I have spent many hours speaking at length with the generals who ran our wars in the Middle East, like David Petraeus, James E. Cartwright, and Martin E. Dempsey. To get the boots on the ground view, I attended the graduation of a friend at the Defense Language Institute in Monterey, California, the world's preeminent language training facility.

As I circulated at the reception at the once top-secret installation, I heard the same view repeated over and over in the many conversations swirling around me. While we can handily beat armies, defeating an idea is impossible. With the planet's fastest growing population, Muslims are expected to double from one to two billion by 2050, the terrorists can breed replacements faster than we can kill them. The US will have to maintain a military presence in the Middle East for another 100 years. The goal is not to win, but to keep the war at a low cost, slow burn, over there, and away from the US.

I have never met a more determined, disciplined, and motivated group of students. There were seven teachers for 16 students, some with PhD's and all native Arabic speakers. The Defense Department calculates the cost of this 63-week, total emersion course at $200,000 per student.

They are taught not just language, but also the history, culture, and politics of the region as well. I found myself discussing at length the origins of the Sunni/Shiite split in the 7th century, the rise of the Mughals in India in the 16th century, and the fall of the Ottoman Empire after WWI, and this was with a 19 year old private from Kentucky whose previous employment had been at Wal-Mart! I doubt most Americans her age could find the Middle East on a map. Students graduated with near perfect scores. If you fail a class, you get sent to Afghanistan, unless you are in the Air Force, which kicks you out of the service completely.

As we feasted on hummus and other Arab delicacies, I studied the pictures on the wall describing the early history of the DLI in WWII, and realized that I knew several of the participants. The school was founded in 1941 to train Japanese Americans in their own language to gain an intelligence advantage in the Pacific war. General 'Vinegar Joe' Stillwell said their contribution shortened the war by two years. General Douglas McArthur believed that an army had never before gone to war with so much advance knowledge about its enemy. To this day, the school's motto is 'Yankee Samurai'.

My old friends at the Foreign Correspondents' Club of Japan will remember well the late Al Pinder. He spent the summer of 1941 photographing every Eastern facing beach in Japan, successfully smuggled them out hidden in a chest full of Japanese blow up dolls and sex toys. He then spent the rest of the war working for the OSS in China. I know this because I shared a desk in Tokyo with Al for nearly ten years. His picture is there in all his youth, accepting the Japanese surrender in Korea with DLI graduates.

I Guess I Should Have Studied Harder

Global Market Comments

February 28, 2013

Fiat Lux

Featured Trade:

(SUNDAY WITH PRESIDENT JIMMY CARTER)

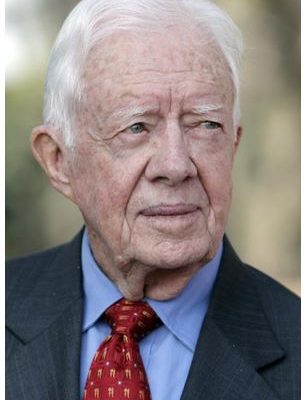

When I heard that our 39th president, former governor of Georgia, and Nobel Peace Prize winner, Jimmy Carter was coming to town, I moved heaven and earth to meet him.

I served in the White House Press Corps as the The Economist correspondent during the latter part of his term, and was dying to get answers to issues that were then classified, or unknowable.

It was tense and politically charged, but a highly productive time. He signed a treaty handing back the Panama Canal, brokered the Camp David accords between Israel and the Palestinians, signed the SALT II Treaty limiting nuclear weapons with the Soviet Union, and normalized diplomatic relations with China.

Then the good will created by these accomplishments went up in smoke when Iran seized 52 hostages by storming the American embassy in Tehran, an ordeal that lasted 444 days. It was a national nightmare and a very dark time for America. That smashed his reelection chances in 1980, and paved the way for Ronald Reagan to ascend to the presidency.

During the seventies, his administration was looking for an American who spoke fluent Japanese and knew Japan?s steel industry inside out. It turned out that I was the only one, having covered the industry on a daily basis for the Sydney based? Financial Review.

I was offered an appointment as Deputy Assistant Secretary of the Treasury for International Affairs, which I turned down because the pay was too low ($15,000 a year for a G-14). It was the biggest mistake I ever made, leaving millions of future potential lobbying fees on the table. Such are the errant ways of youth.

Carter showed up to our meeting in a modest grey suit, red tie, and a thinning mane of pure white hair. He was animated, with a relaxed sense of humor, but answered his questions with rapid-fire succession. Not only was he fully briefed on developments in every country of the world, he personally knew the leaders of many. Touch on issues he deeply cared about, and he responded with fire and brimstone.

One of the great things about interviewing old ex-presidents is that either the events in which they have confidential knowledge have passed their statute of limitations, or they can?t remember if they were classified or not. So having an extended conversation can be very interesting, to say the least. Such was the case with my two hour talk with Jimmy Carter. I will try to summarize what he said.

The former president argues that the United States is now the most unchallenged superpower in history. It is not only the most powerful nation on earth, but in all of human history.

However, despite this unprecedented strength, the country is pulling back from the ideals that made it great in decades past. Once the leader on the environment, we now lag far behind Europe. By using drones to assassinate Americans abroad, we are disavowing the Geneva Convention. Our commitment to human rights has wavered. Half of the 160 prisoners at Guantanamo Bay have never been charged, and are effectively serving life sentences. We now have the largest prison population in the world, up sevenfold in 30 years.

We are the most warlike nation in modern history, and have almost continuously been involved in combat for the past 70 years. The long list of adversaries includes Korea, Lebanon, Vietnam, Cuba, Cambodia, Laos, Grenada, Panama, Nicaragua, Iraq, Serbia, Kosovo, Afghanistan, Iraq again, Somalia, Libya, and most recently Yemen. Next on the menu are Syria, Iran, and Mali. The leadership of many countries live in terror of us. Such a long history of conflict reflects a serial lack of desire to negotiate on our part.

We have retreated from our domestic principles as well. The concentration of wealth at the top continues unabated, with the top 1% seeing a 400% rise in net worth, while the rest of us have seen declines. College tuition has soared from 4% to 10% of family income. Poverty has risen by 31% in just the past five years.

Massive infusions of money into the political system have created a hopeless gridlock in the government, making it impossible to do anything about our problems. His own presidential campaign in 1980 cost nothing, as it was entirely financed with public money. In 2012 both parties spent $6 billion.

Most of this money went into negative TV advertising that so poisons the atmosphere that the winners refuse to talk to each other when they get to Washington. Carter thinks that the Supreme Court?s Citizens United decision, open the way for unlimited anonymous corporate donations, was ?stupid.?

The native of Plains, Georgia said that it was not clear that Iran had decided to develop nuclear weapons, but they certainly had the means to do so. Even if they had such an offensive capability, it is unlikely they would ever use it. Israel has over 200 operational nukes, and the slightest hostile move by Iran would result in them being wiped off the face of the earth. Iran has no desire to commit national suicide.

Nor does North Korea, which has to face America?s 5,000 nuclear bombs. The Clinton administration had a peace treaty written up and ready to sign with Kim Il Sung in the late nineties, ending 45 years of hostilities. Then George W. Bush got elected president and he threw it in the trash. That panicked the North Koreans into a crash program to develop nuclear weapons and intercontinental missiles. The first successful test occurred in 2006.

Carter is a regular traveler to the Hermit Kingdom in order to keep back channels open, where he sees starving children as the cruel face of our economic sanctions. He still believes that North Korea would dump its nukes if we reoffered the peace treaty, when the proper initiatives were taken.

Carter has been visiting China since 1949, when his sub made a brief stop just before the Nationalist collapse. He personally knows the new leader, Xi Jinping, well, and thinks the Middle Kingdom will never pose a military threat to the US. The Carter Center has monitored elections in 650,000 towns and villages there for the past 15 years, where the communist party is not active.

He sees our largest trading partner moving towards full democracy over time. He is assisting in implementing the country?s first Freedom of Information Act. In fact, China has the world?s most rapidly growing Christian population today, with total numbers soon to exceed 100 million. They are also the planet?s largest publisher of the Bible.

The former president is discouraged about developments in Israel, where the Benjamin Netenyahu administration seems hell bent on colonizing the West Bank as quickly as possible. This eliminates the possibility of a two state solution, which the Palestinians and every other country in the Middle East have already said they would sign on to.

Carter sees the Arab Spring as a hugely pro-American development, as every country in which it has unfolded has moved from dictatorship to democracy. But don?t expect every country to elect a leadership in our image. Of course, Egypt is going to choose the Muslim Brotherhood, a country that is 90% Muslim! The new Mohammed Morsi government was the most moderate of several alternatives, and should work well with the US. (He has a PhD in engineering from one of my alma maters, the University of Southern California).

What makes Carter such an interesting person to speak to today is that he has become the most active and hard working ex-president in history. For the last 31 years he has run the Carter Center , a well funded non profit that promotes global peace, advances public health, monitors international elections, and promotes women?s rights.

The Carter Center has just monitored its 93rd foreign election, in the West African country of Sierra Leone. It has almost completely eliminated Guinea Worm, cutting the number of global cases from 3.5 million to only 542. It has treated 75 million cases of trachoma and 12.8 million cases of river blindness.

Despite his strong anti-war stance, Carter insists that he is not a pacifist. He has served on two battleships and three submarines, and came to office with more military experience than any other modern president after Eisenhower.

Jimmy Carter grew up on a farm in rural Georgia during the Great Depression. Childhood diversions included raising a great number of different birds and animals, and searching for pottery fragments left by ancient Indians who once inhabited the land.

He wanted to become a naval officer from the age of five, following in the footsteps of an admired uncle in the US Asiatic Fleet of the twenties and thirties. That led him to Georgia Tech, Annapolis, and eight years in the Navy. His specialty was nuclear engineering, and he served on the Seawolf, America?s second nuclear submarine.

Carter?s memory for numbers was nothing less than stunning for someone born in 1924. When he was growing up in Plains, his father charged him with managing the black tenant farmers. He became a second son to many families, often sleeping over in ramshackle shacks sharing bed bug bites.

He paid daily wages of $1 for a man, 50 cents for a woman, and 25 for a child. Finally, the workers went on strike because they were starving. His father threatened to fire everyone to show that organizing labor was futile. But he gave them the quarter raise they needed after the following New Year so they could eat. It was definitely another time and another place. When I told Carter I wanted to be like him when I was 88, he laughed.

I had to ask him about Argo, the Iran hostage rescue movie nominated for Best Picture at the Academy Awards. He said that it greatly overplayed the role of the Americans. After being turned away by the British embassy, the Canadians ended up doing 90% of the work, and bore most of the risk in the effort to spirit six Americans out of the country.

If it were discovered they were hiding Americans, they too would have been overwhelmed and taken prisoner. To observe the letter of the law, the Canadian Parliament met in secret for the only time in its history to give the approval. The facts aside, Carter said Argo was a wonderfully entertaining movie.

That was spoken like a true diplomat.

Global Market Comments

February 27, 2013

Fiat Lux

Featured Trade:

(WHY THE MARKETS COULD CARE LESS ABOUT SEQUESTRATION),

(BE CAREFUL WHO YOU SNITCH ON)

They say a picture is worth 1,000 words. The map below is worth a PhD thesis, and perhaps a weighty tome. Prepared by my friends from government data at the online financial site run by Henry Blodget, Business Insider, it ranks the states most impacted by the sequestration of federal spending that starts on Friday, March 1. Then, some $85 billion in annual outlays grind to a complete halt. Call it ?F? day.

It confirms what I have known for a very long time, that the US government is basically a giant recycling mechanism that sucks money out of blue states and spends it in red states. The map shows that by far, the biggest beneficiaries of Washington?s largess are Virginia, Kentucky, South Carolina, Mississippi, Alaska, Hawaii, Missouri, Maryland, Texas, and New Mexico. These are the states that stand the most to lose from the 8.5% across the board cut in spending that is about to take place. It is a broad-brush generalization with some exceptions, but you get the picture.

The states that have the least to lose are New York, New Jersey, Oregon, Illinois, Michigan, Minnesota, Ohio, Iowa, Nebraska, and California. These happen to be the states that are the biggest contributors of tax revenue to the Treasury. The two richest, California and New York get back 78 cents in government spending for every dollar in taxes they pay into the system. Alaska and Hawaii each receive a whopping $7 in spending for each dollar raised, while Washington DC get?s a stratospheric $8. Even during these difficult budget times, new museums are under construction on the Great Mall, as I write this.

It?s not hard to figure out where all this money is going. The overwhelming share of this disproportionate red state spending is for defense. This originally began nearly 100 years ago because the big military bases set up during WWI and WWII could only be built where land was cheap and plentiful. That was much more easily found in the middle of nowhere, in the Midwest and the South, rather than on the populous coasts.

The recipients of all this defense spending is easily found in Kentucky (101st Airborne Division at Fort Campbell, Fort Knox), South Carolina (Parris Island Marine Corp training center), Mississippi (Columbus AFB), Alaska (Elmendorf AFB), Missouri (Whiteman AFB), Maryland (Andrews AFB, the Naval Academy), Texas (Fort Hood), and New Mexico (Los Alamos National Labs). In Hawaii (Pearl Harbor, Bellows AFB) and Virginia (Norfolk Naval Shipyard, Quantico) the Navy is responsible for the bulk of the expenditures.

This is why red state representatives in congress are wringing their hands with such distress, as military spending represents such a large proportion of their local GDP. Sequestration brings a sharp slowdown of money pouring into their states. The businesses of their largest donors will noticeably slow. Blue state representatives are far more relaxed, as sequestration effectively means a slowdown of deflationary cash outflows from their states.

Social spending is understandably the greatest where you have the most people, on the coasts. But it represents a tiny proportion of the local economy, and will impact few jobs. The economies of big states are primarily driven by the private sector, such as in New York (banking, finance, media, telecommunications), Illinois (finance, manufacturing, agriculture), and California (technology, housing, international trade).

I doubt we will even notice the sequestration here in the Golden State, unless we turn the TV on, or try to leave. That?s why I think sequestration is going to happen. This time, there will be no last minute pull back from the precipice.

In fact, sequestration could well be the big yawner of the year. It might be the Y2K of this decade. Remember when Armageddon was predicted for the year 2000, but in the end, someone?s toaster didn?t work in Peoria, Illinois? And that was a really old toaster.

This is what the financial markets have been telling us for the past three months. Notice that, with only four days until the disastrous deadline, the stock markets were breaking to new five-year highs, until they were temporarily delayed by the Italian election.

The worst-case scenario seems to be that GDP will slow by a mere 25 basis points. But this will be on the coattails of a dramatic decline in the government deficit. Notice also that the financial markets are headquartered in states that will be minimally impacted by sequestration cuts.

These interstate cash flows go a long way to explain why we have gridlock in Washington. It is the status quo that benefits the most from inaction and has the most to lose from change. President Obama knows this and it is why he is playing such hardball with the Republicans. You can?t make an omelet without breaking a few eggs.

It also explains why there is such a massive building boom for new commercial office space in our nation?s capital. The Citizen?s United ruling, which legalized unlimited anonymous corporate donations, has opened the floodgates for cash to hire new armies of new lobbyists. They keep the money continuing to flow to the hinterlands, and the gravy train running. Knowing all this, it is sometimes easy for me to get discouraged when contemplating our country?s future.

It?s not like our lives depend on all this extra spending on defense. The US has not had an industrial strength enemy since the collapse of the Soviet Union 20 years ago, which is now a faint shadow of its former self. They just sold us the last of their excess weapons grade plutonium to run our nuclear power plants.

Al Qaida has been reduced to a few hundred religious fanatics hiding out in Pakistani basements, and a few sleeper cells, with rather short lifespans. That?s why they have no retirement plan.

Yet US defense spending has doubled to $800 billion since 2000. The sequester will bring the first measurable decline in such spending since the peace dividend of the nineties. Why are we spending so much money without any real enemies?

China?s military is almost exclusively aimed at controlling its own population. The one small, second hand aircraft carrier they acquired from the Ukraine is to protect their oil supplies from the Middle East as we withdraw our forces from there. America has been at war almost non-stop since WWII. Since 1949, China carried out a single invasion only 20 miles into Vietnam, and then retreated after two weeks.

I am not alone with these views. The Joint Chiefs of Staff happen to agree with me, as do the majority of serving generals and admirals, and the CIA. They would much prefer husbanding scarce resources for cyber warfare, special operations, advanced drones, and training. Blowing money on big-ticket, but useless cold war weapons systems, like nuclear aircraft carriers and submarines, and the F-22 and X-35 fighters, just to boost employment in favored congressional districts, is the greater threat to our national security. Talk to anyone who has ever been in the military, and the tales of waste and inefficacy on an industrial scale abound.

Imagine if, instead of committing $1 trillion to the war in Iraq, we had spent it on cyber warfare? Imagine what the Internet would be like now? Imagine what online commerce would be like? It boggles the mind.

Raise such concerns about this unnecessary spending, and you get called a pacifist, a coward, and a traitor. Wasn?t the peace symbol the footprint of the American chicken? That doesn?t work with me. I have been assisting the US military on and off for 40 years, from intelligence, to flying hopelessly risky missions, to grief counseling of Marine widows, orphans, and parents. I am a veteran of six wars, and still carry enough lead to set off metal detectors. Call someone else a pacifist.

I think when sequestration starts on Friday, I?ll go for a long hike. I hope congress does too, down a short pier.

Do We Really Need Ten?

Buried in the recently passed Dodd-Frank financial reform bill are massive financial rewards for turning in your crooked boss. The SEC is hoping that multimillion-dollar rewards amounting to 10%-30% of sanction amounts will drive a stampede of whistleblowers to their doors with evidence of malfeasance and fraud by their employers.

If such rules were in place at the time of the settlement with Goldman Sachs (GS), the bonus, in theory, could have been worth up to $500 million. Wall Street firms are bracing themselves for an onslaught of claims, legitimate and otherwise, by droves of hungry gold diggers looking for an early retirement.

Don't count on this as a get rich quick scheme. Government hurdles to meet the requirement of a true stoolie can be daunting. The standard of evidence demanded is high, and must be matched with the violation of specific federal laws. Idle chitchat at the water cooler won't do. Litigation can stretch out over five years, involve substantial legal costs, and often lead to a non-financial settlement with no reward. For those who do deliver the goods, death threats from defendants are not unheard of.

Having 'rat' on your resume doesn't exactly look inviting either. Just ask Sherron Watkins, the in-house CPA who turned in energy giant Enron's Ken Lay, Andy Fastow, and Jeffrey Skilling just before it crashed in flames. Nearly a decade later, Sherron earns a modest living on the lecture circuit warning of the risks of false accounting, and whistleblowing. There have been no job offers.

Global Market Comments

February 26, 2013

Fiat Lux

Featured Trade:

(SUDDENLY THOSE ITALIAN LESSONS ARE PAYING OFF),

(FXE), (EUO), (EWI), (VIX), (UUP),

(NEW BOJ GOVERNOR CRATERS YEN), (FXY), (YCS), (UUP),

(PETER F. DRUCKER ON MANAGEMENT)

CurrencyShares Euro Trust (FXE)

ProShares UltraShort Euro (EUO)

iShares MSCI Italy Capped Index (EWI)

VOLATILITYS&P500 (VIX)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

If you have been living in a cave for the last 72 years and missed the work of management guru, Peter F. Drucker, here is your chance to catch up. I just finished reading The Essential Drucker, a weighty tome of 368 pages which summarized the high points and pearls of wisdom of the author's 38 books published since 1939.

A self-described 'social ecologist', Drucker was a journalist who moved to Germany because job prospects in his native Austria-Hungary were poor following its defeat in WWI. He became a close friend of Austrian economist Joseph Schumpeter, who popularized the term 'creative destruction,' and attended lectures by John Maynard Keynes. He fled to the US in 1934 after his writings were burned by the Nazis.

For most of human history, armies were the predominant management model, and most corporations today show the military influence. Management only emerged as a science during the 1920's, and Drucker was one of the founding fathers. Early adopters, like Coca Cola, Du Pont, IBM, and General Electric, went on to prosper mightily.

He observed that Franklin Delano Roosevelt set up the most productive administration in history. Taking even a single step was so painful for him that he, and all those who worked around him, had to organize the government with the maximum efficiency possible. This was a key element in America's victory in WWII.

Drucker writes at length on the risks and opportunities of entrepreneurship, and argues that all companies must innovate, or die, no matter how pedestrian their product. He predicted many of the trends that came to dominate the late 20th and early 21st century, such as privatization, decentralization, globalization, and the rise of the knowledge worker. He had a huge following when I was in Japan during the seventies, and his mark can be seen in today's global presence of the major Japanese keiretsu.

While most define a company in terms of producing products and making a profit, Drucker sees its mission as 'creating a customer.' He presents a rigorous process for decision making. He lauds nonprofits as the best run organizations in the country because they have to be. Groups like the Girl Scouts, the Red Cross, and United Way maintain an effective global presence without paying their people any money. He makes the distinction between efficiency and effectiveness; doing things well, versus doing the right thing.

Anyone who manages any business of whatever size, from a Fortune 500 company to a single individual banging away on a PC at home, will benefit from reading this book. It forces you to take a look at your own operation with a fresh set of eyes. It even advises on how to manage one's own time, from dispensing with unnecessary meetings to minimizing paperwork and bureaucracy.

Drucker moved to California during the seventies, where he set up one of the early MBA programs for Claremont College. He died in 2005 at the age of 96. To obtain preferential pricing from Amazon for this insightful book, please click here.

.

Global Market Comments

February 25, 2013

Fiat Lux

Featured Trade:

(ANOTHER DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER),

(SPY), (SPX), (QQQ), (AAPL), (HPQ), (YHOO), (CSCO), (TLT), (TBT), (FXF), (UUP), (FXE), (GLD), (GDX), (TSLA), (USO)

SPDR S&P 500 (SPY)

SPX Corporation (SPW)

PowerShares QQQ (QQQ)

Apple Inc. (AAPL)

Hewlett-Packard Company (HPQ)

Yahoo! Inc. (YHOO)

Cisco Systems, Inc. (CSCO)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

CurrencyShares Swiss Franc Trust (FXF)

PowerShares DB US Dollar Index Bullish (UUP)

CurrencyShares Euro Trust (FXE)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Tesla Motors, Inc. (TSLA)

United States Oil (USO)

Diary Entry for Friday, February 22, 2013

Dear Diary,

4:30 PM Thursday- Thought I?d check my Bloomberg to see how the Asian markets were opening. Wow! Shanghai is really taking it in the shorts, down 5%. Looks like when Ben Bernanke catches a cold, the Chinese markets catch pneumonia. They must be more dependent on our quantitative easing then we are.

5:00 PM- Call from one of the top New York hedge funds. They just received a research report predicting that Google was going to $1,000. Should they chase it up here? I said not in your wildest dreams. A $1,000 target seems to be a death knell for a stock, as it was for Apple (AAPL) last September. People are just buying Google here because it is the anti-Apple. Call me old-fashioned, but I?ll buy a PE multiple of 7 versus 19 any day of the week.

Quite honestly, I don?t want to buy any stocks at these lofty altitudes. Doing so on the first run at a new 13-year high never works, and he could crash and burn.

If someone was holding a gun to my head and forcing me to buy stocks now, I would be looking at technology laggards, like Hewlett Packard (HPQ), Yahoo (YHOO), and Cisco (CSCO). You might pick up some Apple under $450 as well. Mathematically, it is impossible for it to go under $400, with the Einhorn suit and all.

If you look at how San Francisco and Santa Clara real estate prices are going through the roof with ferocious bidding wars, it is just a matter of time before technology takes over market leadership once again. I said he owed me a nice dinner at Masa at Time Warner Center on Columbus Circle, and we?ll meet up at my July 2 New York strategy luncheon.

Then he told me the real reason for his call. He knew I grew up near Hollywood, had dated several movie stars, and even appeared in one as an extra (Francis Ford Coppola?s Apocalypse Now). Perhaps, I had some insights? His firm had put up the money to make Spielberg?s film, Lincoln. Is Daniel Day Louis a shoe-in for best actor? He had some serious money on him with his bookie.

I said absolutely. Day-Lewis?s portrayal of the Civil War president was so accurate that it was creepy. They could reprint his image on the five-dollar bill and no one would notice the change. History is ?in? this year. In fact, he should double his bet while he still had the chance.

6:30 PM-Take kids to see the new animated film, Escape From Planet Earth. Notice how the kid movies are better than the adult movies these days? There are ample double entendres and innuendos to keep the grownups laughing all the way. Brendan Fraser is such a pussycat. Children?s flics are really his genre. And it?s nice to see that James Gandolfini has finally found a new career doing voice overs for animated movies after the Sopranos.

9:00 PM-Call from a friend at the People?s Bank of China in Beijing. He wants to know if they missed the top of the Treasury bond market (TLT) last summer, and if they should start unloading their $1.2 trillion worth of holdings. They have been on a buyer?s strike for the past year, and have already pared back their position by $100 billion from the peak.

I said don?t worry. If we get a serious slowdown later in 2013, I expect the ?RISK OFF? trade to make a big comeback and take the ten-year yield down to 1.60% on a spike at some point. That would be a good time to flush out his bigger positions. Washington is certainly helping, with an imminent sequester threat caused by a permanently gridlocked congress, to be followed by another debt ceiling crisis.

The world is still suffering from a savings glut and a bond shortage, thanks to ?The 1%? hoarding assets in non-risk instruments, so I am not expecting a serious bond crash anytime soon. Plus, you will get a double kicker with a strong dollar. But please don?t try and sell ahead of a three-day weekend, like you did last time. And thanks for the fabulous Peking duck dinner in Shenzhen last year, although, I think I still have indigestion.

Then he asked, did I, by any chance, see the film, Life of Pi, which was nominated for Best Picture? It was a huge hit in Beijing, with lines extending for hours. I answered no, that a film about a tiger in a lifeboat for two hours didn?t really do it for me. Only the Chinese could do that. Go figure.

9:30 PM- Hit the rack and try to catch some shuteye before the next call.

Diary Entry for Saturday, February 23, 2013

2:00 AM-One of my former staff members at Morgan Stanley calls me from a Private Bank in Geneva to tell me that the Euro is getting the stuffing knocked out of it. Is it time to buy? I told him that I would rather find broken glass in my oatmeal this morning. We are miles (kilometers) away from a resolution of Europe?s woes. At the very least, they need a new treaty to create a ministry of finance to be run by the Germans. Expect that to take at least five years, if ever. Then, you can think about buying.

In the meantime, I wouldn?t touch the European currency with a ten-foot pole. European Central Bank president, Mario Draghi, is delusional if he thinks he can levitate the Euro with just talk. Europe can temporary stave off a currency collapse by shrinking their central bank?s balance sheet by $300 billion during the first half of 2013. But with the Fed expanding theirs by $1 trillion and the Bank of Japan by an incredible $1.5 trillion, Europe is assured to lose the race to the bottom in the Currency Wars. The European economy will suffer mightily as a result, eventually crashing the Euro.

Sunday?s Italian election results could well trigger the next leg down for the Euro. It?s looking like a win for Pier Luigi Bersani, continuing the European drift towards socialist governments since the beginning of the financial crisis. Sex with under aged prostitutes will not be a winning campaign strategy for former Prime Minister, Silvio Berlusconi, even in Italy. Better to sell short the yen instead, which has just started on its way from ?76 to ?150 to the dollar.

Then he moved on to the real purpose of his call. What did I think about Les Mis?rables? Do they have a chance of winning something? He had a bet on with his wife, who favored the dark horse, Amour. Only if they have a ?Worst Male Vocal? category. I had to admit I walked out after the first 15 minutes, when Russell Crowe started to sing. He is a better Gladiator than a crooner. I slammed the phone back on the hook and went back to sleep.

6:00 AM-My website administrator called me in a panic. The store is down. A hacker attack prompted PayPal to suspend my account. Since I am one of their largest customers, I call my account rep and get it reopened. The Chinese should know better than to hack my site. One call to Beijing and I could have them shot. Go hack the New York Times, instead. I hear they are looking for a new automotive correspondent.

6:15 AM-An old friend from the Swiss National Bank called asking my read on the US sequester threat. I answered that the financial markets were far more interested in this Sunday?s Academy Awards. Would Ben Affleck capture best picture for Argo, despite being despised by the Hollywood establishment for his appalling performance in Pearl Harbor?

Washington has cried ?wolf? too often for traders to get sucked in one more time. They don?t want to miss the rally when the can gets kicked down the road one more time, as it always does. What? You worried about the long-term deficit growth of the US government? Call me in 2025, when it matters.

I said I owed him a fondue dinner with a bottle of Schnapps for giving me the heads up on the Swiss franc devaluation last year where my followers earned a 400% profit on their puts (FXF). But to collect, he had to take the cog railway up to Zermatt and attend my strategy seminar on August 9.

Since he was asking me about Argo, I had to tell him a story that president Jimmy Carter only revealed to me a few days ago. Most of the Iranian leadership during the late seventies were educated in Germany. So many CIA agents were sent into the country surreptitiously with fake German passports. Once one was asked by Iranian immigration why his passport read ?Aaron H. Schmidt?, when German passports always spelled out the full name. Thinking quickly on his feet, the agent shot back quickly, ?because my parents named me after Hitler, and I received a special dispensation to only use the letter ?H.? The official understood completely and let him go. True story.

7:00 AM Another call from my website administrator. The website is down. My story on ?Why Gold is Dead? (click here) brought a traffic spike that is causing the servers to melt. The gold bugs are going crazy over it. I am burning up the Internet.

8:00 AM- I get a call from a leading money manager in London?s Mayfair district. Europe is closing. With gold down $100 in a week, is it time to buy? Not yet, I said. The panic selling has only just started, and margin clerks everywhere were sharpening their knives. Wait for a capitulation to deliver a false breakdown below $1,500 before jumping in. That?s where I expect emerging market central bank participation to kick in. And go have a pint of bitter for me at the Pig & Whistle next door, will you. Tell the owner, Nigel, to put it on my running tab.

He then raved about the terrorism movie, Zero Dark Thirty. Las Vegas is giving Jessica Chastain 2:1 odds to take best actress. What do you think? I said I thought the movie gave the most accurate portrayal of the actual day-to-day work done by the CIA that I had ever seen. But the whole premise that torture led to bin Laden?s raid was total BS, and was pissing off a lot of people at the agency, from Leon Panetta on down. If anything, the bad intelligence they got from torture slowed them down. Go for Jessica, I said. It?s the patriotic thing to do.

10:00 AM-Better get to work on today?s letter. I?m already behind the eight ball. I?ve gotta lead with the Tesla (TSLA) story. Their earnings are out. Boy, a lot of people sure look at me when I drive that car. Too bad they are mostly guys. But I can?t understand why my passengers keep getting carsick. I better take another look at Ford (F) too. I heard George Soros has taken a 3% stake in the company. Time to double up?

1:15 PM-My friend, JR, a senior executive at an oil major, calls from Houston. What the hell was going on with the price of oil (USO)? Three months ago, it was at $84, then he blinked, and it was $99. I told him that Israeli intelligence thinks there won?t be a war with Iran until the summer at the earliest, if ever. Until then, Texas tea was going to stay in a rough balance, with rising Chinese demand offset by growing American production, thanks to the new fracking technology. That is why oil volatility has collapsed. The range in oil for the past eight months has been tighter than a gnat?s ass, only $15. If you really must have an energy play on, buy some solar, like First Solar (FSLR). Four more years of Obama means four more years of government support for alternative energy.

He said thanks, and next time I was in town he would buy me a 24-ounce chicken fried steak at Billy Bob?s that spilled over both sides of the plate. I can?t wait. I?ll let my doctor have the heart attack.

Then he told me why he really called. He knew that I was a former combat pilot, like him, and wanted to know what I thought about the crash scene in Flight? Wasn?t it cool? Those Hollywood people, with their Brioni Tux?s and designer dresses are really your kind of people. Do you think Denzel Washington has a shot at Best Actor? I confided in him that I had nightmares after watching it because it reminded me of my own many plane crashes. Denzel completely nailed how you handle a high stress situation like that, with total calm and focus, while keeping the people around you from freaking out. But I still liked Daniel Day-Lewis better in Lincoln.

2:00 PM-Still haven?t started on the letter yet. I have been answering 200 email requests for information about the Trade Alert Service. This always happens whenever I have a hot trade on. The watchers want to become players. With my two year return approaching an all-time high of 80%, new subscribers are pouring in.

4:45 PM- Well, I got the letter done, but I?m too late. The web editor has gone to the DMV to register her new Prius, and the backup has gone to the yoga studio. Ouch! 10% sales tax for new cars in Washington State! They must be as broke as California.

5:00 PM I put on a 60-pound pack and my heavy climbing boots and head out the back door on a ten mile hike to climb Grizzly Peak as I do every evening. Gotta stay boot camp ready. You never know when Uncle Sam is going to call again. Who cares if I?m 61?

9:00 PM Back to my screens. The Euro has broken $1.32 again. Where was I last week? Asleep? Still, I am going to avoid the Euro. It has recently been so trendless that it has killed more traders than a bad tin of caviar. There are better things to do.

10:00 PM-Time to call it a night and break out a bottle of Duckhorn merlot. Jeese, it seems people only wanted to talk about the Academy Awards today. Is the market that bad? Such is the price of living in California.

Does anybody want my job?