Global Market Comments

September 19, 2019

Fiat Lux

Featured Trade:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Global Market Comments

September 19, 2019

Fiat Lux

Featured Trade:

(HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

Global Market Comments

September 18, 2019

Fiat Lux

Featured Trade:

(HOW TO HANDLE THE FRIDAY, SEPTEMBER 20 OPTIONS EXPIRATION),

(AMZN), (DIS), (FB), (MSFT), (VIX),

(INDUSTRIES YOU WILL NEVER HEAR FROM ME ABOUT)

The focus of this letter is to show people how to make money through investing in fast-growing, highly profitable companies which have stiff, long-term macroeconomic winds at their backs.

That means I ignore a large part of the US economy, possibly as much as 80%, whose time has passed and are headed for the dustbin of history.

According to the Department of Labor's Bureau of Labor Statistics, the seven industries listed below are least likely to generate positive job growth in the next decade.

As most of these stocks are already bombed out, it is way too late to short them. As an investor, you should consider this a “no go” list no matter how low they go. I have added my comments, not all of which should be taken seriously.

1) Realtors - The number of realtors is only down 10% from its 1.3 million peak in 2006. I have always been amazed at how realtors who add so little in value take home so much in fees, still around 6% of the gross sales price. Someone is going to figure out how to break this monopoly.

2) Newspapers - these probably won't exist in five years, as five decades of hurtling technological advances have already shrunk the labor force by 90%. Go online, or go away.

3) Airline employees - This is your worst nightmare of an industry, as management has no idea what interest rates, fuel costs, or the economy will do, which are the largest inputs into their business. Pilots will eventually work for minimum wage just to keep their flight hours up.

4) Big telecom - Can you hear me now? Nobody uses landlines anymore, leaving these companies with giant rusting networks that are costly to maintain. Since cell phone market penetration is 90%, survivors are slugging it out through price competition, cost-cutting, and all that annoying advertising.

5) State and Local Government - With employment still at levels private industry hasn't seen since the seventies, firing state and municipal workers will be the principal method of balancing ailing budgets. Expect class sizes to soar to 80 or go entirely online, to put out your own damn fires, and keep the 9 mm loaded and the back door booby-trapped for home protection.

6) Installation, Maintenance, and Repair - I have explained to my mechanic that the motor in my new electric car has only eleven moving parts, compared to 1,500 in my old clunker, and this won't be good for business. But he just doesn't get it.

The winding down of our wars in the Middle East is about to dump a million more applicants into this sector. The last refuge of the trained blue-collar worker is about to get cleaned out.

7) Bank Tellers - Since the ATM made its debut in 1968, this profession has been on a long downhill slide. Banks have lost so much money in the financial crisis, they can't afford to hire humans anymore.

It hasn't helped that hundreds of banks have closed during the recession, with many survivors merging to cut costs. Your next bank teller may be a Terminator.

Global Market Comments

September 17, 2019

Fiat Lux

Featured Trade:

(PROFITING FROM AMERICA’S DEMOGRAPHIC COLLAPSE)

Global Market Comments

September 16, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CHOPPY WEATHER AHEAD),

(SPY), (TLT), (FB), (GOOGL), (M), (C),

(XOM), (NFLX), (DIS), (FXE), (FXI)

When commercial pilots fly across the US, they often give each other a heads up about dangerous conditions so other can avoid them. “Chop” is a common one, clear air turbulence that appears on no instruments. Usually, a simple altitude change of a few thousand feet is enough to deal with the problem.

“Chop” is what we traders have had to deal with in the stock market a lot for the past 18 months ever since the trade war with China started. Look at the S&P 500 (SPY) and you see that we have been covering the same ground over and over again, much like trench warfare in WWI. Since April 2018, we have crossed the $270-$290 space no less than six times.

We are just now kissing the upper edge of that band. What happens next depends on your beliefs. If you think the trade war will end in the next month and we don’t go into recession, then the markets will break out to new all-time highs, blasting all the way up to $320. If you don’t, you want to be fading this move, unloading risk, and entertaining short plays.

I’ll let you decide.

As for me, I have been suspicious of this rally since it started the third week of August. It has been led by banks, energy, retailers, and all the other garbage with terrible fundamentals that have been falling for years. In other words, it is pure short covering. There is no net money coming into the market. In the meantime, technology has not fallen, it has ground to a halt awaiting the next flood of capital.

It was Apple (AAPL) day in Silicon Valley, with the world’s largest company rolling out a host of new services and upgrades. The new Apple TV Plus streaming service was the focus, coming out with a $5 a month price, easily undercutting Disney Plus (DIS) at $10 and Netflix (NFLX) at $15.

It is an in-between generation year, so we didn’t get anything big. But with 200 million iPhones needing replacement in coming years (AAPL) is still a good long-term hold. All eyes will be on the share buy backs.

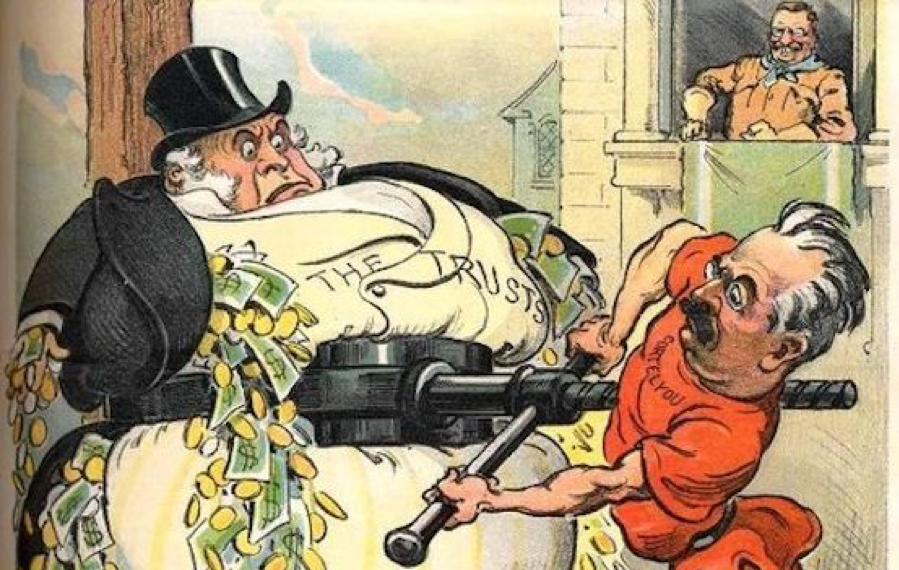

The next antitrust assault on big tech arrived, with Facebook (FB) and Google (GOOGL) now in the sights of 49 US states. This will go nowhere as technology has been leading to lower prices, not higher ones. What is the monopoly value of a service that is given away for free? The choice is very simple: let the US continue to dominate tech, or let China take it over.

Job growth is slowing, and the belief that it has peaked for this cycle is growing. Job openings fell 31,000 in August to 7.2 million according to the Department of Labor. The big loss was in wholesale trade, the big gain in information technology. The economy is moving from old to new.

The John Bolton firing, the national security advisor, crushed oil as the chance of a major Middle Eastern war decline, knocking $1.50 off of Texas Tea. That negotiation with the Taliban didn’t go so well, with them blowing up our people while talking with Mike Pompeo. The risk is that Trump’s next national security advisor could be worse. That’s been the trend. The last national security advisor took money from the Russians.

Europe pulled out all the stops (FXE), renewing a stimulus program with massive quantitative easing. Euro interest rates also to be cut. Eventually, a lot of that money will end up back in the US, the only place in the world with decent investment returns. That's why our stocks are now a few pennies short of a new all-time high.

We saw more of Trump talking up the market ahead of trade talks, with the administration considering half a deal on trade tariffs, while throwing technology under the bus with an intellectual property walkaway. Good for the Midwest, terrible for the west coast.

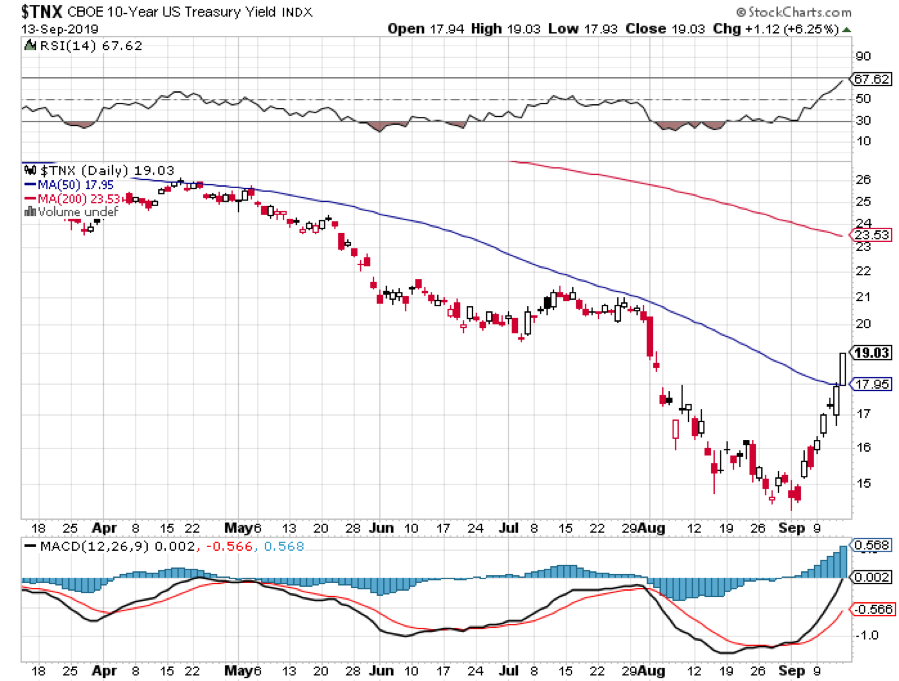

The bond market meltdown continued, with one of the sharpest collapses in history, down 11 points in a week, The ten-year US Treasury bond yield (TLT) has spiked from 1.44% to 1.90% in a week. Hope you got the rate lock on your refi last Friday. Long bonds had become the most overcrowded trade in a decade. Give it a month to digest, then take another run at the highs in prices, lows in yields.

China (FXI) bought ten shiploads of soybeans (SOYB), hoping for a positive outcome in the October trade talks. Or did they make the purchase to start the trade talks in the first place? Who knows? Price spikes 5%, at last! It's why stocks are pushing to new all-time highs.

The budget deficit toped $1 trillion in the first 11 months of fiscal 2019, the highest since the financial crisis. Running deficits this big during peace time with 2% economic growth will leave us with no way to get out of the next recession. It’s setting up the most predictable financial crisis in history, the next one. It’s just a matter of time before the chickens come home to roost. By the time Trump leaves office, the national debt will have increased by $4 trillion, or 20%.

The Mad Hedge Trader Alert Service is treading water in this wildly unpredictable month.

My Global Trading Dispatch stands near an all-time high of 334.99% and my year-to-date remains level at +34.85%. My ten-year average annualized profit bobbed up to +34.35%.

I’ll be running my 40% long in technology stocks into the September 20 options expiration because there is nothing else to do. After watching the bond market crater by 11 points, I could no longer restrain myself and stuck my toe in the water with a small long with yields at 1.90%. I may have to sweat a move to a 2.00% yield, but no more. I break even at 2.10%.

The coming week will be one of the biggest of the year, thanks to the Fed.

On Monday, September 16 at 8:30 AM, the New York Empire State Manufacturing Index is out.

On Tuesday, September 17 at 9:15 AM, the US Industrial Production is published.

On Wednesday, September 18, at 8:30 AM, August Building Permits are released. At 2:30 PM, the Federal Reserve announces its interest rate decision. If they don’t cut look out below?

On Thursday, September 19 at 8:30 AM, the Weekly Jobless Claims are printed. At 10:00 AM, Existing Home Sales are printed.

On Friday, September 20 at 8:30 AM, the Baker Hughes Rig Count is released at 2:00 PM.

As for me, my entire weekend is committed to the Boy Scouts, doing assorted public services projects with the kids, timing a mile run for the Physical Fitness merit badge, and cleaning up San Francisco Bay. Hopefully, I will get some time to review my charts. I usually look at 200 a weekend.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

September 13, 2019

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION),

(BREAKFAST WITH BOONE PICKENS)

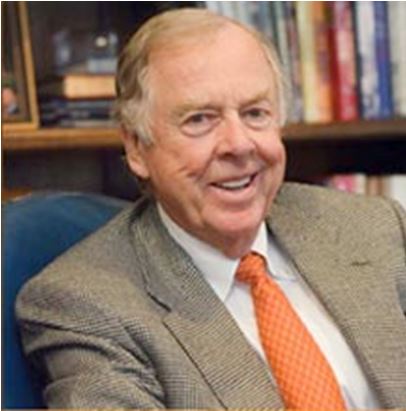

It was with a heavy heart that I learned of the passing last night of the legendary Boone Pickens who has dominated oil markets for the past 50 years. I owe him much of my understanding of the energy markets, which I picked up in crumbs that fell off his table over the past 40 years.

Below, I am rerunning my last meeting with him, which took place six years ago.

Reformed oilman, repenting sinner, and born-again environmentalist, T. Boone Pickens, Jr. says that “When we turn the US green, it will have the best economy ever.”

I met the spry, homespun billionaire at San Francisco’s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because “no one wanted to kick a sleeping dog.”

Production at Mexico’s main Cantrell field is collapsing and will force that country to become a net importer in five years. Venezuela is shifting the exports of its sulfur-laden crude to China for political reasons once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, stable energy prices have put urgent alternative energy development on a back burner, with his preferred natural gas (UNG) taking the biggest hit. If the US doesn’t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won’t work on still nights and can’t power an 18-wheeler. Don’t count on the help of the big oil companies because they get 81% of their earnings from selling imported oil. The answer is in a diverse blend of multiple alternative energy supplies from American only sources.

Boone says he had donated $700 million to charity and argues that the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Back then at 85, he had not slowed down a nanosecond.

As Boone walked out the door, I shook hands with him and said, “I want to be like you when I grow up.” He smiled. When you meet a friend who is 85, you never know if you are going to see him again.

To learn more about the details of his passing, please click here.

Global Market Comments

September 12, 2019

Fiat Lux

Featured Trade:

(WILL ANTITRUST DESTROY YOUR TECH PORTFOLIO?),

(FB), (AAPL), (AMZN), (GOOG), (SPOT), (IBM), (MSFT)

In recent days, two antitrust suits have arisen from both the Federal government and 49 states seeking to fine, or break up the big four tech companies, Facebook (FB), Apple (AAPL), Amazon (AMZN), and Google (GOOG). Let’s call them the “FAAGs.”

And here is the problem. These four companies make up the largest share of your retirement funds, whether you are invested with active managers, mutual funds, or simple index funds. The FAAGs dominate the landscape in every sense, accounting 13% of the S&P 500 and 33% of NASDAQ.

They are also the world’s most profitable large publicly listed companies with the best big company earnings growth.

I’ll list the antitrust concern individually for each company.

Facebook has been able to maintain its dominance in social media through buying up any potential competitors it thought might rise up to challenge it through a strategy of serial defense acquisitions

In 2012, it bought the photo-sharing application Instagram for a bargain $1 billion and built it into a wildly successful business. It then overpaid a staggering $19 billion for WhatsApp, the free internet phone and texting service that Mad Hedge Fund Trader uses while I travel. It bought Onovo, a mobile data analytics company, for pennies ($120 million) in 2013.

Facebook has bought over 70 companies in 15 years, and the smaller ones we never heard about. These were done largely to absorb large numbers of talented engineers, their nascent business shut down months after acquisition.

Facebook was fined $5 billion by the Fair Trade Commission (FTC) for data misuse and privacy abuses that were used to help elect Donald Trump in 2016.

Apple

Apple only has a 6% market share in the global smart phone business. Samsung sells nearly 50% more at 9%. So, no antitrust problem here.

The bone of contention with Apple is the App Store, which Steve Jobs created in 2008. The company insists that it has to maintain quality standards. No surprise then that Apple finds the products of many of its fiercest competitors inferior or fraudulent. Apple says nothing could be further from the truth and that it has to compete aggressively with third party apps in its own store. Spotify (SPOT) has already filed complaints in the US and Europe over this issue.

However, Apple is on solid ground here because it has nowhere near a dominant market share in the app business and gives away many of its own apps for free. But good luck trying to use these services with anything but Apple’s own browser, Safari.

It’s still a nonissue because services represent less than 15% of total Apple revenues and the App Store is a far smaller share than that.

Amazon

The big issue is whether Amazon unfairly directs its product searches towards its own products first and competitors second. Do a search for bulk baby diapers and you will reliably get “Mama Bears”, the output of a company that Amazon bought at a fire sale price in 2004. In fact, Amazon now has 170 in-house brands and is currently making a big push into designer apparel.

Here is the weakness in that argument. Keeping customers in-house is currently the business strategy of every large business in America. Go into any Costco and you’ll see an ever-larger portion of products from its own “Kirkland” branch (Kirkland, WA is where the company is headquartered).

Amazon has a market share of no more than 4% in any single product. It has the lowest price, and often the lowest quality offering. But it does deliver for free to its 100 million Prime members. In 2018, some 58% of sales were made from third-party sellers.

In the end, I believe that Amazon will be broken up, not through any government action, but because it has become too large to manage. I think that will happen when the company value doubles again to $2 trillion, or in about 3-5 years, especially if the company can obtain a rich premium by doing so.

Directed search is also the big deal here. And it really is a monopoly too, with some 92% of the global search. Its big breadwinner is advertising, where it has a still hefty 37% market share. Google also controls 75% of the world’s smart phones with its own Android operating software, another monopoly.

However, any antitrust argument falls apart because its search service is given away to the public for free, as is Android. Unless you are an advertiser, it is highly unlikely that you have ever paid Google a penny for a service that is worth thousands of dollars a year. I myself use Google ten hours a day for nothing but would pay at least that much.

The company has already survived one FTC investigation without penalty, while the European Union tagged it for $2.7 billion in 2017 and another $1.7 billion in 2019, a pittance of total revenues.

The Bottom Line

The stock market tells the whole story here, with FAAG share prices dropping a desultory 1%-2% for a single day on any antitrust development, and then bouncing back the next day.

Clearly, Google is at greatest risk here as it actually does have a monopoly. Perhaps this is why the stock has lagged the others this year. But you can count on whatever the outcome, the company will just design around it as have others in the past.

For start, there is no current law that makes what the FAAGs do illegal. The Sherman Antitrust Act, first written in 1898 and originally envisioned as a union-busting tool, never anticipated anticompetitive monopolies of free services. To apply this to free online services would be a wild stretch.

The current gridlocked congress is unlikely to pass any law of any kind. The earliest they can do so will be in 18 months. But the problems persist in that most congressmen fundamentally don’t understand what these companies do for a living. And even the companies themselves are uncertain about the future.

Even if they passed a law, it would be to regulate yesterday’s business model, not the next one. The FAAGs are evolving so fast that they are really beyond regulation. Artificial intelligence is hyper-accelerating that trend.

It all reminds me of the IBM antitrust case, which started in 1975, which my own mother worked on. It didn’t end until the early 1990s. The government’s beef then was Big Blue’s near-monopoly in mainframe computers. By the time the case ended, IBM had taken over the personal computer market. Legal experts refer to this case as the Justice Department’s Vietnam.

The same thing happened to Microsoft (MSFT) in the 1990s. After ten years, there was a settlement with no net benefit to the consumer. So, the track record of the government attempting to direct the course of technological development through litigation is not great, especially when the lawyers haven’t a clue about what the technology does.

There is also a big “not invented here” effect going on in these cases. It’s easy to sue companies based in other states. Of the 49 states taking action against big tech, California was absent. But California was in the forefront of litigation again for big tobacco (North Carolina), and the Big Three (Detroit).

And the European Community has been far ahead of the US in pursuing tech with assorted actions. Their sum total contribution to the development of technology was the mouse (Sweden) and the World Wide Web (Tim Berners Lee working for CERN in Geneva).

So, I think your investments in FAAGs are safe. No need to start eyeing the nearest McDonald’s for your retirement job yet. Personally, I think the value of the FAAGs will double in five years, as they have over the last five years, recession or not.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.