Global Market Comments

December 27, 2015

Fiat Lux

SPECIAL ISSUE ABOUT THE FAR FUTURE

Featured Trade:

(PEEKING INTO THE FUTURE WITH RAY KURZWEIL),

(GOOG), (INTC), (AAPL), (TXN)

Alphabet Inc. (GOOG)

Intel Corporation (INTC)

Apple Inc. (AAPL)

CBOE Interest Rate 10 Year T No (^TNX)

This is the most important research piece you will ever read, bar none. But you have to finish it to understand why. So, I will get on with the show.

I have been hammering away at my followers at investment conferences, webinars, and strategy luncheons this year about one recurring theme. Things are good, and about to get better, a whole lot better.

The driver will be the exploding rate of technological innovation in electronics, biotechnology, and energy. The 2020s are shaping up to be another roaring twenties, and asset prices are going to go through the roof.

To flesh out some hard numbers about growth rates that are realistically possible and which industries will be the leaders, I hooked up with my old friend, Ray Kurzweil, one of the most brilliant minds in computer science.

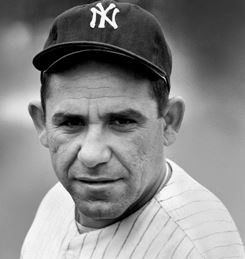

Ray is currently a director of Engineering at Alphabet (GOOG), heading up a team that is developing stronger artificial intelligence. He is an MIT grad, with a double major in computer science and creative writing. He was the principal inventor of the CCD flatbed scanner, first text-to-speech synthesizer, and the commercially marketed large-vocabulary speech recognition.

When he was still a teenager, Ray was personally awarded a science prize by President Lyndon Johnson. He has received 20 honorary doctorates and has authored 7 books. It was upon Ray?s shoulders that many of today?s technological miracles were built.

His most profound book to date, The Singularity Is Near: When Humans Transcend Biology, was a New York Times best seller. In it he makes hundreds of predictions about the next 100 years that will make you fall out of your chair.

I met Ray at one of my favorite San Francisco restaurants, Morton?s on Sutter Street. I ordered a dozen oysters, a filet mignon wrapped in bacon, and washed it all down with a fine bottle of Duckhorn Merlot. Ray had a wedge salad with no dressing, a giant handful of nutritional supplements, and a bottle of water. That?s Ray, one cheap date.

The Future of Man

A singularity is defined as a single event that has monumental consequences. Astrophysicists refer to the big bang and black holes in this way. Ray?s singularity has humans and machines merging to become single entities, partially by 2040 and completely by 2100.

All of our thought processes will include built in links to the cloud, making humans super smart. Skin that absorbs energy from the sun will eliminate the need to eat. Nanobots will replace blood cells, which are far more efficient at moving oxygen. A revolution in biotechnology will enable us to eliminate all medical causes of death.

Most organs can now be partially or completely replaced. Eventually they all will become renewable by taking one of your existing cells and cloning it into a completely new organ. We will become much more like machines, and machines will become more like us.

The first industrial revolution extended the reach of our bodies, and the second is extending the reach of our minds.

And, oh yes, prostitution will be legalized and move completely online. Sound like a turn off? How about virtually doing it with you favorite movie star? Your favorite investment advisor? Yikes!

Ironically, one of the great accelerants towards this singularity has been the war in Iraq. More than 50,000 young men and women came home missing arms and legs (in Vietnam these were all fatalities, thanks to the absence of modern carbon fiber body armor).

Generous government research budgets have delivered huge advances in titanium artificial limbs and the ability to control them with only our thoughts. Quadriplegics can now hit computer keystrokes merely by thinking about them.

Kurzweil argues that exponentially growing information technology is encompassing more and more things that we care about, like health care and medicine. Reprogramming of biology will be the next big thing and is a crucial part of his ?singularity.?

Our bodies are governed by obsolete genetic programs that evolved in a bygone era. For example, over millions of years our bodies developed genes to store fat cells to protect against a poor hunting season the following year. That gave us a great evolutionary advantage 10,000 years ago. But it is not so great now, with obesity becoming the country?s number one health problem.

We would love to turn off these genes through reprogramming, confident that the hunting at the supermarket next year will be good. We can do this in mice now, which in experiments can eat like crazy, but never gain weight.

The happy rodents enjoy the full benefits of no caloric restriction, with no hint of diabetes or heart disease. A product like this would be revolutionary, not just for us, health care providers, and the government, but, ironically, for fast food restaurants as well.

Within the last five years, we have learned how to reprogram stem cells to rebuild the hearts of people who have suffered heart attacks. The stem cells are harvested from skin cells, not human embryos, consequently circumventing the political and religious issues of the past.

If we can turn off genes, why not the ones in cancer cells that enable them to pursue unlimited reproduction, until they kill its host? That development would cure all cancers, and is probably only a decade away.

The Future of Computing

If this all sounds like science fiction, you?d be right. But Ray points out that humans have chronically underestimated the rate of technological innovation.

This is because humans evolved to become linear thinking animals. If a million years ago we saw a gazelle running from left to right, our brains calculated that one second later it would progress ten feet further to the right. That?s where we threw the spear. This gave us a huge advantage over other animals and is why we became the dominant species.

However, much of science, technology, and innovation grows at an exponential rate, and consequently is the reason we make our most egregious forecasting errors. Count to seven, and you get to seven. However, double something seven times and you get to a billion.

The history of the progress of communications is a good example of an exponential effect. Spoken language took hundreds of thousands of year to develop. Written language emerged in thousands of years, books in a 100 years, the telegraph in a century, and telephones 50 years later.

Some ten years after Steve Jobs brought out his Apple II personal computer, the growth of the Internet went hyperbolic. Within three years of the iPhone launch, social media exploded out of nowhere.

At? the beginning of the 20th century, $1,000 bought 10 X -5th power worth of calculations per second in our primitive adding machines. A hundred years later a grand got you 10 X 8th power calculations, a 10 trillion-fold improvement. The present century will see gains many times this.

The iPhone itself is several thousand times smaller, a million times cheaper, and billions of times more powerful than computers of 40 years ago. That increases price per performance by the trillions. More dramatic improvements will accelerate from here.

Moore?s law is another example of how fast this process works. Intel (INTC) founder Gordon Moore published a paper in 1965 predicting a doubling of the number of transistors on a printed circuit board every two years. Since electrons had shorter distances to travel, speeds would double as well.

Moore thought that theoretical limits imposed by the laws of physics would bring this doubling trend to an end by 2018, when the gates became too small for the electrons to pass through. For decades I have read research reports predicting that this immutable deadline would bring an end to innovation and technological growth, resulting in economic Armageddon.

Ray argues that nothing could be further fr

om the truth. A paradigm shift will simply allow us to leapfrog conventional silicon based semiconductor technologies and move on to bigger and better things. We did this when we jumped from vacuum tubes to transistors in 1949, and again in 1959, when Texas Instruments (TXN) invented the first integrated circuit.

Paradigm shifts occurred every ten years in the past century, every five years in the last decade, and will occur every couple of years in the 2020s. So fasten your seat belts!

Nanotechnology has already allowed manufacturers to extend the 2018 Moore?s Law limit to 2022. On the drawing board are much more advanced computing technologies, including calcium based systems, using the alternating direction of spinning electrons and nanotubes.

Perhaps the most promising is DNA based computing, a high research priority at IBM and several other major firms. I earned my own 15 minutes of fame in the scientific world 40 years ago as a member of the first team ever to sequence a piece of DNA which is why Ray knows who I am.

Deoxyribonucleic Acid (DNA) makes up the genes that contain the programming which makes us who we are. It is a fantastically efficient means of storing and transmitting information. And it is found in every single cell in our bodies, all 10 trillion of them.

The great thing about DNA is that it replicates itself. Just throw it some sugar. That eliminates the cost of building the giant $2 billion silicon based chip fabrication plants of today.

The entire human genome is a sequential binary code containing only 800 MB of information which, after you eliminate redundancies, has a mere 30-100 MB of useful information which is about the size of an off-the-shelf software program, like Word for Windows. Unwind a single DNA molecule, and it is only six feet long.

What this means is that, just when many believe that our computer power is peaking, it is in fact launching on an era of exponential growth. Super computers surpassed human brain computational ability in 2012, computing about 10 to the 16th power (ten quadrillion) calculations per second.

That power will be available on a low-end laptop by 2020. By 2050, this prospective single laptop will have the same computing power as the entire human race which is comprised of about 9 billion individuals. It will also be small enough to implant in our brains.

The Future of the Economy

Ray is not really that interested in financial markets or, for that matter, making money. Where technology will be in a half century and how to get us there are what get his juices flowing. However, I did manage to tease a few mind-boggling thoughts from him.

At the current rate of change, the 21st century will see 200 times the technological progress that we saw in the 20th century. Shouldn?t corporate profits and, therefore, share prices rise by as much?

Technology is rapidly increasing its share of the economy, and increasing its influence on other sectors. That?s why tech has been everyone?s favorite sector for the past 30 years, and will remain so for the foreseeable future. For two centuries, technology has been eliminating jobs at the bottom of the economy and creating new ones at the top.

Stock analysts and investors make a fatal error estimating future earnings based on the linear trends of the past, instead of the exceptional growth that will occur in the future.

In the last century, the Dow appreciated from 100 to 10,000, an increase of 100 times. If we grow at that rate in this century, the Dow should increase by 10,000% to 1 million by 2100. But so far, we are up only 8%, even though we are already 16 years into the new century.

The index is seriously lagging, but will play catch up in a major way during the 2020s, when economic growth jumps from 2% to 4% or more, thanks to the effects of massively accelerating technological change.

Some 100 years ago, one third of jobs were in farming, one third were in manufacturing, and one third in services. If you predicted then that in a century farming and manufacturing would each be 3% of total employment and that something else unknown would come along for the rest of us, people would have been horrified. But that?s exactly what's happened.

Solar energy use is also on an exponential path. It is now 1% of the world?s supply, but is only seven doublings away from becoming 100%. Then we will consume only one 10,000th of the sunlight hitting the earth. Geothermal energy offers the same opportunities.

We are only running out of energy if you limit yourself to 19th century methods. Energy costs will plummet. Eventually, energy will be essentially free when compared to today?s costs, further boosting corporate profits.

Hyper growth in technology means that we will be battling with deflation for the rest of the century, as the cost of production and the price of everything falls off a cliff. That makes our 10-year Treasury bonds a steal at a generous 2.60% yield, a full 460 basis points over the real long term inflation rate of negative 2% a year.

The upshot to all of this, these technologies will rapidly eliminate poverty, not just in the US, but around the world. Each industry will need to continuously reinvent its business model or it will disappear.

The takeaway for investors is that stocks, as well as other asset prices, are currently wildly undervalued given their spectacular future earnings potential. It also makes the Dow target of 1 million by 2100 absurdly low, and off by a factor of 10 or even 100. Will we be donning our ?Dow 100 Million? hats then?

Other Random Thoughts

As we ordered dessert, Ray launched into another stream of random thoughts. I asked for Morton?s exquisite double chocolate mousse. Ray had another handful of supplements. Yep, Mr. Cheap Date.

The number of college students has grown from 50,000 to 12 million since 1870s. A kid in Africa with a cell phone has more access to information than the president of the United States did 15 years ago.

The great superpower, the Soviet Union, was wiped out by a few fax machines distributing information in 1991.

Company offices will become entirely virtual by 2025.

Cows are very inefficient at producing meat. In the near future, cloned muscle tissue will be produced in factories, disease free, and at a fraction of the present cost, without the participation of the animal. PETA will be thrilled.

Use of nano materials to build ultra light, but ultra strong, cars will cut fuel consumption dramatically. Battery efficiencies will improve by 10 to 100 times. Imagine powering a Tesla Model S1 with a 10-pound battery! Advances in nanotube construction mean the weight of the vehicle will drop from the present 3 tons to just 100 pounds but will be far safer.

Ray is also on a scientific advisory panel for the US Army. Uncertain about my own security clearance, he was reluctant to go into detail. Suffice it to say that the weight of an M1 Abrams main battle tank will shrink from 70 tons to 1 ton, but will be 100 times stronger.

A zero tolerance policy towards biotechnology by the environmental movement exposes their intellectual and moral bankruptcy. Opposing a technology with so many positive benefits for humankind and the environment will inevitably alienate them from the media and the public who will see the insanity of their position.

Artificial intelligence is already far more prevalent than you understand. The advent of strong artificial intelligence will be the most significant development of this century. You can?t buy a book from Amazon, withdraw money from your bank, or book a flight, without relying on AI.

Ray finished up by saying that by 2100, humans will have the choice of living in a biological or, in a totally virtual, online form. In the end, we will all just be files.

Personally, I prefer the former, as the best th

ings in life are biological and free!

I walked over to the valet parking, stunned and disoriented by the mother load of insight I had just obtained, and it wasn?t just the merlot talking either! Imagine what they talk about at Alphabet all day.

To buy The Singularity Is Near at Amazon, please click here. It is worth purchasing the book just to read Ray?s single chapter on the future of the economy.

Did You Say ?BUY? or ?SELL?

Did You Say ?BUY? or ?SELL?

The Future is Closer than You Think

The Future is Closer than You Think

Global Market Comments

December 26, 2016

Featured Trades:

?(A CHRISTMAS STORY),

(MY FAVORITE SECRET ECONOMIC INDICATOR)

When I was growing up in Los Angeles during the fifties, the most exciting day of the year was when my dad took me to buy a Christmas tree.

With its semi desert climate, Southern California offered pine trees that were scraggly, at best, and we didn?t want to chop down the view that we had.

So the Southern Pacific Railroad made a big deal out of bringing trees down from much more well? endowed Oregon to supply holiday revelers.

You had to go down to the freight yard at Union Station on Alameda Street to pick them up.

I remember a jolly Santa standing in a box car with trees piled to the ceiling, pungent with seasonal evergreen smells, handing them out to crowds of eager, smiling buyers for a buck apiece.

Watching great lumbering steam engines as big as houses whistling and belching smoke was enthralling. We took our prize home to be decorated by seven kids hyped on adrenaline, chugging eggnog.

A half-century later, the Southern Pacific is gone, the steam engines are in museums, anyone going near a rail yard would be mugged or arrested for vagrancy, and Dad long ago passed away. Dried out trees at Target for $30 didn?t strike the right chord.

So I bundled the kids into the SUV and drove to the Eastern shore of Lake Tahoe, on the Nevada side, US Forest Service tree cutting permit in hand.

Deep in the forest at 8,000 feet, the kids, hyped on adrenaline, made the decision about which perfect ten footer to take home. I personally chopped it down, and dragged it down the ridge huffing and puffing all the way. I then tied it to the roof of the car and drove us home.

I netted three trees that day, one for each home, and one for my oldest daughter. I figure I saved myself $400 (the permits were $10 each).

With any luck, these memories will last until the next century, long outlasting me.

Now the story really comes full circle. I was in Portland, Oregon a few weeks ago, and had some free time to kill. So I wandered across the river to the Oregon Rail Heritage Center.

What do I see but Southern Pacific engine no. 4449, the exact same locomotive I marveled at in LA 60 years ago, all decked out in its glorious orange and red paint.

It was like discovering a long lost family member. The 435-ton, 72-year-old behemoth was being rebuilt from the ground up by a dedicated team of similarly aged volunteers to serve as the city?s Christmas train.

For the link to the museum, please click here Oregon Rail Heritage Foundation.

Union Pacific still maintains, in running condition, some of the largest steam engines every built for historical and public relations purposes.

One, the ?Old 844? once steamed its way over the High Sierras to San Francisco on a nostalgia tour. The 120-ton behemoth was built during WWII to haul heavy loads of steel, ammunition, and armaments to California ports to fight the war against Japan. The 4-8-4-class engine could pull 26 passenger cars at 100 mph.

When the engine passed, I felt the blast of heat from the boiler singe my face. No wonder people love these things! To watch the video, please click here and hit the ?PLAY? arrow in the lower left hand corner.

Please excuse the shaky picture. I shot this with one hand, while using my other hand to restrain my over excited kids from running on to the tracks to touch the laboring beast.

Merry Christmas!

John Thomas

Long Time No See, Old Friend

Long Time No See, Old Friend

Thanks for Filling My Stocking with Great Tips, Santa!

Thanks for Filling My Stocking with Great Tips, Santa!

Thanks for Filling My Stocking with Great Tips, Santa!

Thanks for Filling My Stocking with Great Tips, Santa!Global Market Comments

December 23, 2016

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

First and foremost, thank you for what you do.

The small cost of this newsletter pays for itself a thousand times over. My returns mimic those of your portfolio for the year and for that I am grateful.?

The only suggestion I would offer is to keep doing what you are doing. It is people like you that will help return the once storied name to Wall Street.

Regards,

Shirin

Tampa, Florida

?Interest rates are the physical gravity of financial assets. The lower they are, the higher assets will levitate,? said Anthony Scaramucci, the founder and managing partner of SkyBridge Capital, a leading hedge fund of funds.

?

?

Global Market Comments

December 22, 2016

Fiat Lux

Featured Trade:

(REPORT FROM THE FROZEN WASTELANDS OF THE WEST)