Global Market Comments

October 10, 2018

Fiat Lux

SPECIAL TESLA ISSUE

Featured Trade:

(OCTOBER 14 SAVANNAH GEORGIA STRATEGY BREAKFAST),

(THE BULL CASE FOR TESLA),

(TSLA), (GM), (F)

Global Market Comments

October 10, 2018

Fiat Lux

SPECIAL TESLA ISSUE

Featured Trade:

(OCTOBER 14 SAVANNAH GEORGIA STRATEGY BREAKFAST),

(THE BULL CASE FOR TESLA),

(TSLA), (GM), (F)

Come join John Thomas at the Mad Hedge Fund Trader’s Global Strategy Breakfast which I will be conducting in Savannah, Georgia on Sunday, October 14, 2018 at 8:00 AM. A sumptuous breakfast will be followed by an extended question and answer period.

I’ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $209.

Breakfast will be held at a downtown Victorian Savannah hotel nearby that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the breakfast please click here.

Talk about a bad news factory.

A short interest of 26% in Tesla (TSLA) stock has the tendency to manufacture bad news on a daily basis, whether it is true or not. It really has been a black swan a day.

This really is the most despised stock in the market. But you have to expect that when you are simultaneously disputing the auto, oil, dealer, and advertising industries, and doing it all union-free.

It also doesn’t help that Tesla is on the Department of Justice speed dial, undergoing no less than three investigations since the advent of the new administration. I can’t imagine why this is happening, given that the White House is now packed with oil industry executives.

That’s why I have been advising investors to buy the car and not the stock.

That is until now.

The truth is that all of this negativity is generating the best entry point for Tesla shares in two years.

In the meantime, the San Francisco Bay Area has become flooded with new Tesla 3’s. These are suddenly everywhere and soon will outnumber the ubiquitous Toyota Prius, until now the favorite of technology employees.

Q3 production of Tesla 3’s reached an eye-popping 55,840, up from 18,440 the previous quarter, taking Tesla’s total output to 80,000 including the model X.

That puts the company on target to reach 250,000 units in 2019. Tesla may be about to see something it has not witnessed in the company’s 15-year history: a real profit.

When I picked up my first Tesla 1 in 2010, chassis no. 125, I was all alone and treated like I was visiting royalty. The sales staff fawned all over me, offering me free hats, coffee mugs, and other tchotchke. Today, a staggering 200 people a day are gleefully driving their new wheels away from the Fremont factory, and another 200 getting them home-delivered by semis. Take a number and wait in line.

I have pinned down several of these drivers in parking lots, shopping malls, and trailheads to quiz them about their new ride and the answer is always the same. It’s a car from 20 years in the future, the best they have ever driven, and they will never buy another marque again.

Sounds pretty good, doesn’t it?

So I perked up the other day when I heard my old pal, legendary value investor Ron Baron, make the bull case for Tesla.

Ron has never done things by halves. He expects Tesla’s market capitalization to soar from $43 billion today to $1 trillion by 2030, a mere 12 years away. By then, Tesla should be generating $150 billion a year in profits. That implies that a 23-fold increase in the share price to $5,570 is ahead of us.

Half of this will be generated by the auto sales, while the other half will be produced by a burgeoning battery business. Tesla will easily become the largest auto manufacturer in the world within a few years.

Tesla will sell 10-15 million cars a year by 2030, compared to the current 300,000 annual rate.

It already is the one American auto maker with the highest US parts content, nearly 100%. It has also been one of the largest creators of new jobs over the past decade, right behind Amazon (AMZN), at some 46,000.

It’s really all about the math. Today, Tesla is building its Tesla 3’s at a cost of $28,000 apiece and selling them for $62,000. That’s the high price they have been realizing with extra options like four-wheel drive, 300-mile extended range batteries, painted wheels, and all the other bells and whistles. That gives you a $34,000 profit per vehicle.

Tesla’s “cheap” cars, the stripped-down rear wheel drive Tesla 3’s that will sell for a modest but world-beating $35,000 won’t be available until early 2019.

At this rate, the entire company will become profitable when it hits a production rate of 10,000 units a week compared to the current 6,000 units. They should achieve that sometime in early 2019.

Much has been made of drone video footage showing vast parking lots in Fremont, CA chock-a-block with shiny new Tesla 3’s. This creates a false sense of poor sales.

The actual fact is that Tesla has no dealer network. All of those parked cars have been sold and are awaiting owners to pick them up. The months it takes from payment to actual delivery gives Tesla a free float on billions of dollars. That’s worth a lot in a world of steadily rising interest rates.

Oh, and those notorious tents? They could withstand a category 5 hurricane. However, like everything else the company does, they’re revolutionary. They enable bypassed permitting procedures and can be built very quickly and cheaply.

How are things going with the competition? Not so good. The traditional internal combustion car industry has hundreds of billions of dollars tied up in engine factories that will eventually become worthless. They really are the 21st century equivalent of buggy whip makers.

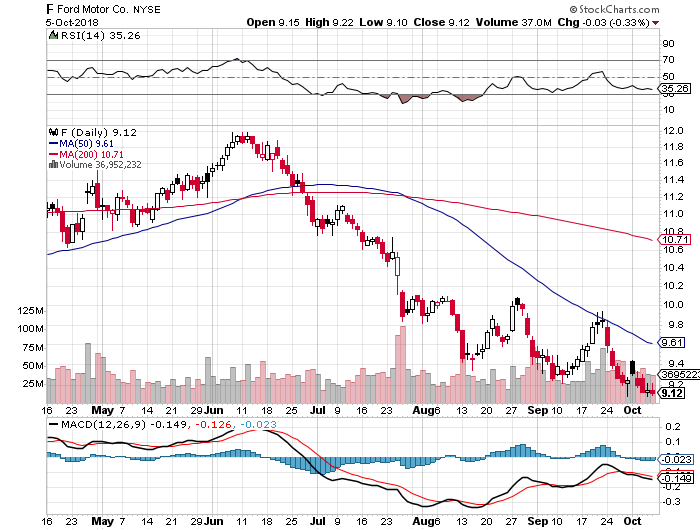

General Motors (GM), Ford (F), and Chrysler are executing slow motion roll out of electric cars in order to squeeze a few more years of use out of these legacy plants. Electric cars don’t use engines. That is putting them ever further behind.

This is what the poor share performance of auto shares has been screaming at you all year despite one of the strongest economies and stock markets in history. Yes, “peak Auto” is at hand.

The high-end brands like Mercedes, BMW, Audi, and Porsche that just entered the all-electric market are a decade behind Tesla in autonomous software and manufacturing processes. They all have huge, expensive dealer networks.

Let’s see how sales go after they suffer their first fatal crash. In the meantime, Tesla has run up 200 million miles worth of driving data.

Factory insiders say a speed-up of new Tesla orders is in the works. Orders placed before December 31, 2018 are entitled to a $7,500 federal tax credit. That drops to $3,750 in the first half of 2019, only $1,750 in the second half, and zero in 2020.

In the meantime, the oil industry is still collecting $55 billion a year of federal oil depletion allowances. Go figure.

At the same time, many states like California, far and away Tesla’s largest market (Texas is no. 2), are either maintaining or expanding their own electric car subsidies or gas guzzler penalties. It is $2,500 per car in California.

Ron Baron is not alone in his admiration of Tesla. Macquarie Research has just initiated coverage with a strong “BUY” and a target of $430 a share, up 70% from today’s close.

Next in the works will be a Tesla Model Y, a small four-wheel drive based on the Tesla 3 chassis. A Roadster relaunch comes next in 2022, a $250,000 super car that will be doubtless aimed at Arab sheiks and billionaire car collectors.

By then the entire product line will spell SEXY. See! Elon Musk does have a sense of humor after all!

Global Market Comments

October 9, 2018

Fiat Lux

SPECIAL REPORT ON GOLD

Featured Trade:

(TAKING A LOOK AT GOLD LEAPS),

(GLD), (ABX), (AMZN)

As incredible as it may sound, I’m starting to hear good things about gold. That’s amazing as the barbarous relic has been the red headed step child of the financial markets for the past six years. Not since the yellow metal peaked in 2011 have I heard the talk so bullish.

You can thank central banks which have become the principal buyers of gold in 2018. China is always the largest buyer. It has been joined by Russia, which is avoiding American trade sanction, and Kazakhstan. Now Poland has joined the fray. Central banks have accounted for a stunning 264 metric tonnes of purchases this year, or some 9.3 million ounces.

You can thank the coming return of inflation in the US economy, gold’s best friend. With a 4.2% GDP growth rate in Q2, the return of rapidly rising prices is just a matter of time. We here in Silicon Valley have grown inured to ever rising prices for everything. You in the rest of the country are about to get the bad news.

You can thank Amazon (AMZN) founder Jeff Bezos for pouring gasoline on the fire. By giving 250,000 US workers a 25% pay increase from $12 to $15, he has created a national short squeeze for minimum wage workers. If McDonald’s (MCD), Target (TGT), and Wal-Mart (WMT) join the fray, as they must or lose workers, wage inflation will go national.

Yes, you can remind me that rising interest rates are a terrible backdrop against which to own gold. The Federal Reserve has essentially promised us four more 25 basis point rate hikes by next summer. That would take the overnight rate to 3.25%, a historically "normalized” rate.

But what happens when the rate hikes stop? Gold takes off like a scalded chimp.

It is in fact a myth that gold can’t perform in a raising rate environment. When you look at gold’s “golden age” during the 1970’s when the barbarous relic rocketed from $34 to $900, a 24-fold increase, interest rates were rising almost as fast.

Over the same time period, the ten-year US Treasury yield soared from 5% to 16%. At the end of the day, investors fear inflation far more than high interest rates.

So when you believe that an oversold asset is about to turn but don’t know when, what is the best course of action?

Long Term Equity Anticipation Securities, or LEAPS, are a great way to play the market when you expect a substantial move up in a security over a long period of time. Get these right and the returns over 18 months can amount to several hundred percent.

At market bottoms these are a dollar a dozen. At all-time highs they are as scarce as hen’s teeth. However, scouring all asset classes there are a few sweet ones to be had.

Today, you can buy the SPDR Gold Shares ETF (GLD) January 2020 $120-$125 call spread for $1.60. For those who are new to the Mad Hedge Fund Trader, that involves buying the January 2020 $120 call and selling short the January 2020 $125 call.

This has the attributes of reducing your cost and minimizing the cost of time decay while giving you highly leveraged upside exposure over a long period of time.

If the price of gold rises by $11.20, from $113.80 to $125, a mere 9.8% by the January 17 option expiration date, the profit on this trade will amount to 212.5%. In order words, a $1,000 investment will become worth $3,125 if gold simply returns back to where it was in April.

If you’re more aggressive than I am (unlikely), you can buy the SPDR Gold Shares ETF (GLD) January 2020 $125-$130 call spread for $1.00, That would give you a maximum potential profit of 400%. In order words, a $1,000 investment will become worth $5,000 if gold simply return back to its February 2018 high.

A number of other fundamental factors are coming into play that will have a long-term positive influence on the price of the barbarous relic.

The only question is not if, but when the next bull market in the yellow metal will accelerate.

All of the positive arguments in favor of gold all boil down to a single issue: they're not making it anymore.

Take a look at the chart below and you'll see that new gold discoveries are in free fall. That's because falling prices from 2011 to 2018 caused exploration budgets to fall off a cliff.

Gold production peaked in the fourth quarter of 2015 and is expected to decline by 20% in the following four years.

The industry average cost is thought to be around $1,400 an ounce, although some legacy mines such as at Barrack Gold (ABX) can produce it for as little as $600.

So why dig out more of the stuff if it means losing more money?

It all sets up a potential turn in the classic commodities cycle. Falling prices demolish production and wipe out investors. This inevitably leads to supply shortages.

When the buyers finally return for the usual cyclical macro-economic reasons, there is none to be had, and price spikes can occur which can continue for years.

In other words, the cure for low prices is low prices.

Worried about new supply quickly coming on-stream and killing the rally?

It can take ten years to get a new mine started from scratch by the time you include capital rising, permits, infrastructure construction, logistics and bribes.

It turns out that the brightest prospects for new gold mines are all in some of the world's most inaccessible, inhospitable, and expensive places.

Good luck recruiting for the Congo!

That's the great thing about commodities. You can't just turn on a printing press and create more, as you can with stocks and bonds.

Take all the gold mined in human history, from the time of the ancient pharaohs to today, and it could comprise a cube 63 feet on a side.

That includes the one-kilo ($38,720) Nazi gold bars with stamped German eagles upon them which I saw in Swiss bank vaults during the 1980's when I was a bank director there.

In short, there is not a lot to spread around.

The long-term argument in favor of gold never really went away.

That involves emerging nation central banks, especially those in China and India, raising gold bullion holdings to western levels. That would require them to purchase several thousand tonnes of the yellow metal!

Venezuela has also been a huge gold seller to head off an economic collapse, thanks to the disastrous domestic policies there.

When this selling abates, it also could well shatter the ceiling for the yellow metal.

Tally ho!

“I have not filed, I have just found 10,000 ways that do not work,” said the 19th century inventor Thomas Edison.

Global Market Comments

October 8, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or GET ME OFF THIS ROLLER COASTER),

(THE INCREDIBLE FUTURE OF THE AUTOMOBILE),

(TSLA), (GM), (F), (TM)

After two years of somnolent complacency, the bond market finally broke out of a two-year range, putting the cat among the pigeons with investors everywhere.

In a mere six weeks, the yield on the ten-year US Treasury bond (TLT) soared by 45 basis points from 2.80% to 3.25%, and 25 basis points during last week alone. It is the kind of move one normally associates with major financial crisis, the bankruptcy of a leading bank, or a major geopolitical event.

Once the 3.11% top was taken out, there was a virtual melt up to 3.25%. Rumors of Chinese dumping of its massive bond holdings were rife. Apparently, trade wars DO have consequences.

The 30-year fixed rate mortgage hit 5%, shutting millions out of the housing market. If you haven’t sold your home by now you’re in for the duration.

Personally, I believe that it was Amazon’s wage hike for 250,000 workers from $12 to $15 an hour that had the bigger impact. The inflation train is obviously leaving the station.

The free ride we have enjoyed in equities since February ended abruptly. The long, long overdue correction is here. This has ignited a rush by managers to lock in gains by selling off their biggest winners, and that would be the large cap tech stocks we have all come to know and love.

It started to be a great week with the settlement of NAFTA 2.0. Suddenly, Canada was no longer deemed a national security threat, and our supply of maple syrup was safe once again. My “trade peace” stocks soared.

The shocker came the next day when Amazon announced that it was raising wages by 25% for its 250,0000 minimum wage US workers. Suddenly, this inflation thing was real. It was the stick that broke the camel’s back.

General Electric (GE) dumped its CEO, after only a year and the stock rocketed 17%. It looks like the hedge fund that makes light bulbs still hasn’t found the “ON” switch.

Tesla cut its deal with the SEC for a token amount, and the stock soared 20%. Then Elon tweeted once again, and it fell 20%. With the Defense Department now dependent on Musk to get their spy satellites into orbit there was no way the case against him was ever going anywhere.

General Motors Q3 sales collapsed by 11.1% YOY as new Tesla 3 sales wiped out the electric Chevy Bolt, down 44%. The two hurricanes didn’t help here either.

Oil prices soared, driven by our new sanctions against Iran, knocking the wind out of transportation stocks like airlines Delta (DAL) and Southwest (LUV). The short squeeze is on, as Europeans scramble to make up lost Iran supplies. The last time this happened we went into a recession.

Tying up the week with a nice bow was the September Nonfarm Payroll Report, which took the headline unemployment rate down to 3.7%, the lowest since 1969.

I remember that year well. I was earning a dollar an hour at the May Company snack bar. Kids who dropped out of my high school were sent off to Vietnam and were killed within weeks. Neither the snack bar nor the May Company nor South Vietnam still exists, but I do. I guess I’m too mean to kill.

Average hourly earnings improved by eight cents to $27.24, and are up 2.8% YOY. Although the print was a weak 134,000, the back month upward revisions for July and August were huge.

Leisure and Hospitality lost 17,000 jobs due to the hurricanes, as did Retail, which shed 20,000 jobs.

Professional and Business Services were up 54,000, Health Care was up 26,000, and Manufacturing gained 18,000.

The performance of the Mad Hedge Fund Trader Alert Service is down -1.42% so far in October. Now, it’s all about keeping positions small. I managed to get a nice bond short off before the big collapse. But the real money was made being long the Volatility Index (VIX) which I missed.

Those who took my advice in the Wednesday Strategy Webinar to buy the iPath S&P 500 VIX Short Term Futures ETN (VXX) March 2019 calls for 50 cents make a quickie 500%.

My 2018 year-to-date performance has retreated to 26.97%, and my trailing one-year return stands at 32.11%.

My nine-year return appreciated to 303.44%. The average annualized return stands at 34.30%. I hope you all feel like you’re getting your money’s worth. The goal here is to minimize losses so we can bounce back quickly to a new all-time high once the dust settles.

Yes, I am looking at BUYING the bond market with a bet that ten-year yields won’t rise above 3.35% in the next month.

This coming holiday shorted week will be pretty non-eventful after last week’s fireworks.

Monday, October 8, is Columbus Day. Stocks will be opened but bonds will be mercifully closed.

On Tuesday, October 9 at 6:00 AM, the September NFIB Small Business Optimism Index is announced.

On Wednesday October 10 at 8:30 AM, the September Producer Price Index is published.

Thursday, October 11 at 8:30 we get Weekly Jobless Claims. At the same time, we get the September Consumer Price Index, the most important inflation indicator.

On Friday, October 12, at 10:00 AM, we learn September Consumer Sentiment. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, it’s fleet week so I’ll be watching the Parade of Ships come in under the Golden Gate Bridge. After that, the Navy’s Blue Angels will be flying overhead using my mountain top home as a key navigation point. I’ll be wishing I was in the air at the stick with them.

Good luck and good trading.

It was the kind of dinner invitation I couldn’t turn down. What I learned was amazing.

I usually prefer to spend my evenings at home catching up on my research, calling customers, and plotting my next great Trade Alert.

So, it takes a lot to get me out of my cozy digs, especially given the recent incredible sunsets we have been getting.

Attending would be senior executives from Tesla (TSLA), General Motors (GM), and engineering professor from the University of California at Berkeley, and the California Air Resources Board.

With US car stocks going ballistic lately, I thought the event would be timely.

The dinner was hosted by a retired billionaire from Microsoft at the top of the Mark Hopkins Hotel in San Francisco.

The topic for discussion would be the very long-term future of the car industry.

I get invited to these things because the guests want to know how their views would fit in within a long-term global geopolitical/economic context, my own particular specialty.

I didn’t want to cramp anyone’s style so I kept my notebook under the table and scribbled away blindly, and illegibly. There’s no particular story line here.

I’ll just give you my random thoughts.

(GM) launched its second-generation Chevy Volt in 2015, and the customer response has been fantastic. The company is building a new $400 million battery plant on the east coast to help meet demand.

Some 60% of the buyers are coming from other automakers. It is fast becoming the new face of Chevy, like the Corvette Stingray and Camaro of years past.

The future is in a 200-mile range $30,000 car, and the Volt is that car, followed by the recently launched all electric Bolt.

Customers want to get away from oil and will only buy the products that accomplish that, be they hybrids or all electric.

He also mentioned that GM is launching an electric bike, which is already widespread in Europe. Not a big needle mover there.

The Tesla guy then proceeded to jump all over him, saying the Volt was “green washing” as usual, since it represents only a tiny fraction of the company’s sales.

GM had a vested interest in promoting the internal combustion engine, in which it had made a century long investment.

Its real focus can be seen in the giant new Suburban factory it was now building in Texas.

Mr. Tesla had driven from the south Bay with his S-1 entirely on autopilot.

The hardware has already been pre-installed in every S-1 produced since 2014, and all that is needed to make them self-driving is to execute a wireless overnight software upgrade.

What is truly amazing is that each car will have a learning program unique to the vehicle. If it misses a hard turn the first time, it will remember that turn and then make it perfectly every time from then on.

The Tesla person said that with the new Gigafactory the company will be on schedule for a tenfold ramp up in car production by 2020.

The $35,000 Tesla 3 that will make this possible will be offered in two wheel and four wheel drive variations. That will take them from 92,000 units a year to 500,000. Q3 2018 Production has already reached 53,000.

I asked him if this means that if your wife suspects you of cheating, will your Tesla rat you out. He answered, “Only if she is a coder.”

Then I wondered what would stop Tesla from selling your driving habits to marketers who would then make special offers from stores you prefer.

A previous Tesla experiment landed me a pair of Seven for All Mankind designer jeans for half off.

Tesla outsells every other luxury car of its class, including the Mercedes S class, the BMW Series 7, and the Audi 8.

Among the US car industry, only Ford and Tesla have never filed for bankruptcy. Tesla is the first new car manufacturer to succeed since Chrysler made its debut in 1928.

I asked about the S-1 maximum single charge range achieved by a driver.

An enthusiast in Norway managed to take one 800 miles on a flat track with no wind and perfect conditions. Wow! My drive from Lake Tahoe record of 400 miles doesn’t come close, and that involved a 7,000 foot decline from the High Sierra crest.

I also enquired about the Cambridge University battery breakthrough (click here for “Battery Breakthrough Promises Big Dividends.”

He said he was aware of it, but that it takes a long time to get a technology from the bench to the marketplace.

Just with their own in-house tinkering, Tesla is boosting battery ranges by 3-5% a year. The current S-1 gets a 305-mile range, compared to my four-year-old 255-mile range.

The Berkeley professor made some interesting observations about Millennials.

He said that while 75% of baby boomers got drivers licenses at 16, and 70% of Generation Xer’s did so by then, only 55% of Millennials took to the road at that age.

The rule of thumb for anything regarding Millennials is that they do everything late.

The gentleman from the Air Resources Board brought out some interesting facts.

More than 80% of all cancer-causing chemicals entering the atmosphere come from diesel engines, so a major effort will be made to cut back emissions from commercial trucks.

Look for the electric fleet coming to a neighborhood near you. Goodbye Volkswagen!

Workplace charging of employee cars will be the next big growth area for charging stations.

Half of all greenhouse gases derive from the burning of oil. The biggest savings in greenhouse gas emissions will come from a clampdown on the refining industry.

Think Koch Brothers.

I was amazed at his commitment to meet California’s goal of obtaining 50% of its energy from alternative sources by 2030.

The oil industry managed to exempt gasoline from the legislation, SB 350. But Governor Jerry Brown put it back in through an executive order.

The state is paying for the initial build-out of hydrogen refueling stations for the new $57,500 Toyota Mirai. A single tank will take the fuel cell vehicle 312 miles.

The state is making major investments in biofuel, planning to obtain 10% of the 50% target from this source.

During a slow moment, I asked a bleach blond trophy girlfriend sitting next to me of her interest in electric cars, expecting the worst.

To my surprise, she said that last summer, she drove an electric bike from New York to Los Angeles, towing a trailer with a solar panel cut in half to provide power.

The southern route avoided the high mountain ranges. I noticed she seemed unusually tanned, and it wasn’t from a can.

I was humbled. For once, I knew less about electric cars than anyone else in the room.

After the dinner, I went up to the Tesla executive and told him “Job well done.” I used to own one of the oldest S-1’s, number 125 off the assembly line, until it was totaled by a drunk driver on Christmas Eve.

I even tested to their safety claims.

Thank you, Tesla! You saved my life!

When invited to run for president in 1868, Civil War general William Tecumseh Sherman replied, “I would rather spend a year in Sing Sing than Washington DC, and I’d come out a better man.”

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.