I arrived early for a meeting in Salt Lake City the other day. I noticed a cluster of tents near the ice skating rink and thought I would catch an update on the Occupy Wall Street movement.

Two guys emerged from a jerry built, homemade structure and braved the frigid 20 degree temperatures to find out what I was all about. I said I was a card carrying member of the 1% and wanted hear their side of the story. They replied that the local movement had dwindled from 100?s to a couple of dozen hard cores, due to the inclement weather. Indeed, there were mounds of fresh snow piled around the edges of the square. But they fully expected their numbers to rebuild after the spring though. The police were being cool and leaving them alone. As we spoke, I noticed an occupier head off to work.

I am following this movement closely because it has the potential to turn the election upside down this year. This could be the Tea Party of 2012, with a similarly large impact on the election results. President Obama has recently expressed sympathies with Occupy aims, while safely keeping his distance from the actual movement. If he can frame this election in terms of the 99% versus the 1%, and paint Romney in a corner as representing the 1%, then he has a winner. He poll numbers have recently been rising sharply, and have been tracking nearly 1:1 with the S&P 500 Index.

I asked them what they wanted and what I got was a minestrone soup of accurate facts, urban legends, and folk tales. I corrected them at every turn. Yes, their interpretation of the repeal of Glass Steagle was correct, but the imposition of the Volker Rule will effectively bring its return. That?s what Bank of America (BAC) shares at $5 was telling us. No, there is no law barring ownership of more than 5 pounds of gold. In fact, you can purchase 100 ounce bars on the Internet. I have several friends who have done so. And the bars in Fort Knox in Kentucky aren?t really lead ones painted gold. I had someone check.

The Chinese don?t shoot its citizens for gold ownership. They stopped that a few years ago. Now they are trying to encourage individual gold ownership, and coin dealers selling once ounce gold and silver pandas are popping up everywhere. No, the Chinese economy is not going to crash, forcing them to sell all their Treasury bonds and crash our economy too.? Yes, the US dollar will remain the reserve currency for the rest of my life, but maybe not the rest of theirs. There just is no other alternative currency with the breadth and depth of the greenback. Alternatives proposed in the past, like the yen and the Euro, have proven to have far more problems than Uncle Buck.

I asked how they were fixed for food. They said that local bakeries were given them their old bread and pastries, and other supporters regularly dropped off dented canned food. I pulled a $100 out of my wallet and suggested they order in pizzas for lunch for everyone. They said that was really cool, but would I mind if it was vegetarian?

?Your Future May Be In Their Hands

?When you talk to private clients, they are nowhere near putting money into equities yet. You can?t even get them to understand dividend growth, let alone buying equities, because they are still worried about losing money. People are going to be very emotional. This is going to be a year of volatility until proven otherwise,? said Brian Belski, chief investment strategist at Oppenheimer & Co.

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

Come join me in the grand appointments of the Cunard Line?s flagship, the elegant and spacious Queen Mary 2, on an eastbound transatlantic cruise. The Ship departs New York at 5:00 PM on July 6, 2012 and arrives at Southampton on July 13. There I will be conducting the Mad Hedge Fund Trader?s Strategy Update, a three hour discussion on the global financial markets.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I?ll highlight the best long and short opportunities. And to keep you in suspense, I?ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $300 for the seminar only.

Attendees will be responsible for booking their own cabin through Cunard. They offer everything from an inside stateroom from $1,545, double occupancy, to $24,780 for Q1 deluxe apartment. Just visit their website at http://www.cunard.com/, or call them directly as 800-528-6273 to make your own arrangements.

The weather this time of year can range from balmy to tempestuous, depending on our luck. A brisk walk three times around the boat deck adds up to a mile. Full Internet access will be available, for a price, to follow the markets. Every dinner during the voyage will be black tie, so you might want to stop at Saks Fifth Avenue in Manhattan to get fitted for a second tux. Don?t forget to bring your Dramamine and sea legs, although the 151,400 tonne, 1,132 foot long $900 million ship is so big, I doubt you?ll need them.

The event will be held at a luxurious penthouse suite on the ships highest deck, the details of which will be emailed to you with your purchase confirmation. To instill us all with a proper sense of humility, I will conduct the seminar as we sail over the wreck of the Titanic. The ship will give a blast of its horn three times as a salute as we pass the site.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the seminar alone, please click on the button below.

[button size="large" color=(blue) link="http://madhedgefundradio.com/queen-mary-2-seminar-at-sea-july-11-2012/?s2-ssl=yes"]Order Luncheon Tickets[/button]

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. Read more

When I covered my short position on the Japanese yen on Friday, it was not because I suddenly fell in love with the Land of the Rising Sun, began each day with a Zen meditation, started eating sushi three times a day, or initiated writing this letter from a hot tub. It is because followers of my Trade Alert Service suddenly had an 11 day, 64% gain on their hands. We now live in a world where a bird in the hand is worth ten in the bush, so I took the money and ran.

There were a few other reasons for my lightning fast, cat like move. A sudden and unexpected extension of the global ?RISK ON? trade spilled into the foreign exchange markets, causing the Japanese currency to depreciate from ?76 to ?78.8. That took my March, 2012 puts from $1.65 to $3.00, before they settled at $2.70.

Taking profits before a three day weekend allowed me to duck the accelerated time decay in these short dated options. An instant return to the ?RISK OFF? trade, which was squarely placed on the table by the stock market?s gap down opening on Friday, could send the yen right back to poking at all-time highs. And while the recent move in the yen has been dramatic, all we have really done is move back to the bottom of a nine month trading range. And there is nothing like adding 3.18% to the value of your portfolio in a month that has otherwise been difficult for hedge funds.

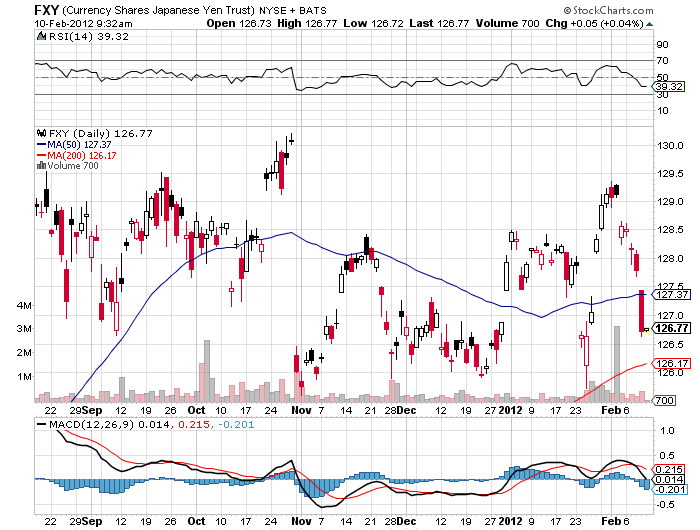

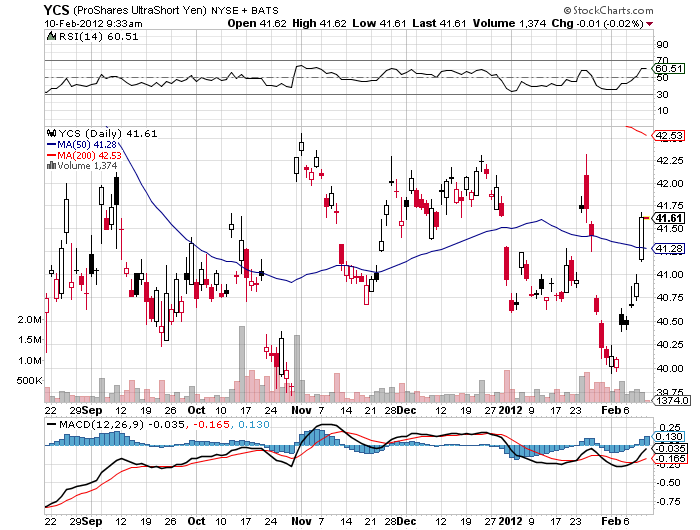

I think that we are getting close to the tipping point for the complete collapse of the Japanese economy. This will lead to eye popping declines in the value of the Japanese stock and bond markets and the yen. For US based investors, the easiest way to play this is with short positions in the ETF (FXY), and through the leveraged short yen ETF (YCS). So I will be revisiting this trade soon, and frequently, I hope.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011. Those who wish to participate should email John Thomas directly at madhedgefundtrader@yahoo.com. Please put ?Global Trading Dispatch? in the subject line, as we are getting buried in emails.

To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last four years of research reports available for free. You might have a good laugh too.

When communications between intelligence agencies suddenly spike, as has recently been the case, I sit up and take note. Hey, do you think I talk to all of those generals because I like their snappy uniforms, do you?

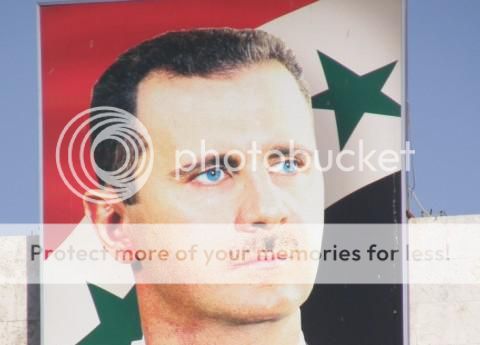

The word is that the despotic, authoritarian regime in Syria is on the verge of collapse, and is unlikely to survive more than a few more months. The body count is mounting, and the only question now is whether Bashar al-Assad will flee to an undisclosed African country or get dragged out of a storm drain to take a bullet in his head. It couldn?t happen to a nicer guy.

The geopolitical implications for the US are enormous.? With Syria gone, Iran will be the last rogue state hostile to the US in the Middle East, and it is teetering. The next and final domino of the Arab spring falls squarely at the gates of Tehran.

Remember that the first real revolution in the region was the street uprising there in 2009. That revolt was successfully suppressed with an iron fist by fanatical and pitiless Revolutionary Guards. The true death toll will never be known, but is thought to be in the thousands. The antigovernment sentiments that provided the spark never went away and they continue to percolate just under the surface.

At the end of the day, the majority of the Persian population wants to join the tide of globalization. They want to buy IPods and blue jeans, communicate freely through their Facebook pages and Twitter accounts, and have the jobs to pay for it all. Since 1979, when the Shah was deposed, a succession of extremist, ultraconservative governments ruled by a religious minority, have failed to cater to these desires

When Syria collapses, the Iranian ?street? will figure out that if they spill enough of their own blood that? regime change is possible and the revolution there will reignite. The Obama administration is now pulling out all the stops to accelerate the process. Secretary of State Hillary Clinton has stiffened her rhetoric and worked tirelessly behind the scenes to bring about the collapse of the Iranian economy.

The oil embargo she organized is steadily tightening the noose, with heating oil and gasoline becoming hard to obtain. Yes, Russia and China are doing what they can to slow the process, but conducting international trade through the back door is expensive, and prices are rocketing. The unemployment rate is 25%.? Iranian banks are about to get kicked out of the SWIFT international settlements system, which would be a death blow to their trade.

Let?s see how docile these people remain when the air conditioning quits running this summer because of power shortages. Iran is a rotten piece of fruit ready to fall of its own accord and go splat. Hillary is doing everything she can to shake the tree. No military action of any kind is required on America?s part.

The geopolitical payoff of such an event for the US would be almost incalculable. A successful revolution will almost certainly produce a secular, pro-Western regime whose first priority will be to rejoin the international community and use its oil wealth to rebuild an economy now in tatters.

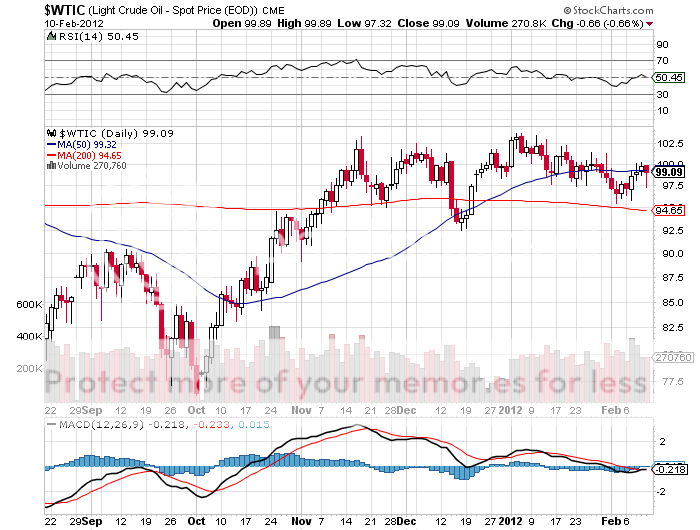

Oil will lose its risk premium, now believed by the oil industry to be $30 a barrel. A looming supply could cause prices to drop to as low as $30 a barrel. This would amount to a gigantic tax $1.66 trillion tax cut for not just the US, but the entire global economy as well (87 million barrels a day X 365 days a year X $100 dollars a barrel X 50%). Almost all funding of terrorist organizations will immediately dry up. I might point out here that this has always been the oil industry?s worst nightmare.

At that point, the US will be without enemies, save for North Korea, and even the Hermit Kingdom could change with a new leader in place. A long Pax Americana will settle over the planet.

The implications for the financial markets will be enormous. The US will reap a peace dividend as large or larger than the one we enjoyed after the fall of the Soviet Union in 1992. As you may recall, that black swan caused the Dow Average to soar from 2,000 to 10,000 in less than eight years, also partly fueled by the technology boom. A collapse in oil imports will cause the US dollar to rocket.? An immediate halving of our defense spending to $400 billion or less and burgeoning new tax revenues would cause the budget deficit to collapse. With the US government gone as a major new borrower, interest rates across the yield curve will fall further.

A peace dividend will also cause US GDP growth to reaccelerate from 2% to 4%. Risk assets of every description will soar to multiples of their current levels, including stocks, bonds, commodities, precious metals, and food. The Dow will soar to 20,000, the Euro collapses to parity, gold rockets to $2,300 and ounce, silver flies to $100 an ounce, copper leaps to $6 a pound, and corn recovers $8 a bushel. The 60 bull market in bonds ends.

Some 1.5 million of the armed forces will get dumped on the job market as our manpower requirements shrink to peacetime levels. But a strong economy should be able to soak these well trained and motivated people right up. We will enter a new Golden Age, not just at home, but for civilization as a whole.

Wait, you ask, what if Iran develops an atomic bomb and holds the US at bay? Don?t worry. There is no Iranian nuclear device. There is no Iranian nuclear program. The entire concept is an invention of American intelligence agencies as a means to put pressure on the regime. The head of the miniscule effort they have was assassinated by Israeli intelligence two weeks ago (a magnetic bomb, placed on a moving car, by a team on a motorcycle, nice!).

If Iran had anything substantial in the works, the Israeli planes would have taken off a long time ago. There is no plan to close the Straits of Hormuz, either. The training exercises we have seen are done for CNN?s benefit, and comprise no credible threat.

I am a firm believer in the wisdom of markets, and that the marketplace becomes aware of major history changing events well before we mere individual mortals do. The Dow began a 25 year bull market the day after American forces defeated the Japanese in the Battle of Midway in May of 1942, even though the true outcome of that confrontation was kept top secret for years.

If the collapse of Iran was going to lead to a global multi decade economic boom and the end of history, how would the stock markets behave now? They would rise virtually every day, led by the technology sector and banks, offering no pullbacks for latecomers to get in. That is exactly what they have been doing since mid-December. If you think I?m ?Mad?, just check out Apple?s chart below, and the big relative underperformance of oil.

Here?s The Next Big Short

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings. However, I believe that 'forever' may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let's back up for a second and review where the great bull market of 1950-2007 came from. That's when a mere 50 million members of the 'greatest generation', those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1949, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer's who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 35% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 42 million homes. Don't count on selling your house to your kids, especially if they are still living rent free in the basement.

The good news is that the next bull market in housing starts in 20 years. That's when 85 million Millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer's. By then, house prices will be a lot cheaper than they are today in real terms. The next interest rate spike will probably knock another 25% off real estate prices. Think 1982 again.

Fannie Mae and Freddie Mac will be long gone, meaning that the 30 year conventional mortgage will cease to exist. All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

For you millennials just graduating from college now, this is a best case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25 year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That's what people told me when I bought my first New York coop in 1982 at one tenth its current market price.

Just remember to sell by 2060, because that's when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

According to my old friend, Rick Sopher, chairman of LCH Investments in London, the top ten hedge funds have earned $153 billion for their investors since inception.

Rick, who runs his business from an elegant flat on posh Eaton Square, compiled the list after a comprehensive survey of the still operating 7,000 hedge funds worldwide. It is dominated by marquee names like Steve Cohen's SAC Capital, Bruce Kovner's Caxton, and Louise Bacon's Moore Capital. Of the 100 largest funds, 95% have returned much of their investors' original capital, and are using the remaining profits to trade on.

Of course, the numbers show a huge survivor bias. They don't include the hundreds of billions of dollars lost by now shuttered 'wanabee' managers during the financial crash, largely with highly leveraged fixed income, spread oriented, 'low risk' strategies. Many of these are still in liquidation, peddling illiquid assets for pennies on the dollar through online auctions and elsewhere.

The numbers highlight the increasing barbell nature of the hedge fund industry. The biggest funds continue to attract the big bucks, and a steady wave of defections from Wall Street, are funding hundreds of new startups. But many mid-tier firms are getting nothing and are struggling to stay in business.

I spent the evening speaking to Gao Jie, a Beijing civil judge who left the bench to join China's growing environmental movement when her kids came home from school one day coughing and wheezing. You only have to inhale in the capitol city these days to understand that they have a huge problem there.

One of the dirty little secrets of international trade for the last three decades has been the offshoring of high polluting industries from the US and Europe to China, which then vociferously complain about the emerging country's toxic environment. Much of the Middle Kingdom's record carbon emissions these days have been imported from the West. 'Cancer villages' are now proliferating throughout the landscape.

China gets 80% of its power from coal, compared to only 50% in the US. As a result, scientists figure that China became the world's largest emitter of CO2 in 2006. The central government is now asking the provinces to achieve both GDP and energy conservation goals at the same time, a difficult task at best. Government policy dictates that air conditioners only kick in at 79 degrees. If you think that went down well, try spending a summer in Beijing sometime.

It is also pushing headlong into alternative energy, is already the technological leader in key areas like wind, and has an eye to exporting low cost platforms to the US. It is no accident that two of the most competitive solar companies in the world, Suntech (STP) and Yingli Green Energy Holding (YGE), are Chinese. China is also having Phoenix based First Solar (FSLR) build the world's largest thin film solar power plant in Western China, which, it turns out, looks a lot like Arizona. The mammoth, 25 square mile facility will supply power to three million homes.

China's problems give one an inkling of how we might have ended up if we hadn't passed the Environmental Protection Act. I first visited China during the Cultural Revolution, when they doused piles of bodies of those who died in the famine with kerosene and burned them, and anyone educated had to endure being paraded down a street in a dunce cap. I had to pinch myself after seeing a sophisticated and well-educated woman like Gao Jie openly pursue her liberal goals, unfettered by a totalitarian regime.