I can?t tell you how many times I have received a call from the Joint Chiefs of Staff asking ?if country ?A? attacks country ?B? what is the effect on country ?Q? and ?Z?? After all, there is a pretty short list of those monitoring the global macro economy for 40 years with direct experience in the Middle East since 1968. So when I saw the 703 area code for the Pentagon light up on my caller ID, I thought ?Who is it this time??

It was the office of Army Chief of Staff, General Ray Odierno, calling, wondering if I would be free for lunch that day in San Francisco. The General had expressed interest in my recent piece, ?The Declining America Myth? and wished to explore my ideas further (click here for the link). General Odierno is the commander of the most effective fighting force in the history of warfare and has access to massive intelligence resources, so I thought I?d pick up some information useful to my readers.

Then I thought, ?Yikes!? I was already committed to some speaking engagements at the San Francisco Money Show that day. But duty calls. So a quick call to the organizer and my friend, Charles Githler, and I was able to roll over everything to the next day. That was fine, as long as I didn?t mind giving four speeches and doing three TV interviews in one day.

Hours later, I was briskly walking up Sutter Street to the Marines? Memorial Club. For good measure, I stopped at a barber shop and cut off all my hair. I have learned over the years that the more you look like someone, the more likely they are to confide in you. So it was ?number two buzz cut? here we come. The unexpected dividend of the move was that there was a definite upsurge in interest from the ladies, now that all the white hair was gone and I looked ten years younger.

When I saw the grey GM Suburbans out front and the attendant armed bodyguards, I knew he was early. General Odierno is a thickset man with a handshake like a vice grip. The hash marks practically made it up to his elbow. His uniform displayed a chest full of campaign ribbons and awards. His epaulettes displayed the four starts of a general. But I also noticed that he lacked the ones for Vietnam, his first action coming with Desert Storm. I must be getting old, I thought. Note to readers: much of what we discussed was classified and this piece has been cleared by Army censors.

The general was spending a few hours in the city on his way to visit Larry Paige and Sergei Brin at Google headquarters in nearby Mountain View. There he hoped to learn of the strategic value of the company?s newest online tools. Technology is now developing so fast that it is a challenge for the military to integrate it in to operations fast enough to have an immediate impact. In the aftermath of the Arab Spring, Facebook is now seen as being worth 10 divisions.

The present size of the army is 490,000, down from 1 million at the end of the Vietnam War. Plans are to reduce the force by 80,000 over the next decade, partly made possible by the withdrawal of troops from Iraq and Afghanistan. The goal is to offset this decline with stepped up training and education of the remaining soldiers to accept greater responsibilities. The challenge is to achieve this without ?hollowing out? our forces.

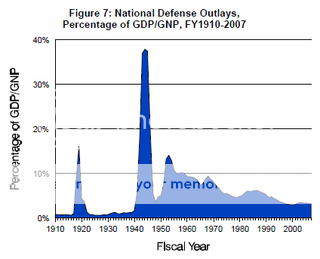

The Joint chiefs are well aware of the fiscal and deficit problems plaguing the US. During the Cold War, the base defense budget peaked at $400 billion, fell to 310 billion by 2001, and ratcheted back up to $510 billion after 9/11. Spending for Iraq and Afghanistan are separately appropriated funds that go on top of this. The target is to lower this to $489 billion over the next ten years. Manpower accounts for 50% of the defense budget, and the cost per soldier has doubled since 2000, making it far and away the biggest cost driver. If budget sequestration comes into force after November ?it will be difficult for the Army to accomplish its mission.?

Odierno says that the Army has made ?incredible progress? training local forces in Afghanistan.

The recent upsurge in suicide bombings and ?insider? attacks prove that the Taliban is losing and is being forced to retreat from the field. This should enable a cut in our forces there from 80,000 to 50,000 by 2014, reducing their role to counter-terrorism and training. While the drone attacks in Pakistan were controversial, they were bringing results, and a major part of the Taliban leadership has been wiped out.

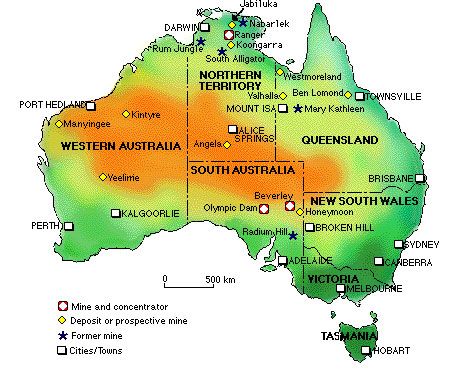

He was optimistic about the future of Iraq. The country is expected to increase oil production from 3 million barrels a day to 5 million, making it the world?s fourth largest producer. If they share the wealth they can look forward to a more stable future. If they don?t, then the internal strife will continue. He wouldn?t get into whether it was a good idea to invade Iraq or not. But removing Saddam Hussein from the global stage has been good news for everyone, especially the Iraqis themselves.

Regarding Syria, Odierno said that he had prepared a list of options for President Obama, and it was up to him to decide what to do. It starts with the existing humanitarian aid and escalates in intensity from there. Next on the list is the enforcement of a ?no fly? zone. I asked why we didn?t just supply the rebels with hand held ?stinger? ground to air missiles, as we did in Afghanistan 25 years ago, with great success. He said it is unclear who the rebels really are and what they represent.

We know that Al Qaida is certainly on the ground in Syria, as foreign fighters account for 10% of the rebel force. The concern is that terrorists could get their hands on these missiles and use them against our own civilian airliners. Odierno chose his words very carefully, as if gingerly stepping through a minefield. Past experience tells me this means that action is imminent.

The general indicated that the Army was making a substantial investment in cyberwarfare. This goes far beyond simple antivirus protection and now includes protection of American financial and industrial networks. It also includes offensive capability. The next war may not start with flying bullets, but with a volley of pernicious computer files that disable enemy communications networks, military, and industrial facilities.

There are hints that this is already underway against Iran, which recently sustained serious damage to its nuclear program from the Israeli ?stuxnet? virus. One of his aides suggested that we now have the ability to ?fry? a country in ten minutes.

I asked the general about the upsurge in army suicides, which are now occurring in record numbers. He said that it was a reflection of American society as a whole, which is seeing a nationwide increase in suicide rates. These are not the fallout from post-traumatic stress, because over half of the deaths have been by soldiers who have never seen combat. The Army is now conducting educational programs to allow officers to identify those at risk. That is tough to do in a profession that values strength and sacrifice.

General Odierno graduated from West Point in 1976 with a commission in field artillery. He has commanded units in Germany, Albania, Kuwait, Iraq, and the US. He commanded the 4th Infantry Division during the invasion of Iraq, and years later became the operational commander for the highly successful ?surge? there. He has been the Army Chief of Staff since 2011.

When I got up to leave, he thanked me for my service. I said that his contribution had been infinitely greater. I reminded him that he had my number and could call at any time, and that I considered the opportunity to serve the country an honor and a privilege. With that, his security guard hustled him out of the room. I wondered how soon the next call would come.

Now Better Trained and Educated