Global Market Comments

March 4, 2016

Fiat Lux

Featured Trade:

(APRIL 20 WASHINGTON DC GLOBAL STRATEGY LUNCHEON),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS),

(GAMING THE MARKET WITH MOMENTUM STOCKS),

(MTUM), (FB), (AMZN), (HD), (SBUX), (V), (SPY)

iShares MSCI USA Momentum Factor (MTUM)

Facebook, Inc. (FB)

Amazon.com, Inc. (AMZN)

The Home Depot, Inc. (HD)

Starbucks Corporation (SBUX)

Visa Inc. (V)

SPDR S&P 500 ETF (SPY)

Hardly a day goes by without a reader asking me which indicators I follow when determining my impeccable market timing.

The short answer is that there are hundreds, and the 50-year accumulation updates real time 24/7 in my head.

However, there is one in particular that is worth mentioning today. That would be the performance of momentum stocks.

Momentum stocks are shares that deliver a larger move in price, or beta, than the market as a whole. They tend to be the shares of high growth companies that deliver a reliable stream of positive earnings surprises.

In fact, they have earned a large following of traders, known as ?momentum investors.?

Call them the canaries in the coal mine.

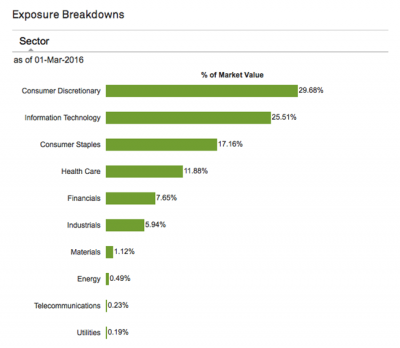

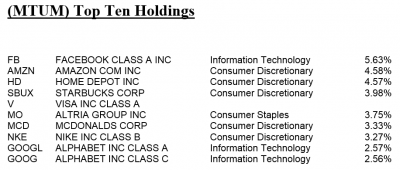

Look at the list of top ten holding below, and you will find many that you know and love, and are often the subject of Mad Hedge Fund Trader Trade Alerts.

Momentum stocks are attractive because they substantially outperform a more sedentary index, like the S&P 500 (SPY).

Momentum stocks can be a great leading indicator for the stock market as a whole.

When momentum stocks take off like a scalded chimp, it is a good idea to adopt a ?RISK ON? approach towards all of your asset selections.

When momentum stocks fail to reach new highs, it is a warning signal that the party is about to end and ?RISK OFF? assets are about to gain favor.

This is why I always keep a close eye on momentum stocks when assembling my own trading book.

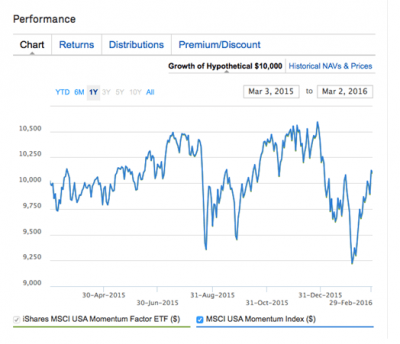

There is one really easy way to follow momentum stocks and that it to watch the iShares MSCI USA Momentum Factor ETF (MTUM) like a hawk.

The (MTUM) seeks to track the performance of an index that measures the performance of 122 U.S. large- and mid-capitalization stocks exhibiting relatively higher momentum characteristics than the main market, before fees and expenses.

This portfolio is then rebalanced every six months to reflect new market trends, and to deep six the losers.

If you want to see how well this works, just take a look at the chart below.

The (MTUM) is particularly attractive because its .15% expense ratio is the lowest among the several offerings in the marketplace.

The fund currently has $1.12 billion in assets, so it is taken seriously by the institutional community.

The trailing 30-day SEC yield is 1.16%, reflecting the fact that many of its holdings are non dividend paying technology and health care stocks.

To learn more about the details of the (MTUM) please click here .

And what are momentum stocks telling us right now?

That they have just had an incredible three-week run and are overdue for a rest.

Global Market Comments

March 3, 2016

Fiat Lux

Featured Trade:

(WILL ?BREXIT? CAUSE THE NEXT RECESSION?),

(FXB), (FXE), (UUP),

(A COW BASED ECONOMICS LESSON)

CurrencyShares British Pound Ster ETF (FXB)

CurrencyShares Euro ETF (FXE)

PowerShares DB US Dollar Bullish ETF (UUP)

?

Economists around the world have been scanning the horizon with their high powered Zeiss binoculars in search of the cause of the next global recession.

It has been a conundrum of the first order because a recession has NEVER taken place in the face of LOW interest rates and LOW oil prices.

However, we may have just found the trigger.

The possible impending departure of the United Kingdom from the European community has cataclysmic implications for economies everywhere.

We?ll know for sure when the referendum is held on June 23.

Yikes! I?ll be in England then!

The move is being driven by the same factors present in the American Republican Party presidential nomination race.

Working class Brits have lost jobs to a tidal wave of immigrants from the rest of the EC, whose common passports allow unfettered access to Old Blighty.

Take a weekend trip to London, and chances are that the desk clerk is from Poland, the porter is from Croatia, the waitress is from Italy, and the cleaning ladies are from Spain and Greece.

Actual Englishmen are to be found only in distant suburbs, or in unemployment offices.

The recent influx of immigrants from the Middle East has also placed a massive strain on the country?s social services resources.

Visit your local neighborhood National Health GP, and you will share the waiting room with foreign refugees missing arms or legs, or bearing near fatal combat injuries. It?s almost like visiting a wartime MASH unit.

Net net, the view is that EC membership is costing England jobs and money, probably in the billions of pounds per year.

As with the US, the populist view is at odds with the economic reality.

While the UK is a net contributor to the Brussels budget, that misses the point. It is greatly outweighed by the additional economic growth generated by EC membership.

Goods flow freely, duty free between all 23 member countries.

A manufacturer in Birmingham, Leeds, or Manchester doesn?t think twice about jumping on the Channel train to call on customers in Paris, Munich, or Copenhagen.

I often sit next to them during my summer continental travels and also get an update on whatever business they may be in.

A British departure would take nearly 20 years of business integration and dump it into the dustbin of history.

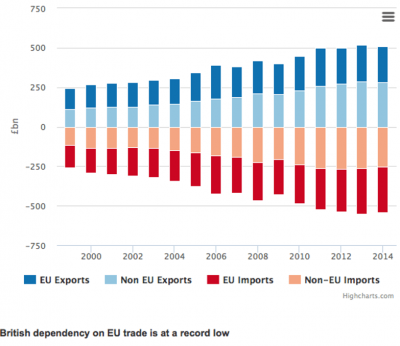

That would be a crushing loss for the British economy, which would lose much of the nearly ?200 billion pounds worth of exports it sent to the EC in 2015. These exports have grown at an impressive 3.6% a year for the past 15 years.

It would also deliver a fatal blow to the City of London, the financial center for all of Europe and one of its largest employers.

I can see the dominoes fall from here.

Europe would lose a similar amount of trade with the UK, taking a chunk out of GDP growth there.

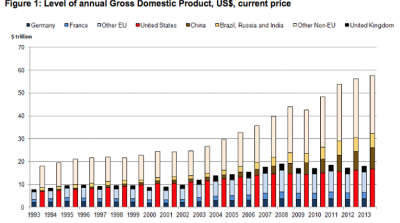

A weak Europe brings a stumbling China, which relies on the continent as its largest customer (yes, even bigger than the US). And a wobbling China will certainly torpedo US exports, increasing volatility in our own financial markets.

In fact, the EC is the world?s largest economic entity. It is hard to see trouble there not spreading everywhere.

The turmoil is already easily visible in the foreign exchange markets. The British pound (FXB) has suffered a gut churning 10.5% nosedive over the past four months to a new ten year low. It has also smothered in the crib the recent rally in the Euro (FXE).

A newly resurgent dollar (UUP) is starting to once again cast a shadow over US multinational earnings.

It seems like the UK is determined to shrink to a smaller country, either by hook or crook.? Only last year, Scotland mounted a campaign to split off from the UK, an effort that eventually failed.

However, it is another one of those cases of being careful what you wish for.

How do you spell ?GLOBAL RECESSION??

Caveat Emptor

I Don't See Anything Yet

I Don't See Anything Yet

?I think this is about Russia reasserting itself on the international stage, basically saying that Russia is back and is a force to be reckoned with.? I think we underestimated for a long time the extent of the humiliation that Russians felt after the collapse of the Soviet Union,? said former Secretary of Defense and CIA head Robert M. Gates.

Global Market Comments

March 2, 2016

Fiat Lux

Featured Trade:

(APRIL 15 HOUSTON STRATEGY LUNCHEON INVITATION),

(THE MAD HEDGE FUND TRADER?S 8TH ANNIVERSARY ISSUE)

Yes, it seems like it was only yesterday. But as of February 1 the Diary of a Mad Hedge Fund Trader has been going out to idea hungry investors now for eight long years.

And what an eight years it has been!

So I will take the opportunity to explain the murky history of this august publication, which is now visited by thousands of readers every day from 137 countries around the world.

I am weak in Mali and North Korea, but am working on that, as soon as they get electricity.

Way back in mid 2007, I was toying with the idea of launching another hedge fund, and started emailing global macro ideas to a list of potential investors. This grew into a daily commentary.

However, I was soon to discover that the regulatory and legal costs of launching a new fund had risen astronomically since the last time I did this in 1989.

The competitive environment had also changed dramatically. When I first started, there were only 20 hedge funds. Now there were 10,000, many with marketing teams in the dozens targeting large institutional clients and pension funds.

The bottom line was that it would cost a minimum of $10 million to get started, and I needed to raise at least $500 million in assets just to break even.

In other words, it was a young man?s game.

So I decided to post my comments on the Internet and see what happened.

Something happened.

First, I had to come up with a name. A quick search at the US Copyright Office records revealed that every possible combination of ?trading?, ?hedge fund?, ?macro?, and ?research? was already taken.

So, I modified the name of an obscure and long forgotten 1970 Alice Cooper movie, ?Diary of a Mad Housewife.? My friends laughed, so I ran with that.

Then, I had to build a website. After obtaining offers from professional website developers to do this for hundreds of thousands of dollars, I decided to try it myself.

With mere teenagers accomplishing this, how hard could it be?

So I spent $5 and bought a used copy of Website for Dummies from Amazon. My goal was to see if I could launch a profitable Internet business for free.

Months of laborious programming followed, where I literally constructed the site on a trial and error basis. Another $5 investment brought a copy of Online Commerce for Dummies. That got me into the arcane world of merchant accounts, search engine optimization, and SSL certificates.

I almost pulled it off. My total up front costs for the launch of the Diary of a Mad Hedge Fund Trader came to $500.

Finally, I put the letter up for sale on February 1, 2008 for $29 a month. I sold one subscription. I thought ?This was the height of hubris for me to think that someone would pay me money for my ideas on the Internet.?

Then a funny thing happened.

Other financial newsletters started stealing my stories. So I developed a business model that encouraged and profited from stealing.

I started posting pieces on sites that then linked back to my own website, like Seeking Alpha, Business Times, Huffington Post, and Zero Hedge.

It also helped that I got a hold of Google?s 50 page long patent for their search engine, and figured out how to make my site unusually sticky and discoverable by searches.

Traffic started to build.

Then in 2010, I decided to enhance the product. Readers were raving about my trading recommendations, so I decided to create a premium Trade Alert service for $2,000 a year. This was quite a leap of faith, as the price then was $499 a year.

This would give followers the exact details they needed to execute on my ideas, including price, number of contracts, ticker symbols, and potential P&L?s.

The idea was to make subscribers feel like they were sitting at the desk of a top hedge fund trader. We launched the product on November 1, 2010.

I was thinking that I might sell a dozen subscriptions by the end of the year. So I didn?t bother to build an online store, expecting to create one when the traffic grew.

I asked buyers to send checks instead.

Oops!

A week later, I happened to be driving by the post office, so I thought I would stop and pick up the mail. The postal clerk asked me to bring my truck around the back. I said I didn?t have a truck.

Some five minutes later, three out of shape postal workers were dragging a 50-pound mail sack across the floor. It was all for me.

I couldn?t believe it.

To make a long story short, we took in 6,000 checks for $2,000 each over the following three months. It was one of the greatest Internet marketing miracles in history. My $500 investment had suddenly turned into $12 million. Overnight, I become a part of Internet lore.

My entire family spent their Christmas vacation opening up letters and manually entering names and email addresses into an excel spreadsheet.

Then something even more amazing happened. Many checks came with effusive letters of thanks. Much to my amazement, readers had been making hundreds of millions of dollars in profits trading off of my advice.

I had no idea.

I learned of college educations I had funded, mortgages paid off, parents retired early, and uninsured chemotherapy treatments for kids paid off.

Some letters brought tears to your eyes, others laughs. I particularly remember the guy who thanked me for his new Toyota Tundra pickup truck, the luxury trailer that slept eight, the camos, and the AR-15. He was going to visit me on his first cross-country trip.

He did, and I still live to tell about it.

The problem then arose of what to do with the checks. My main bank was then in Las Vegas. I didn?t trust FedEx or UPS, so I stuffed $12 million in checks into a backpack and headed for the airport.

Standing in line, I wondered if the metallic strips on the checks would set off the metal detectors. What was my explanation to Homeland Security going to be as to why I was carrying $12 million in a backpack? Was this all some kind of elaborate money laundering operation? Was I a mafia courier headed for Vegas?

In then end, nothing happened. False alarm. Wild imagination.

Once in Sin City, I took a taxi straight for the bank. No, I was not tempted to head for a casino.

I dropped the backpack at the teller?s window and said ?Please deposit these, I?ll be back.? They said ?Oh no, you can?t go anywhere. You have to stand here and watch us individually deposit each and every single check.?

They put two clerks on it, and it took eight hours. Minutes before closing, they handed me back a fist full of checks, that were unsigned, undated, or made out to me personally. I closed my account there shortly thereafter.

We have since used every opportunity to add services and functionality for subscribers. It?s all about getting you, the customer, to make more money.

I added staff around the world. The text alert service, although expensive, accelerated the Trade Alerts to the speed of light, globally. Hedge Fund Radio made its debut. Then came the travel videos, which I promise to add to when I have time.

We are still growing, and looking for new ways to grow. I am always looking for ways to improve the product. Here next to Silicon Valley they like to say that ?As soon as you think you?re finished, you're finished.?

So true, so true.

Looking at my early letters can be quite amusing.

I strongly recommended that everyone protect their assets by piling into gold (GLD) at $900 an ounce (it went to $1,927). I also suggested traders sell short the dollar against the Euro at $1.40 (it went to $1.03).

There is also mention of Microsoft?s bid for Yahoo at $31/share. Jerry Yang later turned down the offer, and the stock plunged to $8, vaporizing $22 billion of market capitalization. It was one of the worst business decisions in history.

Does the quality of any of these tips sound familiar?

Finally, I want to thank the thousands of subscribers who have supported my research over the years and supported a lifestyle that would make Jay Gatsby envious.

Regards,

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

March 1, 2016

Fiat Lux

Featured Trade:

(MARCH 2 GLOBAL STRATEGY WEBINAR),

(THE CODER BOOM),

(THERE ARE NO GURUS)

Global Market Comments

February 29, 2016

Fiat Lux

(SPECIAL PROGNOSTICATION ISSUE)

Featured Trade:

(WHAT IS THE CNN FEAR & GREED INDEX?),

(ORDER EXECUTION 101),

(AND MY PREDICTION IS?.),

(TESTIMONIAL)