Global Market Comments

November 3, 2017

Fiat Lux

Featured Trade:

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG),

(TEN TIPS FOR SURVIVING A DAY OFF WITH ME)

Global Market Comments

November 2, 2017

Fiat Lux

Featured Trade:

(CHICAGO WEDNESDAY, DECEMBER 27 GLOBAL STRATEGY LUNCHEON)

(THE WORST TRADE IN HISTORY), (AAPL)

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG)

Come join me for lunch for the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Chicago on Wednesday, December 27.

A three-course lunch will be followed by an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $239.

I'll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

To purchase tickets for the luncheons, please go to my online store at www.madhedgefundtrader.com, click on the "STRATEGY LUNCH" tab in the second row, then the "USA" tab, and then click on the CHICAGO STRATEGY LUNCHEON link.

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976.

What would that stake be worth today?

Try $75 billion.

That is the harsh reality that Ron Wayne, 83, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant.

Ron first met Steve Jobs when he was a sprightly 21-year-old marketing guy at Atari, the inventor of the hugely successful Pong video arcade game. In those days, Steve never took a bath, as he believed they were unhealthy.

Ron dumped his shares when he became convinced that Steve Jobs' reckless spending was going to drive the nascent start up into the ground and he wanted to protect his assets in a future bankruptcy.

Co-founders Jobs and Steve Wozniak each kept their original 45% ownership. Today Jobs' widow owns 0.5% ownership is worth $4 billion, while the Woz shares remains undisclosed.

Ron designed the company's original logo and wrote the manual for the Apple 1 computer, which boasted all of 8,000 bytes of RAM (which is 0.008 megabytes to you non-techies).

Jobs tried on many occasions to get Wayne to return to Apple, to no avail.

Wayne worked at Atari into 1978, and later moved on to Lawrence Livermore Labs.

Today, Ron is living off of a meager monthly Social Security check in a mobile home park in remote Pahrump, Nevada, about as far out in the middle of nowhere as you can get, where he can occasionally be seen playing the penny slots.

He spends his time collecting rare coins and stamps.

Ron has never purchased an Apple product.

When asked how he manages the time to be chairman of Microsoft, run the world's largest charity, and raise three kids, Bill Gates answered, "I don't mow the lawn."

Global Market Comments

November 1, 2017

Fiat Lux

Featured Trade:

(THURSDAY DECEMBER 28 MINNEAPOLIS STRATEGY LUNCHEON),

(BATTERY BREAKTROUGH PROMISES BIG DIVIDENDS),

(TSLA),

(TESTIMONIAL)

Come join me for lunch at the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Minneapolis, Minnesota at 12:00 noon on Thursday, December 28, 2017.

An excellent meal will be followed by a wide ranging discussion and a minute question and answer period.

I'll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I'll be throwing a few surprises out there too.

Tickets are available for $249.

The lunch will be held at an exclusive downtown Minneapolis private club the details of which will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

The world???s most untradable stock has just gotten cheap again.

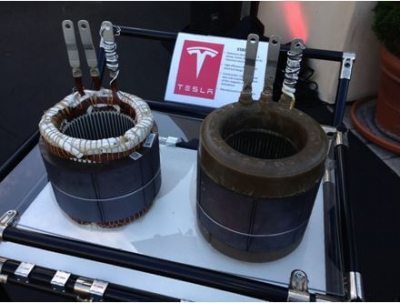

Sure, plenty of analysts have commented on the future of Tesla. But how many have taken apart one of their cars?

I have.

Concerns over the production ramp up for the new $40,000 Tesla 3 on which the company has bet its future is taking place slower than founder Elon Musk had hoped.

Only 1,500 Tesla 3's will be produced by the end of 2017. The goal is to churn out 500,000 a year by 2020.

That has given the shares an embarrassing 19% hickey, and another great entry point for traders.

The dozen manufacturers out there have long struggled to achieve ranges that could match the 300 miles that is standard for competing gasoline engines.

All electric cars on the market today max out at 100-mile ranges or less. Except, that is, my Tesla S-1 (TSLA), which can drive 305 miles....but for $80,000.

That is, unless I am driving back from Lake Tahoe.

By descending 6,200 feet the regenerative braking system enables me to add 100 miles to my range, increasing it to 350 miles. All four wheels essentially act as electric turbines.

In a research paper published in the prestigious journal Science, a Cambridge University research team announced a major breakthrough in electrochemistry that would lead to a 500% increase in electric car ranges.

Expressed in terms of the S-1, it would drop the cost of the 1,000-pound lithium ion battery from $30,000 to $6,000, shrinking the overall cost of the vehicle to $56,000.

That would enable it to undercut equivalent luxury models from Daimler Benz, BMW, and Lexus.

Alternatively, it could maintain the same battery weight and cost and boost the S-1 range to 1,450 miles.

Yikes!

The research was partially funded by the US Department of Energy.

Cambridge University retains the patent, and is already working with several firms to move the technology forward.

The great leap forward is made possible through the use of a lithium-air formula in battery construction. The basic chemistry of lithium-air batteries is simple.

The cell generates electricity by combining lithium with oxygen to form lithium peroxide and is then recharged by applying a current to reverse the reaction.

Making these reactions take place reliably, over many cycles, is the challenge.

The attraction here is that lithium air battery energy densities are ten times higher than the lithium ion batteries now in use.

The Cambridge team was able to tweak battery performance through adding lithium iodide to the process.

Elon Musk has told me that he is shown dozens of new battery technologies every year. The problem is always the same.

The newfangled batteries can only be recharged once or twice. They develop "tendrils" on the anodes and cathodes, which make future recharges impossible.

The Cambridge professor, Dr. Clare Grey, says her team has been able to recharge their lithium air battery 2,000 times.

That's enough to get to the eight-year battery lifetime guarantee mandated by the state of California.

Tesla is no slouch.

They have been tinkering with the electrochemistry of their batteries on their own.

The recent series of cars has achieved a 5% boost in range to 290 miles through the addition of silicon to the battery cathodes.

Of course, it will take a few years before lithium-air reaches full commercial viability. New technology doesn't exactly leap out of labs on to store shelves.

After all, current electric battery design is not too different from that first introduced in electric street trollies of the 1880's.

But my guess is that further research will bring greater battery ranges, not lesser ones.

The news could be better for Tesla. It has always been a "faith" type stock, reliant on the development of futures technologies to achieve future profitability.

All of the profits announced so far have really been accounting tricks, reliant on generous government subsidies and the sale of carbon credits.

Shareholders have to believe that Tesla will become the world's largest carmaker in a decade, or they shouldn't be in the shares. I believe Tesla can do it, but expect the road to be rocky.

Now, at last, we have the technology in hand.

For more background about this car from the future, read "16 Facts and 6 Big Problems I discovered by Tearing Apart my Tesla S-1" by clicking here.

Dear John,

I would like to express my appreciation for all that you put into your daily letter.

My background is in the medical field so when it comes to investing and finances, I need all the help I can get. It's totally amazing that you are a one stop shopping experience.

You incorporate past, present, and future in where to invest.

With your service I have learned the who, what, when, where, and how of successful trading and have done rather well with your input and the text alerts.

Often times though I have gone off on my own in trades and have given much of my profits back.

You warn your subscribers of the pitfalls and the need of strict discipline in knowing when to exit and limit your loses. I am surely learning this the hard way.

You are definitely the voice of experience in all matters of trading and I hold you in high regard as my mentor.

Sincerely,

Christine P

Morristown, NJ

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more