People will be sitting around campfires trading stories about last week’s NVIDIA move for decades.

Analysts have been struggling to outdo each other in describing their earnings report that came out on Thursday. Here’s my favorite: The gain in the company’s market capitalization on that day, at $278 billion the largest in history, exceeded its TOTAL market capitalization at the pandemic bottom.

And here I deserve some bragging rights. Mad Hedge followers went into last week’s melt-up, UP TO THEIR EYEBALLS in (NVDA). They owned the stock, call options, and call spreads. The LEAPS alone delivered a 12X return, and some readers who customize their own strike prices (the $295-$300s) received a 50X return. It was almost everyone’s largest position.

It was easy for me to do the NVIDIA trade. When the company launched its first high-end graphics card in 1993, every computer geek out there flocked to them. I used to tear apart my company’s PCs, throw out the graphics cards they came with, and install NVIDIA cards. The performance improvement was remarkable, especially for advanced mathematical calculations.

The company is blessed. It went public at $12 a share just before the Dotcom Bust and the IPO window closed for years. Adjusted for 12:1 splits over the years and that drops the original IPO price to $1. A dollar invested in 1999 would be worth $750 at last week’s high. NVIDIA’s CEO, Jensen Huang, is now one of the richest men in the world solely through the ownership of his NVIDIA shares.

God Bless America!

Also last week, my inbox was jammed with inquiries on what company will become the next NVIDIA. And here is the bad news. There aren’t any 750:1 returns anywhere on the horizon. There are not even any 175:1 opportunities that we earned from Tesla (TSLA) over the years either where we also had heavy exposure.

And the reason is very simple. You are not going to get the entry points today with the Dow Average at 39,000 that you got in 2009 when it was at only 6,000, or when it was at a mere 600 when I joined Morgan Stanley in 1982. The last decent entry point for (NVDA) was the $100 pandemic low in April 2020.

Want to own the next (NVDA)? Try buying (NVDA), where an analyst raised his target to $1,420, up 80% from the Friday close. It’s just a matter of time before its market cap jumps from $2 trillion to $3 trillion, making it the largest company in the world. That’s what an airtight monopoly in the world’s most valuable product gets you.

Technology earnings are now exploding at such a rapid pace that it is time to consider the unthinkable: What if stocks don’t need interest rate cuts for the bull market to continue? After all, the companies seem to be doing just fine without any such assistance.

Why try to fix what isn’t broken?

In fact, these large cash flow companies would take a hit on their income statements as they are already net creditors to the financial system. Apple (AAPL) alone would lose $8 billion in annual income if interest rates went back to zero.

While that may be true for the Magnificent Seven or the AI Five, it is not true for the Unimagnificent 493. They actually need cheaper money for their stock prices to get going or even just to survive. That is especially true for all the falling interest rate plays, like bonds, utilities, real estate, precious metals, energy, and foreign currencies.

And don’t even talk to me about small caps, which depend on low interest rates for the breath of life.

It says a lot that Warren Buffet believes there is nothing left to buy in his annual letter to shareholders, an early Mad Hedge subscriber. His spectacular annual compounded returns of 19.8% a year, more than double that of the S&P 500 (SPY), are now a thing of the past.

The few targets left out there are few and far between and heavily picked over. (BRK/B) has also lost the advice of its principal mentor, Charlie Munger at the ripe old age of 99. Last year Berkshire acquired Dairy Queen and Berkshire Energy. But at $905 billion in assets under management, those will hardly move the needle. The 93-year-old Buffet has outperformed the S&P 500 by 141:1 since 1964.

Who says age is an impediment?

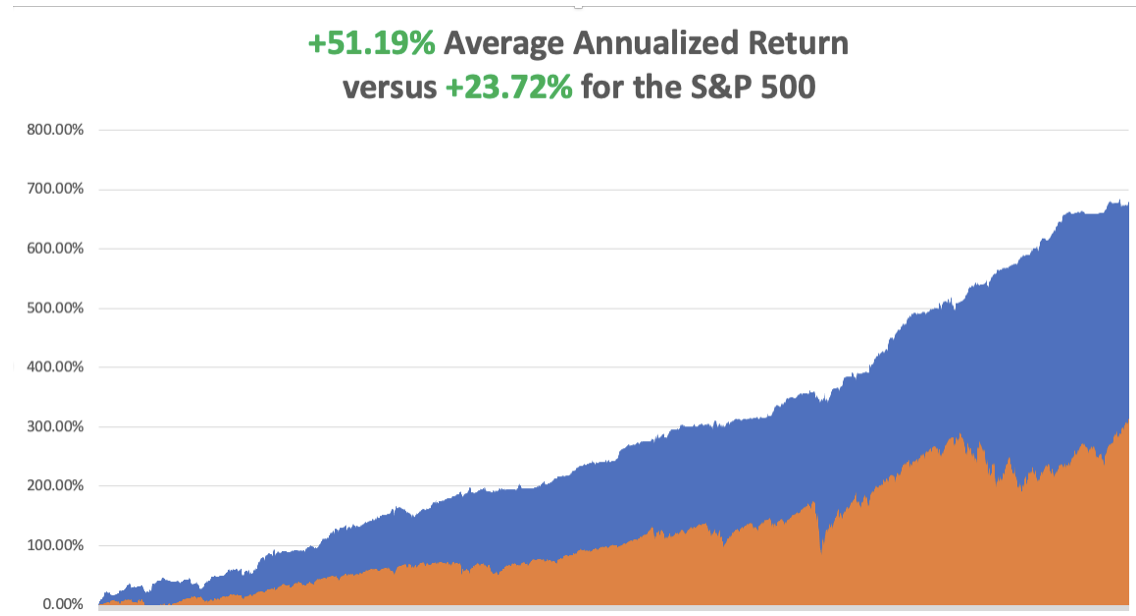

So far in February, we are up +5.92%. My 2024 year-to-date performance is also at +1.64%. The S&P 500 (SPY) is up +6.50% so far in 2024. My trailing one-year return reached +57.73% versus +38.67% for the S&P 500.

That brings my 15-year total return to +678.27%. My average annualized return has recovered to +51.19%, another new high.

Some 63 of my 70 trades last year were profitable in 2023.

I used the ballistic move-in (NVDA) to take profits in my double long there. I am maintaining a single long (AMZN) and am 90% in cash given the elevated level of the markets.

NVIDIA Announces Blowout Earnings, with AI reaching the “tipping point” according to the CEO Jensen Huang. Revenues came in at a spectacular $22.1 billion versus an expected $20.6 billion off the backing of exploding data center demand, up 33%. Earnings were up 22% QOQ and 225% YOY. The shares exploded $100 in the aftermarket at one point, up 15.6%. Forward guidance was ramped up too. Buy NVDA on dips. At a PE multiple of 18X, it is the cheapest AI stock out there.

Mad Hedge Clocks Biggest One Day Gain in 16 Years, with a double weighting in NVIDIA (NVDA), up +6.072%. If you like that the Mad Hedge Technology Letter is doing even better, up +13% YTD. And we are still early days into the tech melt-up, which could go on for another decade. Our YOY gain is up +59.62%. The harder I work, the luckier I get.

Existing Home Sales Jumped 3% YOY, boosted by lower mortgage interest rates in November and December. Inventories of homes for sale in January increased to 1.01 million units, up 3.1% from January 2023, but still at a low 3-month supply. The median existing home price for all housing types in January was $379,100, up 5.1% from a year earlier and an all-time high for the month of January.

Weekly Jobless Claims Dropped to a one-month low, down 12,000 to 201,000. No recession here. California and Kentucky saw the largest declines.

China Bans Stock Selling, by institutional investors at market openings and closes when liquidity is the greatest. It’s part of the government’s most forceful attempt yet to prop up the nation’s $8.6 trillion stock market. It’s another sign of a weakening China. When restrictions are placed on markets, capital flees. Whoever thought of this one must have a hole in their head. Avoid (FXI).

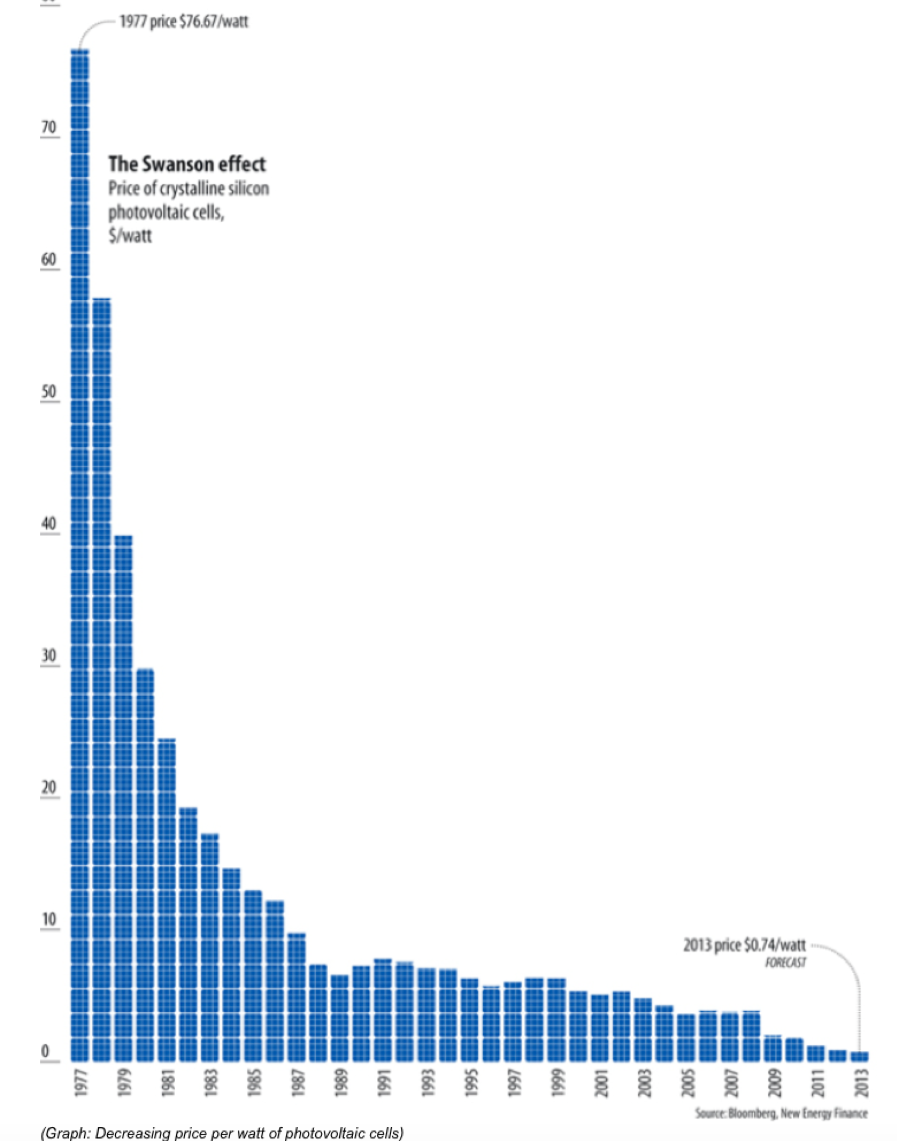

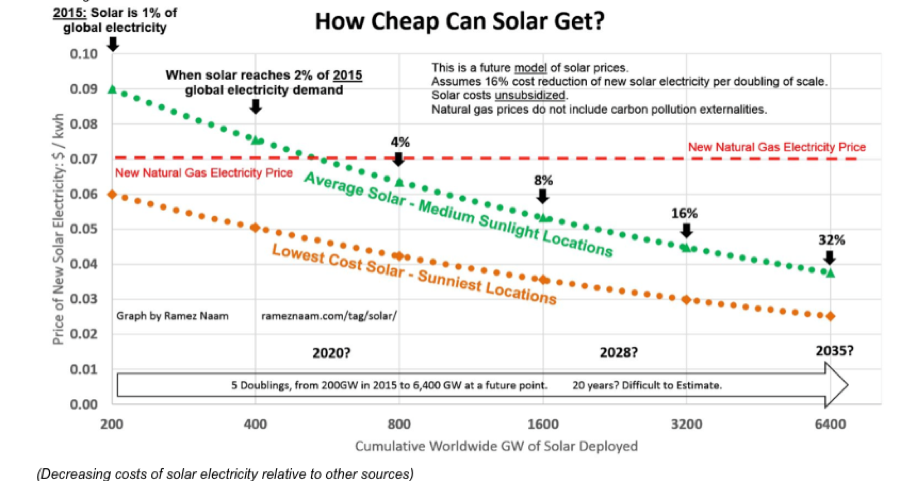

California demolishes Solar Providers, cutting the price the utility PG&E has to pay for home power providers by 75%. Solar companies like SunPower (SPWR), are down 89% since last year. Avoid solar providers for now, which was always a low value-added business.

Amazon (AMZN) is getting added to the Dow Average, opening it up to massive index buying. Retailer Walgreens Boots Alliance (WBA) is getting bumped. Since 1896, the blue-chip index has made few changes to its 30-stock lineup, having altered its constituents about 60 times in its 128-year history. Buy (AMZN) on dips.

US Stocks now account for 70% of Global Stock Market Capitalization, thanks to the ballistic moves in big tech. This level represents the largest country weighting since I helped create this index way back in 1986. It also now has the lowest exposure to non-US stocks. Money is pouring into the US from all corners of the world, the planet's most successful economy.

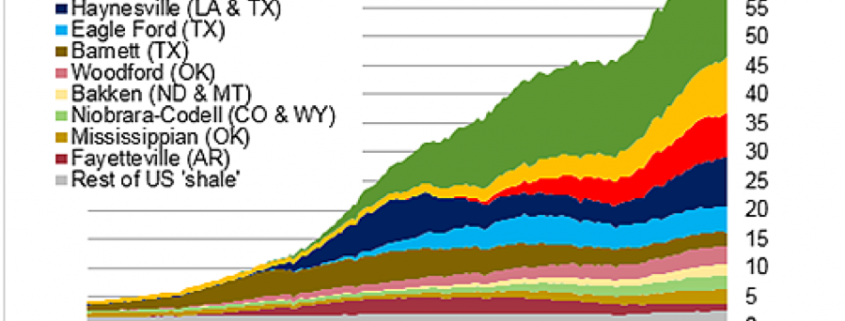

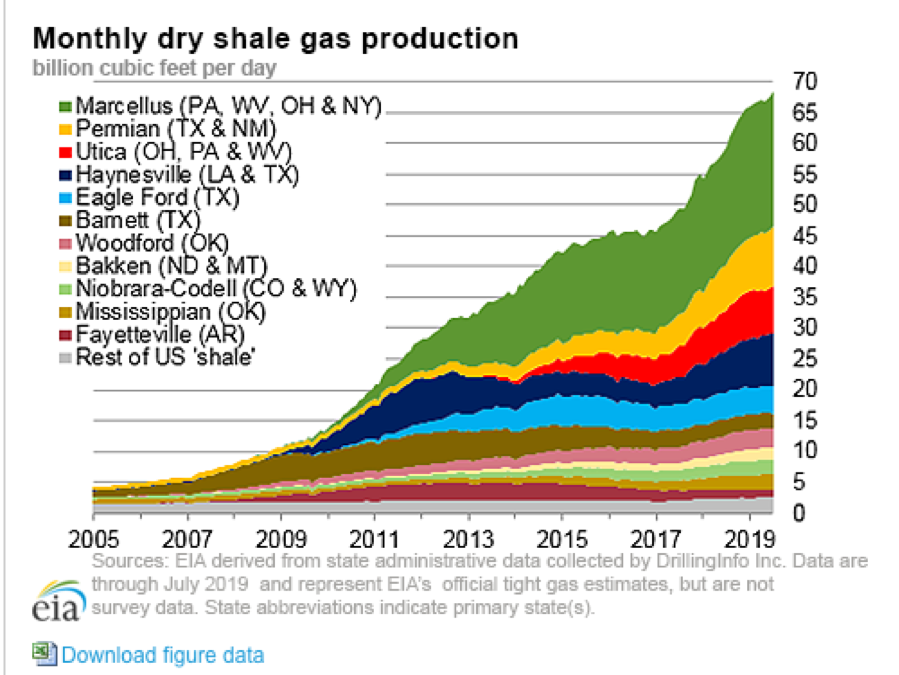

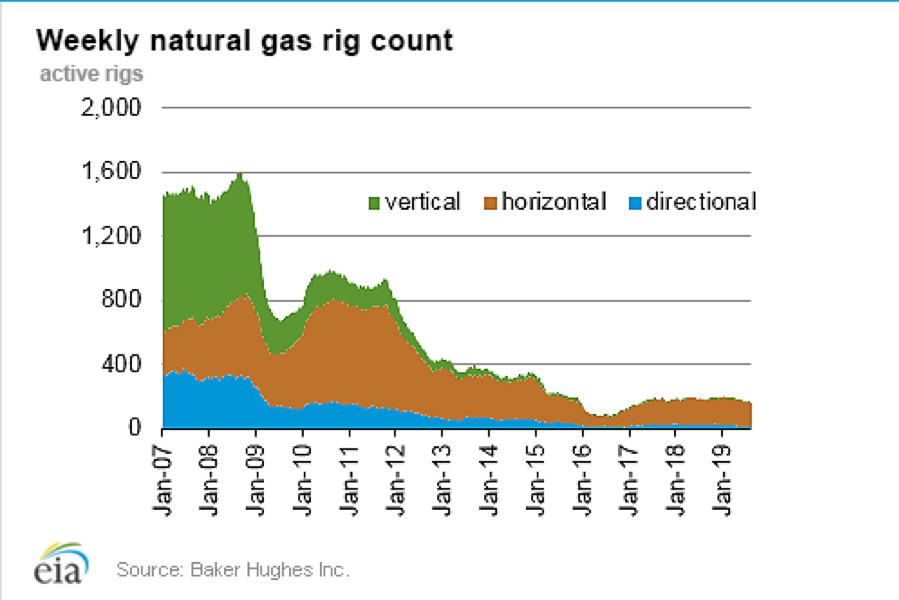

Natural Gas Hits (UNG) Three Year Low, at $1.63MM BTU, and down an eye-popping 50% in a month. Warm weather, high inventories, and overproduction due to cheap capital are the price killers. An LNG train broke down, cutting export demand. If you didn’t get out on the double in December you’re toast. Avoid (UNG).

My Ten-Year View

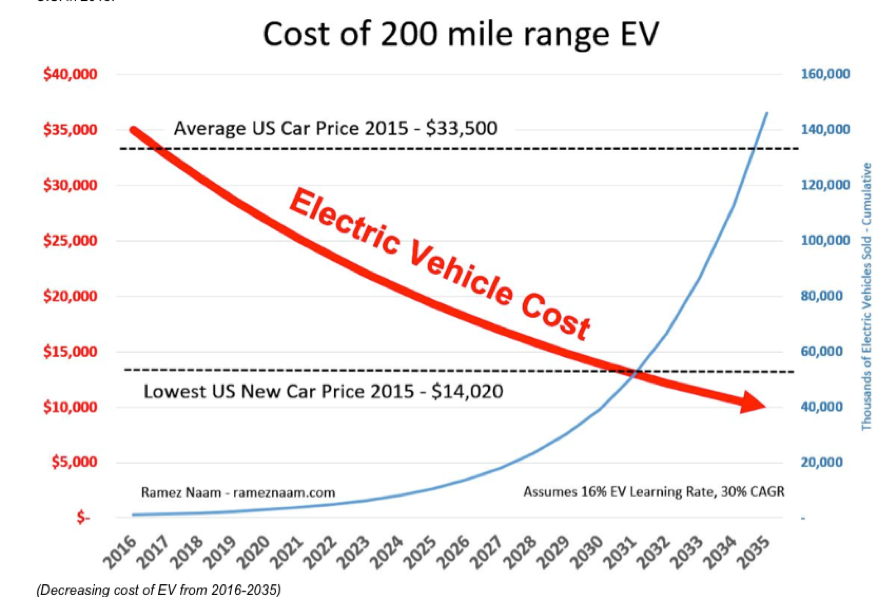

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, February 26, the New Home Sales are announced.

On Tuesday, February 27 at 8:30 AM EST, the Durable Goods are released. The S&P Case Shiller for December is announced.

On Wednesday, February 28 at 2:00 PM, the Q2 GDP second read is published.

On Thursday, February 29 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Core Consumer Price Expectations.

On Friday, March 1 at 2:30 PM, the December ISM Manufacturing PMI is published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, the telephone call went out amongst the family with lightning speed, and this was back in 1962 when long-distance cost a fortune. President Dwight D. Eisenhower was going to visit my grandfather’s cactus garden in Indio the next day, said to be the largest in the country, and family members were invited.

I spent much of my childhood in the 1950s and 1960s helping grandpa look for rare cactus in California’s lower Colorado Desert, where General Patton trained before invading Africa. That involved a lot of digging out a GM pickup truck from deep sand in the remorseless heat. SUVs hadn’t been invented yet, and a Willys Jeep (click here) was the only four-wheel drive then available in the US.

I have met nine of the last 13 presidents, but Eisenhower was my favorite. He certainly made an impression on me as a ten-year-old boy, who I remember as a kindly old man.

I walked with Eisenhower and my grandfather plant by plant, me giving him the Latin name for its genus and species and citing unique characteristics and uses by the Indians. The former president showed great interest and in two hours we covered the entire garden. I still make my kids learn the Latin names of plants.

Eisenhower lived on a remote farm at the famous Gettysburg, PA battlefield given to him by a grateful nation. But the winters there were harsh, so he often visited the Palm Springs mansion of TV Guide publisher Walter Annenberg, a major campaign donor.

Eisenhower was a one-of-a-kind brilliant man that America always came up with when it needed them the most. He learned the ropes serving as Douglas MacArthur’s Chief of Staff during the 1930’s. Franklin Roosevelt picked him out of 100 possible generals to head the Allied invasion of Europe, even though he had no combat experience.

After the war, both the Democratic and Republican parties recruited him as a candidate for the 1952 election. The latter prevailed, and “Ike” served two terms, defeating the governor of Illinois Adlai Stevenson twice. During his time, he ended the Korean War, started the battle over civil rights at Little Rock, began the Interstate Highway System, and admitted Hawaii as the 50th state.

As my dad was very senior in the Republican Party in Southern California during the 1950s, I got to meet many of the bigwigs of the day. New York prosecutor Thomas Dewy ran for president twice, against Roosevelt and Truman, and was a cold fish and aloof. Barry Goldwater was friends with everyone and a decorated bomber pilot during the war.

Richard Nixon would do anything to get ahead, and it was said that even his friends despised him. He let the Vietnam War drag out five years too long when it was clear we were leaving. Some 21 guys I went to high school with died in Vietnam during this time. I missed Kennedy and Johnson. Wrong party and they died too soon. Ford was a decent man and I even went to church with him once, but the Nixon pardon ended his political future.

Peanut farmer Carter was characterized as an idealistic wimp. But the last time I checked, the Navy didn’t hire wimps as nuclear submarine commanders. He did offer to appoint me Deputy Assistant Secretary of the Treasury for International Affairs, but I turned him down because I thought the $15,000 salary was too low. There were not a lot of Japanese-speaking experts on the Japanese steel industry around in those days. Biggest mistake I ever made.

Ronald Reagan’s economic policies drove me nuts and led to today’s giant deficits, which was a big deal if you worked for The Economist. But he always had a clever dirty joke at hand which he delivered to great effect….always off camera. The tough guy Reagan you saw on TV was all acting. His big accomplishment was not to drop the ball when it was handed to him to end the Cold War.

I saw quite a lot of George Bush, Sr. whom I met with my Medal of Honor Uncle Mitch Paige at WWII anniversaries, who was a gentleman and fellow pilot. Clinton was definitely a “good old boy” from Arkansas, a glad-hander, and an incredible campaigner, but he was also a Rhodes Scholar. His networking skills were incredible. George Bush, Jr. I missed as he never came to California. And 22 years later we are still fighting in the Middle East.

Obama was a very smart man and his wife Michelle even smarter. Stocks went up 400% on his watch and Mad Hedge Fund Trader prospered mightily. But I thought a black president of the United States was 50 years early. How wrong was I. Trump I already knew too much about from when I was a New York banker.

As for Biden, I have no opinion. I never met the man. He lives on the other side of the country. When I covered the Senate for The Economist, he was a junior member.

Still, it’s pretty amazing that I met 10 out of the last 14 presidents. That’s 20% of all the presidents since George Washington. I bet only a handful of people have done that, and the rest all live in Washington DC. And I’m a nobody, just an ordinary guy.

It just makes you think about the possibilities.

Really.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

It’s Been a Long Road