Global Trading Dispatch?s Trade Alert Service posted a new all-time high yesterday, clocking a 50.9% return since inception. The 2012 YTD return is now at 10.71%. That takes the average annualized return up to 30.1%, ranking it among the top five performing hedge funds in the world. Those happy subscribers who bought my service on May 23 have seen every one of my 11 trade recommendations turn profitable, reaping a 15.32% gain from my advice.

I really nailed the top of the market on April 2, piling on hefty short positions in the S&P 500 (SPY) and the Russell 2000 (IWM) within a week. Predicting that the conflagration in Europe would get worse, my heavy short in the Euro (FXE), (EUO) was a total home run. I took in opportunistic profits trading the Japanese yen (FXY), (YCS) and the Treasury bond market (TLT) from the short side. I was then able to lock in these profits by covering all of my shorts within 60 seconds of the May 28 market bottom.

In June I caught almost the entire move up with a portfolio packed with ?RISK ON? trades. I picked up Apple (AAPL) at $530 for a rapid $50 gain. I seized the once in a lifetime opportunity to buy JP Morgan (JPM) at a 40% discount to book value, picking up shares at $31, correctly analyzing that the ?London Whale? problem was confined and solvable. My long position in Walt Disney (DIS) performed like the park?s ?Trip to the Moon? ride. While Hewlett Packard (HPQ) fell a disappointing 5% on me, I was able to add 140 basis points to my performance through time decay on an options position.

My satisfaction in all of this comes from the knowledge that thousands of followers are making money in the markets that never would otherwise. I am protecting them from getting ripped off by the sharks on Wall Street with their conflicted and indifferent research. I am expanding their understanding of not just financial markets, but the world at large. And I am doing this during some of the most difficult trading conditions in history.

Earlier this week, I added a short position in the (SPY), expecting that Ben Bernanke would fail to deliver QE3. That assessment proved correct, delivering my 11th consecutive profitable trade. The roster is below:

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Trade Alert Service Since Inception

My first morning in the Swiss mountain hamlet of Zermatt, home to the Matterhorn, I was awoken by an army platoon outside my door, fully armed with fixed bayonets.

No, I was not being arrested for past indiscretions in the idyllic Alpine paradise. My often-inflammatory opinions had not even triggered an international incident worthy of military action. It was in fact, the traditional religious holiday of Corpus Christie, and the entire town was conducting a parade past my hotel, brass band and all, at 6:00 am.

Was It Something I Said?

Back in town I stopped at the Chamber of Commerce to pick up my 40-year visitor?s loyalty pin. The pin entitles me to free concerts at the 18th century church and other such frills.

When I first arrived here, the town was overrun with American college students, backpacking around Europe on shoestring budgets, using their Eurail passes to sleep on overnight trains to save the cost of a Youth Hostel. Alas, the age has passed, and today they are gone. Even the Youth Hostel here now costs $50 a night.

The weak dollar means that the only young Americans you see are the children of ?the 1%? flaunting new Rolex watches and daddy?s American Express platinum card, acting as obnoxious as they can. The locals love the business.

The Strong Swiss Franc Forced Some Economies

Since the Matterhorn has some mystical hold over the Japanese as the world?s most perfect mountain, tour groups are here en masse. At one traditional Swiss restaurant I saw one very loud, drunken fellow stagger from table to table, annoying every guest.

I knew from hard earned experience that this red-faced guy was going to throw up any minute.? I asked the owner why he didn?t throw him out. He said that the miscreant was the tour guide, if he left, his 20 big spending customers would depart with him, and he couldn?t afford to lose the business.

Can I Make a Collect Call to the 16th Century?

Zermatt has been a transit point for those traveling between Northern and Southern Europe for thousands of years. During WWII refugees fleeing fascist Italy were guided to the edge of the glacier never seen again. Hundreds are still thought to be entombed in the many deep crevasses.

On a previous trip, search and rescue was sent out to retrieve a newly discovered body. After sifting through his pockets and dating the coins, authorities realized that the unfortunate victim had been there for at least 400 years.

I always avoid the cheesy souvenir shops, as most of their offerings are now made in China, and I already have enough Swiss Army knives to last a lifetime. Instead, I do my shopping at the local hardware store and supermarket, loading up on my favorite mustard, chocolate bars, and a few cowbells.

There is a huge construction boom underway in Zermatt, with more than 20 hotels and condo buildings under construction. I asked a local business leader why this was so, with the economy of Europe falling apart. He replied that whatever they were losing with Germans, French, Spanish, and Italians they were more than making up with Asians and Arabs. Many shops now offer their chocolate, cuckoo clocks, and T-shirts with Japanese signboards.

More on Zermatt later.

Place to Think Great Thoughts

Many apologies to the hundreds of listeners who were cut short during the broadcast of my biweekly strategy webinar on Wednesday, August 1. Despite the Herculean efforts of the staff, sometimes the technology doesn?t deliver as promised. This was one of those days.

For a start, getting the GoToMeeting software to work on an iMac is a bit like trying to shove a round peg in a square hole. While the scenery in Zermatt is spectacular, the local broadband is still stuck in the 19th century. I did a speed test and discovered, to my horror, that I was clocking 2 mb/second, compared to the blistering 100 mb/second that I get at home.

The satellite link connecting Europe with the US can go down at any time. On top of that, the London Olympics has been sucking up much of the continent?s bandwidth, slowing down everyone?s communications to the speed of molasses in winter.

There were some local issues that further complicated matters. It is the Swiss National Day, or the country?s equivalent to the Fourth of July. So everyone had the day off, and many spent the day surfing the net, further slowing speeds. Fireworks went off constantly, and the party next door started to spill over into my own chalet.

Right at 6:00 pm local time, the church bells started ringing, just as my webinar was getting started. I hope you were able to hear them in the background. Oh, and I think some local goats were chewing on my fiber optic cable. When the call came in that the audio was intermittent, I had little choice but to can the broadcast.

Please go to my website at www.madhedgefundtrader.com and log in. There you will find the PowerPoint for today?s webinar posted, along with all other past strategy webinars. I look forward to hearing from you again when I return to the 21st century next week and have US grade hardware and communications at hand. I?ll be broadcasting from a PC, so that the live Q&A chat window will be restored as well.

After my failed attempt, I headed to central Zermatt to join in the celebrations. I found the main street packed shoulder to shoulder with at least 10,000 revelers. Traditional Swiss music groups played tunes like Yankee Doodle and The Stars and Stripes Forever. Businesses had tables in front selling every imaginable kind of food. They were slinging out fondue, raclette, something called cholera, bratwurst, flamenkuche, and sushi as fast as they could make it. The beer and wine flowed freely, and people of every nationality were in an ebullient mood. I matched every stop at a food stand with two at the bakery tables. The waste line suffered.

As we approached 10:00 pm, the fireworks increased in crescendo. Then three huge signal fires were set on the surrounding mountain peaks, and the festivities moved into overdrive. They clearly do not have the same restrictions as at home, as every juvenile delinquent had an armload of skyrockets, roman candles, and firecrackers, which they put to use with reckless abandon.

Just as the town began its main display, a huge thundercloud barreled up from Italy. We witnessed an awesome duel, with enormous lightening strikes on the Matterhorn challenged by the immense booming of fireworks over the village. As we were deep in an Alpine valley, the reverberating echoes off of the surrounding mountain walls were superb. Finally, a torrential downpour sent everyone scampering for the cover of the overhanging eves of chalets.

In the meantime, good luck and good trading.

John Thomas

Zermatt, Switzerland

My Morning Commute

Taking the express train from Paris to Frankfurt, I was playing around with the map function on my iPhone 4s. It was really cool watching the blue dot marking my location zip across the map at 200 miles per hour.

When I zoomed in on my location, I realized that I recognized many of the names. Soissons, Chateau, Thierry, and Belleau Wood were all names that I recalled from my grandfather?s US Army discharge papers from WWI. That?s where he suffered a mustard gas attack that inflicted total blindness for 5 years and put him in a bad mood for the next 50. The train was traveling along the frontline trenches of the Western Front.

I wondered what my grandfather would say to me today, 45 years after his passing. His parents sent him from his native Sicily to New York City to avoid the Italian draft, which then needed recruits to expand its empire in Libya and Ethiopia. But when 1917 came, he joined the American army?s famed Rainbow Division to gain US citizenship and quickly found himself in the trenches.

I am sure he would be amazed by the technology that emerged nearly 100 years into the future; bullet trains, cell phones, and laptop computers that give immediate access to all knowledge. He was a true renaissance man, spoke five languages, and was well versed in the classics, so he would have appreciated the utility of such devices.

However, he would have been horrified that I was traveling to Germany to speak with the hated ?Bosch?, who committed atrocities against Belgium children, whose submarines sank unarmed civilian ships, and who were no better than lowly ?Huns?. That, however, is precisely where I was going, to advise the German government, the CEO?s of top corporations, and officials from the Bundesbank on how to extricate themselves from their current financial and political predicaments.

Check Out My Frankfurt Digs

When I arrived at Frankfurt station, my origins as a German blue-collar factory worker made themselves abundantly clear. I headed straight for a fast food stand and ordered a bratwurst mit brutchen und kartofelsalat mit eine grosse bier. When I was 16, I spent a summer working at the Sarotti chocolate factory in West Berlin, and the preferences I picked up live with me today. Some of my co-workers had been Russian POW?s in Siberia released only a few years before, and the stories they told me were bone chilling.

When the list of those who wished to hear my views became impossibly long, I finally said to one friend, ?Why don?t we just get everyone together and have one big party.? And that?s exactly what he did. Crammed into the top floor of one of Frankfurt?s highest skyscrapers were 100 of the cream of the German establishment who came to hear my thoughts on the world at large.

I told them that Europe has two choices: it can move backward or forward. If it returns to the past, the European Community and its currency will break up, forcing each country to compete individually against the US and China. This would cut GDP growth by half and lead to a permanent decline in standards of living. Germany would lose all of its banks as they go under en masse from the burden of bad European debts. Eventually, you would end up with a Germany that is angry, broke, and nuclear, and nobody wants that.

Inventory is Not Flying Off the Shelf in Europe

The only choice, then, is to move forward. Europe is really half a country, or a pretend country. It has a common currency, but not the institutions to ensure its survival, like a US style Treasury Department and a dual mandate central bank with teeth. The present system as it stands is guaranteed to fail. But it took a Herculean effort to get this far 13 years ago, with every party expending their last centime of political capital. So here we stand. After a long hiatus, it is now time to move forward.

It?s up to Germany to bail out the weaker economies of Southern Europe. For a start, they have the money to do so. Much of this was earned exporting German products there. Last year exports exceeded $1 trillion, or about 20% of GDP. Complain all you want about Mediterranean borrowing, but a very large part of it was used to buy Mercedes, Volkswagens, BMW?s, and Audi?s. That?s a lot of money to put at risk by allowing their economies to implode.

Research Can Be So Tedious

But bailouts don?t come free, and the quid pro quo for riding to the rescue would be to give Germany control of European monetary policy. The president of the ECB doesn?t even need to be a German. A Belgian would do, as long as he pursues German style anti-inflationary policies.

There are plenty of historical precedents for such arrangements. The US put up the money for the creation of the United Nations in 1945, and kept for itself a permanent seat on the Security Council. The US funded World Bank is always run by an American. The originally US financed International Monetary Fund has traditionally been managed by a European. The current president is former French Finance minister Christine Lagarde. But its headquarters are in Washington DC.

Pulling this off isn?t going to be easy. When the United States wrenched these concessions out of 13 states in 1787, only 5% of the population was allowed to vote?white, property owning males. Good luck trying to achieve that in a loose confederation of 27 states, with 17 in the monetary union that backs the Euro. Some politicians may have to actually earn their pay for a change. I expect this to be a five-year work out, at the very least.

The net net for all of this is that the Euro will get a lot cheaper before we hear the end of this. Parity against the greenback by next year is within reach, and a revisit to the old low of 88 cents is not impossible. Such a bargain currency would give Europe a huge economic advantage on the world stage and might even provide the grease to make an ultimate solution possible. Then we will have a real United States of Europe to be admired, but also feared as a real competitor.

With that, I headed off to a late dinner near the grand Frankfurt Opera House with several of the more senior guests. My host explained that the impressive baroque building was symbolic in Germany in many ways. While it looks ancient and imposing, it in fact was new, rebuilt with modern reinforced steel and concrete on the rubble of WWII.

Powered by beer, Rhine wine, and ultimately schnapps, I made it until midnight and then caught a taxi back to my palace, wondering if I had missed anything that evening. I also wondered if my grandfather would have been proud of me.

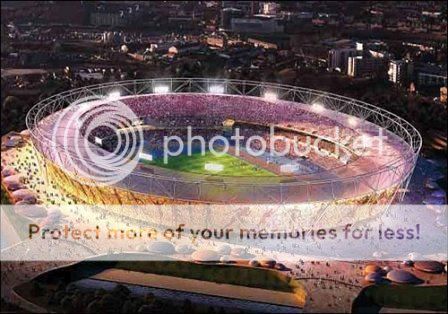

I knew from my own research that these tickets were the most sought after in the world and were going for $20,000 each on the black market. Forgeries abounded. Besides, I was high in the Swiss Alps at Zermatt, and every flight going into London for weeks was booked. How was I supposed to get there?

No problem, he said. He would send his private Gulfstream G5 to pick me up. I answered that I was planning an assault on the Breithorn on Sunday, and that the guides had already been booked and the equipment rented. No worry, he would have the jet on standby in London until I was ready to return.

I said he was out of his mind. The day he was proposing would cost at least $100,000. He replied that he made over a billion dollars on my Swiss franc trade last year and it was the least he could do to say thanks. I said OK, but only if I could fly in the right hand copilot?s seat. ?Done,? he shot back.

I set to work immediately obtaining the necessary flight clearances. The nearby Swiss Air Force base at Sion was easy. But getting permission to land at Luton, just 45 minutes from the Olympics east London venue, was a little trickier. The British were unusually touchy about allowing private aircraft near the games, and my civilian inquiries hit a dead end.

Sion Airport

But after a few well-placed calls to the Pentagon it was settled. Looks like I owe the US Air Force Staff College a free lecture. I checked the NATO meteorological website, and miraculously, it looked like a cold front was veering to the right, and would just miss the Olympic site.

After my Zermatt strategy seminar, I literally ran to the heliport next to the Banhoff. In minutes, we were revving up the engines, and tore down the valley to Sion, an almost instantaneous free fall of 4,000 feet. The route the train covers in 80 minutes we did in ten. As soon as the chopper landed next to the G5 I hopped in with an overnight bag and we taxied for takeoff. At full power, we covered the route via Frankfurt and Paris in just 2 hours.

At Luton, a black Daimler limonene was waiting for me. I held my breath as the driver expertly negotiated the back roads to Stratford, hoping he wouldn?t get tied up in an immense traffic jam. Finally, a mile from the stadium we hit a wall of unmoving cars.

I jumped out and started briskly walking, carrying every form of ID I had, expecting to get challenged at every point. I was armed with a giant full page Olympic ticket with my photo that hung around my neck, a passport, my Department of Defense DD 214, a US commercial pilots license, a membership to the Surrey Rifle Association, and my old Scoutmaster?s card from a Boy Scout troop in west London. I made it just in time.

The atmosphere was absolutely electric, with everyone on a high. Try to imagine the excitement of the Super Bowl, the World Series, and the World Cup combined, and you might have an inkling of the emotions. Just getting here was a major achievement for all in attendance. The sound system was so loud that it reverberated straight through your body.

I sat in a high security VIP area about 100 feet from where Queen Elizabeth II sat surrounded by security men. No one can top the Queen on Olympic credentials. She opened the 1976 Montreal games herself.? Her father, King George VI, opened the 1948 London games. Her grandfather, King Edward VII, did the same for the 1908 games. I never believed for a second that she arrived by parachute with James Bond. Her husband, Prince Phillip, the Duke of Edinburgh, has origins that lie with the Greek royal family. Presidential hopeful, Mitt Romney, was not far away, sitting close to Bill Gates and Sir Richard Branson.

The ceremony opened with a medieval pastoral scene of farms, animals, and maypoles, even though most of the British lost their connection to the land ages ago. The London Symphony Orchestra tastefully opened with Elgar?s Nimrod. I quickly became the historical interpreter for the guests who surrounded me, as few could identify the significance of the Isambard K. Brunel figure played by Kenneth Branagh, the builder of Paddington Station and the first iron ship, the SS Great Britain.

Isambard K. Brunel

The rise of the industrial revolution was truly impressive, with its towering smokestacks, and the costs to the people and the land were clear. This was climaxed by the symbolic forging of the Olympic rings of steel. The smoke gave off the genuine stench of a steel mill.

After that there was so much going on in the arena, it was hard to keep track of it all. It was also a challenge to integrate the story line that played out on the big screen with the live action in front of you, and we all struggled to keep up. Unless you were an authority on English history, it was easy to lose track of what was going on.

I?m not sure many understood the significance of Emily Pankhurst and the suffragettes, the red poppies of WWI, and the blitz of WWII. Then 200 beds on wheels with nurses suddenly appeared as a tribute to the National Heath System created in 1948. After our recent Supreme Court decision on Obamacare, I wonder if we will do the same someday.

Rowan Atkinson was brilliant as the bogus member of the orchestra.? When 50 Mary Poppins holding umbrellas descended from the sky, I was afraid the whole thing would degenerate into a clutch of British clich?s. But then Paul McCartney played Hey Jude and we all nearly lost it.

The parade of the teams certainly challenged one?s knowledge of national flags. We took pictures of them and they took pictures of us. By the lime Lesotho appeared, I was starting to fade, so I told my neighbors to wake me up when the United States appeared. When they did, they looked glorious in their Chinese made Ralph Lauren designed blue blazers and berets.

Of course, the big suspense was over whom would light the Olympic flame. As a former marathon runner, I was hoping for Roger Bannister, who broke the four- minute mile in 1954. Then we were teased into thinking it would be soccer great David Beckham, who grew up nearby and arrived with the torch in a giant, glowing, powerboat. In the end, we saw seven British Olympic greats handing off torches to seven unknown kids to symbolize the passing of the generations. Finally, fireworks went off to the sound of Pink Floyd. How cool is that?

Only through the miracle of cell phones, Mapquest, and GPS was I able to find my forlorn limo driver. By the time I was dropped off at a friend?s house at Hampstead Heath, it was 4:00 AM. I heard it took three hours for Britain?s high-speed rail system to empty the 80,000 spectators from the stadium.

My return to Switzerland was considerably less dramatic. When the G5 landed back at Sion the next day, I took a taxi to the train station and caught a train up the mountain to Zermatt. En route, my friend called me and asked what my big trade for 2012 would be. I said I?d get back to him, but with a presidential election, a continuing European crisis, and a fiscal cliff ahead of us, I had great hopes. I got back to my chalet just in tine to turn on the TV and watch Michael Phelps blow the 400-meter individual medley.

The day checked another item off my bucket list, allowing me to give thanks for my life. And I?m now on my forth bucket list. Sorry, no financial stuff today. The surprise day at the Olympics blew a 24-hour hole in my work schedule, and I?m getting up at 5:00 a.m. tomorrow morning to climb the Breithorn.

Given the choice of bagging another 14,000-foot Alpine peak and publishing the 1,400th Diary of a Mad Hedge Fund Trader, I?ll settle for the altitude. You?ll just have to settle for the two Trade Alerts I sent out Thursday to sell short Treasury bonds and the yen, which I?m happy to report turned immediately profitable.

The full force of soaring oil prices really hit home when I arrived in Paris yesterday. As we passed a gas station, I mentioned to the driver that I didn?t know that they sold gas by the gallon in France. He answered that they didn?t. Those were the prices in liters I was seeing. He then voiced concerns about the future of his taxi business as fuel prices ratcheted up from $10 to $15 a gallon! It makes our own bleating that our prices at $3.50 a gallon appear somewhat detached from reality.

The Paris strategy luncheon, held at the Cercle National des Armees, or the French Army Officers Club, was one of the best yet. You know, the place where Napoleon used to hang out? I gave my talk under the watchful eyes of the portraits of Charles de Gaulle, President Francois Hollande, and the French Foreign Legion. Renditions of the battle of Waterloo were nowhere to be seen.

When I gave my event here last year, Internet access was only available in the lobby. Perhaps that?s why the French lost Vietnam? At the table on my right a group of French Air Force officers were planning the next air strike on Libya. On my right several Chinese admirals were negotiating to buy an aircraft carrier from the French Navy. It was some of the most fascinating eavesdropping I have ever done.

The event turned in to something of a reunion for me, with my former institutional clients from the 1980?s dropping by, as well as some of my French staff from the London office of Morgan Stanley. A gentleman from Warsaw, Poland won the prize for the greatest distance traveled. Spend your Zimbabwe dollars wisely. Maybe you can offload your holding to Bashar Assad, who may soon need them.

The big question at all of my recent lunches is ?Will there be a QE3? I offered the simplest of all possible explanations. Asset classes that prospered mightily from the $600 billion infusion of the Federal Reserve during QE2, like stocks, commodities, precious metals, and oil, will suffer the most from its demise. Asset classes that suffered from the rapid expansion of the monetary base this encouraged, like the US dollar, should see a rebound. The political balance in Washington makes a QE3 impossible, unless the stock market crashes first, vaporizing Ben Bernanke?s wealth effect. So don?t hold your breath. It would be a last desperate act.

Not All is Well in the City of Light

Everyone present complained that the Euro was in freefall at $1.22, but conceded that momentum could take it as low as $1.00 before it sees a reversal. I brought an extra suitcase to Paris, hoping to fill it with goodies for those on the home front at the department store Gallarie Lafayette, Mon Dieu! But prices were still so high that I only purchased a few postcards, knowing I could buy the same products at home on the Internet for half the cost, with free shipping and no import duties.

I spent the weekend playing tourist and visiting my old favorites, such as the Louvre, the Musee d?Orsay, Sacre Coeure, Montmarte, the Eiffel Tower, and a fine dinner floating down the Seine on the Bateaux Parisienne. The food is so good that even the local corner brasserie produced a meal to remember. A stylish people make it impossible to be overdressed, no matter where you go. In Paris, even the homeless have taste. A search for my front teeth on the Left Bank, which I lost in a riot there in 1968 when a flying cobblestone hit me in the mouth, yielded no results.

My next report will be from Frankfurt, Germany.

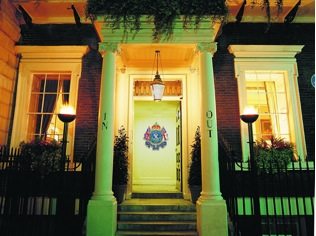

The city is now the most crowded that it has been at any time since WWII. Most hotels have tripled their rates, forcing traveling students on a budget to sleep in doorways and under bridges everywhere.? My usual abode here, The Naval Officers Club near Piccadilly, honored their regular price since I have been such a long term and loyal guest. However, I was the only one in the building not participating in an Olympic event, as the teams of several nations booked every room two years ago. The American team arrived today in their spiffy blue blazers. After randomly driving around London, the hapless bus driver broke down and admitted that he didn?t know where the Olympic Village was. And enterprising athlete whipped out his iPhone, Googled the address, Mapquested the directions, and they finally arrived four hours late. Still, they fared better than the Australian sailing team, whose sales were lost by Qantas Airlines. I decided to flee the madness in London for a day and visit some old friends in the countryside, the 8th Earl and Countess of Carnarvon. The late 7th Earl was an early investor in my first hedge fund and I have kept in touch with the family ever since. ?

During my recent quick run through Chicago, I stopped by Obama?s house on Greenwood Avenue and 50th street in up and coming Hyde Park to say hello. I was thwarted by two concrete crash barriers, 16 cop cars, and army of elderly Chicago police happily pulling overtime. Shifty looking characters wearing long overcoats and sprouting wires out of their ears were everywhere. Needless to say, I did not get invited in for tea and cookies.

Every neighborhood bird nest, flagpole, and chimney sported video cameras, and Google Earth has wiped the block off the map. No wanting to risk my valued Secret Service clearance, I scuttled out of there before anyone started asking questions. Instead, I settled for a visit to the delicious Valois Cafeteria around the corner, the president?s favorite diner, and his preferred bookstore at 57th Street Books. They carried all of his publications. Amazing!

I managed to run into someone, who knew someone, who once babysat Obama?s kids. Need, a presidential pardon, a cushy ambassadorial appointment, a new alternative energy program, or a juicy government contract? I?m now your ?go to? guy! Just make a discreet donation to my favorite 501 (3) (c) and it?s a deal.

It is with a great sense of sorrow that I learned of the passing of industry legend, Barton Biggs. He was 79. I was speaking to him only a few weeks ago when I passed through New York for my strategy seminar, attempting to decipher the medium term trends for these fractious and conflicting markets. It is a reminder of how temporary and fleeting life can be.

Barton was a pioneer in the international investment arena and founding father of the modern hedge fund industry. He became famous for calling market bottoms in 1982, 1987, and 2008. He was a colorful and masterful writer who regularly titillated investors with his iconoclastic and out of consensus ideas. Sound familiar?

Barton grew up as a member of the East coast establishment, his father being the chief investment officer of the Bank of New York. He graduated from Yale in 1955 in creative writing and then did a brief stint in the Marine Corps. He next turned to Wall Street and joined E.F. Hutton as a junior broker (remember ?When E.F. Hutton speaks, people listen??).

In 1965 he spun off to create Fairfield Partners, one of the early long/short US equity hedge funds. After several prosperous years, the fund crashed and burned with the collapse of the ?Nifty 50?. He later told me that was when he first learned of the six standard deviation move. ?The biggest mistake you can make in a bear market is to cover your shorts too soon? he said.

In the mid seventies, he was recruited by a small, white shoed, private partnership called Morgan Stanley & Co. to build up an asset management division from scratch. Barton became my friend and mentor when I joined the firm in the early eighties, and I spent the better part of the decade debating every pebble of the investment landscape with him.

Together, we fought a major uphill battle trying to convince a cautious and blinkered management that the firm?s future lies in international and emerging market equities. Getting them to focus on Toyota and Matsushita instead of General Motors and IBM, we felt like Sisyphus endlessly rolling the boulder up a steep mountain.

Barton persevered, and in the following three decades the business grew to $1 trillion in assets along with a world-class global research department. After Morgan Stanley went public, he became a billionaire in his own right. I bailed to start my own hedge fund a few years later.

In 2003, Barton left (MS) to start a new hedge fund, Traxis Partners. We all thought he was crazy at the time, as it was the last thing you would expect a 71 year old to do. This is a business where 30 year olds regularly drop dead of heart attacks from the stress. That was pure Barton. I heard at one point he reached $5 billion in assets.

He became a regular fixture in the media, offering his wisdom and insights in his characteristic gravelly voice. Always the independent thinker, I know he voted for Obama in the last election, at odds with much of Wall Street.

To listen to my last extended interview with Barton where he gave his global view a few years ago on Hedge Fund Radio, please click here. He was tiring even then, and we had to record the show in 15-minute segments so he could rest in between sessions. But he made the extra effort to give my readers an edge on the market. That was pure Barton too.

Barton will be missed by many.

Sysiphus

I write this to you from my double suite on the Orient Express crossing the Swiss Alps. My manservant, Charles, is off fetching a cup of tea and steam pressing my white dinner jacket for tonight?s formal dinner.

My first night at the Naval & Military Club in London, a group of British Army officers just back from Afghanistan, and their dates, hosted a blowout black tie homecoming party, complete with disc jockey and disco ball. While singing a drunken and rautious ?Rule Britannia? at 4:00 AM we maxed out the amplifiers and ended up blowing the power, not only for our building, but for the entire block.

Suddenly, our 18th century building was plunged back to the 18th century, meaning no lights, Internet, or flushing toilets. Candelabras solved the first problem, and the Financial Times the second, but when nature called, I had to retire to the pub across the street. Each time I did so, I enjoyed a pint of Fuller?s London Pride, not sure if I was making my problem better or worse. Two days later, two truck sized diesel generators on loan from the army magically showed up and solved the power problem, and we returned to the 20th century.

The Globe Theater is a magnificent reproduction of the original, which burned down in 1613 during a canon during scene in Henry VIII (click here for the link at http://www.shakespearesglobe.com/ ). Its thatched roof, open air seats, and 12 inch roughhewn oak beams led me to expect The Bard from Stratford-upon-Avon to walk out any moment. Actors tore through the standing crowds, reciting lines, and embracing a startled few theater goers. Half way through As You Like It, I realized that the devotees sitting next to me were mouthing the lines. They had memorized the entire script.

One afternoon I asked a somewhat doddering old taxi driver to take me to Kensington Palace, who seemed quite impressed. He drove me directly to Harry and Kate?s private entrance. After giving me the gimlet eye, Scotland Yard directed us to the correct entrance for the tourists. I try not to cause international incidents when on vacation, and this time I came close.

England definitely did not show its best face when I walked out of a comedy club into Leicester Square at 2:00 AM. The women were so drunk that they walked barefoot across the vomit covered pavement, unable to walk in high heels.

Another day found me at Christie?s auction house for a private viewing of John James Audubon?s spectacular Birds of America. The multi-volume set was in mint condition, the colors as bright as the day they were printed. Only 70 of the original print run of 140 in 1838 are known to exist. One sold for $11.5 million last year, making it the world?s second most valuable book after the Gutenberg Bible.

My last morning in London found me desperately hailing a taxi in a torrential downpour. The taxi Gods smiled upon me, and I was soon barreling down the streets of Piccadilly and Westminster on the way to Victoria Station. It seems that a 20 pound tip can move mountains here. I arrived with more than enough time for a pre-prandial glass of Champagne before boarding the Orient Express.

Report from London, Part III will be continued tomorrow.

John Thomas

The Mad Hedge Fund Trader