During my college days, one of my math professors used to repeat a truism: ?Statistics are like a bikini; what they reveal are fascinating, but what they conceal is essential.? That has increasingly becoming the case with US economic data, which are leading investors astray with their faulty guidance.

It turns out that most government data releases contain a seasonal adjustment factor that includes a five-year look back. The problem arises when the 2008 figures from the global financial meltdown are averaged in, which includes a panoply of once in a century spikes. Think job losses at 700,000 a month and a shrinking GDP at an annualized -9% rate.

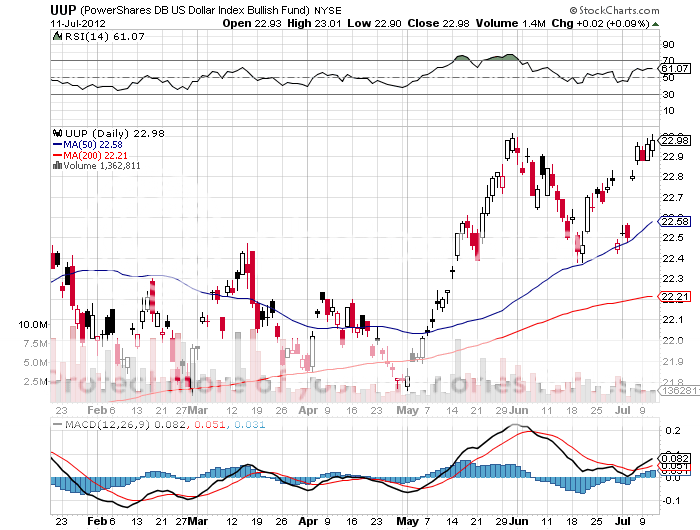

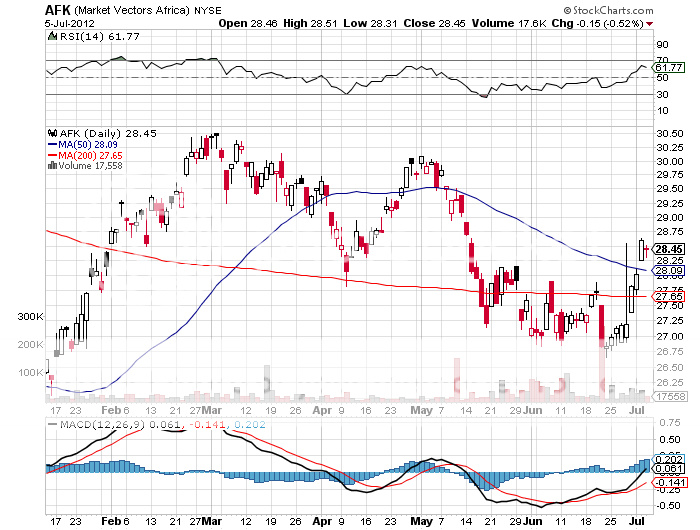

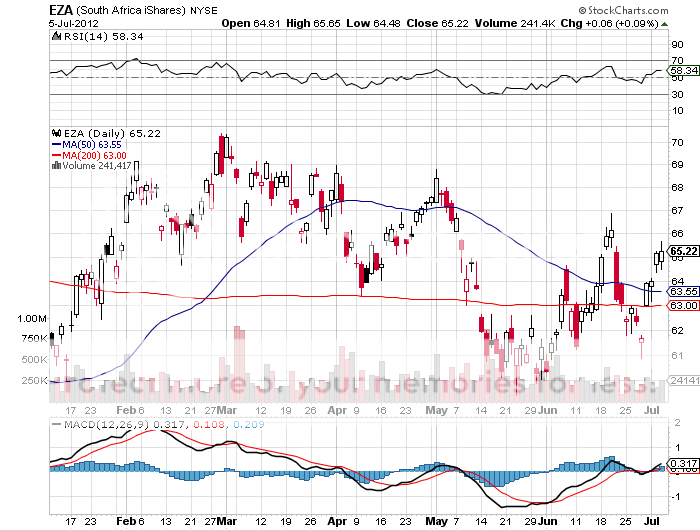

Those data points are skewing today?s releases in unfortunate ways. They are making the economy appear stronger from September to February, and weaker than it should be from March to August. What this does is reinforce an existing historical trend that weakens stocks every spring, only to rally them back in the fall, which has been in force for over 100 years.

My theory is that this dates back to the agricultural foundations of our nation. Farmers were always at maximum distress during the late summer when their borrowing to pay for seed, fertilizer, and labor was at a maximum, just before the harvest. This is why stock market crashes always happen in September and October.

In recent years, bailouts from the Federal Reserve have reinforced the two red herrings above. Being human, they react to four or five months of unrelenting market stress crying ?Uncle? just when the kids are headed back to school. In August 2010 Bernanke sprung QE2 on the market, and in September 2011 he launched his ?twist? policy, or ?QE light?. In both cases these actions led to 6-8 month global rallies in all risk assets.

What all of this does is explain why ?sell in May and go away? has worked so well for the past four years. Using the five-year timetable, it looks like we will see a repeat of this seasonality in 2013. After that, when everyone comes to believe that the trend is a certainty, it will fail. May bears will get run over by a stampede of bulls in 2014 as the statistical aberrations fade away. It will be then that the shortcomings of a bikini become most apparent.

Conceals More Than It Reveals