Global Market Comments

July 7, 2015

Fiat Lux

Featured Trade:

(MY BRIEFING FROM THE JOINT CHIEFS OF STAFF), (XLK),

(WHY THE JGB MARKET MAY BE READY TO COLLAPSE),

(FXY), (DXJ), (EWJ)

The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (XLK)

CurrencyShares Japanese Yen Trust (FXY)

WisdomTree Trust - WisdomTree Japan Hedged Equity Fund (DXJ)

iShares, Inc. - iShares MSCI Japan ETF (EWJ)

Global Market Comments

July 6, 2015

Fiat Lux

SPECIAL GREEK DEFAULT ISSUE

Featured Trade:

(CASHING IN ON THE GREEK CRISIS),

(SPY), (TLT), (VIX), (FXE), (FXY), (GLD), (SLV)

SPDR S&P 500 ETF Trust (SPY)

iShares Trust - iShares 20+ Year Treasury Bond ETF (TLT)

VOLATILITY S&P 500 (^VIX)

CurrencyShares Euro Trust (FXE)

CurrencyShares Japanese Yen Trust (FXY)

SPDR Gold Trust (GLD)

iShares Silver Trust (SLV)

Try as I may, there is absolutely no way to escape a financial crisis in the modern world anymore, not even in the dusty, remote Western Sahara village of Taghazout, Morocco.

There is an Ebola Virus outbreak 1,000 miles to the south, and 35 British tourists were massacred on a beach in neighboring Tunisia last week. There were exactly four passengers on my flight from Lisbon to Morocco.

Was it a warning, or a confirmation of hubris?

Starving stray dogs and cats wander the street, garbage lines the beach, and raw sewage seeps into the ocean. Rangy, two humped camels vainly await riders at the edge of town.

But satellite dishes sprout from the rooftop of even the most forlorn, impoverished, broken down cinder block structures, and the hum of the global markets is never more than a few channels away.

The CNBC here is available only in Arabic, and is fiercely competing with Omani soap operas and the Iraqi Business Channel (yes, despite ISIS, there is such a thing).

But it didn?t take me long to figure out that the people of Greece rejected the ECB latest bailout proposal by an overwhelming 61.5% to 38.5% margin.

It was no surprise to me.

You would think that voting against punishingly higher taxes and an excruciatingly longer recession was a no brainer. But the markets were expecting otherwise, and have been caught seriously wrong footed. Poor summer liquidity is exacerbating the moves.

My somewhat passable French enabled me to discern that the prices were taking it on the nose. Japan and China each dove 2%, while Australia and the Euro pared 1% apiece.

This was going to be a ?RISK OFF? day on steroids.

Suddenly, I smell opportunity everywhere.

Now we know the kneejerk response to an imminent Greek default.

However, the cold, harsh reality of the situation requires a little deeper analysis.

CNN was utterly useless, choosing instead to focus on the human side of the tragedy, the freshly impoverished Greek goat herder and the island hotel operator who can?t pay his staff.

No great insight there.

Greek citizens are now limited to withdrawing 60 Euros a day from an ATM, if they can find one that has any cash at all. To head off a certain run and Armageddon, the Greek banks have all been closed for a week, with no reopening in sight.

Thousands of foreign tourists are now stranded in the land of moussaka, retsina, and Zorba, cursing their vacation destination choice.

So I?ll refer to my May conversation with former Greek Prime Minister, George Papandreou, who ran the country from 2009 to 2011, and shepherded the country through the post financial crisis 2010 debacle.

His late father, Andreas, was also a Prime Minister, as was his grandfather, Georgio, who spent time in jail for his services, consider running this ungovernable country the family business.

To a large extent, the ECB (read the Germans) are in a subprime crisis entirely of their own making.

German banks provided funds to their Greek counterparts, initially to build the $8 billion 2000 Athens Olympics, which was almost entirely subcontracted to German engineering firms.

They then fueled the economic boom that followed, making possible the export of tens of thousands of Mercedes, BMW?s and Volkswagens. That bankrolled a major increase in the Greek standard of living, while adding several points to German GDP growth.

When dubious financial statements were presented to justify this lending binge, bankers simply winked, and looked the other way.

A decade and a half later, they are ?shocked, shocked? that some of the accompanying disclosures were inaccurate, as police inspector Claude Rains might have said in Casablanca (which, by the way, is only 400 miles north of here).

?Gambling in the casino? Perish the thought.? How do you say that in German?

The reality is that this is all a storm in a teacup. Accounting for only 2% of European GDP, it is neither here nor there whether the country stays or goes from the European Community or the Euro.

Total Greek debt to the ECB is now $3.5 billion, a drop in the bucket in the global scheme of things.

What?s more, this crisis is far less serious than the ones that occurred in 2010 and 2012. This time around, Greek bonds have already been taken off the books of German and French banks at cost, and placed with numerous multinational agencies, largely the ECB itself.

What is almost completely lacking here is private risk, unless you happen to own a Greek bank, or the shares of other Greek companies.

What?s more, all of this is happening in the face of a massive 60 billion a month ECB quantitative easing program. The amount Greece owes comes to less than two days worth of this amount.

Never take a liquidity crisis in the middle of a structural global cash glut too seriously.

Even this paltry amount can be easily refinanced by the International Monetary Fund on a slow day. That?s what they are there for.

This pales in comparison to the 39 billion euros spent to bail out the Spanish banking system a few years ago, or the $4 billion IMF rescue of the United Kingdom in 1976.

In the end, the amounts are sofa change to the Chinese, who are starved for high yield investments. It was they who nailed the top of the last European bond yield spike (on my advice, I might add), acting as the buyer of last resort then.

In the end this will be solved, as have all international debt crises since time immemorial, since the British seized the Suez Canal from the French as collateral for bad debts in 1882. Extend and pretend. Move debt maturities out another ten years and hope everything gets solved by then.

It always works.

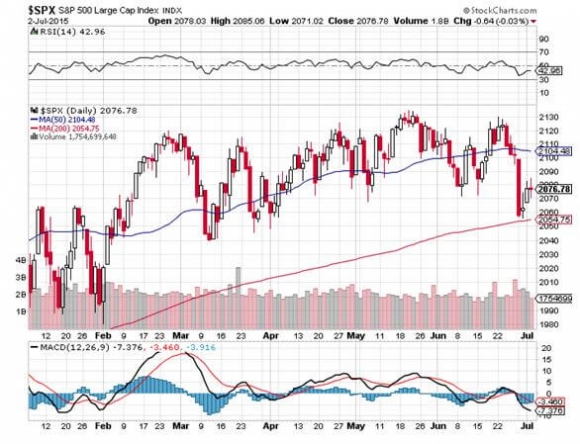

What all of this does do is create a great buying opportunity for the assets not directly involved in this crisis, notably US equities. Modest over valuation has encumbered main indexes with declining volumes, narrowing breadth, and shrinking volatility for all of 2015.

At the very least, the Euro crisis du jour will present a second test of the (SPY) 200-day moving average at $205.74. The best case is that it gives us a real gift, a visit to a full 10% retreat to $193, a pullback whose ferociousness has not been seen since October.

That?s where you load the boat for a rally to new index highs at yearend.

You can expect similar moves in other assets classes.

In this scenario, volatility (VIX) will rocket to 30%. The Euro (FXE) collapses to $103 once more, and the Japanese yen (FXY) revisits $82. Treasury bonds (TLT) enjoy a flight to safety bid that takes yields at least back to 2.30%. Gold (GLD) and silver (SLV) do nothing, as usual.

For followers of my Trade Alert service, this is all a dream come true. Having made 26.71%, or much more, in the first half of this year, you now have the opportunity to repeat this feat in the second half.

Going into a crisis like this with 100% cash and only dry powder is every trader?s wildest fantasy. Make sure you let the current Greek debt crisis play out before you commit.

This is what you all pay me for. At least I?ll get something for suffering through the hell holes and gin joints of West Africa.

I think I?ll go give those camels some business.

Retsina

Retsina

Global Market Comments

July 6, 2015

Fiat Lux

Featured Trade:

(JULY 22 MILAN, ITALY GLOBAL STRATEGY LUNCHEON)

(THE SOLAR ROAD REVISITED)

?The Solar Road Revisited?. Somehow this modernized version of Bob Dylan?s epic folk album doesn?t quite ring true when couched in terms of our hyper accelerating 21st century technology. Perhaps a Millennial bard will improve on this in the future on iTunes, Pandora, and Beats, of course?

Yet, such a futuristic invention has already been created, is raising money through crowdfunding, and even landed a small Federal Highway Administration grant.

We live in an age of exploding technologies. So, when I find some that are especially interesting, offer a potential long term impact on the global economy, or present immediate investment opportunities, I am going to update you in this newsletter.

One common complaint I hear during my road shows is that we are moving into the future so fast, that it is getting increasingly hard to keep up. That is, unless you live within sight of Apple (AAPL), Google (GOOG), Twitter (TWTR), and Facebook (FB) headquarters, which I do. These companies all have venture capital arms, which fund many of these things.

Sandpoint, Idaho based engineers Julie and Scott Brusaw are the founders of Solar Roadways, a tiny engineering company that seeks to convert the American highway system from old fashioned asphalt and concrete to tempered glass and LED?s.

They have raised $2 million through the crowdsourcing website Indiegogo, which saw its amazing videos on the project go viral and attract 15 million views (https://www.indiegogo.com/projects/solar-roadways ).

Caution: conservatives may want to avert their eyes during all of the global warming, anti gasoline, and tree hugging references. But this stuff raises big bucks in California.

What can solar roads do? Obviously, the green hexagonal panels they are made of convert sunlight into electricity, heating roads so they can remain free of ice and snow all year. I could really use that up at Lake Tahoe.

Surplus power can be sold to local utilities to pay for it. Electric cars, like my Tesla Model S-1 (TSLA), can recharge their batteries just by parking on it, as my toothbrush already does in my bathroom.

You can program the LED?s to embed changeable road signs, borders, parking lots, and crosswalks. They can highlight crossing animals (200 deaths a year now in the US), or impending road obstructions.

They can even display layouts for every kind of sport (basketball, tennis, etc). The glass can be cast to give it a better grip than contemporary roads. Highway deaths would plunge, as would insurance costs.

Driving trucks on glass? The material is so strong that it can support the heaviest, or some 62 tons. My question, can handle steel caterpillar tractor treads used in road repair equipment?

Of course, it always comes down to cost with these new technologies, many of which remain pie in the sky forever. Estimates are that these roads cost 50%-300% more than existing ones. Large-scale construction would bring that down through economies of scale via mass production. The design is really quite simple.

The vision is big. It would probably cost over $1 trillion just to pave over the existing 48,000 miles of the interstate highway system. Tens of thousands of blue-collar jobs would be created. It all sounds like a massive public works project would be required, of Rooseveltian, CCC magnitude.

This just gives you a flavor of the incredibly interesting things going on here in the San Francisco Bay area, which I learn about on a daily basis. Check out the site, if only to see the future of start up funding.

You can contribute $5, or just buy a tote bag.

Somehow, It?s Just Not the Same

Somehow, It?s Just Not the Same

Global Market Comments

July 2, 2015

Fiat Lux

Featured Trade:

(JULY 13 MARRAKESH, MOROCCO GLOBAL STRATEGY LUNCHEON)

(WHERE THE ECONOMIST BIG MAC INDEX FINDS CURRENCY VALUE),

(FXF), (FXY), (FXA), (FXE), (CYB)

(CATCHING UP WITH DOWNTON ABBEY),

(TESTIMONIAL)

CurrencyShares Swiss Franc Trust (FXF)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares Australian Dollar Trust (FXA)

CurrencyShares Euro Trust (FXE)

WisdomTree Trust - WisdomTree Chinese Yuan Strategy Fund (CYB)

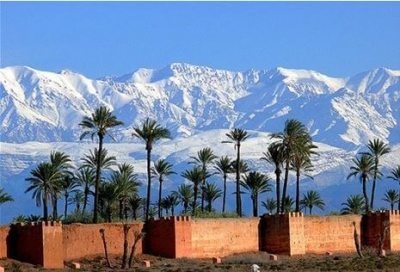

Come join me for lunch for the?Mad Hedge Fund Trader?s?Global Strategy luncheon, which I will be conducting in Marrakesh, Morocco on Monday, July 13, 2015. A three-course lunch will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $277.

I?ll be arriving at 11:30 AM and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive mud walled?riad?in the historic Medina district, an impenetrable maze of ancient souks and alleyways. Believe it or not, you can find this place with your Google mapping app. The precise location will be emailed with your purchase confirmation.

I have been assured that the air conditioning there works, as the temperatures can range up to 135 F degrees during the summer.

Marrakesh is a 1,000-year-old caravan stop on the edge of the Sahara Desert on the storied route to Timbuktu. During the 14th?century, it was the seat of the early Moroccan kings.

It has long been an entrepot for the trading of gold, spices, dates, ivory, guns and slaves. With this trip we will be adding investment advice to that list.

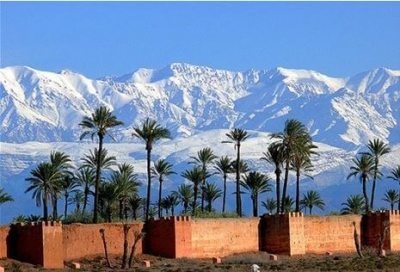

The pink city, just east of the snow-capped Atlas Mountains is one of the most interesting cities in the world, and should be on everyone?s bucket list.

Every evening, snake charmers, magicians and acrobats put on a show for the customers of 100 open-air food stalls at the?Djemaa el-Fna?square. The event is listed as a United Nations World Heritage Site.

Palm oases dot the outside of the town. Today, many of the old shops have been converted to designer boutiques. Berber rugs and leather slippers are sought after items. I have been visiting here since 1968.

Morocco is one of the few Islamic countries that has so far been free of terrorist attacks. However, traffic is down from last year, as are prices, thanks to the ISIS invasion of Iraq. French is widely spoken, so be sure to have the app installed on your iPhone.

If you have extra time, be sure to visit the spectacularly ornate Koutoubia Mosque. Women are required to wear a scarf, and men trousers.

It is not advisable for women to travel alone in North Africa.

Marrakesh can be reached via Royal Air Maroc with a transfer in Casablanca (click here for their site at?http://www.royalairmaroc.com/us-en), which will happily bill your credit card in Euros. Alternatively, you can take a sleeping compartment on the overnight Marrakesh Express from Tangier (yes, it really exists!).

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheon, please?click here.

Global Market Comments

July 1, 2015

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE JULY 2 LISBON, PORTUGAL GLOBAL STRATEGY LUNCHEON)

(THE BEST FINANCIAL BOOK EVER),

(A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy luncheon, which I will be conducting in Lisbon, Portugal on Thursday, July 2, 2015. A three course lunch will be provided.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $257.

I?ll be arriving at 11:30 A.M. and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive restaurant in the elegant Chiado district of the city that will be emailed with your purchase confirmation.

Take an extra day, and you can explore the hillside capitol?s intriguing neighborhoods.

Stroll the picturesque plazas of the riverfront Baixa area. Get lost in the medina like lanes of Alfama that date back to the 13th century Islamic period. Hit the swanky designer shops of Chiado. Belem still has traces of its 15th century colonial origins.

You can also get a decent workout climbing to the mountaintop Castelo de Sao Jorge and investigate its medieval fortifications. Then end you day with a world class bottle of port or rose.

The lunch will be held at a private club on St. James?s Square, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

Global Market Comments

June 30, 2015

Fiat Lux

Featured Trade:

(JULY 1 GLOBAL STRATEGY WEBINAR),

(AUGUST 3 ZURICH, SWITZERLAND GLOBAL STRATEGY LUNCHEON)

(THE NEW COLD WAR)

(WHY I LOVE/HATE THE OIL COMPANIES), (XOM), (USO)

Exxon Mobil Corporation (XOM)

United States Oil Fund LP (USO)