February 19, 2010

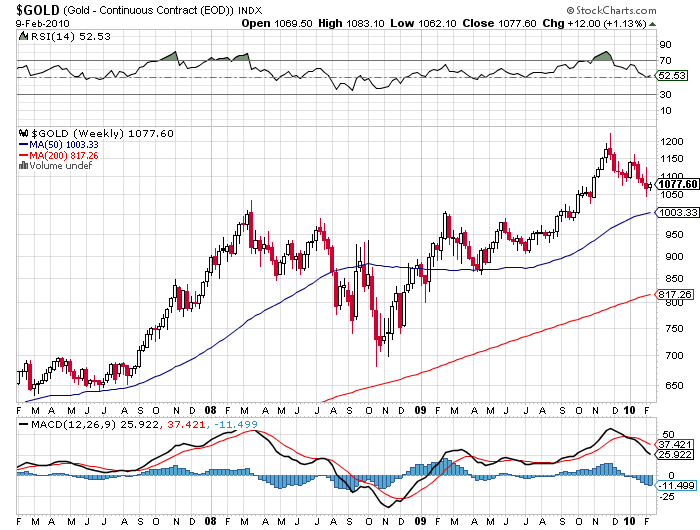

Featured Trades: (GOLD), (GLD),

(STIMULUS PACKAGE),

(SQM), (ENS), (XIDE), (ZBB),

2) Since the one year anniversary of Obama?s stimulus plan has generated much debate over whether it has been a success or a failure, I?d thought I?d pass on this wonderful pie chart from Clusterstock. Of the $792 billion package, 23% has been spent, 12% issued in tax cuts, and 19% is in the pipeline. That leaves 31% more to be spent, and another 15% in tax cuts to be implemented in this and future years. At first glance, the stimulus seems clevery back-end loaded to achieve maximum advantage for the Democrats on Election Day in November. A deeper analysis shows that it is a lot harder to spend $792 billion than you think. Believe me, I?ve tried. You can?t exactly go down to Home Depot, buy some materials, and put a bunch of guys you found on Craig?s List to work. The immense size of Washington?s projects mean the planning and approvals can stretch out for years. You don?t snap your fingers and get a new bullet train from Los Angeles to San Francisco built. Remember also, that for every $10 the feds pump into the economy, the states take back $4 in budget cutbacks, leaving a modest, at best, net impact on the economy. Which state is the biggest beneficiary of government largesse? With a Republican in the White House for eight out of the last nine years, solidly Democratic California was absolutely starved of government spending, and therefore, had the most large, shovel ready projects when the package passed. In fact, the weary residents of the Golden State only get 77 cents back from each $1 they pay the Treasury in taxes.? The local freeways have broken out with a rash of orange cones so severe it would put a junior prom night to shame. It?s just in time too. The potholes were about to shake my poor ?96 Toyota Corolla to death.

3) Long time readers of this letter know that I have been a huge bull on lithium plays, my pick in the sector, Sociedad Quimica Y Minera (SQM), bringing in a handy 250% pop off the lows in 2009. Since I?m in a report reading mood, I thought I would sit back in my Aeron office chair, put me feet up on my polished beech desk, and plow through the numerous submissions forwarded to me by readers who attended the first ?Lithium Supply and Markets Conference? in Santiago, Chile in January. The bad news is that a truly economic, price competitive lithium battery is still some ways off. Prices for lithium-ion batteries for hybrid electric vehicles (HEV) need to drop by 50% and those for plug-in hybrid electric vehicles (PHEV) by 67%-80% in order to compete on a level playing field. Gasoline has 64 times more energy per unit of weight than lithium batteries, but this advantage is partially offset by electric motors that are four times more efficient than conventional piston engines. Lighter weight cars and other design improvements, like recapturing power when braking, shrink the lead further. Dr. Steven Chu?s Department of Energy is pouring money into research on an amazingly wide front, and strides are being made with different electrodes (silver, sulfur, manganese), leading to rapid advances in inorganic chemistry. The challenges are formidable, with overcharged large lithium ion batteries prone to explode or catch on fire, or internally or externally short circuit. The conservative big car companies, Toyota and Honda, have stuck with proven nickel metal hydride batteries offering half the power per weight, and are understandably reluctant to make the needed multibillion dollar investments until more is known about the long term life of lithium batteries. Another wrinkle is that Bolivia, the Saudi Arabia of lithium salt reserves, has effectively nationalized the industry before it got off the ground, limiting its investment in development to $350 million. As the production of EV?s, HEV?s, and PHEV?s is expected to ramp up to 5 million vehicles a year by 2020, this could be a problem. Many in the industry expect that lithium prices will not be driven by demand from car makers, but by the price of oil. Take crude up to $150 again, and all of a sudden, everything works. Unlike past battery car movements, this one is not going away. The intelligent way to approach the industry now is to invest in low cost producers of proven battery technology, like Enersys (ENS), Exide Technologies (XIDE), C&D Technologies (CHP), and ZBB Energy (ZBB). Leave the pie in the sky stuff for later. Unlike past battery car movements, this one is not going to end up crushed in a junkyard. I?ll let you know how my lithium battery powered all electric (EV) Nissan Leaf, on sale in December, works out.

s, publisher of Forbes magazine.