That was the most boring week of 2018.

Not only did we get no net movement; the range was an infinitesimal 200 Dow points. It was hardly enough to make a dog's breakfast.

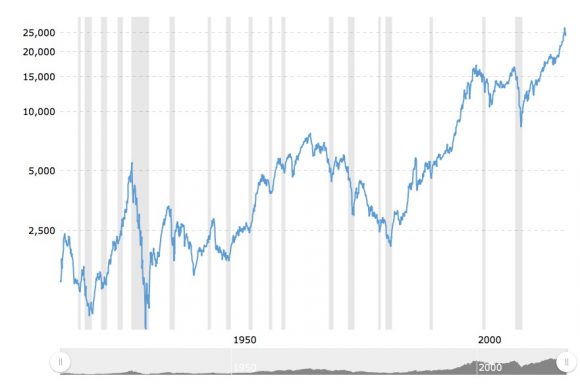

Of course, the big news was the yield on the 10-year U.S. Treasury bond (TLT), which rose to 3.12%, a seven-year high. You might have expected this to prompt a complete stock market rout. It didn't. Maybe that is next week's business.

It is rare that the bullish and bearish arguments reach a perfect balance, but that is what we got. In the meantime, trading volume is shrinking, never a good sign. Will the last one to leave please shut out the lights?

Which is all an indication of what I have been warning you about for months. This is setting up to be a dreadful summer. If you've already made your year, with a 19.88% gain like I have, you're better off taking a long cruise than trying to outsmart the algorithms.

I managed to squeeze off only one trade so far this month. I sold short the S&P 500 (SPY) right at the high of the week. However, when the downside momentum failed, and a Volatility Index (VIX) spike failed to confirm, I bailed for a small profit. Pickings are indeed thin.

Whenever my trading slows down, I get the inevitable customer complaints. My answer is always the same. Reach for the marginal trade and you will get your fingers bit off. Don't be in such a hurry to lose money. As my wise Latin professor used to say, "Festina lente," or "make haste slowly."

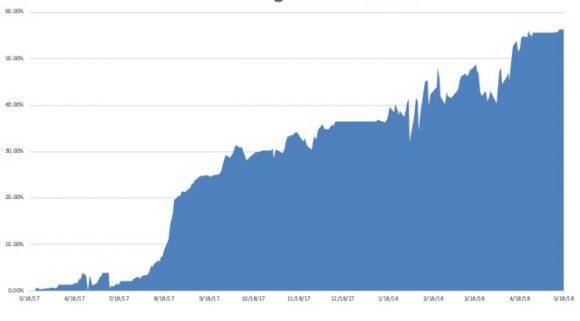

My May return is +0.53%, my year-to-date return stands at a robust 19.83%, my trailing one-year return has risen to 56.25%, and my eight-year profit sits at a 296.30% apex.

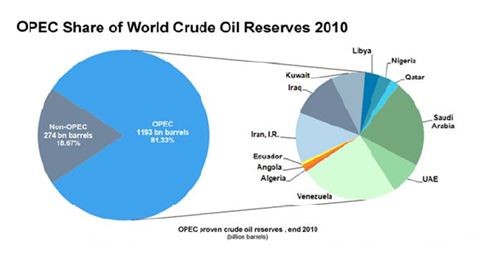

And remember, the market is making this move in the face of rising oil prices and interest rates, always bull market killers.

To mix a few metaphors, when the sun, moon, and stars line up once again I'll go pedal to the metal with the Trade Alerts once again.

If you held a gun to my head and ordered me to tell you how the markets will play out for the rest of the year, try this.

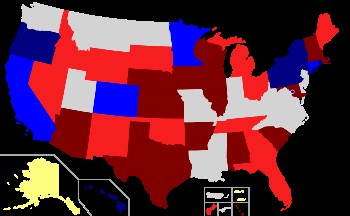

We remain is this narrowing trading range for months, ending with a final decisive break of the 200-day moving average to the downside, now at 23,909. But we find a new low only 1,000 points, or 4% below that.

Then we launch into the post midterm election year-end rally, which could take stocks up 15% to 20% from the 23,000 low. This is why I have been saying that the best trades of 2018 are ahead of us.

So, renew that subscription!

To witness how cruel and stock specific the current market is, look no further than hapless Campbell Soup (CPB), the first ticker symbol I have had to look up this year. There is probably not a reader alive who was not nursed back to health by its iconic red canned chicken noodle soup.

A surprise earnings loss triggered a hellacious 14% one-day plunge. It is the first big victim of the new steel tariffs. Although it amounts to only a few pennies a can, that can be disastrous in this hyper-competitive world. It also turns out that Millennials prefer eating fresh food rather that the canned stuff.

Give thanks for small mercies. With three daughters I am at ultimate risk for a tab for three weddings. The nuptials for Meghan Markle and Prince Harry are thought to cost $45 million, most of it on security. Hopefully I will not someday become the father-in-law of a prince.

This coming week has a plethora of Fed speakers, some key housing numbers, and that's about it.

On Monday, May 21, at 8:30 AM, we get April Chicago Fed National Activity Index.

On Tuesday, May 22, nothing of note is announced.

On Wednesday, May 23, at 10:00 AM, the April New Home Sales.

Thursday, May 24, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a rise of 11,000 last week from a 43-year low. At 10:00 AM, we get April Existing Home Sales.

On Friday, May 25, at 8:30 AM EST, we get April Durable Goods Orders.

We wrap up with the Baker Hughes Rig Count at 1:00 PM EST.

As for me, I will be spending the weekend putting the finishing touches on my 2018 Mad Hedge European Tour.

Thanks to rising U.S. interest rates and a strong dollar, the price of a continental trip has dropped about 10% since the beginning of the year. Got to love that Swiss franc at 1:1 parity with the greenback. Maybe I can afford an extra cheese fondue.

Good Luck and Good Trading.

Yes, It All Looks Like Magic