Global Market Comments

March 22, 2016

Fiat Lux

Featured Trade:

(APRIL 22 NEW YORK STRATEGY LUNCHEON),

(THE HARD TRUTH BEHIND SELLING IN MAY),

(NOTICE TO MILITARY SUBSCRIBERS)

Followers of my Trade Alert service have watched me shrink my book down to only two positions, the smallest of the year.

That?s because I am a big fan of buying straw hats in the dead of winter and umbrellas in the sizzling heat of the summer. I even load up on Christmas ornaments every January when they go on sale for ten cents on the dollar. There is a method to my madness.

If I had a nickel for every time I heard the term ?Sell in May and go away,? I could retire.

Oops, I already am retired!

In any case, I thought I would dig out the hard numbers and see how true this old trading adage is.

It turns out that it is far more powerful than I imagined. According to the data in the Stock Trader?s Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today.

Amazingly, $10,000 invested on every November 1 and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%.

This is despite the fact that the Dow Average rocketed from $409 to $18,300 during the same time period, a gain of 44.74 times!

My friends at the research house, Dorsey, Wright & Associates, (click here) have parsed the data even further.

Since 2000, the Dow has managed a feeble return of only 4%, while the long winter/short summer strategy generated a stunning 64%.

Of the 62 years under study, the market was down in 25 May-October periods, but negative in only 13 of the November-April periods, and down only three times in the last 20 years!

There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973 and 2008), but with the "bad six month" time period there have been 11 losing efforts of 10% or more.

Being a long time student of the American, and indeed, the global economy, I have long had a theory behind the regularity of this cycle.

It?s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920?s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall, when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops.

So they had to borrow all at once, placing a large cash call on the financial system as a whole. This is why we have seen so many stock market crashes in October. Once the system swallows this lump, it?s nothing but green lights for six months.

After the cycle was set and easily identifiable by low-end computer algorithms, the trend became a self-fulfilling prophecy.

Yes, it may be disturbing to learn that we ardent stock market practitioners might in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

It is important to remember that this cyclicality is not 100% accurate, and you know the one time you bet the ranch, it won?t work. But you really have to wonder what investors are expecting when they buy stocks at these elevated levels, over $205 in the S&P 500 (SPY).

Will company earnings multiples further expand from 18 to 19 or 20? Will the GDP suddenly reaccelerate from a 2% rate to the 4% expected by share prices when the daily sentiment indicators are pointing the opposite direction?

I can?t wait to see how this one plays out.

My Sources for Stock Tips are Interstellar

Global Market Comments

March 21, 2016

Fiat Lux

Featured Trade:

(APRIL 21 BOSTON GLOBAL STRATEGY LUNCHEON),

(THE DEATH OF THE HEDGE FUND),

(SPY), (VRX), (USO),

(CHINA?S COMING DEMOGRAPHIC NIGHTMARE),

(FXI)

SPDR S&P 500 ETF (SPY)

Valeant Pharmaceuticals International, Inc. (VRX)

United States Oil (USO)

iShares China Large-Cap (FXI)

Without question, this has been the quarter from hell for the hedge fund industry.

It hasn?t helped that the big cap S&P 500 Index (SPY), has cratered by 14% and then immediately rocketed by 14% three times in the last 18 months, with NO net movement overall.

The latest rally has seen the biggest move up in stock prices since Franklin Delano Roosevelt was first sworn in as president in 1933. I remember it like it was yesterday.

This is your worst trading nightmare.

Such is the price of saying bon viage to America?s aggressive monetary policy of quantitative easing.

Speaking to managers and traders around the globe, my compatriots are either having a terrible time, or they are going out of business. I am one of a hand full eking out a small gain in 2016.

See?. after a half century, this business starts to get easy.

According to Hedge Fund Research, a commercial database, last year was the worst for hedge fund liquidations since 2009. Some 979 funds ran up the white flag, compared to 864 in 2014.

New hedge funds are coming to the fore at a declining rate. Only 183 started up during the fourth quarter, versus 269 in Q3. And they are raising smaller amounts of money with tighter terms.

In January alone total hedge fund assets under management shrank by $64.7 Billion, thanks to redemptions and market losses. They fell again in February to $2.95 billion, the lowest since May, 2014, according to eVestment, another research firm.

Hedge funds are not only the victims of the recent extreme market volatility; they are the cause. Far and away the best performing stocks in 2016 are those with the greatest hedge fund short positions.

Those would include holdings in the energy, commodities, industrial, retailing, and precious metals industries.

Of course, everyone in the know was aware that the market was heading for a pasting at the beginning of the year. That's why I started buying naked puts in the S&P 500 (SPY) for the first time in ages.

The problem is that many hedge funds have grown so large that it takes months to shift a position with any decent weighting. They have in effect become victims of their own success.

Activist hedge funds have in particular become the subject of grief. Pershing Square, run by the controversial boy trader Bill Ackman, has seen one of its largest positions, Valeant Pharmaceuticals (VRX) crash by a gut churning 73% this year. This is on top of an eye popping 61.5% plunge in 2015.

With 100 analysts on board they could see this coming. Go figure. The problem is that at least a half dozen other funds have been riding on Ackman?s coattails and are suffering similar grief.

Hedge funds deliver mediocre high single digit, low double digit gains over the long term in exchange for minimizing or eliminating any downside. So far this year, they have overwhelmingly failed to deliver.

As a result, investors are clamoring for their money back. Easier said than done. Many funds, like Pershing Square limit their partners from withdrawing capital to as many as eight consecutive quarters, with long advance notice periods.

It doesn?t help that we have all be forced into becoming oil traders (USO), with no particular advantage.

After a grinding 82.6% decline from the 2011 peak to a subterranean $26, oil nearly doubled to $42, a 61% pop. Not even career traders in the oil patch saw this coming.

What oil does from here is anyone?s guess. My bet is that we retrace to $30 during the spring refinery maintenance period to make a secondary bottom, wiping out all the newfound bulls.

Long-term Trade Alert followers have noticed that I stop out of losers quicker than usual in this kind of environment. That?s because one bad trade can wipe out the profits of three good ones.

Over time, I try to break even when I?m wrong and make a fortune when I?m right. Most investors will take those kinds of returns all day long.

When I joined a tiny hedge fund industry during the late 1980?s, it gave you a license to print money, and we did so by the millions.

Now it sounds more like a club I wouldn?t want to? to join because it has me as a member.

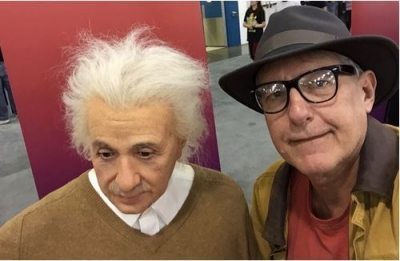

It Takes A Real Einstein To Figure Out This Market

?We?re in a secular bull market for the dollar. ?A strong dollar is a natural consequence of America emerging from a liquidity trap, while Europe and Japan are still stuck in one. The dollar is a growth stock, and growth stocks over time outperform utilities,? said Paul McCulley, formerly the chief economist at bond giant PIMCO.

Global Market Comments

March 18, 2016

Fiat Lux

Featured Trade:

(APRIL 20 WASHINGTON DC GLOBAL STRATEGY LUNCHEON),

(JANET CUTS THE KNEES OUT FROM UNDER THE DOLLAR),

(SPY), (FXY), (FXE), (UUP), (GLD), (GDX), (SLV), (SIL),

(TEN TIPS FOR SURVIVING A DAY OFF WITH ME)

SPDR S&P 500 ETF (SPY)

CurrencyShares Japanese Yen ETF (FXY)

CurrencyShares Euro ETF (FXE)

PowerShares DB US Dollar Bullish ETF (UUP)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

iShares Silver Trust (SLV)

Global X Silver Miners ETF (SIL)

Her action was as certain as it was swift.

Federal Reserve chairman Janet Yellen suddenly ratcheted down interest rate expectations from four-quarter point rises to only one in 2016. And that one rate rise may not come until December.

Foreign exchange traders all share one unique characteristic. You have to SHOW THEM THE MONEY. No interest rate increases mean no more money and they summon the urge to dump the offending currency.

In other words, GOOD BYE US DOLLAR.

Once again, my call that there would be NO rate rises has been vindicated, as elucidated in my 2016 Annual Asset Class Review (click here).

Traders lulled into an always-fatal sense of complacency were taken out to the woodshed and severely spanked.

The message was clear. Never underestimate the dovishness of my former Berkeley economics professor, Janet Yellen.

The Fed has in effect changed policy direction three times in three months, generating some of the most violent market moves in history. If you can survive this, you can survive anything!

Do you know who the longest living subgroup of people in Japan are? Hiroshima atomic bomb survivors. Welcome to the club.

Almost every major hedge fund short play out there rocketed. The Euro (FXE) and the Japanese yen (FXY) soared. Stocks added double-digit gains. Oil (USO) gained a new lease on life. Indeed, the entire weak dollar (UUP) space was off to the races.

Gold (GLD), silver (SLV), and the miners (GDX), (SIL) especially like the outbreak of cautiousness at the Fed.

The barbarous relic made back its entire recent $50 correction in minutes, and then some. Gold sparkles because low rates mean that the opportunity cost of owning it has been pushed back to near zero. Oh, and it?s a weak dollar play too.

I was seconds away from getting executed on another call spread for all of you, but prices moved too far, too fast before we could get the Trade Alert out.

Welcome to show business.

Clearly, international concerns were at the forefront. Janet has, in effect, become the central banker to the world. If Europe, Japan, and China are all weak, it is not time to raise American interest rates.

It doesn?t help that US corporate earnings growth barely has a pulse. Janet?s worst nightmare is that the US goes into the next recession with interest rates at zero, dooming us to a liquidity trap like the one that has mired the Japanese economy for the past two decades.

The Fed action on Wednesday sent a generalized green flag out to all ?RISK ON? assets. The problem is that it comes right on top of one of the steepest moves UP in share prices in market history.

So, after flushing out a few stubborn, last stand shorts, I think the market will be RIPE for a correction, possibly a big one. We are not blasting through to new all time highs any time soon, and probably not until yearend.

You saw it here first.

And Janet, thanks again for that A+ in economics, and you owe me a phone call.

Global Market Comments

March 17, 2016

Fiat Lux

Featured Trade:

(APRIL 19 ATLANTA GLOBAL STRATEGY LUNCHEON),

(AMERICA?S NATIVE INDIAN ECONOMY),

(HOW TO EXECUTE A VERTICAL BULL CALL SPREAD),

(AAPL)

Apple Inc. (AAPL)