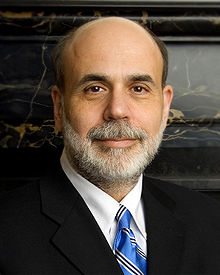

Since nothing less than the fate of the free world depends on the judgment of Ben Bernanke these days, I thought I?d touch base with David Wessel, the Wall Street Journal economics editor, who has just published In Fed We Trust: Ben Bernanke?s War on the Great Panic.

I doubted David could tell me anything more about the former Princeton professor I didn?t already know. I couldn?t have been more wrong, as David gave me some fascinating insights into the inner soul of our much-vaunted Chairman of the Federal Reserve.

Bernanke was the smartest kid in rural Dillon, South Carolina, who, through a series of improbable accidents, and intervention by a local black civil rights leader, ended up at Harvard. He built his career on studying the Great Depression, then the closest thing to paleontology economics had to offer, a field focused so distantly on the past that it was irrelevant. Bernanke took over the Fed when Greenspan was considered a rock star, inhaling his libertarian, free-market, Ayn Rand inspired philosophy in great giant gulps.

Within a year the economy had suddenly transported itself back to the Jurassic Age, and the landscape was suddenly overrun with T-Rex?s and Brontosauri. He tried to stop the panic 150 different ways, 125 of which were terrible ideas, the remaining 25 saving us from the Great Depression II. This is why unemployment is now only 7.6%, instead of 25%.

The Fed governor is naturally a very shy and withdrawing person, and would have been quite happy limiting his political career to the Princeton, NJ school board. To rebuild confidence, he took his campaign to the masses, attending town hall meetings and pressing the flesh like a campaigning first term congressman.

The price tag for Ben?s success has been large, with the Fed balance sheet exploding from $800 million to $3.6 trillion, solely on his signature. The true cost of the financial crisis won?t be known for a decade or more. The biggest risk is that we grow complacent, having pulled back from the brink, and let desperately needed reforms of the financial system and the rebuilding of Fannie Mae and Freddie Mac slide.

How Bernanke unwinds this bubble will define his legacy. Too soon, and we go back into a real depression. Too late, and hyperinflation hits. That?s when we find out who Ben Bernanke really is.

If you are looking for another emerging market to add to your list of things to buy on dips, then take a look at Indonesia (IDX). The world?s largest Muslim country offers a combination that I love, a population with great demographics that is also a major energy and commodities exporter.

The archipelago is the biggest country in Southeast Asia and a huge exporter of oil and LPG to Japan on long-term contracts. (An old friend of mine torched their Borneo fields at the beginning of WWII, and spent four years in a Japanese prison camp for his troubles.) Other big exports include marvelous textiles, rubber, and increasingly rare tropical hardwoods. Another plus is one of the world?s most pro growth population pyramids (see below).

The global financial crisis only knocked their growth rate from 6.1% to 4.5%, and now it is back above 6%. No doubt, $63 billion of direct foreign investment into the country helped. A series of tax reforms promise to keep the train moving, cutting the top corporate rate from 30% in 2008 to 28% in 2009, and 25% in 2010. Wisdom Tree had the ?wisdom? to launch the country?s first ETF (IDX) in January, 2009 (what timing!), which became one of the best performers of the year, rocketing over 300% from the lows to $60.

Islamic inspired terrorism is still a lingering concern. I keep Indonesia in the category of highly volatile, high risk, high return frontier markets that you only want to buy on a big dip. Keep it on your radar.

Meet Your New Investors in Indonesia

Meet Your New Investors in Indonesia

I recently spent an evening with Ambassador Richard Jones, the Deputy Executive Director of the International Energy Agency in Paris, who had some eye opening things to say about the energy space. The IEA was first set up as a counterweight to OPEC during the oil crisis in 1974, and has since evolved into a top-drawer energy research organization.

World GDP will grow an average 3.1%/year through 2030, driving oil demand from the current 84 million barrels/day to 103 million b/d. That means we will have to find the equivalent of six Saudi Arabia?s to fill the gap or prices are going up, possibly a lot. His conservative target has crude at $190 in twenty years. Some 39% of that increase in demand will come from China and 15% from India.

A collapse in investment caused by the financial crisis means that supply can?t recover in time to avoid another price spike. More than 1.5 billion people today don?t have electricity at all, but would love to have it. The best the climate negotiations can hope for is for CO2 to rise until 2020, and then plateau after that, because once this greenhouse gas enters the atmosphere it is very hard to get out.

This will require a massive decarbonization effort reliant on nuclear, hydro, alternatives, and carbon capture and storage. Up to half of the needed carbon reduction can be achieved through simple efficiency measures, like ditching the incandescent light bulb, driving more hybrids, and closing dirty, old coal fired power plants. Natural gas will be a vital bridge, as it is cheap, in abundant supply, and emits only half the carbon of traditional fossil fuels. The total 20-year bill for the rebuilding of our new energy infrastructure will exceed $10 trillion.

Richard, who comes from a long diplomatic career in Kuwait, Kazakhstan, and Israel, certainly didn?t pull any punches. I have been a huge fan of the IEA?s data for 35 years. Better use any weakness in oil prices to accumulate long term positions in crude through the futures, the ETF (USO), the offshore drilling companies like Transocean (RIG), and oil and gas plays like ExxonMobil (XOM)? and Occidental Petroleum (OXY). When oil comes back, it will do so with a vengeance.

I?ll Take Another Six Please

I?ll Take Another Six Please

Global Market Comments

July 8, 2013

Fiat Lux

Featured Trade:

(JULY 19 FRANKFURT STRATEGY LUNCHEON),

(THE TWO CENTURY DOLLAR SHORT),

(UUP), (FXY), (FXE), (FXB), (FXC), (FXA), (BNZ), (CYB)

(CNN?S JOHN LEWIS; THE DEATH OF A COLLEAGUE)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares Japanese Yen Trust (FXY)

CurrencyShares Euro Trust (FXE)

CurrencyShares British Pound Sterling Tr (FXB)

CurrencyShares Canadian Dollar Trust (FXC)

CurrencyShares Australian Dollar Trust (FXA)

WisdomTree Dreyfus New Zealand Dollar (BNZ)

WisdomTree Chinese Yuan (CYB)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Frankfurt, Germany on Friday, July 19, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $239.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a prestigious private club not far for the Botanical Gardens, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

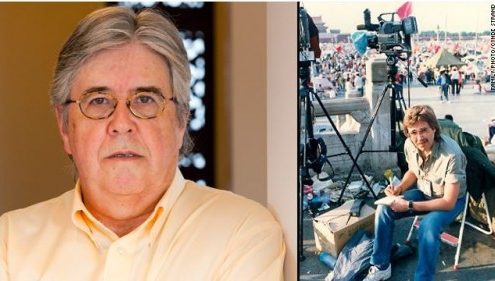

I was deeply saddened by the death of my old friend, CNN Asia correspondent, John Lewis, a legend in television journalism.

I first met John in Tokyo at the Foreign Correspondents? Club of Japan back in 1974, when he was a decorated Vietnam vet from Ohio trying to claw his way into TV, bootstrap style. Personable and easy going, he was one of the few in the club who got along with most of the cantankerous, suicidal, or just plain drunk writers there, and was often the first to step in to stop a fight. In those days you didn?t get fired in this rough and tumble business for punching out competitors.

At my 1977 wedding at the club, John graciously took the pictures because I was too poor to hire a professional. In 1979, rumors spread that this wild man millionaire named the ?Mouth of the South,? Ted Turner, was going to start up a 24 hour news cable channel called CNN, and was looking to hire a full time Asia correspondent. We both jumped at the job, and Lewis won out. Everyone was impressed, but kept their fingers crossed.

I was left part time stringing for NBC news, reporting to the late Bruce McDonald, who had worked his way up from writing for Johnny Carson?s Tonight show to the network producer for Asia, which is a big deal. And you wonder where I got my wicked sense of humor.

I often ran into John in the field, he covering the typhoons, floods, and wars, and me the business angle, which often blended into the same story. So we covered the corrupt Marcos regime in the Philippines, the assassination of Indira Gandhi in India, and the opening up of China. We never missed an opportunity to swap contacts and war stories at dingy, dubious bars from Seoul to New Delhi, and all points in between.

We parted ways in the eighties when my career made a sharp jag to the right with my joining Morgan Stanley in New York. John shot to international fame when he ignored Chinese orders to cease covering the Tianamen Square massacre in 1989, and kept beaming reports abroad until the heavies cut the power off. Gutsy move, John.

I heard that John died of a heart attack at 63. Foreign correspondence did not exactly offer a healthy lifestyle, with all the smoking, drinking, and general carousing that went on. There were also the occupational hazards of the occasional stray bullet, bouts of amoebic dysentery, and stints in jail at the behest of some third world dictator. It was a larger than life existence, but not exactly conducive to a family life, so I moved on. John stuck with it, but what a price! I was appalled when I saw his recent picture. The years had not been kind.

John was one of a dying breed of journalist whose sole interest was to get the story right and get it fast. There was no pandering to a particular political viewpoint, stealth marketing on products, or surreptitious product placement that has regrettably become endemic in the trade today. His was really an old fashioned kind of reporting, almost quaint in its principles.

He will be missed.

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

I have always considered the US military to have one of the world?s greatest research organizations. The frustrating thing is that their ?clients? only consist of the President and a handful of three and four star generals. So I thought that I would review my notes from a dinner I had with General James E. Cartwright, the former Vice Chairman of the Joint Chiefs of Staff, and known as ?Hoss? to his close subordinates.

Meeting the tip of the spear in person was fascinating. The four star Marine pilot was the second highest ranking officer in the US armed forces, and showed up in his drab green alpha suit, his naval aviator wings matching my own, and spit and polished shoes. As he spoke, I was ticking off the stock, ETF, and futures plays that would best capitalize on the long term trends he was outlining.

The cycle of warfare is now driven by Moore?s Law more than anything else (XLK), (CSCO), and (GOOG). Peer nation states, like Russia, are no longer the main concern. Budgeting for military expenditures is a challenge in the midst of the worst economic environment since the Great Depression.

Historically, inertia has limited changes in defense budgets to 5%-10% a year, but in 2010 defense secretary Robert Gates pulled off 30% realignment, thanks to a major management shakeup. We can only afford to spend on winning current conflicts, not potential future wars. No more exercises in the Fulda Gap.

The war on terrorism will continue for at least 4-8 more years. Afghanistan is a long haul that will depend more on cooperation from neighboring Iran and Pakistan. ?We?re not going to be able to kill our way or buy our way to success in Afghanistan,? said the general. However, the 30,000-man surge there brought a dramatic improvement on the ground situation.

Iran is a big concern, and the strategy there is to interfere with outside suppliers of nuclear technology in order to stretch out their weapons development until a regime change cancels the whole program.

Water (PHO), (CGW) is going to become a big defense issue, as the countries running out the fastest, like Pakistan and the Sahel, happen to be the least politically stable.

Cyber warfare is another weak point, as excellent protection of .mil sites cannot legally be extended to .gov and .com sites. We may have to lose a few private institutions in an attack to get congress to change the law and accept the legal concept of ?voluntarism.? General Cartwright said ?Anyone in business will tell you that they?re losing intellectual capital on a daily basis.?

The START negotiations have become complicated by the fact that for demographic reasons, Russia (RSX) will never be able to field a million man army again, so they need more tactical nukes to defend against the Chinese (FXI). The Russians are trying to cut the cost of defending against the US, so they can spend more on defense against a far larger force from China.

I left the dinner with dozens of more ideas percolating through my mind, which I will write about in future letters.

Dilbert cartoonist Scott Adams argues that you should invest in companies you hate because only the most unprincipled and rapacious firms make the greatest profits.

Moral bankruptcy is a great leading indicator of success, and the best ones can get you to balance your wallet on the end of your nose and bark like a seal, as you buy products that you utterly despise. Companies with the work ethic of a serial killer, like British Petroleum (BP) come to mind, but you can also add other firms to the list, like Goldman Sachs (GS), Citicorp (C), Pfizer (PFE), and Altria (MO).

Adams initially started investing in companies he loved, like Enron, WorldCom, and Webvan, and absolutely lost his shirt. Adams? advice to BP is not to waste money on artificially sincere ad campaigns apologizing, but get us to hate them more. Bring on more dead bird pictures!

Who is Adams about to hate next? Apple (AAPL), because he irrationally craves their products, resents their emotional control over his entire family, can?t get ITunes to work, and is appalled by those aloof black turtlenecks that Steve Jobs used to wear.

Global Market Comments

July 3, 2013

Fiat Lux

Featured Trade:

(JULY 12 AMSTERDAM STRATEGY LUNCHEON),

(IRAN SHOULD FOLD ITS NUCLEAR PROGRAM, OR ELSE),

(PETER F. DRUCKER ON MANAGEMENT)