeds; too fast, and too slow,” said Nobel Prize winning economist Milton Friedman to me over lunch one day.

Global Market Comments

October 1, 2020

Fiat Lux

Featured Trade:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Global Market Comments

September 30, 2020

Fiat Lux

Featured Trade:

(INDUSTRIES YOU WILL NEVER HEAR FROM ME ABOUT

Industries You Will Never Hear from Me About.

The focus of this letter is to show people how to make money through investing in fast-growing, highly profitable companies which have stiff, long-term macroeconomic and demographic winds at their backs.

That means I ignore a large part of the US economy, possibly as much as 80%, whose time has passed and are headed for the dustbin of history.

According to the Department of Labor's Bureau of Labor Statistics, the seven industries listed below are least likely to generate positive job growth over the next decade.

As most of these stocks are already bombed out, it is way too late to short them. As an investor, you should consider this a “no go” list no matter how low they go. I have added my comments, not all of which should be taken seriously.

1) Realtors - The number of realtors is only down 10% from its 1.3 million peak in 2006. I have always been amazed at how realtors who add so little in value take home so much in fees, still around 6% of the gross sales price. Someone is going to figure out how to break this monopoly. The Internet is begging to destroy this business model.

2) Newspapers - these probably won't exist in five years, as five decades of hurtling technological advances have already shrunk the labor force by 90%. Go online or go away. Good thing I got out in time….40 years ago.

3) Airline employees - This is your worst nightmare of an industry, as management has no idea what interest rates, fuel costs, or the economy will do, which are the largest inputs into their business. Pilots will eventually work for minimum wage, or for free, just to keep their flight hours up.

4) Big telecom - Can you hear me now? Nobody uses landlines anymore, leaving these companies with giant rusting networks that are very costly to maintain. Since cell phone market penetration is 90%, survivors are slugging it out through price competition, cost cutting, and all that annoying advertising. How many Millennials even have land lines? About 30%.

5) State and Local Government - With employment still at levels private industry hasn't seen since the seventies, firing state and municipal workers will be the principal method of balancing ailing budgets. Expect class sizes to soar to 80 or go entirely online, to put out your own damn fires, and keep the 9 mm loaded and the back-door booby trapped for home protection. Anyone who sells to local governments is toast.

6) Installation, Maintenance, and Repair - I have explained to my mechanic that the motor in my new electric car has only eleven moving parts, compared to 1,500 in my old clunker, and this won't be good for business. But he just doesn't get it. Electric cars will soon price internal combustion ones out of the market.

The winding down of our wars in the Middle East is about to dump a million more applicants into this sector. The last refuge of the trained blue-collar worker is about to get cleaned out.

7) Bank Tellers - Since the ATM made its debut in 1968, this profession has been on a long downhill slide. Banks have lost so much money in the financial crisis, they can't afford to hire humans anymore. Thanks to the pandemic half of the big national branch networks have been closed.

It hasn't helped that hundreds of banks have closed during the recession, with many survivors merging to cut costs (read fire more people). Your next bank teller may be a Terminator.

Out With the Old

And in With the New

Global Market Comments

September 29, 2020

Fiat Lux

Featured Trade:

I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.