Global Market Comments

March 13, 2019

Fiat Lux

Featured Trade:

(WHY BOND YIELDS ARE GOING TO ZERO),

(TLT), (TBT), ($TNX),

(TESTIMONIAL)

Global Market Comments

March 12, 2019

Fiat Lux

Featured Trade:

(AN AFTERNOON WITH ANTHONY SCARAMUCCI OF SKYBRIDGE),

(BRK/A), (EEM)

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Well, that was some week!

After moving up in a straight line for ten weeks, markets are now doing their best impression of a Q4 repeat.

The transports Index (XTN), the most important leading indicator for markets, has been down for 11 straight days, the worst run in 40 years.

And now for the bad news.

Look at a long term chart for the S&P 500 (SPY) and the head and shoulder top practically leaps at you and grabs you by the lapels (that is, if you are one of the few who still wears a suit).

It makes you want to slit your wrist, jump off the nearest bridge, or binge watch all nine seasons of The Walking Dead. It neatly has the next bear market starting around say May 10 at 4:00 PM EST, a rollover point I put out two years ago.

However, hold that move! As long as we have a free Fed put under the market in the form of Jay Powell’s “patience’ policy, we are not going to have a major crash any time soon. That is 2021 business.

It's more likely we trade in a long sideways range until the economy finally rolls over and dies. So when we hit my first (SPY) downside target at the 50-day moving average at $269, which is a very convenient 5% down from the recent top, could well bounce hard and I might add some longs in the best quality names. It all sets of my dreaded flatline of death scenario for the rest of 2019.

Last week saw an unremitting onslaught of bad news from the economy.

The February Nonfarm Payroll report came in at a horrific 200,000 when 210,000 was expected, sending traders to man the lifeboats. The headline Unemployment Rate dropped 0.2% to 3.8%. Average Hourly Earnings spiked 11 cents to $27.66, a 3.4% YOY gain and the biggest pop since 2009.

Construction lost 31,000 jobs, while leisure and Hospitality added no jobs at all. The stunner is that the U6 long term structural “discouraged worker” unemployment rate dropped an amazing 0.8% to 7.4%, the sharpest drop on record. Fewer jobs, but at higher wages is the takeaway here, the exact opposite of what markets want to hear.

US Construction Spending fell off a cliff, down 0.6% in December. It seems that nobody wants to invest ahead of a recession.

The dollar soared (UUP), and gold (GLD) got hammered. You can blame the slightly stronger GDP print on Thursday the week before, which came in at 2.2% instead of 1.8%. As long as Jay doesn’t raise interest rates this is just a brief short covering rally for the buck.

China cut its growth forecast from 6.5% to 6.0% GDP growth for 2019. The trade war with the US and the stimulus hasn’t kicked in yet. The last time they did this, the market fell 1,000 points. Buy (FXI) on the dip.

US Trade Deficit hit ten-year high at $59.8 billion for December, and a staggering $419 billion for the year. It’s funny how foreigners stop buying your goods when you declare war on them. Even Teslas (TSLA) are being stopped at the border in China. Who knew?

New trade tariffs hit US consumers the hardest adding $69 billion to their annual bill. Falling real earnings and rising costs is hardly a sustainable model. Will someone please tell the president?

US growth is fading, says the Fed Beige Book, slowing to a “slight to moderate rate”. The government shutdown is the cause. With Europe already in recession, I’ll be using rallies to increase my shorts. Sell (SPY) and (IWM).

The European Central Bank axed its growth forecast sharply, from 1.7% to 1.1%. Stimulus to renew on all front, including more quantitative easing. It’s just a matter of time before their recession pulls the US down. Sell the Euro (FXE).

You lost $3.7 trillion in Q4, or so says the Fed about the decline of national personal net worth during the stock market crash, the sharpest decline in a decade. You’re now only worth $104.3 trillion.

The Mad Hedge Fund Trader actually gained ground last week, thanks to profits on our short positions rising more than our offsetting losses on our longs.

I have doubled up my overall positions, finally taking advantage of the rollover in all risk assets from a historic ten-week run to the upside. I added shorts in the S&P 500 (SPY) and the Russell 2000 (IWM) against a very deep in-the-money long in Freeport McMoRan (FCX) the world’s largest copper producer.

The thinking here is that with China the only economy in the world that is stimulating its economy and the planet’s largest copper consumer, copper makes a nice long side hedge against my short positions.

The Mad Hedge Technology Letter is happily running a short position is Apple (AAPL) which is now almost at its maximum profit point. We only have four days to run to expiration when the position we bought for $4.60 will be worth $5.00.

February came in at a hot +4.16% for the Mad Hedge Fund Trader. March started out negative, down -0.84%, thanks to a wicked stop loss on Gold (GLD). We had 80% of the maximum potential profit at one point but left the money on the table at the highs.

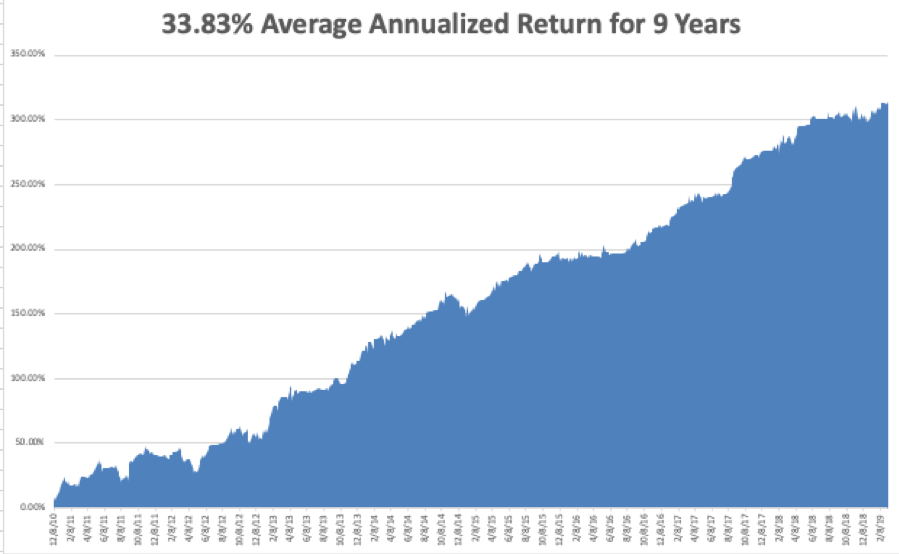

My 2019 year to date return ratcheted up to +12.84%, a new all-time high and boosting my trailing one-year return back up to +29.92%.

My nine-year return clawed its way up to +312.94%, another new high. The average annualized return appreciated to +33.83%.

I am now 50% in cash, 20% long Freeport McMoRan (FCX), and 10% short bonds (TLT), 10% short the S&P 500, and 10% short the Russell 2000.

We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be pretty boring on the data front after last week's fireworks.

On Monday, March 11, at 8:30 AM EST, January Retail Sales is ut.

On Tuesday, March 12, 8:30 AM EST, the February Consumer Price Index is published.

On Wednesday, March 13 at 8:30 AM EST, the February Durable Goods is updated.

On Thursday, March 14 at 8:30 AM EST, we get Weekly Jobless Claims. These are followed by January New Home Sales.

On Friday, March 15 at 9:15 AM EST, February Industrial Production comes out. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’ll be headed to the De Young Museum of fine art in San Francisco to catch the twin exhibitions for Monet and Gaugin. When it rains every day of the week, there isn’t much to do but go cultural.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Good Trades are Getting Harder to Find

“For myself, I am an optimist. It does not seem to be much use being anything else,” said British WWII Prime Minister, Winston Churchill.

Global Market Comments

March 8, 2019

Fiat Lux

Featured Trade:

(MARCH 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SDS), (TLT), (TBT), (GE), (IYM),

(MSFT), (IWM), (AAPL), (ITB), (FCX), (FXE)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 3 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Are you sticking to your market top (SPY), (SDS) by mid-May?

A: Yes, at the rate that economic data is deteriorating, and earnings are falling, there’s no prospect of more economic stimulation here, my May top in the market is looking better than ever. Europe going into recession will be the gasoline on the fire.

Q: Where do you see interest rates (TLT) in 1-2 years?

A: Interest rates in 2 years could be at zero. If interest rates peaked at 3.25% last year, then the next move could be to zero, or negative numbers. The world is awash in cash, and without any economic growth to support that, you could have massive cuts in interest rates.

Q: Will (TLT) be going higher when a market panic sets in?

A: It will, which is why I’m being cautious on my short positions and why I’m only using tops to sell. You can be wrong in this market but still make money on every put spread, as long as you’re going far enough in the money. That said, when the stock market starts to roll over big time, you want to go long bonds, not short, and we may do that someday.

Q: Do you see a selloff to stocks similar to last December?

A: As long as the Fed does not raise interest rates, I don’t expect to get a selloff of more than 5% or 6% initially. If we do get a dramatic worsening of economic data and it looks like we’re headed in that direction, the Fed will start cutting interest rates, the recession signal will be on and only then will we drop to the December lows—and possibly as low as 18,000 in the Dow.

Q: General Electric has gone from $6 to $10; what would you do now?

A: Short term, sell with a 66% gain in a stock. Long term, you probably want to hold on. However, their problems are massive and will take years to sort out, probably not until the other side of the next recession.

Q: Microsoft (MSFT): long term hold or sell?

A: Absolutely long-term hold; look for another double in this company over the next 3 years. This is the gold standard in technology stocks today. Short term, you’re looking at no more than $15 of downside to the December low.

Q: Would you short banks (IYF) here since interest rates have failed to push them higher?

A: I would not; they’ve been one of the worst performing sectors of the market and they’re all very low, historically. You want to short highs like I’m doing now in the (SPY), the (IWM), and Apple (AAPL), not lows.

Q: Is the China trade deal (FXI) a ‘sell the news’ event?

A: Absolutely; there’s not a hedge fund out there that isn’t waiting to go short on a China trade deal. The weakness this week is them front-running that news.

Q: Do you see emerging markets (EEM) pushing higher from the 42 level, or will a global recession bring it back to earth?

A: First of all, (EEM) will go higher as long as interest rates in the U.S. are flatlining, so I expect a rally to last until the spring; however, when a real recession does become apparent, that sector will roll over along with everything else.

Q: Would you buy homebuilders (ITB) if this lower interest rate environment persists?

A: I wouldn’t. First of all, they’ve already had a big 28% run since the beginning of the year— like everything else—and second, low-interest rates don’t help if you can’t afford the house in the first place.

Q: Would you short corporate bonds if you think there’s going to be a recession next year?

A: I’m glad you asked. Absolutely not, not even on pain of death. I would buy bonds because interest rates going to zero takes bond prices up hugely.

Q: Should you buy stocks in front of a blackout period on corporate buybacks?

A: Absolutely not. Corporate buybacks are the number one buyers of shares this year, possibly exceeding $1 trillion. Companies are not allowed to buy their own stocks anywhere from a couple of weeks to a month ahead of their earnings release. By removing the principal buyer of a share, you want to sell, not buy.

Q: What are the chances the China trade deal (FXI) breaks down this month and no signing takes place?

A: I have a feeling Trump is desperate to sign anything these days, and I think the Chinese know that as well, especially in the wake of the North Korean diplomatic disaster. He has to sign the deal or we’ll go to recession, and that would be tough to run on for reelection.

Q: Which stock or ETF would you short on real estate?

A: If you short the iShares US Home Construction ETF (ITB), you short the basket. Shorting individual stocks is always risky—you really have to know what’s going on there.

Q: What’s the best commodity play out there?

A: Copper. If China is the only country that’s stimulating its economy right now, and China is the largest consumer of copper, then you want to buy copper. The electric car boom feeds into copper because every new vehicle needs 20 pounds of copper for wiring and rotors. Copper is also cheap as it is coming off of a seven-year bear market. What do you buy at market tops? Only cheap stuff.

Q: Why did you go so far in the money in the Freeport-McMoRan (FCX) call spread with only a 10% profit on the trade in five weeks?

A: In this kind of market, I’ll take 10% in 5 weeks all day long. But additionally, when prices are this high, I want to be as conservative as possible. Going deep in the money on that is a very low-risk trade. It’s a bet that copper doesn’t go back to the December lows in five weeks, and that’s a bet I’m willing to make.

Q: Will a new round of QE in Europe affect our stock market?

A: Yes, it’s terrible news. It will weaken the Euro (FXE), strengthen the dollar (UUP), and force US companies to lower earnings guidance even further. That is bad for the market and is a reason why I have been selling short.

Sending You Trade Alerts from Africa

Global Market Comments

March 7, 2019

Fiat Lux

Featured Trade:

(BETTER BATTERIES HAVE BECOME BIG DISRUPTERS)

(TSLA), (XOM), (USO)

Global Market Comments

March 6, 2018

Fiat Lux

Featured Trade:

(WILL UNICORNS KILL THE BULL MARKET?),

(TSLA), (NFLX), (DB), (DOCU), (EB), (SVMK), (ZUO), (SQ),

(A NOTE ON OPTIONS CALLED AWAY), (TLT)

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away.

I have already gotten calls from holders of the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $124-$126 in-the-money vertical BEAR PUT spread who have seen their short March $124 puts called away.

If it does, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position. You just won the lottery, literally.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money call option spread, it contains two elements: a long call and a short call. The short called can get assigned, or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

What your broker had done in effect is allow you to get out of your put spread position at the maximum profit point seven days before the March 15 expiration date.

All you have to do was call your broker and instruct him to exercise your long position in your March $126 to close out your short position in the March $124.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A call owner may need to sell a long stock position right at the close, and exercising his long March 15 puts is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, calls even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.