Since I am in a major patting myself on the back mood, I thought I would rerun a piece I ran last October entitled ?Apple is Ready to Explode?. This is back when the shares were trading at a lowly $490 a share.

Since then I have been urging readers to get in on the long side at every opportunity. They are now up a mind boggling 43% from that timely recommendation. They are laughing all the way to the bank.

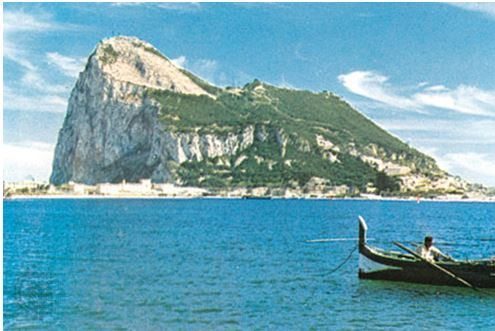

?You have to be impressed how Apple shares have been trading during the Washington shutdown and the debt ceiling crisis. While other highflying technology stocks have crashed and burned, Apple has held like the Rock of Gibraltar.

Is this presaging much better things to come?

After the bar was set extremely low in the run up to the iPhone 5s launch, there has been an onslaught of good news. The first weekend sales came in at a staggering 9 million units, nearly double analyst forecasts. That?s a lot of units to be wrong by.

This has led to a series of broker upgrades by Cantor Fitzgerald, Cowen & Co., Piper Jaffray, Sanford Bernstein, and most recently by Jeffries. Entrenched bears are slowly an inexorably turning into bulls. Targets range up to $780.

During the summer, when the shares were trading in the low $400?s, Apple emerged as the largest buyer of its own stock. Still, it only made a dent in the $60 billion the company has dedicated to the program.

Of course, corporate raider and green mailer Carl Icahn (he lived in my building in Manhattan and was always a bit of a jerk) wants Apple to buy $160 billion of its stock, about $36% of the total market capitalization. But with a position of only $2 billion, Carl doesn?t have enough skin in the game to get anything more than a free dinner from CEO Tim Cook.

Still, the more Icahn bangs the drum about the value of Apple, the more money he sucks in. His blustering has probably added about $50 to the stock price. That works for me.

Like the Origin of the Universe and the 105-year long losing streak suffered by the Chicago Cubs baseball team, the cheapness of Apple shares is one of those mysteries that baffles investors. Sure, you?d expect some natural profit taking after the meteoric 15 year run in the shares, from $4 to $707. But a 46% drawdown is a lot, and many would say too much.

The company has eye popping net profits of $3.5 million per business hour (click here for the most recently quarterly announcement). Some one third of it capitalization, or $150 billion, sits in cash in European bank accounts.

That works out to $165 of the current $490 share price. This brings the ex cash trailing price earnings multiple down to a subterranean 11.8 times, or a 25% discount to the 16X market multiple. The dividend yield of 2.5% still exceeds that of the ten year Treasury bond. This is absurdly cheap.

Anyone who makes their living looking at the numbers has been loading up on the stock for the past eight months. Even permabear and short seller, Jim Chanos, has been buying on the theory that both Apple, and competitor Samsumg, together have been demolishing the Wintel architecture.

I think there is something important going on here. Apple is bringing out the next generation iPad in two weeks. Product refreshes for the iMac, Macbook, and Airbook in coming months are already well known. Every time an announcement of an announcement is made, the stock spikes $10.

But the 800-pound gorilla in Apples earnings stream is the iPhone, which accounts for more than 70% of its profits. The wildly successful 5s and 5c launches will take total smart phone sales from around 36 million in Q3 to at least 56 million units in Q4. The analyst community is nowhere near these numbers, so they are substantially underestimated the profitability of the company.

Apple has already cracked the China market for cash buyers with the latest upgrade of its wireless operating system. The whale here is a deal with China Mobile (CHL) with its 740 million customers, which has been to subject to on again and off again negations for years. Still, Apple has already told its manufacturers to add china Mobile to its approved carrier list.

I think the stock is beginning to discount the launch of the iPhone 6, which is still a distant 11 months away. That will take the company another generation ahead, with an expansive six-inch screen and a blazing fast A8 processor, leaving competitors in the dust.

The business is so big that my favorite airline, Virgin America, has initiated nonstop service from San Francisco to Austin. I?m told the plane is always full. That?s where they make processors for the new phones.

All of this leads me to believe that Apple will be a major mover in 2014. The chip shot is $600, and we get a real head of steam into the iPhone 6 rollout, we could match the old high at $707.

You can buy the stock here with some comfort. If you are hyper aggressive, try playing the weekly call options on the next breakout. The more cautious can settle for the Technology Select Sector SPDR ETF (XLK), or the ProShares Ultra Technology 2X leveraged ETF (ROM). Apple has major weightings in both of these ETF?s.?

For the link to the original story, please click here.

So Where is the Power Button on this Thing?

So Where is the Power Button on this Thing?

Global Market Comments

August 19, 2014

Fiat Lux

Featured Trade:

(WHY WE DON?T CARE ABOUT OIL),

(USO), (UNG)

(AUSTERITY HITS WALL STREET)

(THE TWELVE DAY YEAR)

United States Oil (USO)

United States Natural Gas (UNG)

This year, your bonus is that you get to keep your job. That is the bad news that will be dished out to many disappointed staff during annual reviews at the major Wall Street firms this year.

We all know that volumes have been trading at subterranean levels, which have created a real draught of commission incomes. New regulations imposed by Dodd-Frank and the Volker rule mean that banks have to become boring, no longer able to juice earnings with trading revenues.

For boring, read less profitable, leading to smaller budgets for compensation. This is the price of preventing banks from committing suicide with your money in hand.

Industry compensation experts are seeing bonus cuts of up to 40%. Bond trading divisions are seeing the greatest cuts, reflecting a generational peaking of bond prices and volumes. Next is anything related to home mortgage origination and precious metals?

Senior staff is being nudged toward early retirement to further reduce overhead. Only private wealth managers are seeing pay increases, thanks to their ability to charge rich fees for enhanced customer service and place high margin products, like local municipal bonds.

The scary thing is that shrinking payouts is a trend that could continue for years. When I first started working on Wall Street 40 years ago, one out of three taxi drivers were brokers recently rendered jobless by deregulated commissions. Rates of 25 cents a share supported a lot of fluff.

Be careful next time you cross the street. You might get hit with some free investment advice.

Did You Say ?Buy? or ?Sell??

Did You Say ?Buy? or ?Sell??

Global Market Comments

August 18, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER SETS NEW ALL TIME HIGH WITH 27% GAIN IN 2014),

(SPY), (TLT), (TBT), (FXE), (EUO),

(WILL GOLD SUFFER THE FATE OF THE $10,000 BILL?)

(GLD), (GDX)

SPDR S&P 500 (SPY)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

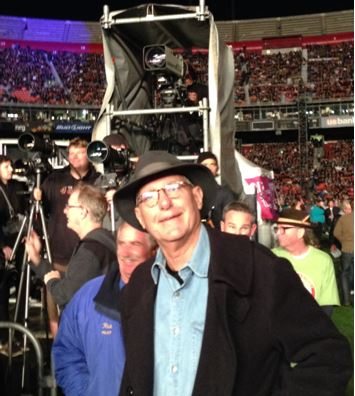

If you think this letter is being written by someone who is stoned, you?d be at least partially right this morning. For that is the after effect of my attending the Paul McCartney concert at Candlestick Park in San Francisco last night.

I was sitting in the infield in the most expensive $1,000 seats, well attended by Silicon Valley royalty. Excuse me Mr. Cook, can I please get by Mr. Ellison, hey, Sergei, love the service. I calculated that there was at least $1 trillion in market capitalization in my row, alone.

All that meant was that the second hand smoke in my section was more expensive, and more potent. And there was always the risk that the gyrating figure in the aisle on LSD might crash into you.

This was not a sit back in your seat and listen to the tunes concert. Some 70,000 people were on their feet for the duration, rocking out, dancing, and tapping their feet. McCartney, who appears immune to ageing, delivered in spades.

While he played, the fog rolled in from the bay, hit the high intensity lights, and vaporized, creating a surreal, magical effect.

Candlestick Park, which Paul pronounced in his drawn out Liverpudlian (scousian) accent, holds a special place in the hearts of Beatles fans. They first played there when the stadium was new in 1966. They last played together there in 1969. After tonight?s concert, it will be torn down.

Candlestick was originally built in 1959 to lure the Giants baseball team from Brooklyn. Structurally, it never recovered from the 1989 Loma Prieta earthquake, which occurred when a World Series was in play. The damp, freezing cold, the lack of mass transit connections, and the terrible parking have been perennial complaints about The Stick.

Last night, loyal fans could be seen digging up tufts of grass, or tearing down signs to take home. The San Francisco Giants moved downtown to play at AT&T Park more than a decade ago, and the 49ers relocated to a new stadium in San Jose this year.

To watch a video of McCartney?s blockbuster opening number, ?Eight Days a Week,? please click here.

This diversion aside, I am happy to report that I have been rocking out in my own way. The total return for my followers so far in 2014 has reached 27.1%, compared to a far more arthritic 2% for the Dow Average during the same period.

In August, followers have earned a welcome 3.2%, making it one of my best months of the year. Did I just hear someone shout at me to ?take more vacations??

The three and a half year return is now at an amazing 149.6%, compared to a far more modest increase for the Dow Average during the same period of only 36%.

That brings my averaged annualized return up to 41%. Not bad in this zero interest rate world. It appears better to reach for capital gains than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

This has been a real trader?s market this year, with plenty of volatility in the past month, but little net movement in the overall indexes. I played the S&P 500 from both the long and short side, selling the peak within minutes and buying the bottom 5% lower.

I managed to eke out some small profits shorting the Treasury bond market (TLT), stopping out before the real carnage began.

A short position in the Euro (FXE), (EU) is the gift that keeps on giving. I am on my third roll-down in strikes over the past month. It also helps that I went into Russia?s latest incursions into the Ukraine with a tiny book, and 80% cash. Thus I have plenty of dry powder to act opportunistically going forward.

I am ready to use the next microdip to jump back in. It is just a matter of time before Apple breaks $100 a share and hits a new, split adjusted all time high.

In the meantime, the world is waiting to see whether the US can deliver a second half GDP growth rate of 4% per annum?or not. We might have to settle for 3%, given the new sanctions against Russia.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real, and new ones come in almost every day.

My esteemed colleague, Mad Day Trader Jim Parker, was no slouch either, dodging in an out of the raindrops to make money on an intra day basis.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don?t forget that Jim clocked an amazing 2013 with a staggering 374% trading profit. That was just for an eight-month year!

The Opening Bell with Jim Parker, a quickie but insightful webinar giving followers an instant snapshot of the market opening every day, has been an overwhelming success. Many customers have already reported dramatic improvements in their trading results.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing.

Our business is booming, so I am plowing profits back in to enhance our added value for you. The latest is the Mad Hedge Fund Trader Channel on YouTube that enables me to post videos from my frequent travels around the world.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product,?Mad Hedge Fund Trader Pro, costs $4,500 a year. It includesGlobal Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, find the??Mad hedge Fund Trader PRO??or??Global Trading Dispatch??box on the right, and click on the blue??SUBSCRIBE NOW??button.

Global Market Comments

August 15, 2014

Fiat Lux

Featured Trade:

(BONDS OR STOCKS: WHO?S RIGHT?),

(TLT), (TBT), (SPY),

(WHO SAYS THERE AREN?T ANY JOBS?),

(TESTIMONIAL)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR S&P 500 (SPY)

Global Market Comments

August 14, 2014

Fiat Lux

Featured Trade:

(HOW THE UKRAINE CRISIS WILL PLAY OUT),

(USO), (UNG), (WMT), (AAPL), (MCD)

(MY PERSONAL ECONOMIC INDICATOR),

(HMC), (NSANY), (GM), (F), (TSLA)

United States Oil (USO)

United States Natural Gas (UNG)

Wal-Mart Stores Inc. (WMT)

Apple Inc. (AAPL)

McDonald's Corp. (MCD)

Honda Motor Co., Ltd. (HMC)

Nissan Motor Co. Ltd. (NSANY)

General Motors Company (GM)

Ford Motor Co. (F)

Tesla Motors, Inc. (TSLA)

Global Market Comments

August 13, 2014

Fiat Lux

Featured Trade:

(A SAD FAREWELL TO ROBIN WILLIAMS),

(THE CASE AGAINST TREASURY BONDS),

(TBT), (TLT), (MUB), (LQD), (LINE),

(A NOTE ON THE FRIDAY OPTIONS EXPIRATION),

(TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

iShares 20+ Year Treasury Bond (TLT)

iShares National AMT-Free Muni Bond (MUB)

iShares iBoxx $ Invst Grade Crp Bond (LQD)

Linn Energy, LLC (LINE)

We have a couple of options positions that expire on Friday, and I just want to explain to the newbies how to best maximize their profits.

These include:

iShares Barclay 20+ Year Treasury Bond Fund (TLT) August, 2014 $115-$118 in-the-money bear put spread with a cost of $2.70

iShares Barclay 20+ Year Treasury Bond Fund (TLT) August, 2014 $117-$120 in-the-money bear put spread with a cost of $2.61

As long as the iShares Barclay 20+ Year Treasury Bond Fund (TLT) closes at $115.00 or below on Friday, you will achieve the maximum profit in both these positions. Today, the (TLT) closed at $114.76, so, so far, so good.

Both positions expire with a value of $3.00, giving you a profit of 11.1% on the $115-$118 put spread and 13% on the $117-$120 put spread.

In this case, the process is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

Your broker (are they still called that?) will automatically use the long put to cover the short put, cancelling out the positions. The profit will be credited to your account on Monday, and he margin freed up.

Of course, I am watching this position like a hawk. If an unforeseen geopolitical event causes the (TLT) to take off to the upside once again, such as if Russia invades the Ukraine in the next two days, I will quickly STOP OUT for a small loss. You should get the text alert in seconds.

Those who were able to put both spreads on will probably still make money overall, as the expiration breakeven point for the pair has been boosted to $115.69.

If the (TLT) expires slightly in the money, like at $115.05, or $115.10, then the situation may be a little more complicated, and can become a headache.

On the close, your short position expires worthless, but your long put position is converted into an outright naked short position in the (TLT) with a cost of $118.

This you do not want on pain of death, as the potential risk is huge and unlimited, and your broker probably would not allow it unless you put up a ton of new margin.

Professionals caught in this circumstance then buy a number of shares of (TLT) equal to the short position they inherit with the expiring $118 put. Then the short (TLT) position is cancelled out by the long (TLT) position, and on Monday both disappear from your statement. However, this can be dicey to execute going into the close.

So for individuals, I would recommend just selling the $115-$118 put spread in the market if it looks like this situation may develop and the (TLT) is going to close very close to $115.00.

Keep in mind, also, that the liquidity in the options market disappears, and the spreads widen, when a security has only hours, or minutes until expiration. This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

Well done, and on to the next trade.

What Do You Think? Will the (TLT) Close Over or under $115?

What Do You Think? Will the (TLT) Close Over or under $115?

Global Market Comments

August 12, 2014

Fiat Lux

Featured Trade:

(AUGUST 13 GLOBAL STRATEGY WEBINAR),

(THE COST OF AN AGING WORLD),

(EWJ), (EWI), (EWG), (EWQ), (EWL), (EWU), (PIN),

(TESTIMONIAL)

iShares MSCI Japan (EWJ)

iShares MSCI Italy Capped (EWI)

iShares MSCI Germany (EWG)

iShares MSCI France (EWQ)

iShares MSCI Switzerland Capped Index (EWL)

iShares MSCI United Kingdom (EWU)

PowerShares India ETF (PIN)