Global Market Comments

February 19, 2016

Fiat Lux

Featured Trade:

(HOW THE REST OF 2016 WILL PLAY OUT),

(SPY), (AAPL), (PANW), (BAC), (GILD),

(TLT), (TBT), (HYG), (AMLP),

(FXE), (FXA), (FXC), (CYB),

(FCX), (GLD), (SLV), (ITB)

(A NOTE ON THE MARCH OPTIONS EXPIRATIONS)

SPDR S&P 500 ETF (SPY)

Apple Inc. (AAPL)

Palo Alto Networks, Inc. (PANW)

Bank of America Corporation (BAC)

Gilead Sciences Inc. (GILD)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares iBoxx $ High Yield Corporate Bd (HYG)

Alerian MLP ETF (AMLP)

CurrencyShares Euro ETF (FXE)

CurrencyShares Australian Dollar ETF (FXA)

CurrencyShares Canadian Dollar ETF (FXC)

WisdomTree Chinese Yuan Strategy ETF (CYB)

Freeport-McMoRan Inc. (FCX)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

iShares US Home Construction (ITB)

Traders and investors can be excused for being confused, befuddled, and clueless about the future direction of all asset classes after the trading violence of the first six weeks of 2016.

$500 points down!

$400 points up!

Ten year Treasury bond yields at 1.55%!

Negative interest rates in Japan!

Oil hits $26!

HELP!

Professional Investment Advisors have seen their phones ring off their hooks, with no clear answers to give nervous clients.

As for me, the future direction of every asset class for the balance of 2016 is as clear as the view from my mountaintop aerie today. I can even see both the distant Farallon Islands and the snow covered High Sierras without a telescope from where I sit.

I?ve seen all this before.

Every decade or so, we get a year like this one.

In 1962, the Cuban Missile Crisis promised to bring us nuclear Armageddon.

I remember 1968 like it was yesterday. The Vietnam War was in full swing, and we were losing 2,000 men a month. My turn was coming up.

Martin Luther King was assassinated in Memphis, and Robert Kennedy was shot the night he won the California Democratic presidential primary.

1974 gave us Watergate, the US government cut its last ties with the gold standard, and the barbarous relic soared.

That led to free floating exchange rates, the money-making opportunity of the century. We all became experts in anything foreign very quickly.

Then came 1979.

We were subjected to the prolonged torture of the Iran Hostage Crisis, when more than 60 staff from our Tehran embassy were held for 444 days. The US economy was in a deep, long-term funk. The world thought we had become weak.? Post Vietnam American military strength reached a nadir.

No one in the industry will forget the 1987 crash. Note: after a one-day 20% fall, stocks resumed a bull market that lasted 13 more years. Take that as a hint for the future.

I?ll never forget 1998, when Russia defaulted on its debt, and Long Term Capital Management went bust. The Volatility Index (VIX) rocketed to $42, and stayed there forever. The first funds shorting technology stocks started going under.

I don?t need to remind you of 2008, as most of you were around. My readers and I made a fortune then on the short side. But for most traders and investors the scars still run deep.

And now it is 2016!

You already know what has happened so far since the stork brought in the New Year. So I?ll focus on an asset class by asset class breakdown of what?s coming next.

Stocks: We have just defined the trading range for the next six months. After breaking down from $202, we plunged to the $1,812 Overture low on February 11. I remember sitting in my Incline Village home watching my screens thinking ?This is the low for the year.?

From here we will see a succession of lower highs and higher lows, creating a giant triangle formation on the charts. Watch out for false breakouts and breakdowns along the way engineered by high frequency traders.

Then institutional investors will return from their summer vacations, realize that stocks boast a PE multiple of 15 times and pay a 2%-3% dividend in a NIRP (negative interest rate policy) world. They put on their buying boots and break the market out to a new all time high by year end, but not by much.

Buy the sectors that will lead, especially banks (BAC), technology (AAPL), and biotech (GILD).

Bonds: The double top is in, as is screamingly obvious from the long term chart below. Japan?s move to NIRP, and the negative yield on the ten year there gave us our final capitulation top in prices and low in yields at 1.55%.

Double digit yielding junk bonds (HYG), energy MLP?s (AMLP), and emerging market bonds (ELD) offer the best value in a decade. Buy the (TBT).

Foreign Exchange: Without any further Fed interest rate rises this year, the dollar will roll over and fall asleep. It won?t crash, it will just go dormant. Currencies will gain (FXE), (FXA), (FXC), but not by much. Hedge fund dreams of a collapse in the Chinese Yuan (CYB) will be shattered. It will be a low volatility year for currencies from here.

Energy: The bottom is in for oil, but expect multiple tests of the $26 a barrel level before anyone believes it. High frequency traders may even give us a momentary false breakdown to $24.

That means there is a potential 70% move up in the cards to my $44 target. Volatility will reign supreme. Now that the Saudis, Russians, and Iranians are talking, it could still take years for demand to catch up with supply.

Think China.

Commodities: The bottom is close, if not behind us. Copper is obviously putting in a head and shoulders bottom on the charts, as are iron ore, zinc, and even some grains. When it?s cheaper to buy commodities on the floor of the New York Stock Exchange than in mines and pits, it is time to buy their shares.

Precious Metals: The bottom is in here too. Assets emerging from five-year bear markets don?t have much downside risk, a newly popular concept. Gold also does tremendously well in a NIRP world, as there is no opportunity cost for holding the yellow metal.

Agriculture: Avoid. Not even El Nino can help this despised asset class. After all, they grow like weeds. Avoid.

Real Estate: The last bull market lives, thanks to interest rates lower than anyone imagined possible. The 30-year fixed rate conventional mortgage at 3.50%? And now a two decade long demographic tailwind is about to kick in.

Calling all Millennials! Go forth and multiply!

There, I?ve made it easy for you. Thank you for your support.

Adjust your portfolios accordingly.

There, I?ve Made It Easy for You

There, I?ve Made It Easy for You

We have the February options expiration today and have the good fortune to see two positions in our model trading portfolio expire at their maximum potential profit point.

Those who held on through the dog days last week will be richly rewarded. Good job, and on to the next trade. You are one of the fortunate few who are up on the year.

Those include the:

(SPY) February $173-$178 deep in-the-money vertical bull call spread

(up +10.62%)

(SPY) February $176-$181 deep in-the-money vertical bull call spread

(up +9.56%)

We also have a March options position that is deep in the money and expires in 25 trading days, and I just want to explain to the newbies how to best maximize their profits here as well.

This comprises:

The S&P 500 (SPY) March $170-$175 deep in-the-money vertical bull call spread with a cost of $3.95.

As long as the (SPY) closes at or above $175.00 on Friday, March 18, the position will expire worth $5.00 and you will achieve the maximum possible profit.

This will work out to a 26.58% gain in seven weeks, not too shabby in these peripatetic times. Better that a poke in the eye with a sharp stick, as they say.

In this case, the expiration process is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

Your broker (are they still called that?) will automatically use the long call to cover the short call, cancelling out the positions. The profit will be credited to your account on the following Monday, and the margin freed up.

Of course, I am watching these positions like a hawk, as always. If an unforeseen event causes the (SPY) to crash once again, such as if Janet Yellen suddenly, and shockingly, raising interest rates, you should get the Trade Alert in seconds.

If the (SPY) expires slightly out-of-the-money, like at $174.90, then the situation may be more complicated, and can become a headache.

On the close, your short call position expires worthless, but your long call position is converted into a large, leveraged outright naked long position in the (SPY) shares with a net cost of $173.95.

This position you do not want on pain of death, as the potential risk is huge and unlimited, and your broker probably would not allow it unless you put up a ton of new margin.

This is not what moneymaking and risk control is all about.

Professionals caught in this circumstance then sell short a number of shares of (SPY) on expiration day right at the close equal to the long position they inherit with the expiring $170 call to hedge out their risk.

Then the long (SPY) position is cancelled out by the short (SPY) position, and on Monday both disappear from your statement. However, this can be dicey to execute going into the close and requires a level of expertise most of you don?t have.

So for individuals, I would recommend just selling the March (SPY) $170-$175 call spread outright in the market if it looks like this situation may develop and the (SPY) is going to close very close to the $175 strike.

Keep in mind, also, that the liquidity in the options market disappears, and the spreads widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

As of this writing, this position looks pretty safe as it is a full 18 points in the money. But a lot can happen in 26 days.

Well done, and on to the next trade.

Well Done and On to the Next Trade

Well Done and On to the Next Trade

Global Market Comments

February 18, 2016

Fiat Lux

Featured Trade:

(MY MOST DANGEROUS ADVENTURE EVER),

(BRING BACK THE UPTICK RULE!)

I was walking into the post office here in Incline Village, Nevada when I came across three little old ladies sitting at a card table.

One asked ?Have you registered yet for the February 20 Nevada caucus??? I answered that I was an independent, as I didn?t trust anyone. That meant I couldn?t vote in either Nevada primary.

We got to talking.

They thought it was fascinating that my dad was the head of the Republican Party in Southern California during the 1950?s, that I worked in the White House under president Ronald Reagan, and had met 9 out of the last 11 US presidents (missed Johnson, who died young, and George W. Bush, who never came to California).

They mentioned that the Republican Women?s Association was having a debate party this coming Saturday night.

Would I like to come?

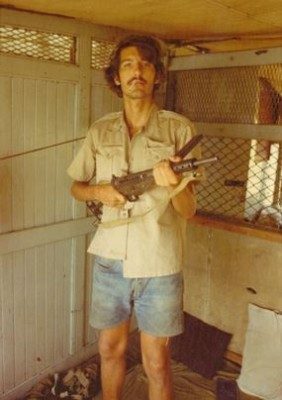

Throughout my life, I have never turned down a mission, no matter how dangerous or suicidal.

This would be a particularly risky venture, as Nevada is not only a pro gun state, it is an active gun using state. Every other pickup truck has a gun rack in the back window holding a high-powered rifle or a shotgun.

And who knows what the ladies are packing in their purses?

I said I?d love to come.

I then called my office in Florida and cautioned them that if they didn?t hear from me by Tuesday morning they should call the Incline Village police department and have Tahoe Search and Rescue look for my bullet riddled body.

Given the age of the members, it was an early event, starting at 6:00 PM at a local bar. I sat down at a table with four couples, all over seventy, nursing amber ales.

While the Republican debate went on in the background on a big screen TV through the haze (indoor smoking is still legal in Nevada, as is everything else), I started to solicit their views.

I asked what was the big deal about Hillary Clinton.

?Benghazi!? They shouted in unison.

But doesn?t the Republican Women?s Association have an interest in women?s? rights?

?Email server!? they responded in kind.

Not even equal pay for equal work?

?Benghazi!? they repeated, with more passion.

But what about global warming? Every Republican candidate is a card carry denier on an issue most Americans are concerned about.

?Email server!?

So given a choice between Hillary and Donald Trump, the primary frontrunner, who would they vote for?

One woman said she would vote for Trump because she liked a ?strong? candidate. The others said they wouldn?t vote at all.

I asked a number of other questions.

Here were the answers:

?Benghazi!?

?Email server!?

?Benghazi!?

?Email server!?

I couldn?t help but point out that whoever the Republican candidate was, they would lose if they ran their campaign on ?Benghazi!? or ?Email server!? The average American doesn?t have the slightest interest in any of these issues.

At this point, my hosts were glumly staring into their ales. I decided that I had worn out my welcome and made for the door while I still could.

Republican predictions of election outcomes are wildly inaccurate, because they only talk to each other, or others who agree with them, always an invitation for disaster.

This is why it came as a complete shock when they lost the popular vote in six out of the last seven presidential elections, soon to be seven out of eight.

The real problem is that Republicans spend two years proving to the base how conservative they are to win the primary, and only two months to move to the middle and win the national election. Not all the money in the world can pull off that swing.

The one out of six elections the Republicans won was in 2004, for George W. Bush?s second term, which is always a lay up. He only won by a narrow 3 million votes.

The Citizen?s United Supreme Court decision, which allowed unlimited anonymous campaign donations, put a turbocharger on this trend. It made available unlimited funds to even the weakest candidates. It thus forced frontrunners to become more shrill and radical to get the necessary media attention.

That created this year?s Republican Primary circus, which has offended and appalled their entire country, it not the world.

Therefore, I believe that Citizen?s United will ultimately lead to the destruction of the Republican Party, unless a future more liberal Supreme Court repeals it.

Adjust your long-term portfolio accordingly.

Oh, and before I left the bar, I paused at the door, just in case anyone was following me.

You never know.

Which One Will It Be?

Which One Will It Be?

Global Market Comments

February 17, 2016

Fiat Lux

Featured Trade:

(WHY I?M BUYING THE EURO),

(FXE), (UUP), (DXJ), (RSX), GREK),

(THE CASE FOR EUROPE),

(FXE), (DXJ), (RSX), GREK),

(OPTIONS FOR THE BEGINNER)

CurrencyShares Euro ETF (FXE)

PowerShares DB US Dollar Bullish ETF (UUP)

WisdomTree Japan Hedged Equity ETF (DXJ)

Market Vectors Russia ETF (RSX)

Global X FTSE Greece 20 ETF (GREK)

?

I am used to my readers thinking that I have gone ?Mad?, am out of my tree, or have started smoking California?s number one cash crop (hint: it?s not almonds).

Such was the abuse that I received last week when I demanded they buy oil at $28 a barrel last week. After all, no other authority than Barron?s said it would imminently plunge to $20.

By the way, I kicked those call options out this morning with a three day, 23% profit. Buy the rumor, sell the news.

I got similar levels of thankless abuse this morning when I then told them to buy the Euro (FXE).

WHAT? COME AGAIN?

I think the Euro (FXE) has just entered a new uptrend against the US dollar (UUP).

We have spent over a year putting in a bottom for the beleaguered continental currency at $103, which right now, looks like it is holding like the Rock of Gibraltar.

If you can?t trade options here, just buy the (FXE) outright for a move to $116 in coming months.

We broke through the 200-day moving average to the upside two weeks ago, and are falling back to test that line. The old resistance at $108.49 is the new support.

ECB president, Mario Draghi, has once again threatened further stimulus in March to keep the continent?s meager growth rate growing. That gave us a $2.4-point pull back today from the recent top, and a nice entry point for this call spread.

However, past experience has proven that Mario is a better talker than a doer.

Not only that, what quantitative easing Mario Draghi has already implemented seems to be working. The latest Euro Zone GDP growth rate came in at 0.30%, not exactly robust, but better that the negative numbers we saw last year.

All we need now is for China, Europe?s biggest customer, to post some better economic numbers, and it will be off to the races for the Euro.

Now that the prospect of further interest rate rises by the Federal Reserve has been thrown out the window, the dollar has run out of appreciation fuel.