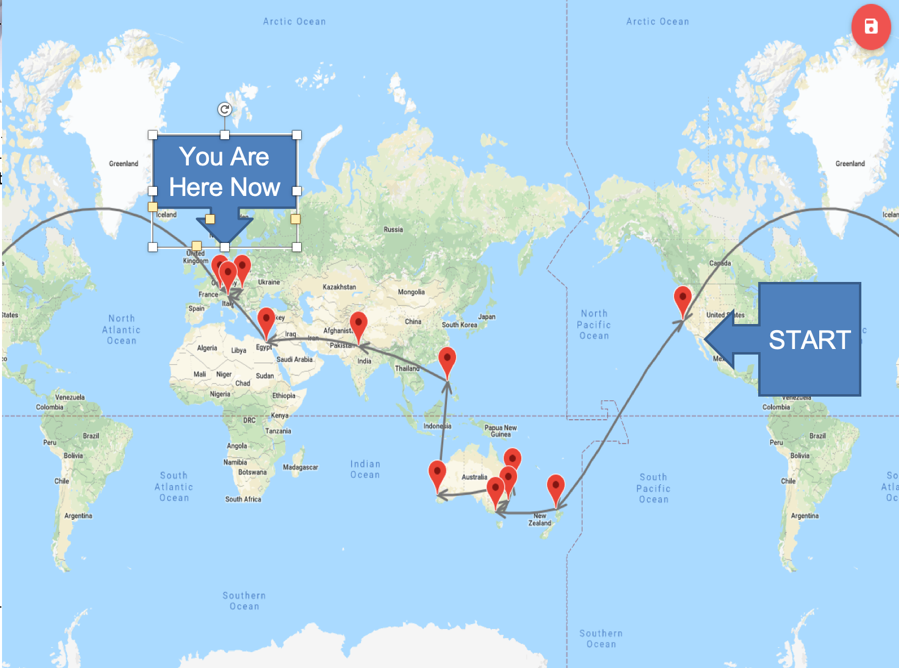

I beat Phileas Fogg by 55 days, who needed 88 days to complete his trip around the world to settle a gentleman’s bet. But then he had to rely on elephants, sailing ships, and steam engines to complete his epic voyage, or at least the one imagined by Jules Verne.

I actually took a much longer route, using a mix of Boeings and Airbuses to fly 80 hours over 40,000 miles on 18 flights through 12 countries in only 33 days. Incredibly, our baggage made it all the way, rather than see its contents sold on the black markets of Manila, New Delhi, or Cairo.

It was a trip around the world for the ages, made even more challenging by dragging 13 and 15 year old girls along with me. I have always considered my most valuable asset to be the trips I took to Europe, Africa, and Asia in 1968. The comparisons I can make today some 51 years later are nothing less than awe-inspiring. I wanted to give the same gift to them.

It began with a 12 ½ hour flight from San Francisco to Auckland, New Zealand. Straight out of the airport, I rented a left-hand drive Land Rover and drove three hours to high in the steam-covered mountains of Rarotonga where we were dinner guests of a Maori tribe. To earn my dinner of pork and vegetables cooked underground, I had to dance the haka, a Maori war dance.

Of course, with kids in tow, a natural stop was the Hobbit Village of Hobbiton 1½ hours outside of Auckland. I figured the owners of the idyllic sheep farm were earning at least $25 million a year showing tourists the movie set.

In all, I put 1,000 miles on the car in four days, even crossing New Zealand’s highest mountain range on a dirt road. The thick forests were so primeval, my daughter expected to see a dinosaur around the next curve. We reached our southernmost point at Mt. Ruapehu, a volcano used as the inspiration for Mt. Doom in Peter Jackson’s Lord of the Rings.

The Real Mount Doom

The focus of the Australia leg were ten strategy lectures which I presented around the country. I was mobbed at every stop, with turnout double what I expected. The Mad Hedge Fund Trader and the Mad Hedge Technology Letter picked up 100 new subscribers in the Land Down Under in five days. Maybe it was something I said?

My kids’ only requirements were to feed kangaroos and koala bears, which we duly accomplished on a freezing cold morning outside Melbourne. We also managed to squeeze in a tour of the incredible Sydney Opera house in between lectures.

I hosted five Mad Hedge Global Strategy Luncheons for existing customers in five days. The highlight was in Perth, where eight professional traders and I enjoyed a raucous, drunken meal. They had all done well off my advice, so I was popular to say the least. Someone picked up the tab without me even noticing.

After that, it was a brief ten-hour flight to Manila, Philippines with a brief changeover in Hong Kong, where massive protest demonstrations were underway. Ever the history buff, I booked myself into General Douglas MacArthur’s suite at the historic Manila Hotel. The last time I was there, I interviewed president Ferdinand Marcos and his lovely wife Imelda. After a lunch with my enthusiastic Philippine staff, I was on my way to the airport.

I took Malaysian Airlines to New Delhi, India which has lost two planes over the last five years and where the crew was definitely on edge. I asked why a second plane was lost somewhere over the South Indian Ocean and the universal response was that the pilot had gone insane. Security was so tight that they confiscated a bottle of Jamieson Irish Whiskey that I had just bought in duty free.

India turned out to be a dystopian nightmare. If global warming continues, this is your preview. With temperatures up to 120 degrees in 100% humidity, people here dying of heatstroke are by the hundreds. Elephants had to be hosed down to keep them alive. It was so hot you couldn’t stray from the air conditioning for more than an hour.

In Old Delhi, the kids were besieged by child beggars pawing them for food and there were mountains of trash everywhere. In the Taj Mahal, my older daughter passed out and we had to dump our remaining drinking water on her to bring her back to life. We spent the rest of the day sightseeing indoors at the most heavily air-conditioned shops. The handwoven Persian carpet should arrive any day now.

If global temperatures rise by just a few more degrees, you’re going to lose a billion people in India very soon.

On the way to Abu Dhabi, we flew directly over the tanker war at the Straights of Hormuz. It was too dusty to see any action there. We got a much better view of Sinai and the Red Sea, which, I told the kids, Moses parted 5,000 years ago (they’ve seen Charlton Heston in The Ten Commandments)

Upon landing at Cairo, Egypt’s military intelligence service immediately picked me up. Apparently, I was still in their system dating back to my coverage of Henry Kissinger’s shuttle diplomacy for The Economist in 1976. That was all a long time ago. Having two kids with me meant I was not there to cause trouble, so they were very friendly. They even gave us a free ride to the downtown Nile Hilton.

After India, Cairo and the Sahara Desert were downright pleasant, a dry and comfortable 100 degrees. We did the standard circuit, the pyramids and the Sphynx followed by a camel ride into the desert.

If you are the least bit claustrophobic, don’t even think about crawling into the center of the Great Pyramid on your hands and knees as we did. I was sore for two days. We spent the evening on a Nile dinner cruise, looking for alligators, entertained by an unusually talented belly dancer.

The next stage involved a one-day race to Greece, where we circled the Acropolis in all its glory, and then argued with a Greek taxi driver on how to get back to the airport. We ended up taking an efficient airport train, a remnant of the 2000 Athens Olympics. If impoverished and bankrupt, Athens has such great airport train, why doesn’t New York or San Francisco?

It was a quick hop across the Adriatic to Venice, Italy, where we caught an always exciting speed boat from the airport to our Airbnb near St. Mark’s Square. We ran through the ancient cathedral and the Palace of the Doges, admiring the massive canvases, the medieval weaponry, and the dungeon.

One of the high points of the trip was a performance of Vivaldi’s Four Seasons in the very church it was composed for. A ferocious thunderstorm hit, flooding the plaza outside and causing the lead violinist’s string to break, halting the concert (rapid humidity change I guess).

When we got home with soggy feet, the Carabinieri had cordoned off our block with police tape because a big chunk of the 400-year-old roof had fallen into the street. It taxed my Italian to the max to get into our apartment that night. The Airbnb host asked me not to mention this in my review (I didn’t).

The next day brought a circuitous trip to Budapest via Brussels. Budapest was a charm, a former capital of the Austria Hungarian Empire and the architecture to prove it. The last time I was there 51 years ago, the Russian Army was running the place and it was grim, oppressive, and dirty.

Today, it is a thriving hot spot for Europe’s young, with bars and night clubs everywhere. Dinners dropped from $150 in Venice to $30. We topped the night with a Danube dinner cruise with a folk dancing troupe. I’m told you can live there like a king for $1,000 a month.

The next morning we drew closer to our final destination to Zurich, Switzerland. A four-hour train ride brought us to my summer chalet in Zermatt and some much-needed rest. At the end of a long valley and lacking cars, Zermatt is one of those places where you can just give the kids 50 Swiss francs and tell them to get lost. I spent mornings hiking up from the valley floor and afternoons getting caught up on the markets and my writing.

There’s nothing like recharging my batteries in the clean mountain air of the Alps. The forecast was rain every day for two weeks, but it never showed. As a result, I ended up hiking ten miles a day to the point where my legs were made of lead by the end.

The only downer was watching helicopters pick up the bodies of two climbers who fell near the top of the Matterhorn. As temperatures rise rapidly, the ice holding the mountain together melts leading to a rising tide of fatal accidents.

I caught my last flight home from Milan. Anything for one more great dinner in Italy which I enjoyed in the Galleria. At the train station, I chatted with a troop of Italian Boy Scouts in blue uniforms headed for the Italian Alps. The city was packed with Chinese tour groups, and there was a one-month wait to buy tickets for Leonardo DaVinci’s The Last Supper. Another Airbnb made sure I stayed up all night listening to the city’s yellow trolleys trundle by.

Finally, an 11-hour flight brought me back to the City by the Bay. Thanks to two sleeping pills of indeterminate origin, I went to sleep over England and woke up over Oregon preparing for a landing. It seems that somewhere along the way, I proposed marriage to the Arab woman sitting next to me, but I have no memory of that whatsoever. At least that’s what the head flight attendant thought.

My return home has me already planning next year’s trip. After Australia, should I fly up to Japan and catch the 2020 Tokyo Olympics and then go to Zermatt? Or, should I fly directly to South Africa for a safari and then make it to Switzerland? And I have to get home in time to join a 50-mile hike with the Boy Scouts in New Mexico.

What a great problem to have.