If you would like to get a free headline service from The Diary of the Mad Hedge Fund Trader, then please join my 1,375 friends. Every day we are posting headlines along with summaries of the stories on our Facebook page. As soon as you open your own Facebook page, you will receive our latest headlines as newsfeeds. To ?friend me?, please go to my home page at http://madhedgefundradio.com/ and click on the Facebook box.

If you have been negative on bonds as I have, these charts should enable you to sleep much better.

Virtually every fixed income product is peaking now. Let me draw a simple picture for you laymen out there. That means you should sell every major bond market rally for the next ten years. It?s looking like the 1.38% yield we reached in the Treasury bond market will be the absolute nadir.

The technical set up is now so dire, that bonds are going to have a really tough time rallying from here. The momentum players will eventually smell blood in the water, and they'll be jumping in with both feet at every opportunity. The lost decade for bonds has begun!

Of course, you knew this was coming. It doesn?t help that the budget proposals for both political parties going forward will engineer a dramatic increase in the deficit. The bond market is not laughing. It is time to dump that old investment guideline where you own your age in bonds. From here on, the bond/equity ratio should be 0% in bonds and 100% in equities, whatever your age. You now should own your age in high dividend paying equities and the balance in aggressive growth or emerging market equities.

Global Market Comments

January 9, 2013

Fiat Lux

Featured Trades: None

Returning from my transcontinental rail trip, I had a ton of local errands to run. Pick up the mail, the dry cleaning, and my newly resoled hiking boots, which suffered 1,500 miles of backpacking last year, all of it uphill. The Toyota Highlander was still a disaster from the Lake Tahoe trip, the Christmas tree had to come down, and the Lionel electric train set put away in storage for another year.

So I was in somewhat of a hurry when I turned the corner on to my street. After all, I still had a letter to get out for the day. A black Porsche Boxster reversed right in from of me and I jammed on the brakes. A young man stalled the car in the middle of the road and I nearly t-boned him.

Then I looked to my left. The house was clearly empty and the alarm was wailing. A bell went off in my head. While a lot of young guys in the San Francisco Bay area drive $100,000 cars, there was no way a Porsche owner didn?t know how to drive a stick shift. The car was being stolen.

The thief tried to start the engine again, popped the clutch, and stalled it. He grimaced at me with an expression of absolute guilt, knowing full well he had been caught red handed. I got ready to ram the Porsche with my SUV. If the driver reached for the door, I was going to hit the gas, because it could only mean one thing. He was about to come after me with a gun. I tried to memorize every feature of the miscreant; African American, six feet tall, light build, 28, high cheek bones, and a blue knit cap at 4:00 on a warm afternoon. I tightened my seat belt.

Finally, on the third try, the driver got the car running and tore off down the road. I called 911 to report a car theft in progress. I then called the homeowner, blustering my way past an obdurate secretary with ?an extremely urgent personal call.? A quizzical neighbor came out of an important meeting and picked up the phone.

?Do you own a black Porsche,? I asked?

?Yes.?

?Does anybody have permission to drive it today??

?No.?

?Then someone just stole your car. I already called 911, but you better get on home.?

The police cruiser showed up ten minutes later. The offenders had pried open a back window, ransacked the house, and found the car keys in a drawer. The entire range of Apple products were stolen.

Waiting to make my statement, I noticed that the officer wore a Purple Heart campaign ribbon. He flew Blackhawks, and was wounded by an IED on his way to work. We traded Kuwait stories for a while, and I regaled him with tales of the Persian Gulf in the prewar days, like pages out of Arabian Nights. Then I asked,

?Why don?t you just get the owner?s Apple login and ID and activate the GPS tracker??

?The crooks know about this technology, and they turn them off as soon as they grab them, so we can?t find them.?

?Maybe these are dumb crooks. Perhaps they don?t go to Mac World Expo every year. Why don?t you try??

The thing about the military is that the men honor the chain of command, even after they leave the service. An hour later I got a call from the duty officer.

?We activated the Apple GPS tracker. The phones and laptops had been turned off, but there was one iPad that was in sleep mode with a black screen. It was transmitting its location the whole time. It pinpointed an address in Oakland. We now have the house surrounded and want you to come identify the perpetrator. ?At his home in his neighborhood.? By the way, this is now a vehicular manslaughter case because the suspect hit and killed a female pedestrian while making his escape. You are the only witness.?

The officer was shocked when I said ?Sure thing.? Volunteers for this request are unheard of.

?A cruiser will pick you up in five minutes.?

?Ship it in.?

The same Iraq veteran picked me up. He drove me to the worst neighborhood in the city with the highest per capita murder rate in the United States. Every house had barred windows, cars were up on blocks, and trash was everywhere. It was a real cesspool. Six cop cars surrounded a corner house, and groups of curious neighbors crowded the perimeter.

The police walked the handcuffed suspect into the headlights of our car. My night vision isn?t the greatest these days, so I picked up a pair of spotter?s binoculars I kept from my Marine sniper training days. There were the high cheekbones, with an insolent, disdainful look that you only see on the ghetto. There was absolutely no doubt. I affirmed to the officer that I could make a 100% positive ID.?

I told him of my plan to ram the car. ?We wish you had. You would have saved that lady?s life.? I then told the officer, ?Let?s get out of here. You guys all have second chance vests and I don?t. I don?t want to catch a stray round.

On the way home my driver informed me that all of the stolen property from the crime had been recovered, along with many additional items taken during other robberies. The suspect had an arrest record going back to age 16. They had been trying to bust this gang for years, and I had given them their break. With the manslaughter, grand theft auto, hit and run, and burglary charges, the guy was looking at 30 years. A public defender might plea-bargain this down to 15 years, so there was unlikely to be a trial.

I was overcome by a sense of sadness. What a senseless waste of two lives.

When I returned to my neighborhood I was greeted as a conquering hero. Several reported seeing the same guys casing the area over recent months. The robbers broke in just after the cleaning lady left. The homeowner was effusive in his praise, and said his missing property would be returned the next day. The Porsche was totaled in the crash, but was insured. He asked if I needed anything. I said absolutely not. ?I?m just an old combat veteran always on the lookout for a new fight.? A case of 2006 Silver Oak Cabernet mysteriously showed up on my doorstep the next morning.

By now, the letter for the day was a complete write off. All of my worldwide staff had gone to bed, and there was no one left to email or post it. Besides, they still had yesterdays? 5,000-word magnum opus to digest.

I called my 85-year-old mother with a blow-by-blow description of the events. She said she would have the best story ever to tell her breakfast crowd the next morning at her assisted living facility. At least something good came of this tragedy.

No, I?m Not Going to Wear Them

Global Market Comments

January 4, 2013

Featured Trades: (LUNCH WITH THE TREASURY SECRETARY)

Global Market Comments

January 3, 2013

SPECIAL FOREIGN CURRENCY ISSUE

Featured Trades:

(LONG TERM DOLLAR TREND),

(FXA), (FXC), (BNZ), (CYB), (FXE)

(THE COMING COLLAPSE OF THE YEN),

(THE BIG MAC INDEX), (MCD

CurrencyShares Australian Dollar Trust

CurrencyShares Canadian Dollar Trust

WisdomTree Dreyfus New Zealand Dollar

WisdomTree Dreyfus Chinese Yuan

CurrencyShares Euro Trust

Any trader will tell you the trend is your friend and the overwhelming direction for the US dollar for the last 220 years has been down.

Our first Treasury Secretary, Alexander Hamilton, found himself constantly embroiled in sex scandals. Take a ten-dollar bill out of your wallet and you?re looking at a world class horndog, a swordsman of the first order. When he wasn?t fighting scandalous accusations in the press and the courts, he spent much of his six years in office orchestrating a rescue of our new currency, the US dollar.

Winning the Revolutionary War bankrupted the young United States, draining it of resources and leaving it with huge debts. Hamilton settled many of these by giving creditors notes exchangeable for then worthless Indian land west of the Appalachians. As soon as the ink was dry on these promissory notes, they traded in the secondary market for as low as 25% of face value, beginning a centuries long government tradition of stiffing its lenders, a practice that continues to this day. My unfortunate ancestors took him up on his offer, the end result being that I am now writing this letter to you from California?and am part Indian.

It all ended in tears for Hamilton, who, misjudging former Vice President Aaron Burr?s intentions in a New Jersey duel, ended up with a bullet in his back that severed his spinal cord. Cheney, eat your heart out.

Since Bloomberg machines weren?t around in 1790, we have to rely on alternative valuation measures for the dollar then, like purchasing power parity, and the value of goods priced in gold. A chart of this data shows an undeniable permanent downtrend, which greatly accelerates after 1933 when FDR banned private ownership of gold and devalued the dollar.

Today, going short the currency of the world?s largest borrower, running the greatest trade and current account deficits in history, with a diminishing long term growth rate is a no brainer. But once it became every hedge fund trader?s free lunch and positions became so lopsided against the buck, a reversal was inevitable. We seem to be solidly in one of those periodic corrections, which began six month ago, and could continue for months or years.

The euro has its own particular problems, with the cost of a generous social safety net sending EC budget deficits careening. Use this strength in the greenback to scale into core long positions in the currencies of countries that are major commodity exporters, boast rising trade and current account surpluses, and possess small consuming populations. I?m talking about the Canadian dollar (FXC), the Australian dollar (FXA), and the New Zealand dollar (BNZ), all of which will eventually hit parity with the greenback. Think of these as emerging markets where they speak English, best played through the local currencies.

For a sleeper, buy the Chinese Yuan ETF (CYB) for your back book. A major revaluation by the Middle Kingdom is just a matter of time.

I?m sure that if Alexander Hamilton were alive today, he would counsel our modern Treasury Secretary, Tim Geithner, to talk the dollar up, but to do everything he could to undermine the buck behind the scenes, thus over time depreciating our national debt down to nothing through a stealth devaluation. Given Geithner?s performance so far, I?d say he studied his history well. Hamilton must be smiling from the grave.

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade. To remind you why you hate the Japanese currency, I?ll refresh your memory with this short list:

* With the world?s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt approaching 200% of GDP, or 100% when you net out inter agency crossholdings, Japan is at the top of the list.

* The Japanese long bond market, with a yield of 0.1.2%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country?s beleaguered exporters.

When the big turn inevitably comes, we?re going to ?100, then ?120, then ?150. That works out to a price of $40 for the (YCS), which last traded at $16.35. But it might take a few years to get there. The Japanese government has some on my side with this trade, not that this is any great comfort. Four intervention attempts have so been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?84 I see on my screen today is unbelievable. That would then give you a neat 15-year double top.

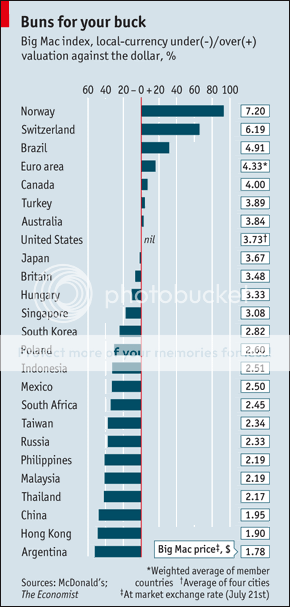

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations (click here for the link).

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) fat and sodium packed premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation.

What are its conclusions today? The Swiss Franc, the Brazilian Real and the Euro are overvalued, while the Hong Kong Dollar, the Chinese Yuan and the Thai Baht are cheap. I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

The Big Mac in Yen is Definitely Not a Buy