February 25, 2010

February 25, 2010

Featured Trades: (?EUREKA?), (SPX),

(VIX), (USO), (FCX), (GLD), (TBT),(TBF), (CHK),

(UNG), (COAL), (BTU), (LUMBER), (WY),

(HEDGE FUND RADIO)

2)After my year in the White House Press Corps, I vowed never to return, and took a really long shower, hoping to scrub every last spec of prejudice, self interest, and institutionalized dishonesty off of my battered carcass. But sometimes I see some maneuvering that is so unprincipled, crooked, and against the national interest that I am unable to restrain my fingers from the keyboard. I?m talking about the absolutely merciless hatchet job the coal producers are inflicting on the natural gas industry. Coal today accounts for 50% of America?s 3.7 trillion kilowatts in annual power production. Chesapeake Energy?s (CHK) Aubrey McClendon says correctly that if we just shut down aging conventional power plants over 35 years old, and replace them with modern gas fired plants, the US would achieve one third of its ambitious 2020 carbon reduction goals. The share of relatively clean burning natural gas of the national power load would pop up from the current 23% to 50%. Even the Sierra Club says this is the fastest and cheapest way to make a serious dent in greenhouse gas emissions. So what do we get? The press has recently been flooded with reports of widespread well poisonings and forest destruction caused by the fracting processes that recently discovered a new 100 year supply of ultra cheap CH4. While the coal industry has had 200 years to build a formidable lobby in Washington, the gas industry is a neophyte, their only public champions being McClendon and T. Boone Pickens. But memories in Washington are long, and Obama & Co. recall all too clearly that this was the pair that financed the Swift Boat Veterans for Truth that torpedoed Democrat John Kerry?s 2004 presidential campaign. What goes around comes around. This will be unhappy news for the 23,000 the American Lung Association expects coal emissions to kill this year. Can?t the coal industry be happy selling everything they rip out of the ground to China? There! I?ve had my say. Now I?m going to go have another long shower.

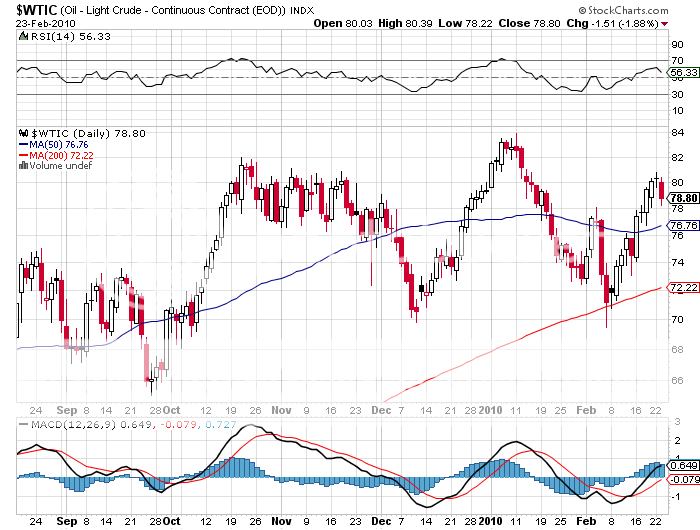

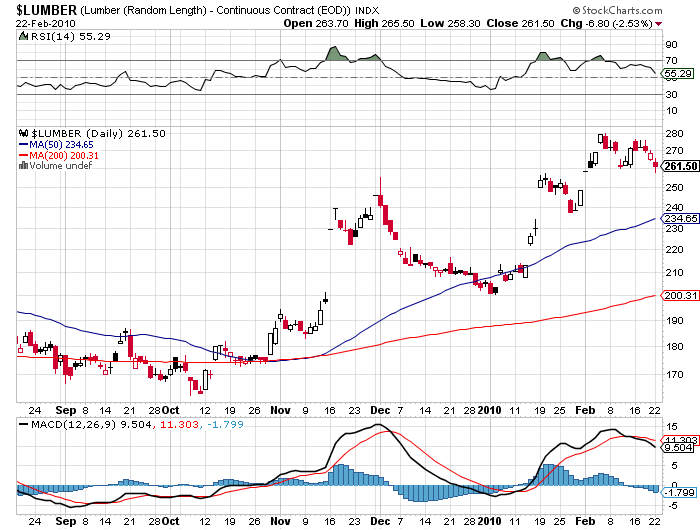

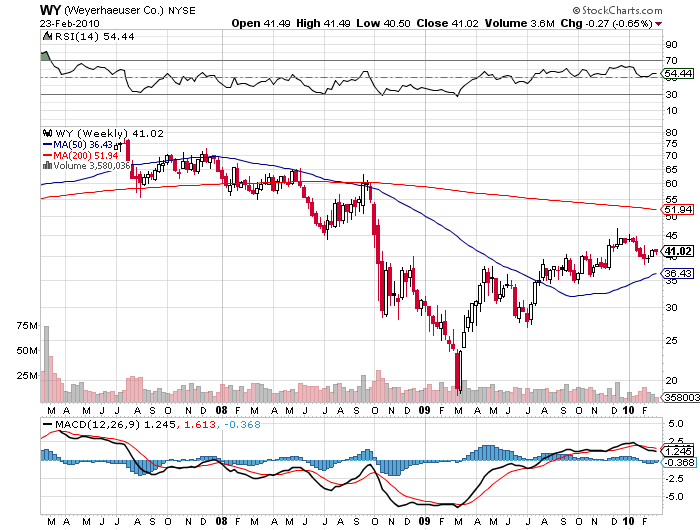

3)Long term readers of this letter know that I, alone in the forest,? have been a huge bull on lumber futures for the past year. The draw was a double play on low interest rates, and a subsidy fueled recovery of new home construction, and a rising tide of imports by China. A soggy greenback was another incentive, as was decades of mill closures, both by environmentalists and economists that left the supply/demand balance so finely tuned that prices could rise on the purchase of a single rail car of two by fours. And up they went, from $1.35 to a high of $2.80 by last week. I also recommended Weyerhaeuser (WY), which managed a double. I have to tell you that the bloom is now coming off the rose. The dollar is strong, eating into exports, and Chinese demand is starting to flag as the Mandarins in Beijing slam on the monetary brakes. And the long awaited homebuilding recovery? With a tsunami of foreclosures about to hit an already distressed market, that is looking more like a 2020 than a 2010 affair. Best case? We grind sideways with other commodities for the reasons that I have listed above. Worst case? We burn to the ground once more. Bottom line? Time to get out of Dodge and leave it for Bambi.

4) My guest on Hedge Fund Radio this week is Jon Najarian, the co-founder of the online trading platforms, OptionMonster and TradeMonster. Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund Citadel in 2004. OptionMonster uses a patented algorithm developed by Jon called ?Heat Seeker??, which spots unusual tr

ading patterns by monitoring the 180,000 transactions per second that occur in the financial markets. Jon is going to talk to us about the state of the financial markets, online research, and the tricks involved in becoming a winning trader. You can log into Hedge Fund Radio anytime from anywhere in the world for free by clicking here

QUOTE OF THE DAY

?The total breakdown of the system is ahead of us. It may come in four, five, or ten years, and it will devastate the world economy. By bailing out the issuers of derivatives, the Fed actions have only postponed the day of reckoning,? said Marc Faber, publisher of the Gloom, Doom & Boom Report.