Global Market Comments

November 16, 2017

Fiat Lux

Featured Trade:

(STANDBY FOR THE COMING GOLDEN AGE OF INVESTMENT),

(SPY), (INDU), (FXE), (FXY), (UNG), (EEM), (USO),

(TLT), (NSANY), (TSLA)

Global Market Comments

November 15, 2017

Fiat Lux

Featured Trade:

(NVIDIA REPORTS...STOCK ROCKETS, AGAIN),

(NVDA), (IBM), (HPQ), (TSLA), (DVMT),

(IS USA, INC. A "SELL")

Last year, whenever anyone asked me for a stock most likely to double in 2017, I uniformly responded with the same name: NVIDIA (NVDA).

For me, it was a no-brainer.

The processor manufacturer occupied the nexus of the entire movement towards machine learning and artificial intelligence, and then was still relatively unknown.

I lied.

The stock didn't double, it more than tripled, from $67 to a high of $219.

These days, I am being asked the same question.

But this time, I'm going to be boring. Believe it or not, the name to double again in 2018 is (NVDA).

You would think I am MAD to be chasing the big winner of 2017.

But take a look at their blockbuster earnings announced last week first, which blew away the street's most optimistic expectations.

Q3 revenue leapt 54% to just over $2.64 billion, and net profits of $1.33 a share, up 33% YOY, and 41.5% greater than expected.

Their gross operating margin is an eye popping 59.7%.

It is dominating in the fastest growing sectors of the technology space, including AI, virtual reality, and fast data processing.

Every automobile company is basing its self-driving technology on its XP computer.

And now there is a new game in town.

(NVDA) is a major beneficiary of the exponential growth of cryptocurrencies, whose need for processing power is growing voraciously.

At this point, the company has a huge installed base of users on which to build on.

Look at the spec sheets of anything you buy these days and you will find NVIDIA parts somewhere in the guts.

I bought a Dell Alienware Area 51gaming PC to run the Oculus Rift virtual reality hardware for my kids this Christmas (they don't read this letter on a daily basis). It came with a state of the art NVIDIA GeForce GTX 1080 graphics card.

I also happen to know that NVIDIA chips are lurking somewhere in my Tesla (TSLA) Model S-1 and Model X.

Most companies have only one or two artificial intelligence experts. NVIDIA has over 1,000.

While the stock is priced for perfection, it is continuing to deliver just that. The shares actually fell on the earnings announcement.

But let's face it. The momentum of this stock has been unassailable.

However, the company is so far ahead of its competitors it is actually increasing its lead. Nobody has a chance of catching them.

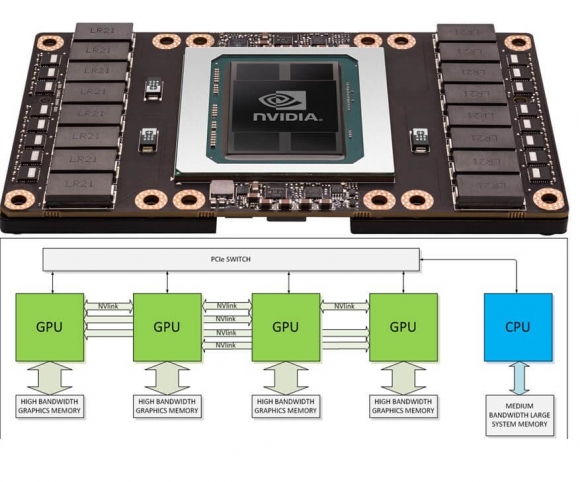

The company is managing an industrywide migration of processing power from the CPU to the GPU. You have to use their architecture, or you will go out of business.

This is why every PC manufacturer, including Dell (DVMT) and Hewlett Packard (HPQ), are partnering with them. IBM (IBM) is using their chips in their high-end machines.

This is because (NVDA) is now first to market with everything important.

Nvidia's dominance of the high-end GPU market is allowing it to soak up all of the spending that would normally have been at least somewhat split between itself and AMD.

Gaming was the big revenue booster for Nvidia, which now accounts for 59% of sales.

Sales of Nvidia's flagship product, the passively cooled 16GB Tesla P100 GPU, is being ravenously consumed by data centers around the country, and should double again in 2018.

And the company has just started to ship its new Volta-based Tesla V100 GPU, which offers a tenfold increase over previous generations.

Hold one of these dense, wicked fast processors in your hand and you possess nothing less than the future of western civilization.

Over the long term, the picture looks even better. It should continue with annual earnings growth of at least 20%-30% a year for the foreseeable future.

At a minimum, the shares have at least another double in them. If I'm wrong, they'll only go up 50%.

Not a bad choice to have.

To learn more about Nvidia, please visit their website by clicking here.

For those of you who did the trade at the beginning, or better yet, bought deep out of the money one year option LEAPS, well done!

I am hearing of 800% returns, or better.

What would happen if I recommended a stock that had no profits, was losing billions of dollars a year, and had a net worth of negative $44 trillion?

Chances are, you would cancel your subscription to the Mad Hedge Fund Trader, demand a refund, unfriend me on Facebook, and unfollow me on Twitter.

Yet, that is precisely what my former colleague at Morgan Stanley, technology guru Mary Meeker, did.

Now a partner at venture capital giant, Kleiner Perkins, Mary has brought her formidable analytical talents to bear on analyzing the United States of America as a stand-alone corporation.

The bottom line: the challenges are so great they would daunt the best turnaround expert. The good news is that our problems are not hopeless or unsolvable.

The US government was a miniscule affair until the Great Depression and WWII, when it exploded in size. Since 1965 when Lyndon Johnson's "Great Society" egan, GDP rose by 2.7 times, while entitlement spending leapt by 11.1 times.

If current trends continue, the Congressional Budget Office says that entitlements and interest payments will exceed all federal revenues by 2025.

Of course, the biggest problem is health care spending which will see no solution until health care costs are somehow capped. Despite spending more than any other nation, we get one of the worst results, with lagging quality of life, life span, and infant mortality.

Some 28% of Medicare spending is devoted to a recipient's final four months of life. Somewhere, there are emergency room cardiologists making a fortune off of this. A night in an American hospital costs 500% more than in any other country.

Social Security is an easier fix. Since it started in 1935, life expectancy has risen by 26% to 78, while the retirement age is up only 3% to 66. Any reforms have to involve raising the retirement age to at least 70 and means testing recipients.

The solutions to our other problems are simple, but require political suicide for those making the case.

For example, you could eliminate all tax deductions, including those for home mortgage interest, charitable contributions, IRA contributions, dependents, and medical expenses. That would raise $1 trillion a year, and more than wipe out the current budget deficit in one fell swoop.

Mary reminds us that government spending on technology laid the foundations of our modern economy. If the old DARPANET had not been funded during the 1960s, Google, Yahoo, EBay, Facebook, Cisco, and Oracle would be missing in action today.

Global Positioning Systems (GPS) were also invented by and are still run by the government. They have been another great wellspring of profits (I got to use it during the 1980s while flying across Greenland when it was still top secret).

There are a few gaping holes in Mary's "thought experiment". I doubt she knows that the Treasury Department carries the value of America's gold reserves, the world's largest at 8,965 tons worth $576 billion, at only $34 an ounce versus an actual current market price of $1,280.

Nor is she aware that our ten aircraft carriers are valued at $1 each, against an actual cost of $5 billion each in today's dollars. And what is Yosemite worth on the open market, or Yellowstone, or the Grand Canyon or the Grand Tetons? These all render her net worth calculations meaningless.

Mary expounds at length on her analysis, which you can buy in a book entitled USA Inc. at Amazon by clicking here.

Worth More Than a Dollar?

"The rule of thumb is to do your homework, do your analysis, don't give up prudent risk management for the sake of certain fads. Look for real valuations, and stay true to your time frames," said Marc Chandler, the global head of currency strategy at Brown Brothers Harriman.

Global Market Comments

November 14, 2017

Fiat Lux

Featured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(HOW TO HANDLE THE FRIDAY, NOVEMBER 20 OPTIONS EXPIRATION), (AAPL), (TLT),

(THE FAT LADY IS SINGING AGAIN FOR THE BOND MARKET)

We have the good fortune to have an options position left that expires on Friday, November 17 and I just want to explain to the newbies how to best maximize their profits.

This involves:

The US Treasury Bond Fund (TLT) November 2017 $127-$129 vertical bear put spread

Provided that we don't have a monster "RISK OFF" move in the market over the next few days (war with North Korea?), which cause bonds to rally big time, the (TLT) position should expire at its maximum profit point below $127.

In that case, your profits on this position will amount to 12.32% in 13 trading days, or $1,232.

We got a real gift last week thanks to the Republican mishandling of the tax bill.

A proposal to delay corporate tax cuts into 2019 triggered the sharpest one day selloff of 2017.

This happened the day after I doubled my short position.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

You don't have to do anything.

Your broker (are they still called that?) will automatically use your long $129 put position to cover your short $127 put position in the October (TLT), cancelling out the total holding.

The profit will be credited to your account on Monday morning October 23, and the margin freed up.

Some firms charge you a modest $10 or $15 fee per leg for performing this service.

If you don't see the cash show up in your account on Monday, get on the blower immediately.

Although the expiration process is now supposed to be fully automated, occasionally mistakes do occur. Better to sort out any confusion before losses ensue.

I don't usually run positions into expiration like this, preferring to take profits two weeks ahead of time, as the risk reward is no longer that favorable.

But we have a excess cash right now, and I don't see any other great entry points for the moment.

Better to keep the cash working and duck the double commissions. This time being a pig paid off handsomely.

If you want to wimp out and close the position before the expiration, it may be expensive to do so.

In the unlikely event that we approach the upper $127 strike in the (TLT) spread, we may have to do some finessing going into expiration.

Keep in mind that the liquidity in the options market disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration.

This is known in the trade as the "expiration risk."

One way or the other, I'm sure you'll do OK, as long as I am looking over your shoulder, as I will be.

This expiration will leave me with a 70% cash position.

I am going to hang back and wait for good entry points before jumping back in. It's all about getting that "Buy low, sell high" thing going.

I'm looking to cherry pick my new positions going into yearend.

Take your winnings and go out and buy yourself a well-earned dinner. Or use it to pay your upcoming 2017 income tax bill.

It's probably going to be a big one, given how much money you made trading this year.

Well done, and on to the next trade.

You have just been adopted by a new rich uncle.

I doubled my short position in the US Treasury bond market last week (TLT).

Furthermore, I'll be using any subsequent price rise to sell more bonds, roll forward put options, put spread options positions, buy LEAPS, sell short bond futures, and buy the ProShares Ultra Short 20+ Treasury Bond Fund (TBT).

It is undoubtedly the cleanest trade out there in the world today.

Of all the momentous changes in the prospects for asset classes as a result of the presidential election, bonds absolutely top the list.

And not just US bonds, but German, Japanese, British, and every other kind of bond out there in the world as well are exiting a 30-year bull market and entering a 20-year bear market.

Fixed income instruments are totally toast for the next four and possibly eight years. Indeed, the list of reasons is so long that I'll have to list them one by one.

1) The hallmark of Trump's economic policy revealed so far is to run the economy hot by launching a massive round of deficit spending.

Independent analysis predicts that the US national debt could rise by as much as $10 trillion over the next decade.

That's what a massive tax cutting, spending rises gets you.

Call it Reagan 2.0, without the jokes.

Even if the Federal Reserve does nothing, this unprecedented issuance of new government paper will crowd out private borrowers and drag interest rates upward, to the detriment of bond prices and borrowers everywhere.

2) The bond market was already in trouble well before the election. Prices peaked in July 2015, and have been steadily eroding since. Every bond position I have strapped on since then has been from the short side.

This was because the world was assigning a growing probability of a long series of Fed interest rate hikes.

You could see this in the way bank shares traded, which started moving off of multiyear bottoms during the same time period.

All the election did was pour gasoline on a small fire that was just starting to build.

3) After hiding in a deep cave for the past ten years, inflation is about to make a dramatic comeback. It was already starting to edge up with recent economic reports.

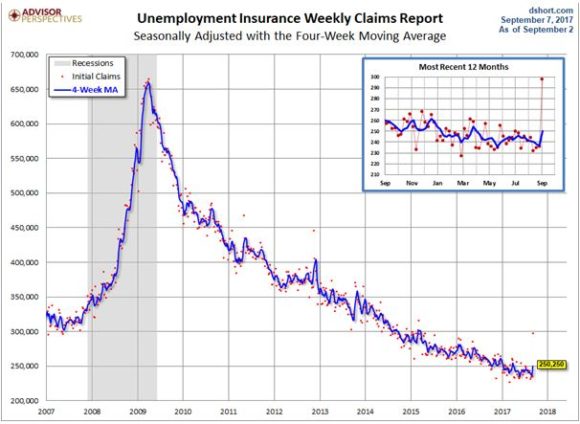

And here is the problem. If you initiate a huge new jobs program with weekly jobless claims already at a 43-year low, wages will take off like a scalded chimp.

Oh, and by the way, wages are the largest component in any inflation calculation.

4) Years of zero, or subzero, interest rate policies from central banks around the world have created a substantial mal investment bubble in all fixed income assets. As a result, the relative valuations have reached ludicrous levels.

However, that government liquidity flow will turn negative by October 2018, thanks to simultaneous and coordinated QE wind downs.

The S&P 500 is now trading at 20 times earnings, and possibly 18 times 2018 earnings. US Treasury bonds at a 2.37% yield are trading at an amazing 45 times earnings.

This sets up the mother of all asset reallocations, out of the worst yielding financial instruments in the world, into the best.

5) After spending 50 years in the financial markets, I can describe to you a problem that I have noticed from the very start.

Institutional investors keep their foot firmly on the gas pedal while only looking in the rear-view mirror.

Call it the herd instinct, safety in numbers, or the lack of imagination, but portfolio managers, by definition, ALWAYS overweight the wrong asset classes at market tops, and underweight the right ones at market bottoms.

Making matters worse is the fact that these institutions move with the speed of molasses in the dead of a High Sierra winter.

Some entertain changes in sector and asset weightings only once a quarter, while others do it annually.

Yes, this means they can minimize tax bills. But it also assures that they are perpetually behind the curve.

When the memo gets out and real changes DO occur, they unfold over years, if not decades.

Every institution in the world is now overweight bonds and underweight stocks.

Guess what happens next?

Global Market Comments

November 13, 2017

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE TAX BILL COMES DUE)

(INDU), (TLT), (GLD), (NVDA)

(WHY TECHNICAL ANALYSIS DOESN'T WORK)

(TESTIMONIAL)