Global Market Comments

July 20, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE JULY 22 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(IS AIRBNB YOUR NEXT TEN BAGGER?)

Global Market Comments

July 20, 2016

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE JULY 22 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(IS AIRBNB YOUR NEXT TEN BAGGER?)

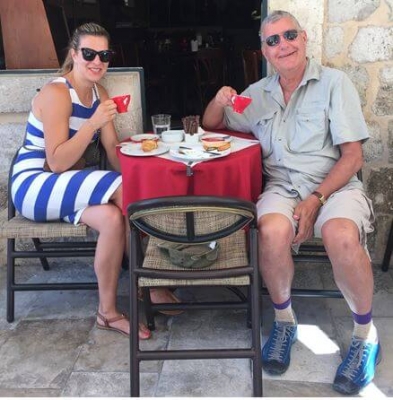

Come join me for afternoon tea for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Friday, July 22, 2016.

The guests and I will engage in an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $197.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The hotel is just down the street from the town?s beautiful 17th century church.

The details will be emailed directly to you with your confirmation.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Socks only are welcome, and if it?s cold, we will throw some extra wood on the fire.

Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired but elated. He even gave me a valued pebble from the summit.

The Swiss National Day is on the following Saturday, August 1 and Zermatters throw a blowout party to celebrate the event. Citizens converge on the village from all over Switzerland to participate in an hour long parade up the main cobble stoned street, dressed in traditional folk costume and playing mountain instruments.

The Bahnhoffstrasse is packed with merchants offering national dishes, fine pastries, and plenty of local beer and wine. We usually end up dancing a polka in front of the town church.

If you can still stand up, giant bonfires are lit on the surrounding mountain peaks at sunset, followed by an impressive fireworks display. For the last three years, a torrential downpour followed.

It is all a complete blast, so I attend every year.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the seminar, please click here .?

I was not surprised to hear that the home sharing app, Airbnb, was given a $30 billion valuation in the latest venture capital funding round.

The big question for you and me is: Will the valuation soar tenfold to $300 billion, and how much of a piece of that will you and I be allowed to get?

To answer that question I just spent six weeks traveling around Europe as an Airbnb customer. This enabled me to understand their business model, their strengths and weaknesses, and analyze their long term potential.

As a customer, the value you receive is nothing less than amazing.

I have been a five star hotel client for most of my life, with someone else picking up the tab much of the time, so I have a pretty good idea on the true value of accommodations.

What you get from Airbnb is nothing less than spectacular. You get three or four times the space for one-third the price.

The standards are often five-star and at the top end, depending on how much you spend. I found I could often get an entire three-bedroom house for the price of a single hotel room, with a better location.

Or, I could get an excellent abode in rural settings, where none other was to be had, whatsoever.

That?s a big deal for someone like me who spends so much of the year on the road.

You also get a new best friend in every city you visit.

On most occasions the host greeted me on the doorsteps with the keys, and then introduced me to the mysteries of European kitchen appliances, heating, and air conditioning.

Pre stocking the refrigerator with fresh milk, coffee, tea, and jam seems to be a tradition the hosts pick up in their Airbnb orientation course.

One in Waterford, Ireland even left me a bottle of wine, plenty of beer, and a frozen pizza. She read my mind. Thanks, Mary!

They then took me on a one-hour tour of their city, divulging secrets about their favorite restaurants, city sights, and nightspots. Every one proved golden.

After you check out, Airbnb asks you to review the accommodation. These can be incredibly valuable in deciding your next pick.

I had one near miss with what I thought was a great deal in London, until I read, ?The entire place reeks of Indian cooking.?

Similarly, the hosts rate you as a guest. One hostess shared a story about picking up her clients from town after they got drunk and lost in the middle of the night. Then they threw up in the back of the car on the way home.

Guests forgetting to return keys are another common complaint.

Needless to say, I received top ratings from my hosts, as fixing their WIFI to boost performance became a regular habit of mine.

After my initial experience in London, I thought the experience might be a one off, limited to only the largest cities. So I started researching accommodations for my upcoming trips.

I couldn?t have been more wrong.

Just the Kona Coast on the big island of Hawaii had an incredible 50 offerings, including several bargain beachfront properties.

The center of Tokyo had over 300 listings. The historic district in Florence, Italy had an incredible 351 properties.

Fancy a retreat on the island of Bali in Indonesia and tune up your surfing? There are over 197 places to stay!

While we weren?t looking, Airbnb has truly gone global.

Airbnb?s business model is almost too simple to be true, involving no more than a couple of popular applications. Call it an artful melding of Google Earth, email, text, and PayPal.

The company has 2 million hosts worldwide, and 100 million customers. That supply/demand imbalance shifts the burden of cost to the renters, who usually have to fork out a 12% fee, plus the cost of the cleaning service.

Hosts only pay 3% to process the credit card fees for the payment.

The tidal wave of revenues this has created has enabled Airbnb to become San Francisco?s second largest privately owned ?unicorn?, right after the $65 billion behemoth ride sharing app, Uber.

To say that Airbnb has created controversy would be a huge understatement.

For a start, it has emerged as a major challenge to the hotel industry, which is still stuck with a 20th century business model. There?s no way hotels can compete on price.

One Airbnb ?super host? in Manhattan is managing 200 apartments, essentially, creating from scratch, a medium sized virtual ?hotel?.

Taxes are another matter.

Some municipalities require hosts to pay levies of up to 20%, while others demand quarterly tax filings and withholding taxes. That is, if tax collectors can find them.

Airbnb may be the largest new source of tax evasion today.

In cities where housing is in short supply Airbnb is seen as crowding out local residents. After all, an owner can make far more money subletting their residence nightly than with a long-term lease.

Several owners told me that Airbnb covered their entire housing cost for the year, while paying off the mortgage at the same time.

Owners in the toniest neighborhoods, like mid town Manhattan off of Central Park or the old city center in Dubrovnik, rent their homes out as much as 180 days a year.

Airbnb is nothing less than life changing.

That has forced local governments to clamp down.

San Francisco has severe, iron clad planning and zoning restrictions that only allow 2,000 new residences a year to come on the market.

It is cracking down on Airbnb, as well has other home sharing apps like FlipKey, VRBO, and HomeAway, by forcing hosts to register with the city or face brutal $1,000 a day fines.

So far, only 1,675 out of 9,000 hosts have done so.

Ratting out your neighbor as an off the grid Airbnb member has become a new cottage industry in the City by the Bay.

Airbnb is fighting back with multiple lawsuits, citing the federal Communications Decency Act, the Stored Communications Act, and the First Amendment covering the freedom of speech.

It is a safe bet that a $30 billion company can spend more on legal fees than a city the size of San Francisco.

The company has also become the largest contributor in San Francisco?s local elections. In 2015, it fought a successful campaign against Proposition ?F?, meant to place severe restrictions on their services.

An Airbnb stay over is not without its problems.

The burden of truth in advertising is on the host, not the company, and inaccurate listings are withdrawn only after complaints.

A twenty something year old guy?s idea of cleanliness may be a little lower than your own.

Long time users learn the unspoken ?code?.

?Cozy? can mean tiny, ?as is? can be a dump, and ?lively? can bring the drunken screaming of four letter words all night long, especially if you are staying upstairs from a pub.

And that spectacular seaside view might come with relentlessly whining Vespas on the highway out front. Always brings earplugs and a sleep mask as a precaution.

Researching complaints, it seems that the worst of the abuses occur in shared accommodations. Learning new foreign cultures can be fascinating, but your new roommate may want to get to know you better than you want.

In one notorious incident a Madrid guest was raped. The best way to guard against such experiences is to rent the entire residence for your use only, as I do.

Another problem arises when properties are rented out for illegal purposes, such as prostitution or drug dealing.

More than once, an unsuspecting resident woke up one morning to di

scover they were living next door to a new bordello.

Wild parties that trash the dwelling, annoy the neighbors, and bring in the police are another worry.

Of course, the million-dollar question is ?When will the company go public??

The current ?unicorn? philosophy is to milk the company for all it?s worth, and take it public when it is about to go ex-growth.

That?s what happened to Twitter (TWTR), which grew exponentially, and then saw shares dive a gut churning 72% after its initial public offering.

On seeing the massive crowds of new tourists packing Europe this summer, my conclusion is that the travel industry is entering a hyper growth phase. Blame the emerging middle class Chinese, who seem to be everywhere.

?

That means that at whatever price Airbnb goes public, there may not be a ten bagger left for you. But a two or three bagger may be possible.

The real shock came when I left Airbnb and stayed in a regular hotel. Include the fees and the cleaning charges, and the service is no longer competitive for a single night stay.

In any case, most hosts have two or three night minimums to minimize hassle.

When I checked in at a Basel, Switzerland, Five Star hotel, all I got was a set of keys and a blank stare. No great restaurant tips, no local secrets, no new best friend.

I spent that night surfing www.airbnb.com , planning my next adventure.

?There are just not enough human buyers in the market,? lamented Eddie Perkin, chief investment officer at Eaton Vance.

Global Market Comments

July 19, 2016

Fiat Lux

Featured Trade:

(JULY 20 GLOBAL STRATEGY WEBINAR),

(WHY WATER IS ONE OF 2016?S BEST SECTORS),

(CGW), (PHO), (FIW), (VEOEY), (TTEK), (PNR),

(WHY ACTIVISTS HAVE THE UPPER HAND),

(JCP), (NFLX), (HLF), (AAPL),

(TESTIMONIAL)

CGW Guggenheim S&P Global Water ETF

PHO PowerShares Water Resources ETF

FIW First Trust ISE Water ETF

VEOEY Veolia Environnement S.A.

TTEK Tetra Tech, Inc.

PNR Pentair plc

JCP J. C. Penney Company, Inc.

NFLX Netflix, Inc.

HLF Herbalife Ltd.

AAPL Apple Inc.

I bet you didn?t know that water infrastructure plays have been one of the top performing stock sectors in 2016.

In fact, shares of this little known industry are up more than 25% since the February market bottom.

If you think that energy is scarce, it will pale in comparison to the next water crisis. So investment in fresh water infrastructure is going to be a great recurring long-term investment theme.

One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights.

Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. Global warming is freeing up some of this, but not fast enough.

In places like China, with a quarter of the world's population, up to 90% of the fresh water is already polluted, some irretrievably so, with heavy metals.

About 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years.

Aquifers in the US, which took nature millennia to create, are approaching exhaustion.

It has become so extreme in California, that subsidence has destroyed hundreds of buildings. The Golden States Central Valley is now about 10 feet lower than it was during the 19th century.

While membrane osmosis technologies exist to convert seawater into fresh, they use ten times more energy than current treatment processes, a real problem if you don't have any, and will easily double the end cost of water to consumers.

While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. Beef exports are really a way of shipping water abroad in concentrated form.

The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of the 2008 US stimulus package was similarly spent.

It says a lot, that when I went to the University of California at Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds and were not allowed to talk!

At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW). You can get it for a bargain now, as it has just fallen by more than 10% since the stock market melt down began.

You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR).

Who has the world's greatest per capita water resources? Siberia, which could become a major exporter of H2O to China in the decades to come.

There is a potential happy ending to this story. If solar energy cost improvements continue their Moore?s law like descent, energy will effectively become free by the 2030?s.

If you think this is pie-in-the-sky stuff, know this. On peak days alternatives are now accounting for 56% of California power grid, largely through solar.

That will dramatically drop the cost of desalination. Indeed, major efforts along these lines are already underway by utilities in the Middle East.

San Diego?s Poseidon project only recently came on line, and is producing 50 million gallons of fresh water a day. The goal is for the Carlsbad facility to obtain 8% of the county?s water from the ocean by 2020.

And the last time I checked, we had plenty of seawater.

Having been in this market for yonks, ages, and even a coon?s age, I have seen trading strategies come and go.

First, there was the nifty fifty during the 1960?s. Junk bonds had their day in the sun. Then portfolio insurance was all the rage.

Oops!

While the dollar was weak, international diversification was the flavor of the day. After foreign stocks turned bitter, the IPO mania and the Dotcom bubble of the nineties followed.

Macro trading dominated the new Millennium until the high frequency traders took over.

What is the cutting edge management strategy today?

According to my friend, Anthony Scaramucci, of Skybridge Capital, activist shareholder trading now has the unfair advantage.

Anthony, known as the ?Mooch? to his friends, is so convinced of the merit of this bold, in-your-face approach that he has devoted nearly 40% of his assets to this aggressive posture.

That is no accident.

Have you ever heard the term ?unintended consequences?? Scaramucci argues that The Financial Stability Act of 2010, otherwise known as Dodd-Frank produced that effect with a turbocharger.

The Act brought in a raft of new shareholder rights intended to help Mom & Pop. But activist investors have, so far, been the prime beneficiaries of the reform, using the new regulations to shake down companies for quick profits.

Historic low interest rates are allowing them to leverage up at minimal cost, increasing their firepower.

These include known sharks (once spurned as ?green mailers?) like my former neighbor, Carl Icahn, and his younger, more agile competitor, Bill Ackman.

They can simply buy a small number of shares in a target company and demand a management change, share buy backs, the spinning off of assets, several seats on the board, and even making allegations of criminal activity, which are often unfounded.

A message from Icahn on the voicemail is not something management is eager to hear.

He even shook down Apple (AAPL) last year, with great success, harvesting a near double on the trade.

This is why names like Herbalife (HLF), Netflix (NFLX), and JC Penny?s (JCP) are constantly bombarding the airwaves.

The net result of this is that savvy activist shareholders have effectively replaced the traditional ?buy and hold? strategy as a way to add alpha, or outperformance.

This has enabled activist oriented hedge funds to beat the pants off of traditional macro hedge funds because many historical cross asset relationships they follow have broken down.

Tell me about it!

Suddenly, the world no longer makes sense to them and has apparently gone mad, at the investors? expense. Long/short equity managers, which comprise 43% of the funds out there, are also underperforming for the sixth consecutive year.

The activist managers themselves justify their often harsh actions by arguing that individual shareholders can ride to riches on their coattails. Shaking up management can result in better-run companies, even if it is at the point of a gun.

Activism accelerates evolution, breaks up clubby boards of insiders, and enhances the bottom line. Corporations can be forced to retool and restructure.

How does the individual investor get involved in the new wave of activist investors? The short answer is that they don?t. There are few, if any, such exchange traded funds (ETFs) in existence.

Doing the quantitative screens to generate short lists of potential activist targets, and then listening to the jungle telegraph regarding who is coming into play, are well beyond the resources of your average Joe.

You can try to give your money to the best activist managers. But they are either closed to new investors, or have very high minimum initial investments, often in the $1-$10 million range.

If you are lucky enough to get your dosh in, you will find the talent very expensive. Activist funds are one of the last redoubts of the old 2%/20% management fee and performance bonus structure. And ?hockey stick? bonus schedules are not unheard of.

When I ran my old hedge fund, we made 40% a year like clockwork. I took the first 10%, the limited partners the remaining 30% and they were thrilled to get it.

And you wonder why the small guys feel the market is rigged.

The activist trend won?t last forever. Interest rates will inevitably rise, making the strategy expensive to finance. If the stock market keeps rising, as I expect, then cheap targets will become as scarce as hen?s teeth.

Eventually, gobs of money will pour into the strategy, compressing returns as the Johnny-come-latelys pile in. In the end, trading around activist shareholders will get tossed into the dustbin of history, along with all the other investment fads.

Checking in With the ?Mooch?

Checking in With the ?Mooch?I am an independent financial advisor in Atlanta, GA.? We have spoken via email and text a few times.? Historically, you have always been responsive, even to my complaints, and I have always appreciated that.

After canceling my Service a few months ago, I have decided to come back.? In markets like yesterday your insights are just too valuable not to have.? So I am officially again a paid subscriber.

I still think your macro timing is better than your stock picking, but I hope you prove me wrong.? Regardless, you?re still the man.? You should be in the Dos Equis commercials as "the second most interesting man in the world".

Thank you for sharing your insights with the world for the bargain price of $3000 per year.

Brody

Atlanta, Georgia

?If someone called me tomorrow and said that ten year US Treasury bonds were at 0.75%, I would not be surprised,? said Larry Fink, the founder of BlackRock, the world?s largest asset manager.

Global Market Comments

July 18, 2016

Fiat Lux

Featured Trade:

(WHAT?S ON YOUR PLATE FOR THIS WEEK?),

(SPY), (TLT), (FXY), (YCS), (JNK), (GLD),

(TEN STOCKS TO BUY ON THE NEXT DIP)

SPY SPDR S&P 500 ETF

TLT iShares 20+ Year Treasury Bond

FXY CurrencyShares Japanese Yen ETF

YCS ProShares UltraShort Yen

JNK SPDR Barclays High Yield Bond ETF

GLD SPDR Gold Shares

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.