Now you see it, now you don't.

If you think this was some kind of magic show, you'd be right. For what has been disappearing is the US stock market.

American companies have been buying their own shares back at a frenetic pace, some $5 trillion worth in the last six years. And since the beginning of 2018, that buy back rate has doubled, thanks to the machination of the new tax bill.

If you own stocks, you should feel like you just landed in Heaven.

Mergers and acquisitions have vaporized another $2 trillion of equity.

Some 35% of the American equity markets have gone poof, gonzo, and bye-bye in a mere half a decade

This all compares to a total remain stock marketing capitalization today of $25 billion.

The laws of supply and demand are really quite simple. The fewer shares that are out there, the more valuable the remaining ones become.

It's not like shares go to money heaven when they are bought back.

Companies are not allowed to keep them. Instead, they retire them, increasing the relative ownership of the company for the remaining shareholders, like you and me.

This means there are fewer claims on earnings, and a greater say in the future of the company through increased voting power at shareholder meetings and proxy fights.

The net effect is to improve the firm's financial ratios and boost return on equity and the return on assets. These are all excellent reasons for the shares to trade at higher price earnings multiples and rise in value.

You can't blame corporate America for falling into a narcissistic love affair with its own shares.

For a start, because the S&P 500 (SPY) up 400% from its March, 2009 bottom, they have been fantastic investments.

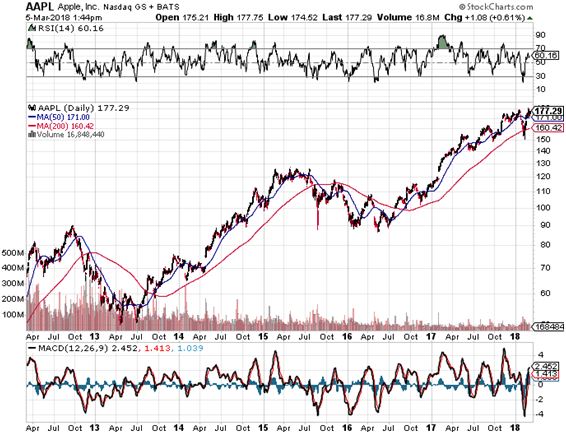

Take a look at Apple (AAPL), with the largest buyback program in absolute dollar terms by miles. Since it announced its share repurchase plan in late 2012 the value of its stock has skyrocketed some 262%.

According to their latest announcement, the firm is committed to buying back another $170 billion worth of stock, or 68% of its current $250 billion cash hoard.

Anyone who thinks this money is coming home to create new jobs is smoking California largest export crop.

The same is true for most other big names.

The bottom line here, ironically, is that companies can make more money buying back their own shares than investing in their own core businesses, even with technology firms.

Expect this to continue. Looking in the only in the rear-view mirror with your foot firmly on the accelerator has proved a successful management strategy for decades.

It not like senior management solely have the interests of shareholders at heart either. The bulk of their personal compensation is usually tied to stock options in their own firms' stocks.

More aggressive corporate share buybacks pave the path to high prices and personal enrichment beyond the dreams of Croesus.

That has enabled a continuously rising stock market to mint more billionaires than you can count, even though the beneficiaries had no idea what markets were going to do.

It's like the cock taking credit for the rising sun.

No wonder I have such a tough time chartering a personal jet these days!

Take a look at the share prices of some of the most ambitious buyers of their own stock.

Bed Bath & Beyond (BBBY) has purchased 50% of its outstanding float, at one point delivering a 400% gain in its shares, even though its core retail business sucked.

The Travelers Company (TRV) has removed a mind boggling 60% of its shares from the market, delivering another 400% gain in the shares.

Gap, Inc., a member of another dying industry, which bought back some 55% of its shares, saw prices jump some 800% at the top.

Wasn't it Calvin Coolidge who, our 30th president, who said that, "The business of America is business."

The reality is that the business of America is buying shares.

You can also blame interest rates, which have stayed at ultra-low levels for the past nine years, thanks to the Federal Reserve's aggressive quantitative easing programs.

Back in the day, when overnight interest rates were at 6%, large companies maintained substantial cash management divisions to administer their excess funds.

No more. It doesn't take a lot of talent to bring in a zero return. And cutting a few green eyeshades was always a popular cost cutting measure.

It's not like shares go to money heaven when they are retired.

Largest Share Repurchase Programs 2010-2017

Industrials

Northrop Grumman (NOC) - 50%

CSX Corp. (CSX) - 29%

3M Co. (MMM) - 25%

United Technologies (UTX) - 25%

Technology

Microsoft (MSFT) - 30%

Intel (INTC) - 30%

Cisco (CSCO) - 32%

Consumers

Travelers (TRV) - 60%

Gap (GPS) - 55% (GPS)

Bed Bath & Beyond (BBBY) - 50%

McDonald's (MCD) - 36%

The Business of America is Buying Shares?

Global Market Comments

March 5, 2018

Fiat Lux

SPECIAL STEEL ISSUE

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or EVERYTHING YOU ALWAYS WANTED TO KNOW ABOUT STEEL)

(X), (GM), (WEAT), (AAPL), (JPM), (BA), (K),

(THE FIRST TRADES IN THE TRADE WAR HAVE BEEN FIRED AND YOU GOT HIT),

(X), (F), (GM), (TM)

We certainly have gotten a crash course on the global steel industry over the past few days.

I, on the other hand already knew the intricacies of this complex industry, as I was the Iron and Steel Correspondent for the Australian Financial Review

during the 1970's. I had to write an original news story about the topic every day for five years!

Suffice to say that I know which end of a one inch steel I-beam to hold upwards.

So let me summarize for you the issue in a few short paragraphs. No research for me today! I can write this entirely out of my own head.

For a start, I saw all this coming someday, which is why I aggressively recommended a long position in US Steel (X) in August at $21. Yesterday, it traded at $48, up 128%, so well done to those who followed my advice!

If you own any other stocks, read on for the bad news.

The United States has not been cost competitive in steel production for 70 years. Since then, there has been a long succession of countries that could produce steel cheaper than we could, thanks to lower labor costs.

Germany and England were first, followed by Japan, South Korea, Canada, and more recently China, India, Russia, and Mexico.

Foreigners had another big advantage in that the US blew up almost the entire world's steel production during WWII, except our own.

That meant the new competitors operated with brand new efficient steel mills, compared to our own ancient plants. Go to a US steel mill today and you are impressed with how antiquated everything is, employing processes that are over 100 years old.

A third factor is that the use of steel in all products has been on a secular long-term decline, as advancing technology permitted large reductions in costs and weight.

A new car today weighs half of what it did in the 1950's. Tesla's don't use steel at all, as they are made entirely of aluminum, carbon fiber, glass, and lithium.

If steel production ramped back up again barely any new jobs would be created. It took ten man-hours to produce a ton of steel in 1980. Today, it is only two. That's an 80% productivity increase. That is why US steel companies exist at all today.

This has left us with seven generations of declining employment in the US steel industry, from 750,000 in 1946 to 140,000 today. This quickly devolved into a hot button political issue for both parties.

Steel has been a trade issue at least since the 1950's, when the US sought to protect a retreating industry with jawboning, quotas, and tariffs. It was always a losing battle.

Punitive tariffs like the 25% duty imposed by the president have not been used as a trade tool for 80 years for good reason. Tit for tat tariffs employed by countries during the 1930's are now widely understood to have greatly extended the Great Depression.

They are also illegal, a violation of rules laid out by the World Trade Organization, and will almost certainly be overturned in future litigation.

Tariffs were also abandoned because they make no sense for the US economy. At most, higher steel prices will create a few hundred jobs.

But they will also raise prices an all steel containing products for 330 million American consumers. That means it is costing millions of dollars to create a single job in the steel industry.

It is also bad for the steel industry over the long term. Higher prices will force them to cede foreign markets and only sell to the domestic market.

In the meantime, the largest users of American steel, the auto industry, has seen the cost of their vehicles rise by a few hundred dollars each.

That erodes their ability to compete with imported cars made with cheaper foreign steel. Notice that the shares of General Motors (GM) got slaughtered, off some 12% in two days.

The stock market got it right with the 1,500-point swoon in the Dow average the tariffs triggered. Steel producing companies saw the value of their companies rise by $2 billion. Steel consumers saw the value of their shares fall by $150 billion. No, the risk/reward doesn't look right to me either.

Foreign steel exporters are certain to retaliate. Target number one will be the US agricultural exports, where it enjoys a major cost advantage of its own.

This is why you heard so much carping from red state congressional representatives. Note that wheat (WEAT) prices, the most internationally traded ag commodity, dove some 4.8% yesterday.

Retaliation could spread to other globally traded US products, such as those in high tech (AAPL), services (JPM), aircraft (BA), and even Coca Cola (K) (see more in the piece below). This is why the steel issue has taken the entire market down, including most sectors.

There is also a national security element to all of this. Some of the largest exporters of steel to the US are military allies, like Japan and South Korea.

Attack some of their most important strategic industries and they will be less likely to assist us in any future military alliance. The steel tariffs could well push them into the China orbit.

This is why National Security Advisor HR McMasters is ready to resign. I hope he writes another book.

And last of all, who is the largest foreign owner of US Treasury bonds? You guessed it! You already know from my "Exploding Deficits" Series that it is China, with $1.2 trillion of American paper, and who have already started boycotting recent bond auctions.

My guess is that trade will remain a growing weight on the stock market. With the tin hat crowd of conspiracy theorists advising an increasingly distracted president, what else could you expect? Watch Rome burn!

Who do we bail out next? The buggy whip makers?

With crash course on the steel industry done, let's look forward to the week ahead.

This coming week will be dominated by raft of new jobs data.

On Monday, March 5 at 10:00 AM EST we kick off the week with the February ISM Non-manufacturing Index

On Tuesday, March 6 at 10:00 AM we learn January Factory Orders.

On Wednesday, March 7, at 8:45 AM EST, we get the first read on February jobs situation with the ADP Employment Report.

Thursday, March 8 leads with the Weekly Jobless Claims at 8:30 AM EST, which hit a new 49-year low last week at an amazing 210,000.

On Friday, March 9 at 8:30 AM EST we get the big number of the week with the February Nonfarm Payroll Report. All eyes will be on the wage growth numbers, which came in last month at a red hot 0.50%.

At 1:00 PM we receive the Baker-Hughes Rig Count, which saw a small rise of three last week.

As for me, I am going to be more ambitious in collecting my used aluminum cans and recycling them. I hear they are now a lot more valuable.

Good luck and good trading!

There is no doubt about it.

The opening shots of a global trade war have been fired. The bad news is that you got hit.

And we may have to suffer another Great Depression before these errant policies get reversed.

That's what happened last time.

Today we learned that the administration is imposing an emergency 25% tariff on imported steel from ALL countries, friend and foe alike.

This is on the heels of the cancellation of the Trans-Pacific Partnership last year.

The move promises to bring to a screeching halt the import of semi finished goods from Mexico and Canada, essential in the production of US autos. American manufacturing will suffer.

The big victims will be American car buyers, who in the future will have to pay much higher prices for lower quality products.

It also cedes international markets to foreign car manufacturers who will labor under no such restrictions.

This is why the shares of American carmakers have been so badly sold off.

The recent 20% import duty on Canadian lumber achieved much the same. The move will add about $3,000 a year to the cost of new homes.

Notice that there is a commonality in these measures.

They favor a small number of producers at the cost of millions of consumers.

The lumber duty is especially lopsided, benefiting about 1,000 lumbers producers at the expense of 550,000 homebuyers a year.

It is also moving money out of blue liberal states and into red Trump supporting states, where most lumber mills reside.

Expect this trend to continue for three more years.

The costs of these protectionist moves are already being felt.

Mexico, the second largest buyer of American agricultural exports, has started shifting purchases to friendlier Brazil and Argentina.

You can see this across the commodities markets, which are all plumbing new five-year lows. Trump supporting American farmers are about to get totally shafted.

We already know that at the first sign of restrictions against Chinese imports, the Middle Kingdom will simply cancel orders for hundreds of Boeing aircraft and move the business to Airbus Industries in Europe.

I guess we're lucky because it took all of 80 years to forget the hard learned lessons of the last round of "America First" policies during the 1930's. There were many.

Trade wars aren't damaging to the initiators of trade wars. They hurt all countries.

Globalization expands the pie. Protectionism shrinks it. And yes, we will suffer less than our competitors because we have the largest domestic market. But suffer we will nonetheless.

Foreign restrictions on US exports have been blamed for the demise of the US manufacturing base, declining real wages, and falling standards of living.

However, according to the World trade Organization, only 6.5% of global trade is subject to such barriers.

Protectionism is also a highly regressive tax, as the resulting higher prices eat up a larger share of lower earning families.

Protection of an industry signs its death warrant.

I watched this happen to the US auto industry from 1985 to 2009.

President Reagan forced export restrictions on Japanese car manufacturers and engineered the Palace Accord, which resulted in an eventually tripling of the value of the Japanese yen against the US dollar.

What happened?

The Japanese share of the US car market grew steadily from 20% to 45%. It turns out that consumers were happy to pay up for quality and superior technology, which Detroit sorely back.

Detroit could have produced the Prius at any time in the last 50 years. There is no new technology in it. Instead, it was created by Toyota Motors (TM) in Nagoya.

General Motors (GM) eventually went bankrupt, Chrysler got taken over by Fiat, and Ford (F) barely hung on by the skin of its teeth.

Even today, some 50 years into this competition, US car mileages lag Japanese ones by the huge margin

The enemy here isn't foreign competition and protectionism. It is technology and productivity growth.

In fact, blatant protectionism is often used to cover up plain old bad management, as we found out in GM's case.

But don't blame foreigners. Business has been going to lower costs domestic mini mills that run on cheaper scrap metal.

Textile employment has suffered a similar fate, as have toy manufacturing and many other former US manufacturing industries.

When the US does take action to protect an industry, usually a dying one, the costs to consumers are enormous.

In 2009, the Obama administration imposed punitive duties on cheap Chinese tires. The measure saved 1,200 jobs but caused US tire prices to rise 10%. That worked out to about $900,000 per job saved.

Better just to give them Food Stamps.

Despite all the hoopla, I have not heard of a single manufacturer who is shutting down a foreign plant and reopening in the US.

Far more common is fanfare, publicity, and presidential handshakes surrounding the saving of 200 jobs, thanks to some local subsidy, while 2,000, or 20,000 quietly slip abroad.

Yes, it is easy to demonize foreigners and blame all our problems on them. We certainly know they made great campaign fodder.

Yes, we will all have to pay a price for these misbegotten ideas. More likely it will be sooner than later.

Watch out below when the stock market notices.

Global Market Comments

March 2, 2018

Fiat Lux

Featured Trade:

(FEBRUARY 28 GLOBAL STRATEGY WEBINAR Q&A),

(GOOGL), (AAPL), (SPY), (LEN), (FCX), (FXY),

(NOTICE TO MILITARY SUBSCRIBERS)

Below please find subscribers Q&A for the Mad Hedge Fund Trader February 28 Global Strategy Webinar.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot!

Q: Will we retest the 200-day moving average?

A: No, we won't. With the last test of the 200-day, we didn't even get to the 200-day, we just flirted with it. Moreover, there was a complete washout-not only from, all the short volatility players but, additionally, all the hot money in the market as well. So, I doubt we will get down to the 200-day again this year. Next year is likely, this year no.

Q: What is the next catalyst for a move up in the market?

A: Either a spectacular earnings report from a major company like Apple (and the next one is May 2), or news of the size of major share buybacks from companies like Google (GOOGL), Apple (AAPL), Microsoft (MSFT), Cisco (CSCO), etc. Some indication of news like that will draw more buyers back into the market.

Q: When will companies start buying back their shares?

A: They are buying them back every day. They're not allowed to buy back shares just before or just after earnings reports, but all of the Q4 earnings reports are done now, so we have a free run here for about two months where most companies are going to be automatically buying their own shares back daily. They're on auto-buy programs to dispel any risk of insider trading in their own shares. That's also why the largest share buyback companies had the largest moves in the last three weeks- Apple was certainly one of them, with the share up $31 in only two weeks.

Q: Should I look to emerging markets now? Is it a better value play than US equities?

A: Yes. I still expect emerging markets to outperform the US stock market by about a 2 to 1 margin. Buy the (EEM) on any dip.

Q: Do you think the infrastructure bill will get passed this year?

A: No, because it will require more deficit spending, and at a certain point the Republicans have to draw the line. We still have a large number of deficit hawks inside the Republican Party. If they do pass something, it will essentially be meaningless, (giving tax breaks for real estate developers or something of that sort). There will be no real impact on the economy or the stock market.

Q: What about LEAPS on NVIDIA (NVDA) and Lam Research (LRCX)?

A: That would have been a great thing to do on Feb 9. You don't want to do LEAPS - long term one-year option positions -??after stocks have just made 30% moves up, you do it before. You only do these at the very bottom of market moves. Because of their long duration, they can really get slaughtered when the stock goes against you.

Q: Is NVIDIA still going up to new highs?

A: Yes. My last bet was for a third double in the shares from $180 to $320, and we are already well on our way. The company is firing on all cylinders.

Q: Should I buy housing stocks?

A: They're still down from February...I would say yes. We see an extreme shortage in housing supply continuing for year, and enormous increases in new construction permits from the big home builders- like up 10% in a month; these are huge numbers. So, I'd have to think that the housing stocks like Lennar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are going to come back big time.

Q: What is your TBT target?

A: I would say right around here I would be happy to take a short-term profit. You don't want to run the TBT for the long-term because it has a -6% per year negative cost of carry. It's a great short-term trading instrument, not a long-term hold. We now have a monster profit - it's just gone from $32 to $40, which is a 25% gain in three months. I'd take that and look for a better re-entry point later.

Q: If we missed the Currency Shares Japan Yen Trust (FXY) short position yesterday, should we go into it today?

A: Yes, but only use limit orders in the middle market. If you get done at your price: great. If not, walk away and just watch it. The fundamentals for the Japanese yen are as terrible as ever.

Q: If you had a choice between gold and Bitcoin, what would you take?

A: Bitcoin, never. It reliably brings us 70% corrections at any time without warning. Buy gold on the next dip. The bull market for the barbarous relic still lives, it's just getting a slow start.

Q: Is First Solar (FSLR) a buy even though it's not supported by the administration?

A: Yes. First Solar's business model is so strong they will be profitable no matter who's in office and whether there are subsidies or not. So, any dip on that is a green light. That's why the shares are up 200% in eight months. They are a back-door oil play. That said, there is some double top risk on the shares right here.

Q: Is Freeport McMoRan (FCX) a hold?

A: Yes, because copper will recover. Guess what electric cars buy tons of? We are moving to a copper-based transportation system. China's economy is also holding steady, which is another major factor supporting copper.

Q: Has your view on commodities changed over the last few months?

A: No, I still think commodities will outperform stocks this year- that view has not changed. You had a fantastic entry point two weeks ago. Look for higher highs now. Commodities are always big movers as we approach the end of an economic cycle.

With all that, I'll see you at the next Global Trading Strategy webinar on March 14 at 12:00 EST.

Good Luck and Good Trading!

John Thomas

CEO & Publisher

Diary of a Mad Hedge Fund Trader