With any luck, by the time you read this, I will be setting up my tent next to a High Sierra lake somewhere over 9,000 feet.

For I will be leading 40 Boy Scouts on a 50-mile hike around the Desolation Wilderness next to Lake Tahoe. The vertical climb for this ambitious route is 6,300 feet, which we will cover in seven days. Bears are everywhere, so we will be hanging our food from trees at night.

Usually, I am hanging out at my chalet in Zermatt, Switzerland this time of year, watching climbers descend from the Matterhorn. However, because of our poor response to the Coronavirus, Americans are banned from Europe for the foreseeable future. We are just too dangerous to let in.

My pack weighs in at a featherlike 50 pounds, including five pounds of medical supplies and a fifth of Jack Daniels, for medicinal purposes only. Gentleman Jack is excellent for sterilizing animal bites, large cuts, and gunshot wounds, and has saved my life many times.

With 40 kids under my control ranging in age from 11-17, what could possibly go wrong? At least they don’t have rattlesnakes and poison oak in the High Sierras.

The hike should take no more than 40 hours, which will give me plenty of time to think of great trades for the second half. Hopefully, I will come back refreshed, invigorated, and 20 pounds lighter.

I deserve the time off.

I have worked the hardest of my career over the last six months, going battle with the pandemic and the worst market crash in history. I knocked out 164 trade alerts, triple the normal rate. As a result, I have pulled in a stunning 28.83% profit so far in 2020, and 68.19% over the past 12 months. I know that many of you have made much more. These are the best numbers I have pulled in during 50 years of trading.

While I am communing with nature over the next two weeks, I will be sending you in daily installments FOR FREE the print edition of my best-selling book, “Options Trading for Beginners.” If you are one of the many recent new subscribers, this will give you the tools with which you can max out your profits in the coming months.

Thank you for supporting my research. Once back, I will do whatever I can to maintain your trust and continue to bring in some blockbuster numbers.

I want to take this opportunity to share an experience that has been immensely valuable to me and could be to you as well...

Over the holidays last December, a long-time buddy of mine and I were golfing Quail Creek in Green Valley, AZ. As a career money manager, he mentioned the name of John Thomas, the Mad Hedge Fund Trader. It didn’t take him long to convince me to buy Tesla in late December, based on John’s recommendation in his email, “Diary of a Mad Hedge Fund Trader” After all, Mr. Thomas had been driving the cars for 11 years and had visited the Fremont factory countless times. Soon thereafter, anyone who follows Tesla (TSLA) stock knows what happened then.

Then, in late January, John drew upon his experience as a biochemist to identify the companies that would benefit from the Covid-19 pandemic. His statement that “Biotech is today what tech was in 1990” has been a rocket so far as well.

Then, when the market crashed in March, John urged the lead chip stocks, NVIDIA, Advanced Micro Devices, and Micron Technology, which he had been following for decades. Those stocks all doubled. I also increased my position in Tesla some more.

Some six months after hearing about John Thomas, I couldn’t be more grateful. It has given me the financial security to get my family and our three kids through this pandemic while supporting the gallery as well. It has also set me up in a position I never expected through these tough times.

John has been an incredible asset to my family, I believe he could be for yours as well. I am so grateful for his guidance in this stage of my life! I personally subscribed to his biotech newsletter and trade alerts after attending his free seminars and seeing the results. I missed the tech boom of the ’90s. If biotech is the new tech, I don’t want to miss that one too! And I wouldn’t chance it without John’s guidance.

All our best to you all in these difficult times.

Sincerely,

Greg

Las Vegas

Global Market Comments

July 23, 2020

Fiat Lux

Featured Trade:

(THE BEST COLLEGE GRADUATION GIFT EVER),

(TESTIMONIAL)

Global Market Comments

July 22, 2020

Fiat Lux

Featured Trade:

(MY NEWLY UPDATED LONG-TERM PORTFOLIO),

(PFE), (BMY), (AMGN), (CELG), (CRSP), (FB), (PYPL), (GOOGL), (AAPL), (AMZN), (SQ), (JPM), (BAC), (BABA), (EEM), (FXA), (FCX), (GLD)

I am really happy with the performance of the Mad Hedge Long Term Portfolio since the last update on October 17, 2019. In fact, not only did we nail the best sectors to go heavily overweight, we completely dodged the bullets in the worst-performing ones, especially in energy.

For new subscribers, the Mad Hedge Long Term Portfolio is a “buy and forget” portfolio of stocks and ETFs. If trading is not your thing, these are the investments you can make, and then not touch until you start drawing down your retirement funds at age 70 ½.

For some of you, that is not for another 50 years. For others, it was yesterday.

There is only one thing you need to do now and that is to rebalance. Buy or sell what you need to reweight every position to its appropriate 5% or 10% weighting. Rebalancing is one of the only free lunches out there and always adds performance over time. You should follow the rules assiduously.

Despite the seismic changes that have taken place in the global economy over the past nine months, I only need to make minor changes to the portfolio, which I have highlighted in red.

To download the entire portfolio in an excel spreadsheet, please go to www.madhedgefundtrader.com , log in, go to “My Account”, then “Global Trading Dispatch”, then click on the “Long Term Portfolio” button.

My 5% holding in Biogen (BIIB) was taken over by Bristol Myers (BMY) at a hefty premium at an all-time high, so I’ll take the win. I am replacing it with Covid-19 vaccine frontrunner Bristol Myers (BMY) itself.

I am also taking out healthcare provider Cigna (CI), whose profits have been hammered by the pandemic. A future Biden administration might also move to a national healthcare system that will cap profits. I am replacing it with another Covid-19 vaccine leader Pfizer (PFE).

My 30% weighting in technology remains the same. Even though these stocks are 30% more expensive than they were three years ago, I believe they will lead the charge into the 2020s. It’s where the big growth is. These have doubled or more over the past nine months.

I am sticking with a 10% weighting in banking. Thanks to trillions in stimulus loans, they are now the most government-subsidized sector of the economy. I also believe that massive bond issuance by the US Treasury will deliver a sharply steepening yield curve, another pro bank development.

With my 10% international exposure, I am taking out a 5% weight in slow-growth Japan and replacing it with Chinese Internet giant Alibaba (BABA). The US will most likely dial back its vociferous anti-Chinese stance next year and (BABA) will soar.

I am executing another switch in my foreign currency exposure, taking out a long in the Japanese yen (FXY) and a short in the Euro (EUO) and substituting in a double long in the Australian dollar (FXA).

Australia will be a leveraged beneficiary of a recovery in the global economy, both through a recovery on commodity prices and gold which has already started, and the post-pandemic return of Chinese tourism and investment. I argue that the Aussie will eventually make it to parity with the US dollar, or 1:1.

I’m quite happy with my 10% holding in gold (GLD), which should move to new all-time highs imminently….and then go ballistic.

As for energy, I will keep my weighting at zero, no matter how cheap it has gotten. Never confuse “gone down a lot” with “cheap”. I think the bankruptcies have only just started and will stretch on for a decade. Thanks to hyper-accelerating technology, the adoption of electric cars, and less movement overall in the new economy, energy is about to become free.

My ten-year assumption for the US and the global economy remains the same.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

I hope you find this useful and I’ll be sending out another update in six months so you can rebalance once again.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

July 21, 2020

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

$1 trillion is about to hit the stock market if another government stimulus package passes in July. So far, most stimulus has ended up in the stock market, one way or the other.

Perhaps that is why we saw a golden cross in the S&P 500 weeks ago, where the 50-day moving average rose sharply through the 200-day moving average. That is usually a bullish signal.

The problem is that everyone knows this, and there are more important issues to consider.

The stock market is now more overpriced than it has been over the last 20 years when the Dotcom Bubble exploded. The (SPY) has risen and an unprecedented 40% in four months.

And the pandemic is triggering a secondary shutdown of much of the economy, trashing the most optimistic “V” shaped recovery scenarios.

We are also solidly into the high risk, low return time of the year from May to November. Historically, the total return for stocks this time of year for the past 70 years is precisely zero.

I, therefore, think it is timely to review how to make money when prices are falling. I call it Short Selling School 101.

I don’t think we are going to crash to new lows from here, maybe drop only 10%-20%. So, some of the most aggressive bearish strategies described below won’t be appropriate.

If you are long stocks in general a low-risk hedge for you might be to sell short the August S&P 500 August 21, 2020, $340 call options for $1.40. If stocks plunge, you have some downside cushion ($1.40 X 100) = $140 in cash. Sell short one call option for every 100 shares of (SPY) you own. If stocks rise and your stock gets called away 6% higher you will think you died and went to heaven. Just buy them back on the next dip.

If the bear move extends you can simply repeat this gesture every month until the cows come home.

If you have big positions in single stocks, like Tesla (TSLA) or Apple (AAPL), you can execute the same kind of strategy. Selling short the Tesla August 21, 2020 $2,000 call option for $70.00 to hedge an existing long in the stock look like the no brainer here. You should sell one option contract for every 100 shares you own to bring in ($70.00 X 100) = $7,000 in cash.

There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed.

No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media right at the next market bottom.

That is always how it seems to play out, great closing the barn doors after the horses have bolted.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock prices are still rich.

I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so.

Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH).

In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free.

There is also the “cost of carry,” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still, individuals can protect themselves from downside exposure in their core portfolios through buying the (SH) against it (click here for the prospectus). Short selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke.

Virtual all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus).

My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus).

Leveraged Bear ETFs

My favorite is the ProShares UltraShort S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry this ETF, or you might be disappointed.

3X Leveraged Bear ETF

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 on Thursday allows me to sell short $145,600 worth of large-cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better is good with these because when the market goes against you, put options can go poof and disappear pretty quickly.

That’s why you read this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stock you already own but may not want to sell for tax or other reasons.

If the market goes sideways or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially they get called away, but at a higher price so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

Selling Futures

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risks for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 June 2016 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund.

Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and it is the quickest way to make a fortune if your market direction is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can, therefore, protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Selling Short IPOs

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands, known as “flippers,” don’t have a broad institutional shareholder base.

Many of the recent ones don’t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus at http://www.renaissancecapital.com/ipoinvesting/ipoetf/ipoetf.aspx ). As you can tell from the chart below, (IPO) was warning that trouble was headed out way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum while falling markets produce falling momentum.

So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Buying Bearish Hedge Funds

Another subsector that does well in plunging markets is publicly listed bearish hedge funds. There is a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

Oops, Forgot to Hedge

“If you’re a retail CEO and the tariff announcement comes, you’re on your front porch looking for a cloud of locusts,” said Charlie O’Shea, a retail debt analyst at Moody’s.

Global Market Comments

July 20, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE’S YOUR SERVING OF ALPHABET SOUP),

(SPY), (TLT), (GLD), (TSLA), (DRI), (WYNN), (H), (AMC)

Here is your generous helping of alphabet soup. If you look very closely, you can find some bay leaves, oregano, black pepper, and lots of V’s, W’s, U’s, and L’s.

Now, let’s play a game and see who can pick the letter that most accurately portrays the current economic outlook.

Here is a code key:

V – the very sharp collapse we saw in Q1 and Q2 is followed by an equally sharp recovery in Q3 and Q4.

W – The sharp recovery in Q3 and Q4 fails and we see a double-dip extending into 2021.

U – The economy stays at the bottom for a long time before it finally recovers.

L – The economy collapses and never recovers.

The question is, in which of these forecasts should we invest our investment strategy?

For a start, you can throw out the “L”. Every recession flushes out a covey of Cassandras who predicts the economy will never recover. They are always wrong.

I believe what we are seeing play out right now is the “W” scenario. This is the best cash scenario for traders, as it calls for a summer correction in the stock market when we can load the boat a second time. If you missed the March low you will get a second bite of the Apple.

With corona cases soaring nationwide, and deaths skyrocketing, it is safe to write off the “V” recovery scenario.

If I’m wrong, we will get a “U”, a longer recovery. This cannot be dismissed lightly as the unemployment rate is about to take off as the PPP money runs out, state unemployment benefits are exhausted, and mass evictions ensue.

If I limited the outlook to only four possible scenarios, I’d be kidding you. The truth is far more complicated.

Each industry gets its own letter of the alphabet. Technology, some 27% of total stock market capitalization gets no letter at all because it is thriving, thanks to the global rush to move commerce online. That explains the single-minded pursuit of this sector by investors since the market 23 bottom.

Hotel chains like Hyatt Hotels (H) and casinos like Wynn Resorts (WYNN) get a “U” because they will recover after a long period of suffering. As for Movie theaters like AMC Entertainment Holdings (AMC) and restaurant chains such as Darden Restaurants (DRI), they get an “L” because it is hard to see any sustainable recovery before widespread use of a vaccine.

Weekly Jobless Claims remained at Historic Levels, at 1.3 million, reaching a total of 51 million since the pandemic began. We are about to see a huge surge in the unemployment rate as PPP money and state unemployment benefits run out. Without help from the federal government, millions will be thrown out on the street.

Tesla hit $1,800, up $255, on the news they may join the S&P 500 forcing a ton of institutional buying. Its market capitalization is now a staggering $330 billion, more than the entire global car industry combined. They also cut Model Y prices by $3,000, from $53,000 to $50,000, in another effort to keep new entrants at bay. The model Y is expected to be the biggest seller in history, hence the ballistic move in the shares now. Close your eyes and keep buying (TSLA) on dips.

Tesla is dead, long live Tesla, says Morgan Stanley analyst Adam Jonas. The big upside here will not be in (TSLA) itself, but in supplier companies such as ST Microelectronics, NXP Semiconductors (NXPI), Cree (CREE), and China’s CATL. Jonas, an early Tesla bull, still maintains a $3,000 target, but that is now only a double from here, a far cry from the 110X move behind us off the post IPO low.

5G cell phones could offset Corona losses to the global economy, or so says a French economic research institute. Productivity improvement alone could be worth $2.2 trillion a year. The big winner? Apple (AAPL). Is this really why stocks are going up so fast?

California shut down again as hospital emergency rooms approach capacity. All indoor business has ceased for a state that accounts for 21% of US GDP. The Golden State saw 8,357 new cases on Sunday. Unfortunately, it gives more credence to my “W” shaped recovery for the economy. Stocks noticed about three hours into the Monday session, diving 550 points. It’s not me! I tested negative last week.

Homebuilders saw the best June in history, up 55% YOY. Builders and supplies are now in short supply and prices are rising sharply. New homes are being favored over existing ones, which can’t be viewed through standardized virtual presentations. Keep buying (LEN), (KBH), and (PHM) on dips as the gale-force Millennial tailwind continues unabated.

Homebuilder Confidence jumped back to pre-pandemic levels, up a massive 14 points to 72. The golden age for the sector is just beginning as Millennials working in tech move to the burbs where the home office rules. Lumber is in short supply, thanks to Trump's tariffs with Canada, so prices just hit a two-year high. Keep buying.

We may get our fifth stimulus bill next week, as the Senate attempts to protect corporations from Covid-19 liability. Almost all of the $3 trillion in stimulus so far has ended up in the stock market, and another trillion can only be bullish.

Moderna claimed success with a true Covid vaccine, with 100% results in a 45-person human trial. (MRNA) soared by 15% on the news. A late July trial will involve 30,000. The company has never produced a product before using its RNA technology. Keep buying biotechs on dips. I’m long (SGEN), (ILMN), and (REGN). Dow futures up 300 in Asia on the news.

US air travel was down 89% in May, YOY. Whatever recovery you’re seeing in the economy it’s not happening here. I’m 200,000 miles a year guy and I probably won’t go near a plane until 2022. Avoid all airline stocks on pain of death. There are much better fish to fry.

Apple won a European antitrust case big time, ducking a massive 14.4 billion fine. Stock was up $7 on the news and is rapidly approaching my two-year target of $400. It's yet another case of “not invented here.” European regulators jealous of American success constantly assault US big tech. They view it as just another cost of doing business.

US budget deficit soared to $867 billion in June, taking it to an unprecedented $10.4 trillion annual rate. The national debt will rocket by 50% this year. Your grandkids are going to have a monster bill to pay. Keep selling every rally in the US dollar (UUP) and the bond market (TLT) and buy gold (GLD).

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

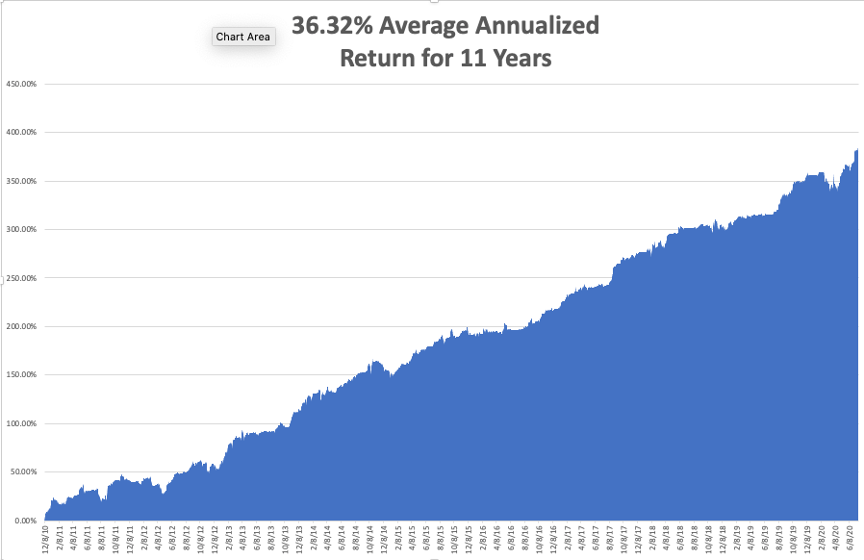

My Global Trading Dispatch enjoyed another sizzling week, up a red hot +2.73%. My eleven-year performance rocketed to a new all-time high of 384.54%. A triple weighting in biotech did the heavy lifting. A four-day short position in the bond market (TLT) was the icing on the cake.

That takes my 2020 YTD return up to an enviable +28.63%. This compares to a loss for the Dow Average of -6.2%, up from -37% on March 23. My trailing one-year return popped back up to a record 68.19%, also THE HIGHEST IN THE 13 YEAR HISTORY of the Mad Hedge Fund Trader. My eleven-year average annualized profit recovered to a record +36.32%, another new high.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. It’s jobs week and we should see an onslaught of truly awful numbers.

On Monday, July 20, IBM (IBM) reports Q2 earnings.

On Tuesday, July 21 at 7:30 AM EST, the June Chicago Fed National Activity Index is released. Microsoft (MSFT), Tesla (TSLA), and Lockheed Martin (LMT) report earnings.

On Wednesday, July 22, at 7:30 AM EST, the all-important Existing Home Sales for June are published. Amazon (AMZN) and Thermo Fisher Scientific (TMO) report earnings. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, July 23 at 8:30 AM EST, the frightful Weekly Jobless Claims are announced. American Airlines (AA) report.

On Friday, June 24, at 7:30 AM EST, the New Home Sales for June are published. The Baker Hughes Rig Count is out at 2:00 PM EST. Verizon (VZ) reports earnings.

As for me, I have been going down memory lane looking at my old travel photos because that’s all I can do in quarantine.

I am now banned in Europe.

So are you for that matter. In fact, there are very few countries in the world that will accept an American visitor. With the world’s highest Covid-19 infection, rates we are just too dangerous to have around. This is tough news for a guy who usually travels around the world once or twice a year.

It’s not the first time I have been banned from a country.

During the 1980s, The Economist magazine of London sent me to investigate the remote country of Nauru, one-half degree south of the equator in the middle of the Pacific Ocean. They had the world’s highest per capita income due to the fact that the island was entirely composed of valuable bird guano.

During an interview with the president, I managed to steal a top-secret copy of the national budget. I discovered that the president’s wife had been commandeering aircraft from Air Nauru to go on lavish shopping expeditions in Sydney, Australia where she was blowing $200,000 a day, all at government expense.

It didn’t take long for missing budget to be found. I was arrested, put on trial, sentenced to death for espionage, and locked up to await my fate.

Then one morning, I was awoken by the rattling of keys. The editor of The Economist in London had made a call. I was placed in handcuffs and placed on the next plane out of the country. When I was seated next to an Australian passenger, he asked “Jees, what did you do mate, kill someone?” On arrival, I sent the story to the Australian papers (click here for the story).

I have not been back to Nauru since.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Climbing the Matterhorn in 2019