'I think the price of oil is high here. There is still some panic because of Libya. We prefer to have it around $70-$80 a barrel. Our goal is the find an equilibrium between our needs and your needs' said Prince Al-Waleed bin Talal of Saudi Arabia, the largest foreign investor in the US.

Featured Trades: (IS JAPAN GETTING READY TO BLOOM?),

(TM), (NSANY), (FANUY), (CAJ), (KMTUY), (FXJ),(YCS)

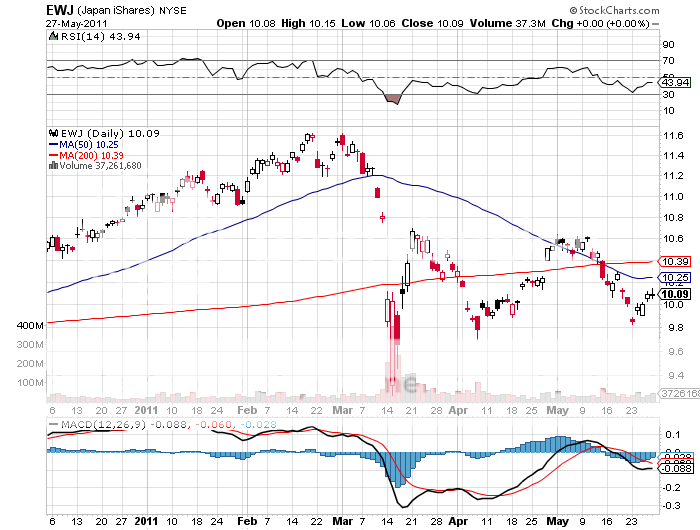

1) When to Buy Japan? It has been three months since the horrific Japanese tsunami, the economy is in free fall, and radiation is still lingering in the air and water. It now appears that the beleaguered nation's GDP shrank at a 4% rate, in line with my own expectations, but far worse than anyone else's. The down leg of the 'V' is well underway. When does the up leg begin, and when should we start positioning for it?

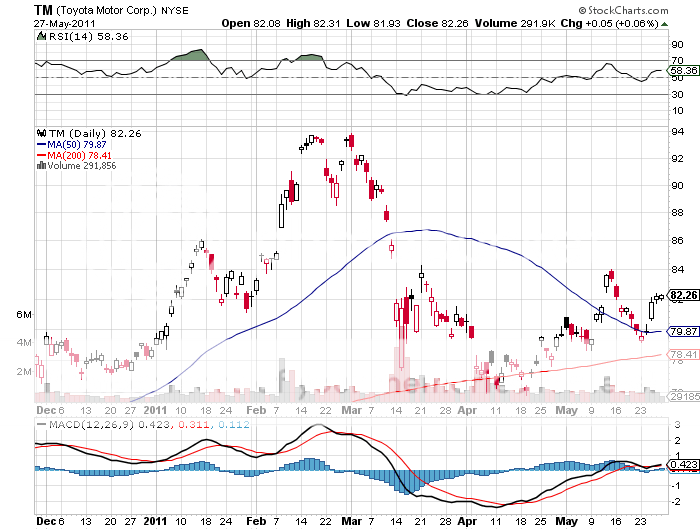

One need look no further than Toyota's Motor's stunning year on year decline in domestic sales of -69%. Consumers in the US want to buy their fuel efficient cars, but sought after models are in short supply. Power shortages have been a major headache, and additional nuclear shut downs have exacerbated the problem. A 28 week, $60 billion buying spree of Japanese stocks has ground to a halt, taking the Nikkei down 10%.

The government has already passed two supplementary budgets to get reconstruction underway, one for $50 billion and a second for $125 billion. The Bank of Japan has carried out quantitative easing worth $500 billion; nearly triple the Federal Reserve's own recent QE2 efforts on a per capita basis.

Surging loan demand indicates that these efforts are yielding their desired results. Companies are moving away from their famous kamban 'just in time' inventory system towards a 'just in case' model that provides a bigger buffer against unanticipated disasters. This is a net positive for the economy.

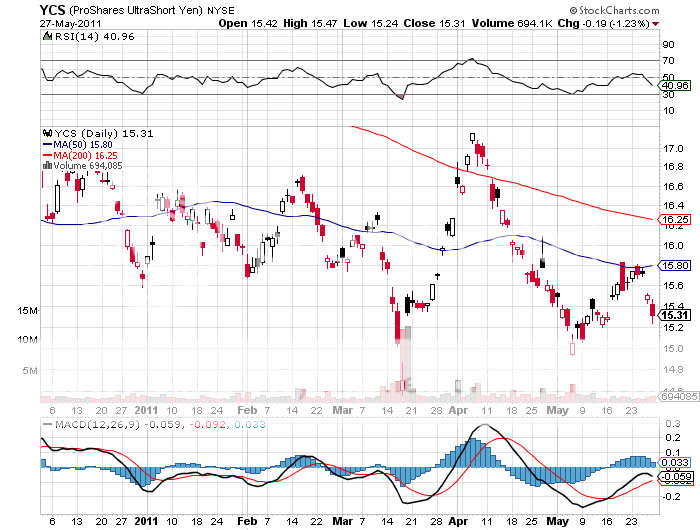

This Godzilla sized stimulus is expected to deliver GDP growth in 2012 as high as 3%, taking it to the top of the pack of developed nations. That will prompt rally of at least 20% in the Japanese stock market. What's more, widening interest rate differentials between Japan and the US should finally start to weaken the yen, giving a further boost to the economy and to stocks. This burst in business activity should also enable the country to flip from chronic deflation to inflation, and will?? knock the wind out of Japanese government bonds, now yielding a pitiful 1.11% for the ten year.

So when do we pull the trigger? If my theory is correct and we get a multi month 'RISK OFF' trade that deflates all asset prices, then you want to hold off for now. But I can see a final bottoming of prices sometime this summer. The easy play here is to buy the ETF (EWJ).

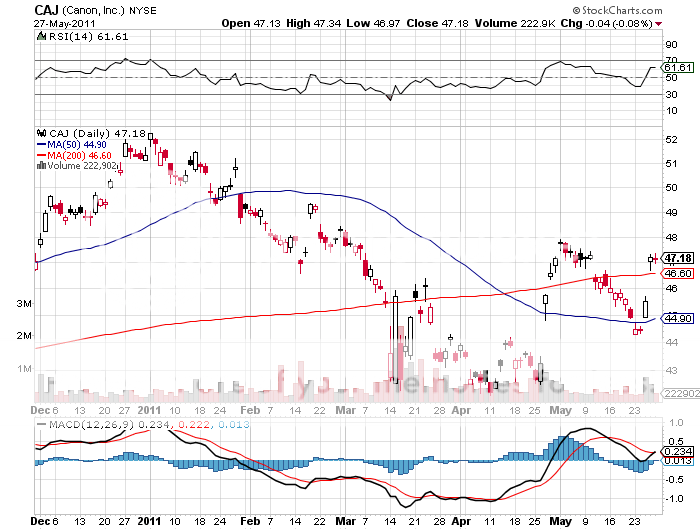

The next level of commitment includes the five best of blue chips I mentioned in March, Toyota Motors, (TM), Nissan Motors (NSANY), Fanuc (FANUY), Canon (CAJ), and Komatsu (KMTUY). Keep in mind that you will want to hedge your currency here through buying puts on the (FXJ) and through the 2X (YCS), as a weak yen will be part of a winning recipe.

-

-

-

-

Is Japan Getting Ready to Bloom?

Featured Trades: ('RISK OFF' TAKES A BREAK)

2) 'RISK OFF' Takes a Break. If you had to pick a point where the 'RISK OFF' trade takes a short break, it would be right here. One month into the strategy, and virtually all asset classes have hit key points where you would naturally expect some serious resistance, which you never break on the first go around. You may recall that the 'RISK OFF' strategy bets on a rising dollar and bonds, and falling stock, commodities, oil, and precious metals.

Look at the chart below for the (UUP), the dollar long against a basket of currencies. The two year support line we broke in March now becomes upside resistance. Ditto for the chart of the S&P 500, which clearly will not give up the 100 day moving average at 1,314 without a fight.

Furthermore, major trend line support for the big cap index for the rally that has continued since the advent of QE2 talk last August kicks in right here. Will the end of QE2 break that support? My bet is yes.

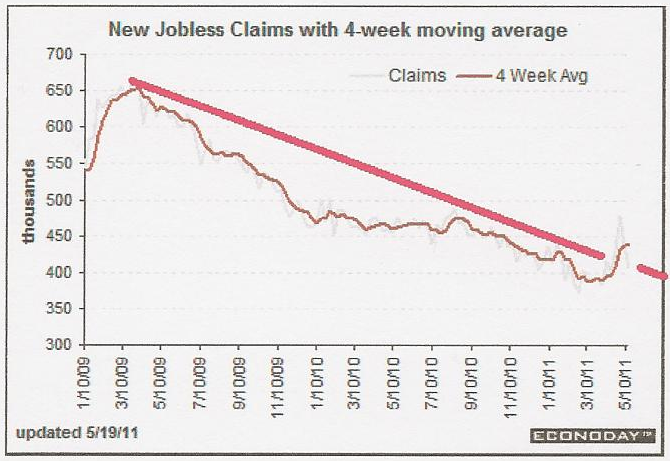

The steady drumbeat of poor economic data released this week suggest that I will be right. Many economists bet that Q1 GDP would get revised up from a pathetic 1.8% to 2% this week. It didn't. The heavy hand of foreclosure spawned high inventories kept new home sales in the basement. How there is anyone left in this industry still amazes me. And the best indicator of all, weekly jobless claims, showed more deterioration with a gain of 10,000 this week.

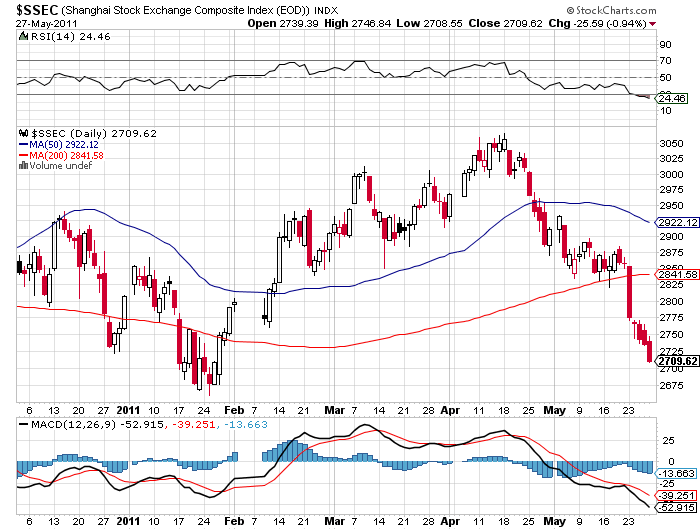

Data from Lipper Analytical Services show that $5.6 billion was withdrawn from equity mutual funds last week. And if you believe that the Shanghai stock market has any predictive power for our markets, they aren't buying this week's rally for one nanosecond.

Sure, it would have been nice to cover all of my shorts at the opening last Monday and resell them on the Friday highs. But my hard earned experience shows that when you try to get too cute like this, you leave the bulk of your gains on the table. June has delivered falling stock markets the last six consecutive years. Shall we shoot for seven, especially when the 800 pound gorilla in the room, QE2, is about to exit? I think so.

But devotees may have to endure a few more days of pain. On May 31 there will be some month end window dressing pushing prices up. Then you get new monthly cash flows on June 1. June 3 brings a May nonfarm payroll that is likely to be strong. The 'RISK OFF' is likely to resume June 6, D-Day.

-

-

-

-

-

The 800 Pound Gorilla is About to Leave the Room

-

I'm Shooting for Seven

Featured Trades: (THE BATTLE OF THE 100 DAY MOVING AVERAGE)

2) The Battle of the 100 Day Moving Average. Take a look at the chart below from StockCharts.com and it is clear that the line in the sand for the stock market is the 100 day moving average at 1,312.

I have noticed an interesting pattern that trading has fallen into since stocks peaked on April 29. All year, the Monday action indicated the medium term direction of the market. For the first four months, that brought rising stocks more than 90% of the time. For the past month, Mondays of delivered falling stocks like clockwork.

The indexes then bring in a few days of indecisive, double digit, low volume rallies. Next, a big risk off trade hits on Friday as short term traders clear the books for the weekend. The weekend press then produces some new bomb shells from Europe plus a lot of handwringing from domestic analysts that severely beat up stocks on Monday morning. That is then the low for the week.

If the 100 day moving average breaks then look out below, because the 'RISK OFF' trade will then continue all the way up until QE2 ends on June 30. The next support becomes the 200 day average at 1,240, or down 75 points from here. If it doesn't break, then it won't. Just thought you'd like to know.

-

Featured Trades: (THE VULTURES ARE CIRCLING AROUND THE EURO), (FXE), (EUO)

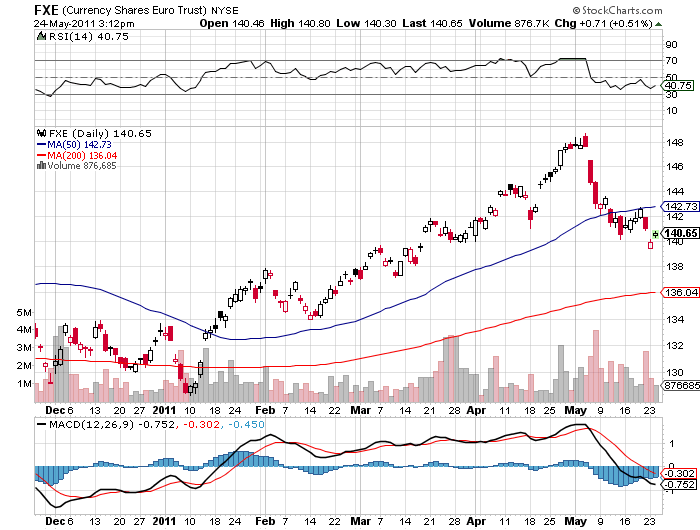

2) The Vultures are Circling Around the Euro. It has not been a great week for the beleaguered European currency (FXE), (EUO). The chickens, no, make that vultures, are coming home to roost.

Belgian and Spanish debt has been downgraded. The UK's debt is under review. The ratings agencies now seem to be taking aim at Italy. Perhaps the only good news for the Euro is that former IMF chief and future French presidential candidate, Dominique Strauss-Kahn, was able to post bail for his sex crimes in New York.

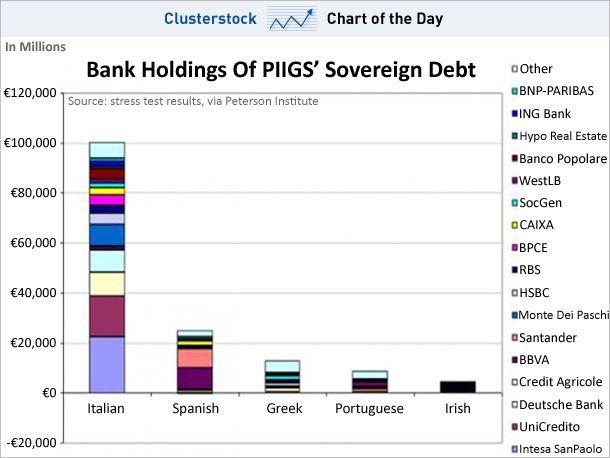

To understand why Italy is such a big deal, take a look at the chart below showing bank holdings of PIIGS debts. Italian bonds are far and away the most widely owned, dwarfing all other sovereign issuers combined, and their default would certainly wipe out a major portion of European bank capital. If you wonder why I am constantly asserting that European banks have a de facto negative net worth and their eventual demise with bring the death of the euro, this is a good reason.

In the meantime, hedge funds are starting to jump on the bandwagon for the Euro short play. Some two thirds of the long positions in the futures markets have been liquidated in the past ten days. We will see the next down leg for the Euro when the reminder gets dumped and the street flips to a net short. As for me, I have been short since $1.49 and am comfortable with the position. Any rally from here, and I will be quite happy to double up.

-

-

Is That a Euro I See?

Featured Trades: (HOW'S THAT RISK OFF TRADE WORKING?),

(SPX), (SDS), (GLD), (USO), (DUG), (TLT), (TBT), (FCX), (CU)

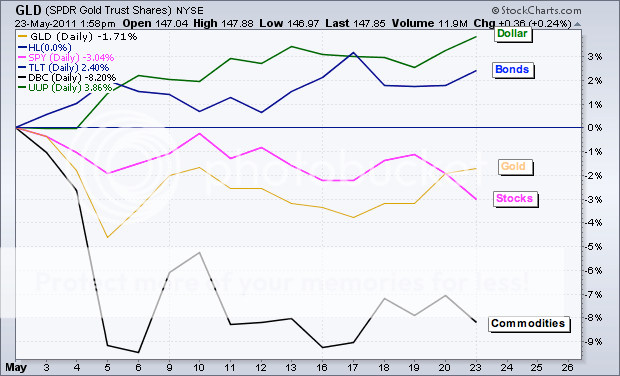

3) How's That 'RISK OFF' Trade Working? Take a look at the chart below since I made my watershed call to put on a 'RISK OFF' portfolio on April 25 (click here for the link). Almost all ass asset classes peaked exactly four days later.

You may recall that the 'RISK OFF' portfolio bets on falling prices for stocks (SPX), (SDS), commodities (CU), (FCX), oil (USO), (DUG), foreign currencies (UUP), (FXE), (EUO), and precious metals (GLD), (SLV). Simultaneously, a flight to safety bid would bring rising prices for the dollar and bonds. The fundamental rational for the portfolio was that all of the money that ran into assets to take advantage of QE2 would run right back out again. Call this my 'Anti-QE2 Portfolio'

I think that the 'RISK OFF' trade will run for not days or weeks, but months. The challenge will be not to get shaken out of the portfolio when the inevitable, technically driven short covering rallies ensue. What would it take to change my mind and return to a 'RISK ON' portfolio? Here is a short list:

*US corporations produce blow out earnings in their September quarterly reports three months off.

*China abandons its inflation fight, cuts interest rates and bank reserve requirements.

*We get a run of weak economic data that prompts Ben Bernanke to launch a real QE3.

*The Japanese governments awakens from its tsunami induced stupor and orders the Bank of Japan to run the printing presses to finance reconstruction. That enables the yen to return as a carry trade and collapse.

All of the above will eventually occur. For precise timing, watch this space. You'll be the first to know.

-

'RISK OFF' Has Months to Run

Featured Trades: (MACRO MILLIONAIRE TOPS 40%)

1) Macro Millionaire Portfolio Clocks a 40% Gain YTD. After posting one of the best days of the year yesterday, up 5%, the Macro Millionaire model trading portfolio year to date performance topped 40%. This compares to a gain of only 11% for the S&P 500 since November 29, when our tracking year began. The gains were made thanks to our aggressive short positions in US stocks, oil, and the Euro taken not long after the markets peaked on April 29.

Macro Millionaire is now the fastest growing online trading and mentoring service. It has helped thousands of individuals to learn the strategies, tools, and thinking employed by the top hedge fund traders. If you would like more information on how to subscribe to this highly entertaining and informative educational program, please email John Thomas at madhedgefundtrader@yahoo.com.

Buy Low, Sell High, I Never Thought of That!

Featured Trades: (QE3 HAS ALREADY STARTED)

2) QE3 Has Already Started. Most analysts have missed the fact that QE3 has already started in earnest. Of course, it would have been easy to miss. Ben Bernanke has not made any grand pronouncements. He hasn't done some public thinking out loud, as he did among friends at Jackson Hole, Wyoming last August. It is not even called 'QE3'. Think of it as a 'stealth QE3'. But make no mistake. A new variety of quantitative easing has already begun in a big way, and is generating its desired effect.

The new QE3 is the 'RISK OFF' trade. QE2 ended up pouring $600 billion into stocks, commodities, oil, gold, and silver. Since April 29, the prospect of slowing economic growth has prompted this hot money to take flight and bail from these assets classes. Think of it as the same $600 billion stampeding into risky markets, doing a 180, and then stampeding right back out against.

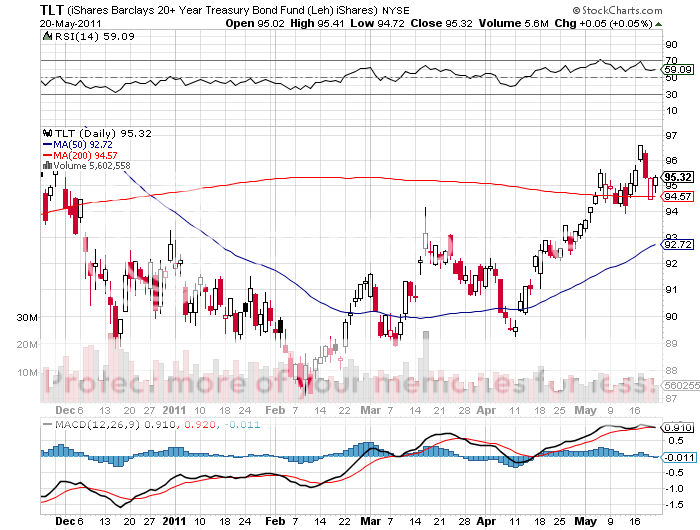

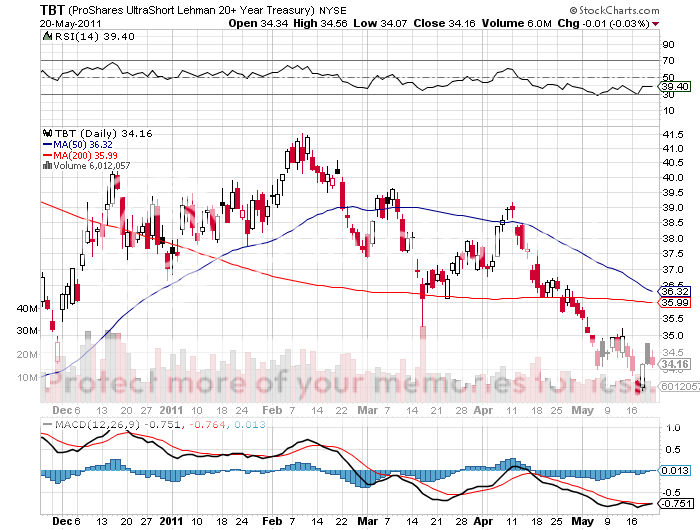

Where is all this money going? Into the Treasury bond market. We have in fact been in new bull market for bonds since February, taking the yield on the ten year Treasury down from 4.10% to 3.10%. If the current 'RISK OFF' trade continues, or even accelerates, we could see ten year yields down to 2.0%-2.5% by the end of the summer.

In the ultimate irony, we might even see bonds peak and risk assets bottom on June 30, the day QE2 ends. Given the way that events compress and accelerate these days, I would not be surprised to see things unfold this way. This is why I have been selling short puts on the long bond ETF (TLT), and avoiding bearish bets on bonds, like the plague, such as the (TBT). It is also why I have been piling on shorts in oil and stock at every opportunity.

There is no doubt that this is Ben Bernanke and Treasury Secretary Tim Geithner's plan, and they have voiced as much to Washington confidents in recent weeks. The beauty of this plan is that it has no government fingerprints on it. They are getting private investors to do the heavy lifting for them. That will make them immune from attacks from anti-interventionists, like the Tea Party, and anti-Federal Reservists, like Ron Paul. Bernanke can just sit back and let natural market forces do his handiwork for him.

Clever Ben, clever.

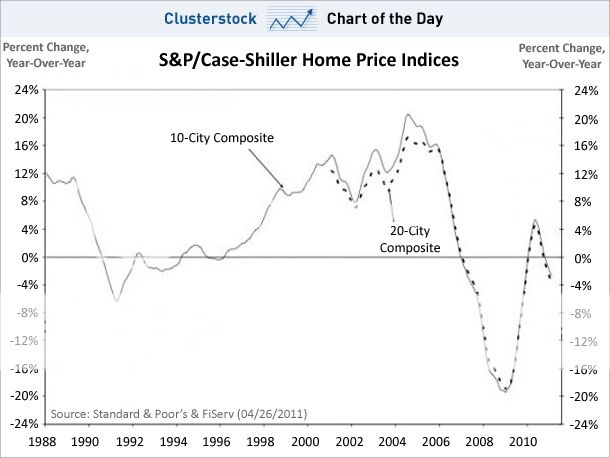

Of course Bernanke cannot employ this strategy forever. Eventually the expiration of Obama's many stimulus programs, the end of the Bush tax cuts, a growing drag by the state and municipal sector, and a worsening structural unemployment problem, will slow economic growth enough to where the Fed will have to take real action. Then they will have to launch a real QE3, or face another Great Recession, something the administration would rather not see in an election year.

Keep in mind that the next Recession will be far worse than the last one. None of the problems of the 2008-2009 debacle, like too big to fail, the real estate collapse, and the burgeoning bad debts on bank balance sheets, have really been solved. The can has merely been kicked forward. The only difference will be that there will be no TARP and no bail outs next time. The chips will fall where they want.

This all means that you better keep running your shorts and make some serious coin from the unfolding 'RISK OFF' trade while you can. Look out below.

-

-

What Do You Have Up Your Sleeve, Ben?

Featured Trades: (THE S&P 500 IN 2020)

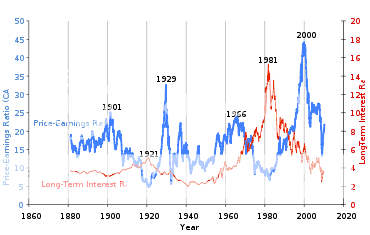

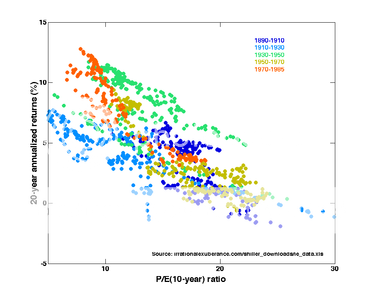

2) The S&P 500 in 2020. Dr. Robert Shiller certainly knows which end of a PE multiple to hold up. He is one of the few economists out there who has produced the sort of long term historical and mathematical analysis of financial valuations that is rare on Wall Street.

Among his many claims to fame was his forecast of the coming residential real estate collapse in the mid 2,000's, banging every pot and pan as loudly as he could to warn us all. His Case-Shiller index is the benchmark for tracking prices in regional real estate markets.

So I have to pay attention when the eminent Yale professor predicts that the S&P 500 will go no higher that 1430 by 2020, a mere 90 points higher than it is today. His data shows that from 1871 to 2008, the multiple has averaged 14, ranging from a high of 45 in 2000 to a low of 5 in 1921. By his calculation, the current multiple normalized over the past ten years is 23, making the market outrageously expensive.

That implies that we are only 17 months into a second lost decade for the stock market. With the country still digesting the housing bust, American standards of living falling, its currency chronically weak, relative global competitiveness shrinking, deficits ballooning, wealth excessively concentrating at the top, and the stimulus pump running dry, what else did you expect?

-

-

-

Rent, Don't Buy

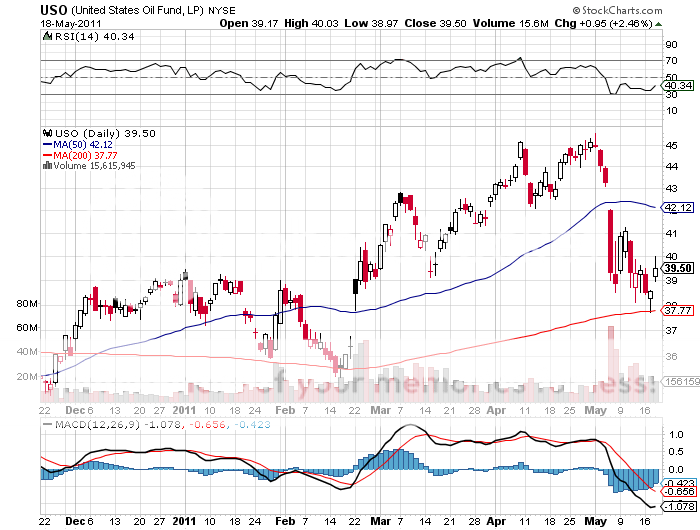

Featured Trades: (THE BEAR CASE FOR OIL), (USO), (DUG)

3) The Bear Case for Oil. Let's do some out of the box thinking here. Let's say that the global economy is really slowing down. The demand for oil will fall. Let's say that China continues to raise interest rates, slowing its economy further. Then Chinese oil demand starts to wane.

Then we bring on stream new US onshore supplies opened up by advanced technologies in places like the Bakken field in North Dakota. Then current high prices at the pump deliver a summer driving season that is a shadow of its former self. Next, the exchanges get religion and decide to damp down speculation in earnest by raising margin requirements on oil.

Now, let's thrown in an outlier. Muammar Khadafi chokes to death on a bad falafel, bringing the Libyan civil war to an immediate end, and unleashing 1.2 million barrels a day of light crude on the European market.

What I have just outlined here is a perfect storm for oil prices. It's not that these are low probability events. They are in fact the most likely scenario that will unfold over the next three months. And they are all likely to hit at the same time, taking crude down to the bottom of the last year's range of $84/barrel.

So I think that it is prudent here to start adding some short exposure for oil. Selling short the US Oil Fund (USO) might be a good idea, which has one of the worst tracking errors in the ETF world, and never fails to rob investors blind. Play this from the short side, and these gross inefficiencies work in your favor. When I employed this strategy through the put options in March, I scored a near double in just five days.

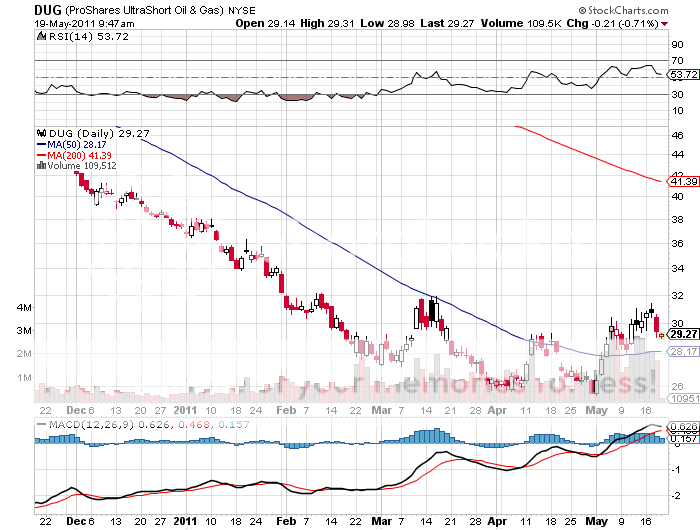

Just to add a little kicker to your short oil play, you might buy the (DUG), a -2X inverse short ETF on the oil majors now trading at $29.25. Falling oil prices will lead to plunging oil company profitability, shrinking PE multiples, and sharply declining stock prices, all of which work in favor of (DUG). Throw in a broader global risk off trade, and this thing works with a turbocharger.

-

-

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.