Global Market Comments

August 8, 2014

Fiat Lux

Featured Trade:

(AUGUST 13 GLOBAL STRATEGY WEBINAR),

(ANNOUNCING THE MAD HEDGE FUND TRADER YOUTUBE VIDEO IN ISTANBUL)

(AN UPDATE ON THE TESLA FIRE), (TSLA)

Tesla Motors, Inc. (TSLA)

Global Market Comments

August 8, 2014

Fiat Lux

Featured Trade:

(AUGUST 13 GLOBAL STRATEGY WEBINAR),

(ANNOUNCING THE MAD HEDGE FUND TRADER YOUTUBE VIDEO IN ISTANBUL)

(AN UPDATE ON THE TESLA FIRE), (TSLA)

Tesla Motors, Inc. (TSLA)

Come with me to visit one of the most lavish palaces ever built, complete with its own harem. Explore one of the boldest engineering works ever undertaken. Learn how to navigate your way around a Turkish bazaar. Admire some of the greatest wonders of the architectural world.

These are just a few of the enticements to be found in my personal video tour of Istanbul, Turkey.

One request I get more than any other, is to expand on my half-century of international travel, provide a business, economic, and historical backdrop, and place it in today?s global context.

Shake up such a cocktail of experience and knowledge, and more than a few trading and investment ideas spill over the top. If it?s funny, that helps too.

It seems that I am one of a tiny handful of people still alive in the world today who can do this.

This is not your normal travel show. Think of it as Lifestyles of the Rich and Famous meets The Economist and the History Channel, all couched in a language any trader will understand.

These are places of interest I have accumulated over five decades of living out of backpacks and suitcases. The goal is for you to learn from every single segment.

One of the great advantages of spending so long on the road is that I can chronicle the momentous changes that civilization has endured over the past half century. And sometimes, what hasn?t changed is much more impressive than what has.

I will be the sole producer of content for this show, grinding out entertainment and education as easy and cheaply as possible. Like everything else on the Internet, I am looking to achieve zero cost and infinite distribution.

So, all of the audio will be shot on my iPhone 5s. A running audio commentary will be provided via the Audio Memos app. Since the iPhone 5s is so sensitive, it picks up all the ambient sounds around me. I can only provide live audio when there is dead silence elsewhere.

Since the 19th century broadband found in many foreign hotels makes it difficult for me to email content back to the head office, segments are limited to a minute each. Each program will run from 15-30 minutes in length.

Full disclosure: None of the people involved in the production of this program have the slightest idea of what they are doing. They include the producers, editors, website designers, researchers, and of course, myself, the presenter, writer, and cameraman.

However, as with the inception of the Diary of a Mad Hedge Fund Trader seven years ago, we shall push ourselves down the learning curve at hyper speed, or we shall perish. In a few months, these shows should get pretty good, and might even make an appearance on a cable TV channel someday.

If you have any suggestions for how we might improve this service, or comments of any kind, positive or negative, please don?t hesitate to email me at support@madhedgefundtrader.com . Just put ?Video show? in the subject line and it will go straight to me.

You can?t beat the price. It?s free. The philosophy of this business has always been to charge people for the content that makes them money, like our market beating Trade Alert service, and give everything else for nothing.

So please come join me on my adventure in Istanbul by clicking here. Or just go to my home page at www.madhedgefundtrader.com and click on the ?MHFT VIDEO? menu tab.

Bon Voyage!

Once again, Tesla (TSLA) visionary, Elon Musk, surprised to the upside with his latest reports on earnings and production for his revolutionary vehicle.

Musk, who also founded groundbreaking Space X and Solar City (SCTY), expanded on his plans to manufacture in China and expand sales in Europe, where 220 volts is already standard.

The first ever left hand drive Model S-1 was just delivered in London to E.L. James, author of Fifty Shades of Grey, a fictional tome that is racy in its own right (worst book I ever read).

You can? keep a good stock down, which is now spitting distance from an all time high. That was the obvious message on Tesla (TLSA) shares in the wake of last year?s fire that consumed one of its $80,000 Model S-1?s on a Washington state road after it ran over the rear bumper of the truck it was following.

The video was quickly plastered all over YouTube (click here to view). Tesla quickly delivered a new car to the grateful owner within a week.

This was the first S-1 to catch fire since the production run started two years ago. There have been two others since. Compare that to the roughly 400 gasoline powered vehicles that catch fire on US roads nearly every day.

If you really want to see how volatile gasoline is, try lighting a campfire with it some day. Even tossing in matches in from a great distance, as I once did, you?ll be lucky to have your eyebrows left. I didn?t.

To make amends, Tesla is installing titanium armor plating on the bottom of every S-1 for free. They did mine this week, and gave me new a new Tesla as a loaner!

Tesla followed up quickly with an analysis and a letter with a complete explanation sent to all other S-1 drivers signed by none other than CEO Elon Musk. I have included the entire text below in italics. He doesn?t leave much to the imagination.

If only all car manufacturers behaved like this!

?Earlier this week, a Model?S traveling at highway speed struck a large metal object, causing significant damage to the vehicle. A curved section that fell off a semi-trailer was recovered from the roadway near where the accident occurred and, according to the road crew that was on the scene, appears to be the culprit. The geometry of the object caused a powerful lever action as it went under the car, punching upward and impaling the Model?S with a peak force on the order of 25 tons. Only a force of this magnitude would be strong enough to punch a 3 inch diameter hole through the quarter inch armor plate protecting the base of the vehicle.

The Model?S owner was nonetheless able to exit the highway as instructed by the onboard alert system, bring the car to a stop and depart the vehicle without injury. A fire caused by the impact began in the front battery module ? the battery pack has a total of 16 modules ? but was contained to the front section of the car by internal firewalls within the pack. Vents built into the battery pack directed the flames down towards the road and away from the vehicle.

When the fire department arrived, they observed standard procedure, which was to gain access to the source of the fire by puncturing holes in the top of the battery's protective metal plate and applying water. For the Model?S lithium-ion battery, it was correct to apply water (vs. dry chemical extinguisher), but not to puncture the metal firewall, as the newly created holes allowed the flames to then vent upwards into the front trunk section of the Model?S. Nonetheless, a combination of water followed by dry chemical extinguisher quickly brought the fire to an end.

It is important to note that the fire in the battery was contained to a small section near the front by the internal firewalls built into the pack structure. At no point did fire enter the passenger compartment.

Had a conventional gasoline car encountered the same object on the highway, the result could have been far worse. A typical gasoline car only has a thin metal sheet protecting the underbody, leaving it vulnerable to destruction of the fuel supply lines or fuel tank, which causes a pool of gasoline to form and often burn the entire car to the ground. In contrast, the combustion energy of our battery pack is only about 10% of the energy contained in a gasoline tank and is divided into 16 modules with firewalls in between. As a consequence, the effective combustion potential is only about 1% that of the fuel in a comparable gasoline sedan.

The nationwide driving statistics make this very clear: there are 150,000 car fires per year according to the National Fire Protection Association, and Americans drive about 3 trillion miles per year according to the Department of Transportation. That equates to 1 vehicle fire for every 20 million miles driven, compared to 1 fire in over 100 million miles for Tesla. This means you are 5 times more likely to experience a fire in a conventional gasoline car than a Tesla!

For consumers concerned about fire risk, there should be absolutely zero doubt that it is safer to power a car with a battery than a large tank of highly flammable liquid.?

Elon Musk

CEO,

Tesla Motors

Tesla Traffic Jam

Tesla Traffic Jam

Global Market Comments

August 7, 2014

Fiat Lux

Featured Trade:

(WHY I?M COVERING MY STOCK SHORTS),

(SPY), (SPX), (HYG), (TBT), (TLT),

(AN AFTERNOON SURPISE IN SWITZERLAND)

SPDR S&P 500 (SPY)

S&P 500 Index (SPX)

iShares iBoxx $ High Yield Corporate Bd (HYG)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares 20+ Year Treasury Bond (TLT)

Exhausted, and running on fumes, I returned to Zermatt from my assault on Monte Rose, at 15,203 feet, the highest mountain in Switzerland.

You know, the one where I hung by a rope on a cliff face with one hand, while sending out a Trade Alert on my iPhone 5s to short the S&P 500 with the other?

The desk clerk looked particularly grim. He said the city government had been looking for me, and that I better get down to their offices right away.

I thought, what could they possibly want?

It has been 25 years since I had been a director of the Swiss Bank Corporation, and certainly the statute of limitations had long since run out on anything that transpired there. Yes, they later got taken over by the Union Bank of Switzerland, which then fell on hard times (poor Marcel!).

As for all those Nazi gold bars, I had nothing to do with it! That was another department; although I did think the Third Reich?s stamped gold eagles did look kind of cool. Besides, that too, was resolved in a court settlement a decade ago.

There was that relationship with the teenaged girl at the Youth Hostel. But that was in 1968, and she was older than me.

So what could the authorities in Zermatt possibly want?

Then my mind set to racing. If I caught the 8:00 AM cable car at the Kleine Matterhorn, I could be over the Italian border by 10:00 AM. I would thus be treading the path of refugees for time immemorial, although going in the opposite direction.

Ten minutes later, I was at their offices on Bahnhoffstrasse, still wearing my backpack, mud splattered, and my hair standing straight up. ?My goodness, where have you been? We?ve been looking all over for you!? cried the official.

I answered that I had been climbing the Monte Rose, and then asked ?Why??

?The mayor wants to give you the keys to the city. It seems you have been visiting Zermatt longer than almost anyone. But you have to get over to the Zermatterhoff Hotel. The ceremony starts in five minutes!

Five minutes! I stumbled, out of breath, into the elegant reception room at Zermatt?s premier five star hotel. Not only was the mayor there dressed in all of his finery, so were the entire city council and a number of guests.

Gold leaf rimmed the cornices and angels adorned the ceiling. I was handed a glass of Switzerland?s finest white wine (where do they hide this stuff?).

Then began the festivities...in the local Swiss German dialect. I agreed with everything and laughed at all the jokes. Then came the moment of truth.

The mayor had heard that I was visiting Zermatt for my 46th year. Since the tourist records for the city did not go back that far, he was going to give me a test to see if I had really been coming there for that long.

I said, ?Fire away.?

Question number one: ?Where is the Matterhorn from?? That was easy. During my fracking days in West Texas I had undergone a crash course in Geology.

I had long been a student of the local Swiss rocks, taking several beautiful specimens home every year (mica embedded shiest, black basalt, and low grade jade!), and correctly answered that the Matterhorn came from Africa. (The European Continental Plate is subducting under the African plate, forcing the Matterhorn to grow an inch a year).

?Right!? he responded.

Question number two: ?Who was the first man to climb the Matterhorn?? ?The Englishman, Sir Edward Whymper, in 1865,? I replied. (It?s also the name of a downtown bar). Correct again, cheered the mayor.

Question number three: ?Who was the most famous American to climb the Matterhorn?? Piece of cake: President Theodore Roosevelt, in 1888.

With that, the entire room burst into applause and bravos.

Then, a young woman wearing traditional folk dress approached with a red satin pillow bearing a gold pin. The mayor pinned it on my sweaty shirt. On it was inscribed the words ?40 Danks?, which translates into ?40 Thanks.? He went on to say that if I came back in four years, they would give me my 50-year pin.

I asked if they had a 60-year pin. He replied that no one had been awarded one yet, but if I came back in 14 years, they would have one specially made for me.

This is an invitation I am willing to accept. With that came a refill of that fabulous wine.

No one mentioned my ramshackle appearance. Climbers are afforded a special status here. Maybe, they think we are all insane, and give a wide breadth, for safety?s sake. Everyone else there was wearing a suit and tie.

After that, I went back to my hotel and collapsed. It?s all again proof that if you live long enough, you get to see everything.

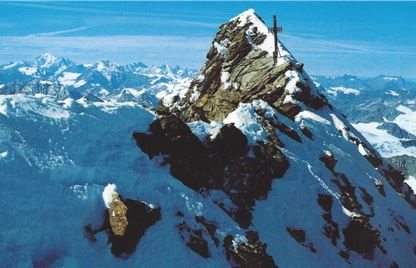

Matterhorn Summit

Matterhorn Summit

Global Market Comments

August 6, 2014

Fiat Lux

Featured Trade:

(WHAT COULD DERAIL THE COMING GOLDEN AGE?)

(TESTIMONIAL)

Hi John,

I was a subscriber when you first started the service.? Then I got busy and did not renew.? I listened to your webinar yesterday and bought the January (TBT) calls. I have already made over $12,000 on the trade.? So, I guess that I need to sign up for the service again!

Suzanne

Cary, North Carolina

Global Market Comments

August 5, 2014

Fiat Lux

Featured Trade:

(SHAKING THE HAND THAT KILLED OSAMA BIN LADEN)

Global Market Comments

August 4, 2014

Fiat Lux

Featured Trade:

(RUSSIAN SANCTIONS CRUSH EUROPEAN YIELDS),

(FXE), (EUO), (TLT), (TBT), (UNG), (XOM)

(TEA WITH FORMER SECRETARY OF STATE GEORGE SHULTZ)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

United States Natural Gas (UNG)

Exxon Mobil Corporation (XOM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.