Global Market Comments

July 10, 2015

Fiat Lux

Featured Trade:

(THE FALLING MARKET FOR KIDS),

(HOLLYWOOD CASHES IN ON WALL STREET TROUBLES),

(THOUGHTS AT SEA ABOARD THE QE2-PART I)

Global Market Comments

July 9, 2015

Fiat Lux

Featured Trade:

(AUGUST 3 ZURICH, SWITZERLAND GLOBAL STRATEGY LUNCHEON)

(THE ULTRA BULL ARGUMENT FOR GOLD),

(GLD), (GDX), (ABX), (SLV),

(PLAY CHINA?S YUAN FROM THE LONG SIDE),

(CYB), ($SSEC), (EEM)

SPDR Gold Trust (GLD)

Market Vectors ETF Trust - Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

iShares Silver Trust (SLV)

WisdomTree Trust - WisdomTree Chinese Yuan Strategy Fund (CYB)

Shanghai Stock Exchange Compostite Index ($SSEC)

iShares, Inc. - iShares MSCI Emerging Markets ETF (EEM)

One of the oldest games in the foreign exchange market is to always buy the currencies of strong countries that are growing and to sell short the currencies of the weak countries that are shrinking.

Any doubts that China?s Yuan is a huge screaming buy should have been dispelled when news came out that exports have once again started to surge, thanks to the recovery of its largest customer, Europe.

China?s surging exports of electrical machinery, power generation equipment, clothes and steel were a major contributor.

Interest rate rises for the Yuan and a constant snugging of bank reserve requirements by the People?s Bank of China, have stiffened the backbone of the Middle Kingdom?s currency even further.

That is the price of allowing the Federal Reserve to set China?s monetary policy via a semi fixed Yuan exchange rate.

The last really big currency realignment was a series of devaluations that took the Yuan down from a high of 1.50 to the dollar in 1980. By the mid-nineties, it had depreciated by 84%. The goal was to make exports more competitive. The Chinese succeeded beyond their wildest dreams.

There is absolutely no way that the fixed rate regime can continue and there are only two possible outcomes. An artificially low Yuan has to eventually cause the country?s inflation rate to explode. Or a future global economic recovery causes Chinese exports to balloon to politically intolerable levels. Either case forces a revaluation.

Of course timing is everything. It?s tough to know how many sticks it takes to break a camel?s back. Talk to senior officials at the People?s Bank of China and they?ll tell you they still need a weak currency to develop their impoverished economy. Per capita income is still at only $6,000, less than a tenth of that of the US. But that is up a lot from a mere $100 in 1978.

Talk to senior US Treasury officials and they?ll tell you they are amazed that the Chinese peg has lasted this long. How many exports will it take to break it? $1.5 trillion, $2 trillion, $2.5 trillion? It?s anyone?s guess.

One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. In fact, the desire to prevent foreign hedge funds from making a killing in the market is not a small element in Beijing?s thinking.

The Chinese government says it won?t entertain a revaluation for the foreseeable future. The Americans say they need it tomorrow. To me that means it?s coming.

Buy the Yuan ETF, the (CYB). Just think of it as an ETF with an attached lottery ticket. If the Chinese continue to stonewall, you will get the token 3%-4% annual revaluation they are thought to tolerate. Double that with margin, and your yield rises to 6%-10%, not bad in this low yielding world. Since the chance of the Chinese devaluing is nil, that beats the hell out of the zero interest rates you now get with T-bills.

If they cave, then you could be in for a home run.

Ready for a Long Term Relationship with China?

Ready for a Long Term Relationship with China?

Global Market Comments

July 8, 2015

Fiat Lux

EMERGENCY OIL ISSUE

Featured Trade:

(SPECIAL UPDATE ON THE OIL COLLAPSE),

(USO), (XOM), (OXY), (COP), (LINE)

United States Oil Fund LP (USO)

Exxon Mobil Corporation (XOM)

Occidental Petroleum Corporation (OXY)

ConocoPhillips (COP)

Linn Energy, LLC (LINE)

?

The Middle East is a miserable place to be during Ramadan, a month where the faithful reevaluate their lives and recommit to the teachings of Islam. This year it runs from June 17 to July 17.

During this period, the Muslims are not permitted to eat or drink from sunrise to sunset, or criticize others, or engage in a long list of other hurtful activities.

Although infidels, such as myself, are exempt from these rules, living amidst a population subject to these eighth century laws can be wearing. Everyone is starving, exhausted, and in a foul mood. Restaurants don?t open until sunset. Then people party all night, keeping you awake.

In the more fundamentalist conservative countries, like Saudi Arabia, Oman, and Kuwait, the Religious Police beat offenders with sticks and clubs that they come across in public.

That includes those eating, drinking, or women wearing immodest dress, like short pants and tank tops. Did I mention it reached 120 degrees yesterday in those countries?

As a result, anyone who can afford to do so flees to more liberal regimes during the fasting period, like Turkey, Egypt, and Morocco.

As a result, I am bumping into quite a few interesting people in the five star hotels here who have quite a lot to say about the price of oil.

A rash of hurried negotiations has suddenly broken out between American and European oil majors and the government of Iran. The word is out. Iran is going to imminently cave on US demands of inspections of nuclear facilities, especially the military ones.

The fact that this is all happening now is no coincidence. According to the Koran, Ramadan is a time to ?make peace with those who have wronged us.?

The hard numbers being assigned to these contracts is having the effect of increasing the size of the carrot for both the West and Iran to wind up the talks. The impact will be to permit Iran to rejoin the global economy for the first time in 36 years.

This paves the way for Iran to double its oil exports from 1.2 to 2.4 million barrels a day immediately, and then double them again once desperately needed energy infrastructure investments are made.

It won?t take long for this impending tsunami of oil to hit the markets. The Reuters news agency is reporting that 38 million barrels of Iranian oil are sitting in 15 VLCC tankers slow cruising the Persian Gulf and Indian Ocean.

The second the ink is dry on any US/Iran agreements, these ships are sailing for western and Asian ports to make delivery.

This is why you have seen a cataclysmic plunge in the price of Texas tea over the past few weeks, from $62 to $51, some 18%.

Saudi Arabia has responded to the decline by aggressively cutting prices for their largest customer, and ramping up production even more, in a determined effort to boost market share.

Therefore, the March low of $43 now seems within range, and maybe then some. You have already seen this in the contango for far month futures markets, which have widened fantastically. The world has returned to paying huge premiums for storage.

In case you missed the generational low at these prices four months ago, you now have another shot.

The share prices of my favorite oil plays, Exxon Mobile (XOM), Occidental Petroleum (OXY), Conoco Phillips (COP), and Linn Energy (LINE) all saw this route coming months ago and are already there.

In fact, the weak energy sector, which accounts for 10% of the S&P 500, was a major reason why the index failed to break out to new highs a few weeks ago.

I think that energy could be one of your seminal investment plays for the rest of 2015. Crude should make it back up to the $90 handle within the next three years, riding on the back of the global synchronized economic recovery.

After that, the question arises of whether the next move is to $10, as carbon based energy forms are replaced by alternatives on a large scale. Allow for a Moore?s Law type exponential growth of efficiencies, and we?ll soon be there.

That is Saudi Arabia?s current $5 per barrel cost of production, plus a 20% profit margin and $4 for shipping. Remember, it was only $8 as recently as 1998.

Just thought you?d like to know.

And now, back to my loyal rental camel, whose price, it turns out, is determined by, you guessed it, the price of oil.

Sometimes, You Have to Go to the Source

Sometimes, You Have to Go to the Source

Global Market Comments

July 8, 2015

Fiat Lux

Featured Trade:

(JULY 31 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR)

(THE TWO CENTURY DOLLAR SHORT),

(CNN?S JOHN LEWIS; THE DEATH OF A COLLEAGUE)

Global Market Comments

July 7, 2015

Fiat Lux

Featured Trade:

(MY BRIEFING FROM THE JOINT CHIEFS OF STAFF), (XLK),

(WHY THE JGB MARKET MAY BE READY TO COLLAPSE),

(FXY), (DXJ), (EWJ)

The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (XLK)

CurrencyShares Japanese Yen Trust (FXY)

WisdomTree Trust - WisdomTree Japan Hedged Equity Fund (DXJ)

iShares, Inc. - iShares MSCI Japan ETF (EWJ)

Global Market Comments

July 6, 2015

Fiat Lux

SPECIAL GREEK DEFAULT ISSUE

Featured Trade:

(CASHING IN ON THE GREEK CRISIS),

(SPY), (TLT), (VIX), (FXE), (FXY), (GLD), (SLV)

SPDR S&P 500 ETF Trust (SPY)

iShares Trust - iShares 20+ Year Treasury Bond ETF (TLT)

VOLATILITY S&P 500 (^VIX)

CurrencyShares Euro Trust (FXE)

CurrencyShares Japanese Yen Trust (FXY)

SPDR Gold Trust (GLD)

iShares Silver Trust (SLV)

Try as I may, there is absolutely no way to escape a financial crisis in the modern world anymore, not even in the dusty, remote Western Sahara village of Taghazout, Morocco.

There is an Ebola Virus outbreak 1,000 miles to the south, and 35 British tourists were massacred on a beach in neighboring Tunisia last week. There were exactly four passengers on my flight from Lisbon to Morocco.

Was it a warning, or a confirmation of hubris?

Starving stray dogs and cats wander the street, garbage lines the beach, and raw sewage seeps into the ocean. Rangy, two humped camels vainly await riders at the edge of town.

But satellite dishes sprout from the rooftop of even the most forlorn, impoverished, broken down cinder block structures, and the hum of the global markets is never more than a few channels away.

The CNBC here is available only in Arabic, and is fiercely competing with Omani soap operas and the Iraqi Business Channel (yes, despite ISIS, there is such a thing).

But it didn?t take me long to figure out that the people of Greece rejected the ECB latest bailout proposal by an overwhelming 61.5% to 38.5% margin.

It was no surprise to me.

You would think that voting against punishingly higher taxes and an excruciatingly longer recession was a no brainer. But the markets were expecting otherwise, and have been caught seriously wrong footed. Poor summer liquidity is exacerbating the moves.

My somewhat passable French enabled me to discern that the prices were taking it on the nose. Japan and China each dove 2%, while Australia and the Euro pared 1% apiece.

This was going to be a ?RISK OFF? day on steroids.

Suddenly, I smell opportunity everywhere.

Now we know the kneejerk response to an imminent Greek default.

However, the cold, harsh reality of the situation requires a little deeper analysis.

CNN was utterly useless, choosing instead to focus on the human side of the tragedy, the freshly impoverished Greek goat herder and the island hotel operator who can?t pay his staff.

No great insight there.

Greek citizens are now limited to withdrawing 60 Euros a day from an ATM, if they can find one that has any cash at all. To head off a certain run and Armageddon, the Greek banks have all been closed for a week, with no reopening in sight.

Thousands of foreign tourists are now stranded in the land of moussaka, retsina, and Zorba, cursing their vacation destination choice.

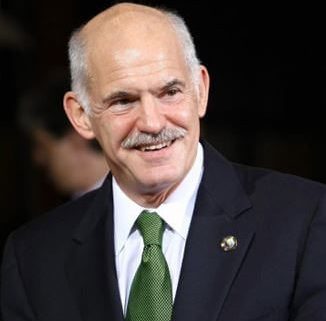

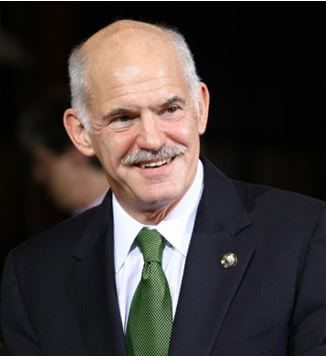

So I?ll refer to my May conversation with former Greek Prime Minister, George Papandreou, who ran the country from 2009 to 2011, and shepherded the country through the post financial crisis 2010 debacle.

His late father, Andreas, was also a Prime Minister, as was his grandfather, Georgio, who spent time in jail for his services, consider running this ungovernable country the family business.

To a large extent, the ECB (read the Germans) are in a subprime crisis entirely of their own making.

German banks provided funds to their Greek counterparts, initially to build the $8 billion 2000 Athens Olympics, which was almost entirely subcontracted to German engineering firms.

They then fueled the economic boom that followed, making possible the export of tens of thousands of Mercedes, BMW?s and Volkswagens. That bankrolled a major increase in the Greek standard of living, while adding several points to German GDP growth.

When dubious financial statements were presented to justify this lending binge, bankers simply winked, and looked the other way.

A decade and a half later, they are ?shocked, shocked? that some of the accompanying disclosures were inaccurate, as police inspector Claude Rains might have said in Casablanca (which, by the way, is only 400 miles north of here).

?Gambling in the casino? Perish the thought.? How do you say that in German?

The reality is that this is all a storm in a teacup. Accounting for only 2% of European GDP, it is neither here nor there whether the country stays or goes from the European Community or the Euro.

Total Greek debt to the ECB is now $3.5 billion, a drop in the bucket in the global scheme of things.

What?s more, this crisis is far less serious than the ones that occurred in 2010 and 2012. This time around, Greek bonds have already been taken off the books of German and French banks at cost, and placed with numerous multinational agencies, largely the ECB itself.

What is almost completely lacking here is private risk, unless you happen to own a Greek bank, or the shares of other Greek companies.

What?s more, all of this is happening in the face of a massive 60 billion a month ECB quantitative easing program. The amount Greece owes comes to less than two days worth of this amount.

Never take a liquidity crisis in the middle of a structural global cash glut too seriously.

Even this paltry amount can be easily refinanced by the International Monetary Fund on a slow day. That?s what they are there for.

This pales in comparison to the 39 billion euros spent to bail out the Spanish banking system a few years ago, or the $4 billion IMF rescue of the United Kingdom in 1976.

In the end, the amounts are sofa change to the Chinese, who are starved for high yield investments. It was they who nailed the top of the last European bond yield spike (on my advice, I might add), acting as the buyer of last resort then.

In the end this will be solved, as have all international debt crises since time immemorial, since the British seized the Suez Canal from the French as collateral for bad debts in 1882. Extend and pretend. Move debt maturities out another ten years and hope everything gets solved by then.

It always works.

What all of this does do is create a great buying opportunity for the assets not directly involved in this crisis, notably US equities. Modest over valuation has encumbered main indexes with declining volumes, narrowing breadth, and shrinking volatility for all of 2015.

At the very least, the Euro crisis du jour will present a second test of the (SPY) 200-day moving average at $205.74. The best case is that it gives us a real gift, a visit to a full 10% retreat to $193, a pullback whose ferociousness has not been seen since October.

That?s where you load the boat for a rally to new index highs at yearend.

You can expect similar moves in other assets classes.

In this scenario, volatility (VIX) will rocket to 30%. The Euro (FXE) collapses to $103 once more, and the Japanese yen (FXY) revisits $82. Treasury bonds (TLT) enjoy a flight to safety bid that takes yields at least back to 2.30%. Gold (GLD) and silver (SLV) do nothing, as usual.

For followers of my Trade Alert service, this is all a dream come true. Having made 26.71%, or much more, in the first half of this year, you now have the opportunity to repeat this feat in the second half.

Going into a crisis like this with 100% cash and only dry powder is every trader?s wildest fantasy. Make sure you let the current Greek debt crisis play out before you commit.

This is what you all pay me for. At least I?ll get something for suffering through the hell holes and gin joints of West Africa.

I think I?ll go give those camels some business.

Retsina

Retsina

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.