Walking through the Capital dome on my way to the House the Representatives, I couldn?t help but sense the presence of ghosts of friends from decades past. There was Tip O?Neill with his ever-present scowl. Ted Kennedy was hurrying off to another meeting, barking orders in his peculiar Boston accent. Mike Mansfield was maintaining his ever aloof and professorial demeanor.

President Ronald Reagan was giving a hearty laugh after retelling the same off color joke for the umpteenth time, turning the faces of the female press crimson. I found the spot where 30 years ago, I ambushed Treasury Secretary Nicholas Brady and got a heads up on the impending bailout of Latin America, financed by, what else, Brady bonds.

I stood briefly to admire the timeless paintings in the filtered light, Washington Crossing the Delaware, the Victory at Saratoga, and the Surrender at Yorktown. My ancestors were present at all three. Then I hurried over to the House chamber, up the wide marble steps, and into the office of the Minority Speaker of the House, Nancy Pelosi.

The Madame Speaker welcomed me into her spacious, high ceilinged office and then immediately reached for my lapel. She touched my Marine Corps pin and said ?Thank you for your service.? I replied that it was a very long time ago and that many more had made far greater sacrifices since. She then launched into a description of her recent trip to Afghanistan where she described to the troops in Kandahar the opportunities and benefits that awaited them on their return.

To open on a light note, I asked her how it felt to be the most powerful woman in history after Cleopatra and Catherine the Great. She replied ?Having the levers of power at hand does have its uses.?

Agree with Nancy and she can be ingratiating and even motherly, taking the opportunity to pour me a cup of tea and offering a cherry Danish. Argue with her and she turns into a pit bull, whipping out well-rehearsed arguments and data so fast it almost knocked me back on my heels.

Pelosi is one of the most liberal Reprentatives in congress. Her multi ethnic constituents in the 8th California congressional district in San Francisco repeatedly return her to office with a resounding landslide. Most locals don?t even know who ran against her. In fact, many of her supporters bitterly complain that she is not liberal enough and compromises too often.

The nation?s greatest concentration of wealth creation is also an easy commute from her San Francisco office, and Nancy is well attuned to technology issues. Apple (AAPL), Google (GOOG), Hewlett Packard (HPQ), Oracle (ORCL), and Facebook (FB), have together created $1 trillion in market capitalization over the last decade.

If the Democrats retake the House in November she will reclaim her former job as House Majority Leader, making her third inline to succeed the president. If not, she will remain a major source of input to the president on economic policy. So I thought it judicious to listen what she had to say. Thin skinned, died in the wool conservatives might want to skip the rest of this story.

As the Supreme Court?s decision on Obama?s health care plan was imminent, I asked for her analysis of the likely outcome. She insisted that basic health care was a right and not a privilege. The Affordable Health Care Act will be a crucial tool to get health care spending under control and cut significantly into the budget deficit.

For business, it is a competitiveness issue, with backbreaking health insurance costs cutting into profitability and leaving managers reluctant to add employees. Foreign competitors bear no such overheads, the cost borne by generous national health programs. Employees here are ?job locked? by the old system, which prevents them from moving or changing careers for fear of losing company health insurance.

Every developed economy that implemented national health care has been able to keep spending to 8% of GDP compared to the 13% now suffered by the US, on its way to 18%. As the most efficient economy in the world, there is no reason why America cannot match these results. The program should also create 4 million jobs extending care to 50 million people.

Pelosi says the constitutionality of Obamacare is ?iron clad? and expects the Supreme Court to rule in its favor by a 6-3 margin. The right of congress to regulate interstate trade is clearly enshrined in the 1803 Marbury versus Madison case. While an activist conservative court may chip away at the act, such as through barring the individual mandate, severability prevents them from throwing out the entire measure.

While full implementation does not begin until 2014, 80 million have already benefited. They include children under 26 added to parents? policies, coverage for consumers with pre-existing conditions, and shrinking the drug benefit ?doughnut? for seniors. Young children who get cancer are no longer treated as having a pre-existing conditions for life. However, Nancy concedes that the administration has lost the public relations battle over the issue.

The Democrats need to win 25 seats in the November election to retake the House. She thinks there is a 50:50 chance of that happening. Even if they fail to regain the majority, the Tea Party?s influence will be greatly diminished, making compromise and deal making much more likely. That could lead to a resuscitation of the ?Grand Bargain? that was nearly reached last summer. This would be a hugely market positive development.

She urged Republicans to ?take their party back from the radicals? who don?t believe in any public role for the government beyond defense. The sole accomplishment of the Tea Party has been to hand control of the Senate to the Democrats by running weak, ideologically rigid candidates in the primaries, most notably in Delaware, Nevada, and now Indiana.

Nancy admitted that when growing up, a career in politics was the last thing on her mind. She was the progeny of the premier Italian political dynasty in Baltimore. Her father was both mayor of Baltimore and a member of congress. Her brother was also a mayor. After spending a childhood handing out campaign leaflets, her rebellious nature prompted her to run a mile from the family business.

It turns out that she ran all the way to California. With her five children nearly grown, she took a post on the San Francisco Library Committee. Then ?one thing led to another? and she ended up in her current job, which she has been working at tirelessly for 25 years.

At her first speech to congress in 1987 she boldly announced that ?I am here to fight AIDS.? A pall cast over the chamber as the members went mute. While the disease was ravaging San Francisco, it had yet to go national. Reagan denied funding for research because he believed the people who got it deserved it, overruling his own surgeon general.

It proved an important time for California to have aggressive representation in Washington. In 1989, the Loma Prieta earthquake hit, and federal funds played an important part in reconstruction. The base closures of the 1990?s cut a wide swath across the state. Almost every military facility in the San Francisco Bay area was closed, where many structures were up to 150 years old, in favor of more modern bases in San Diego and Bremerton, Washington. At one point, an aircraft carrier was used to move the 1,500 personal vehicles owned by transferring troops to save money.

I thanked Nancy for generously carving out an hour from her jam packed schedule and called it a day. As is usual with these high level political meetings, I gleaned a dozen or so valuable investment ideas. I will send out the trade alerts when I see good entry points.

The Capitol Dome

I never resist a dinner invitation from Bill Clinton?s Secretary of Labor, Robert Reich. A Rhodes Scholar who dated Hillary Clinton at Yale, he unsuccessfully ran for governor of Massachusetts against Mitt Romney, and authored 13 books. Bob is never without an original thought, nor a stranger to controversy. Today he didn?t disappoint. On top of that, he is about the funniest guy I have ever met, not far behind Groucho Marx, but well ahead of the rest of the world. A funny intellectual, imagine that.

Bob says that the US has entered a ?replacement economy? where people buy just what is absolutely necessary, and then, only when the things they own fall apart. Such economies are characterized by chronic slow growth. That is why US car sales have recovered to 14.5 million units a year, the precise number of vehicles we scrap each year, but won?t go much beyond that. Still, that is well up from the annualized 9 million units we saw at the 2009 low.

Consumers and corporations are so reluctant to spend because the scars of the 2008 crash are fresh. That year saw the most dramatic collapse in consumption in 80 years. Normally, the economy rebounds strongly after such sharp draw downs. Not this time. Bob describes the current lethargic 2% growth rate as ?disturbing.?

The real problem is that so few consumers are now participating in the economy. Of course, the 14.5% of the broader U-6 don?t spend beyond bare essentials. But much of the working middle class has also seen their purchasing power pared to the bone, thanks to 30 years of wage cuts and cost of living increases. Real purchasing power has dropped by half and explains a GDP growth rate that is little more than half of the long term trend growth rate of 3%. Without a middle class, you don?t have a United States. Needless to say, this does not bode well for equity prices, as low growth only justifies low multiples.

If you raise growth to 4%, then all of the country?s deficits go away by themselves over time. A major government investment in the country?s rotting infrastructure would accomplish this. Good luck getting that through a gridlocked congress.

Franklin Delano Roosevelt?s great accomplishment was to provide the means for more people to join the economy, creating an unprecedented 40 year boom. While many blame high taxes for our current problems, America?s golden age of the 1950?s, during the Eisenhower administration, took place with a maximum tax rate of 91%. Growth then was double what it is now.

Last fall, when Obama was trailing badly in the polls, he briefly considered bringing on Hillary Clinton as a running mate to shore up the ticket. He has since pulled into the lead, thanks to a bruising Republican primary and a series of strategic missteps by the GOP, and that plan has been put on a back burner. Hillary isn?t interested anyway because she can?t stand working for Obama.

Not only have the Republicans offended every minority, including Hispanics, women, and the young, they are on the wrong side of the country?s broad demographic trends. They are just not making white conservatives anymore as fast as they used to, except in Utah.

Obama has wisely made ?fairness? the hallmark issue of the current campaign. Since 1990, the top 1%?s share of national earnings has soared from 23.5% to 40%. The last time it was that high was in 1928. CEO earnings have grown especially fast, rising at 400 times the rate of blue collar workers over the last three decades. The concentration of wealth at the top stagnates the economy by redirecting savings into Treasury and municipal bonds, away from job creating direct investment. This is why ten year Treasury bond yields are a subterranean 1.55%, despite massive monetary growth.

The generation of the ?Occupy? movement has suffered the most from the lack of new job creation. In days past, many of these kids would have gone into domestic manufacturing or other union jobs, which no longer exist. Entry level jobs are now scarce, as are the career ladders that follow, as cost cutting companies no longer invest in training the young. ?Occupy? has focused a great spotlight on the issue, which the wealthy and the right would much rather avoid, and helps to define the national debate.

Money in politics is a huge problem. He is glad he lost the Massachusetts election because if successful, he would have had to have spent 70% of his time fund raising, as do most politicians today. Democracy only works when people get involved in large numbers. Otherwise, they get overwhelmed by big money.

I took two of Bob?s economics classes at the University of California at Berkeley, and know too well his wry humor, acid wit, and preference for backing up arguments with mountains of empirical data. Entering students are obliged to buy 400 pages of photocopied charts, tables, and other raw data about the labor market, which they are expected to commit to memory by the end of the semester. These are not basket weaving classes by any means.

Bob warned me not to take his investment advice, as he bought his home in north Berkeley at the 2006 market top, just before it dropped in value by half. On top of that, he has had to eat two 10% cuts in his Berkeley professor?s salary forced on him by drastic state budget cutbacks. UC Berkeley is the crown jewel of public education. However, the state has little choice but to starve it to death. This is not good for the long term future of the Golden State, which has to create the educated class to earn the wealth to pay the taxes.

Every time I walk away from one of Bob?s dinners I find my mind churning from his out of the box thinking and alternative viewpoints. I?ll let you know the next time I make the invitation list.

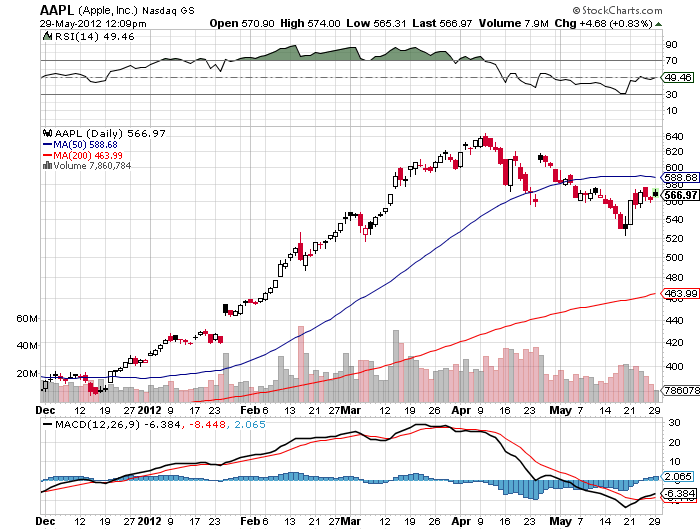

The news out this morning that Apple (AAPL) may launch its HD television product in time for the Christmas holidays caused a nice pop in the stock this morning, so I thought I would quickly review the fundamental case behind owning the company. The story originated from rumors in China that its main manufacturer, Foxcon, had already placed orders for key component parts. It will be another web to lure consumers into the Apple ecosystem and then trap them there for life. It also makes my 25% core long position in an August deep in the money call spread look pretty good.

Apple earnings have grown at a rate of 76% a year for the last seven years, and there is no sign that ballistic growth rate will abate anytime soon. The iPhone 5 launch in September will be an absolute blowout and the firm?s biggest new product launch ever. Even I have lined up a buyer of my almost new iPhone 4s at a big discount so I can get the vastly more powerful upgrade.

There are longer term strategic considerations too, such as the fact that Apple has only scratched the surface in China, the world?s largest cell phone market. A China Mobile (CHL) deal looming which will give Apple access to 600 million potential new subscribers. After refusing to support Apple products for decades, corporations are now adding Apple products in large numbers, urged on by the convenient and imminent demise of (RIMM)?s Blackberry.

The real icing on the cake here is that Apple is still one of the cheapest stocks in the market. Back out the $120 billion in cash it will soon have on its balance sheet, and you have in your hands a hyper growth company that is selling at an earnings multiple of only 8X. Look at a full year earnings target of $110 a share and rerate it up to a 10X multiple and you get a 12 month price target of $1,100.

There are some outliers that could pee on Apple?s parade. If the Android operating system somehow takes off that could slow growth. You also have to wonder how much of this amazing story is already baked into the price and when will the law of large numbers kicks in for this $532 billion company.

Paid up subscribers to Global Trading Dispatch and the Diary of a Mad Hedge Fund Trader newsletter are entitled to a password that gives them access to my premium content. Without it you will be unable to access the best parts of the new website, including my daily real time trading portfolio, trade alert tutorial and user?s manual, my Review of 2011, 2012 Outlook, and live biweekly strategy webinars. If you still have not received your password, or have lost it, please email us at support@madhedgefundtrader.com . A new password will be issued promptly.

For those who are yet to have their investment returns enhanced beyond their wildest imagination by Global Trading Dispatch, please sign up for the newsletter only for $500 a quarter. If you like what you see, then you can upgrade later to the full service for $3,000 a year and we will give you a credit for what you already spent.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011, and has an annualized 25% return since inception. The service includes my Trade Alert Service, daily newsletter, real time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. The goal is to level the playing field for you and Wall Street. To subscribe, please go to my website at www.madhedgefundtrader.com , find the Global Trading Dispatch box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

The first thing I noticed when Paul walked in was the few extra pounds and silvery tinge to his hair he acquired since I saw him last. He?s clearly spending too much time behind a computer writing those acidic columns for the New York Times. We?re all short dated options in the end, I thought.

We met at my favorite San Francisco restaurant, Gary Danko?s (click here for their site at http://www.garydanko.com/), where one can get a once in a lifetime, bucket list type meal for about $300 for two, but only if you get the cheaper wine. Ideally located near Fisherman?s Wharf, they are one of only a tiny handful of Bay area restaurants to boast a coveted Michelin star. Good luck getting a reservation if you?re not having dinner with Bill Clinton.

Paul went for the lobster salad with hearts of palm and the soft shell crab with bacon. I settled for the Dungeness crab salad with quinoa and quail stuffed with foie gras. We washed it down with an excellent 2008 Duckhorn cabernet called ?The Discussion?. I kidded him about recent articles in the press that described him as the ?Mick Jagger of economics?.

These days, Paul is not about pulling any punches. He argued that the US is really in another Great Depression that started in 2007. Only narrow segments of the economy are doing well, like the fracking driven boom in the Dakotas, which has a population smaller than Brooklyn.

In terms of chronic unemployment, human suffering, and hopelessness, this Depression is every bit as soul crushing as the one the country experienced during the 1930?s. Long term unemployment over 4 million is unprecedented in the postwar period. The jobless rate of recent college grads is even worse.

The only thing preventing Depression era breadlines and soup kitchens is the Food Stamp program that is feeding 45 million people, including many active duty military. The original Great Depression lasted ten years and included two mini recoveries like the one we just saw. The current one will last just as long if we continue the current policies.

The great misconception is that these problems are long term and structural. Adopt the right policies, and the economy would rebound ?faster than you can possibly imagine?. Vicious austerity at the state and local level is the main culprit, squeezing the life out of the economy and cancelling out any stimulus efforts by the federal government.

Austerity is not the answer. It doesn?t work when everyone is trying to reduce their debt at the same time. One man?s debt is another?s income. It?s all about the teachers. The Great Recession has prompted the firing of 1.2 million and prevented the hiring of another 800,000. Hire 2 million teachers, and the unemployment rate drops from 8.1% to 6.5%, and the consumer spending and the multiplier effects they bring with them will return the economy from a 2% to a more normal and sustainable 3% growth rate.

The answer is to spend more money, and a lot of it. If you need proof before proceeding, look no further than the 1939-41 period. Then it was massive government spending in the buildup to WWII that caused the unemployment rate to plummet from 20% to near zero.

If Paul were king of the world, he would immediately allocate $300 billion to the states to rehire teachers, and maintain the infusion annually until we are out of the crisis. The one time only injection we saw in 2009 was inadequate. He would change FHA rules to allow underwater homeowners to refinance at current rock bottom interest rates. That will keep their homes off the market and allow some recovery there, one of the largest sectors of the economy. He would keep monetary policy easy. A modest level of subsidies for alternative energy so we can quit financing sellers of oil in the Middle East who are trying to kill us is also justified.

The origins of the current malaise aren?t hard to fathom and are an exact repetition of what occurred in the 1920?s. A long period of complacency led to a relaxed attitude towards debt and risk. The flames were fanned by deregulation. Gatekeepers of the public interest were lavishly paid to look the other way. Then the Wiley E. Coyote moment came when he only plummets after looking down, that particular physics unique to cartoon characters.

Today, the waters are being deliberately muddied by a dozen billionaires funding hundreds of PAC?s and countless bogus research institutes. Their sole interest is to minimize their own tax bills, at whatever cost.

Krugman spits out ideas with machine gun rapidity and is a gold mine of insightful economic data. Eye opening observations are regularly interlaced with biting humor. I?m sure that in a past life he was a standup comedian, or in vaudeville.

I only touched on Europe with him, as my own predictions there have already come true and have become my biggest earner this year. He said that the US and Europe are in a contest to see who has the worst managed economy, and that right now, Europe was winning. He observed that maintaining a single currency without a single government is untenable. It doesn?t help that in the German language the same word is used for debt and guilt. A work out will take years, if not decades.

Paul used to work for Fed Chairman Ben Bernanke as a Princeton economics professor before Ben was demoted to the job of saving the world. When he recently met him he handed him a well-known academic paper written in the 1990?s on the monetary policy mistakes that led to the post bubble collapse of the Japanese economy, and admonished him for repeating the mistakes. The author of the paper? Ben Bernanke.

Krugman argued that the tax system was long overdue for a major overhaul, which now has the lowest tax burden of any developed country in terms of GDP. He said the maximum rate should rise from the current 43%, including state and local taxes, to 70%, possibly for earners over $1 million.

That is still well below the 90% peak rates during the Roosevelt era. Money is concentrating at the top at an unprecedented rate and stagnating in the bond market instead of being invested to create jobs. As for health care, we may have to implement a European style VAT tax to pay for it, however regressive that may be.

I asked, with the national debt now over 100% of GDP, how much more could the US borrow without crashing the bond market, he answered ?a lot more.? Japan is able to borrow 240% of GDP at only 0.8% interest rates with far worse fundamentals than our own. There is a global savings glut and bond shortage, and investors are crying out for a safe haven.

Runaway government borrowing is a problem, but not now. Falling bridges and failing infrastructure are causing much more long term damage to the economy than additional debt. Kids today are infinitely more concerned about getting a job tomorrow than the amount of money the government will owe in 30 years.

Paul is a naturally shy fellow who avoids the limelight whenever possible. He once had a thin skin, but after the attacks from the right that erupted after he started writing for the New York Times, ?a rhinoceros has nothing on me?.

As divine as they are at Gary Danko?s, I skipped the desert, as I know I will be packing on the pounds during my upcoming cruise across the Atlantic on the Queen Mary 2. Paul went for the warm Louisiana butter cake with apples, huckleberry sauce and vanilla bean ice cream. Well, that explains the weight gain.

Before he left, Paul handed me an autographed copy of his latest book, End This Depression Now!, the second tome he penned since the 2008 crash (click here to buy the book at Amazon at a discount). There was one condition. I had to give him an autographed copy of my next book.

I pointed out that by grinding out 10,000 words a week with my blog, trade alerts, and webinars, I was effectively knocking out a new book every two months. That was no excuse he said, with the impatience of a university professor admonishing a grad student who was late with a dissertation. With that, he was out the door like a whirlwind.

I don?t get to meet with Nobel Prize winners very often, so I thought I would give you the full blast. Believe it or not, I left out some of his more incendiary opinions. After all, I have dined with only three in the past month. So take from it what you may.

The next step has been taken in the coming Japan crisis. American ratings agency, Fitch, has downgraded Japanese government debt to A+, with a negative outlook. The move cut the knees out from under the country?s dubious currency, sending it down sharply.

Fitch expects the country?s debt to reach a nosebleeding 240% of GDP by year end, far and away the largest of any major country. That makes our own 100% debt to GDP look paltry by comparison. The Mandarins in Tokyo have been able to finance this enormous debt through a whole raft of financial regulations that limit local institutions to investing a large portion of their assets in Government bonds.

Regular readers of this letter are well aware that the asset base of these institutions is about to shrink dramatically due to the death through old age of the country?s primary savings generation. The problem is that there is not another generation of savers to follow them. An average growth rate of 1% for the last 22 years, and a ten year government bond yield that has hovered around 1% since 1995 mean that no one has accumulated new savings for a very long time. It is just a matter of time before the country runs out of money. In the meantime, government borrowing for perennial stimulus packages continues to skyrocket.

How long it will take this house of cards to collapse is anyone?s guess. My old friend, retired Japanese Vice Minister of Finance, Eisuke Sakakibara, otherwise known as ?Mr. Yen?, thinks that is still five years away. Hedge fund legend, Kyle Bass, says that it should have started in April. The timing of the onset of this looming financial crisis is now a subject of endless analysis by the hedge fund industry, and will be one of the big investment calls of the coming decade.

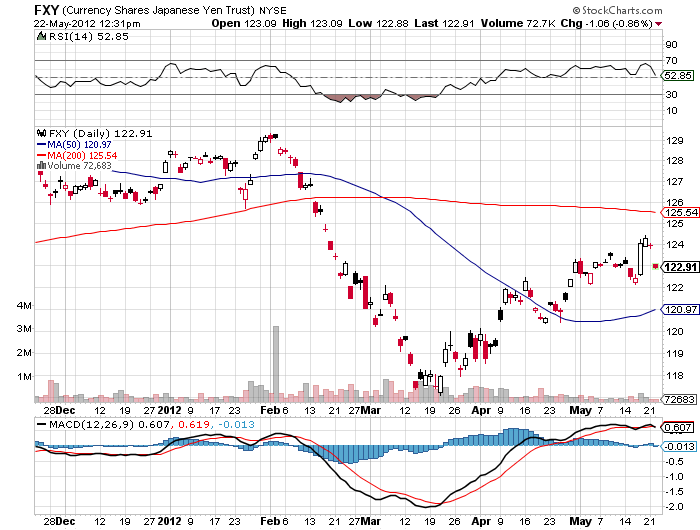

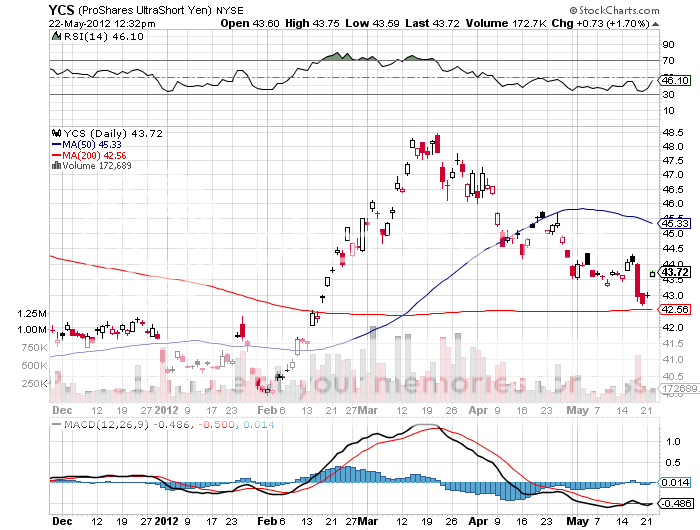

This is why I am running a major short position in the yen through the (FXY), and frequently am involved in the double short yen ETF (YCS). When the sushi hits the fan, you can count on this beleaguered currency to fall to ?90, then ?100, then ?120, and finally ?150. This gets you 200% potential gain on the (YCS). Us the recent ?RISK OFF? run to establish shorts in the yen at great prices.

Time to Sell the Yen?

The global resource frenzy has grown so heated that money has begun pouring into the marginal fringes of the universe. The Mongolian stock market has been one of the world?s best performers over the last three years, posting two back to back 100% gains.

I have been pounding the table on Mongolia for over three years now, as the fundamentals were stacking up nicely for it to become a high growth pioneer market (click here for the call). Never mind that you can?t buy it unless you become a resident of Ulan Bator and pay with local currency. But the indirect plays I recommended are did extremely well, including Ivanhoe Mines (IVN) and Rio Tinto (RTP). Government officials were in New York recently negotiating with NASDAQ to take over the management of their nascent exchange, which even after the double, has only 300 listed companies with a total market capitalization of only $1 billion.

There?s nowhere I won?t go to make a buck, so I had to sit up and pay attention when friends in Tokyo told me that the next big Asian equity play will be in Mongolia. Genghis Khan?s ancestral land has enormous mineral resources which make it a natural commodity play (did he know?), and it has one of the world?s most GDP friendly population pyramids.

But incompetent government administrators with antiquated Soviet era sentiments managed to kill every development opportunity in the crib with onerous windfall taxes and harsh joint venture restrictions. The resources stayed in the ground. National elections finally turned over the regressive administration in 2008, and the anti-growth tax regime was dumped.

Mongolia has inked a deal with Ivanhoe Mines and Rio Tinto to develop the massive Oyu Tolgoi mine, the world?s largest undeveloped copper resource, which could lead to a doubling of the GDP in five years. We?re talking a gigantic 450,000 tons of copper and 330,000 ounces of gold a year. Friends have been e-mailing in the results of core drillings from Oyu Tolgoi, and it is clear that this is one of the richest ores ever discovered. Also on tap is the development of huge coking coal and uranium deposits.

The spillover benefits for the rest of the economy would be substantial. Now that visas are no longer impossible to get, as they were in my day, my Japanese and Chinese speaking trilingual son tells me that Ulan Bator has become the trendy place for American college grads fleeing unemployment at home.

Who knows? Give me a low enough PE multiple and I might even develop a taste for the country?s national dishes, sheep brains and fermented mare?s milk.

The Bulls Are Loose in Mongolia

Pack your portfolios with agricultural plays like Potash (POT), Mosaic (MOS), and Agrium (AGU) if Dr. Paul Ehrlich is just partially right about the impending collapse in the world?s food supply. You might even throw in long positions in wheat (WEAT), corn (CORN), soybeans (SOYB), and rice.

The never dull, and often controversial Stanford biology professor told me he expects that global warming is leading to significant changes in world weather patterns that will cause droughts in some of the largest food producing areas, causing massive famines. Food prices will skyrocket, and billions could die.

At greatest risk are the big rice producing areas in South Asia, which depend on glacial run off from the Himalayas. If the glaciers melt, this crucial supply of fresh water will disappear. California faces a similar problem if the Sierra snowpack fails to show up in sufficient quantities, as it has this year.

Rising sea levels displacing 500 million people in low lying coastal areas is another big problem. One of the 80 year old professor?s early books The Population Bomb was required reading for me in college in 1970, and I used to drive up from Los Angeles just to hear his lectures (followed by the obligatory side trip to the Haight-Ashbury).

Other big risks to the economy are the threat of a third world nuclear war caused by population pressures, and global plagues facilitated by a widespread growth of intercontinental transportation and globalization. And I won?t get into the threat of a giant solar flare frying our electrical grid.

?Super consumption? in the US needs to be reined in where the population is growing the fastest. If the world adopts an American standard of living, we need four more Earths to supply the needed natural resources. We must to raise the price of all forms of carbon, preferably through taxes, but cap and trade will work too. Population control is the answer to all of these problems, which is best achieved by giving women an education, jobs, and rights, and has already worked well in Europe and Japan.

All sobering food for thought.

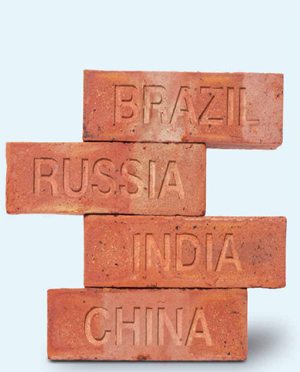

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter, this is music to my ears. By 2018 the combined GDP of the BRIC's, Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that requires is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate.

'BRIC' almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

If you believe that the global financial markets will go back into risk accumulation mode by the end of the summer, as I do, then you probably should use the dip to top up your Brazil position, as it has lagged in the smaller emerging markets so far this year. Jim Chanos, you may be right about a China crash, but you're early by a decade!

Dennis Gartman, of the ever interesting The Gartman Letter, published an interesting analysis on the 'Monday-Friday' effect. If you bought every Friday close last year and sold the Monday close, your return would have been 14.20%, versus a 0.42% return on the S&P 500 (SPX). Virtually all the gains would accrue at the Monday morning gap opening.

If you did the reverse, bought the Monday close and sold the Friday close, then your YTD loss would have been 11.00%. Apparently, the market is paying a huge premium for traders willing to run the weekend risk, which during the financial crisis is when all the disasters occurred. I know of several desks that have been working this trade all year long, with much success. On paper you could have made 25.20% on a non-leveraged basis, and less once you take execution and other frictional costs out.

The longer this works, the more who will pile into it, until it blows up, as all of these purely quantitative approaches always do. This is symptomatic of a market dominated by short terms traders, arbs, and hedge fund where the end investor has fled. Expect things to get worse before they get better. By the way, don't try Googling the word 'exposed'. You'd be shocked, shocked.