?'Patience is underrated,' said Steve Wozniak, creator of the first PC and cofounder of Apple.

Featured Trades: (COMMODITY OVERVIEW),

(FCX), (VALE), (RIG), (JOY), (CCJ), (FSLR), (UNG), (USO), (MOO), (DBA), (MOS), (MON), (AGU), (POT), (PHO), (FIW)

2) Don't Buy Anything That Can Be Created With a Printing Press. I just want to take a moment to provide the long term view of commodities. This is my favorite asset class for the next decade, as investors increasingly catch on to the secular move out of paper assets into hard ones. Don't buy anything that can be manufactured with a printing press.

Focus instead on assets that are in short supply, are enjoying an exponential growth in demand, and take five years to bring new supply online. The Malthusian argument on population growth also applies to commodities; hyperbolic demand inevitably overwhelms linear supply growth. Consumers want to buy stuff tomorrow, but many commodities take up to a decade to bring new production online.

Of course, we're already eight years into what is probably a 20 year secular bull market for commodities and these things are no longer as cheap as they once were. Copper at 85 cents a pound? Oil at $8 a barrel. You could have bought all you wanted 10-12 years ago at these prices, which are distant memories today. There is no doubt the hot money is here in size, so bring on the volatility. You are going to have to allow these things to breathe.

Ultimately this is a demographic play that cashes in on rising standards of living in the biggest and highest growth emerging markets. Some one billion people are expected to join the middle class over the next decade, and 2 billion by 2050. All of them are going to want to buy 'things' made out of natural resources.

You can start with the traditional base commodities of copper and iron ore. The derivative equity plays here are Freeport McMoRan (FCX) and Companhia Vale do Rio Doce (VALE).

Add the energies of oil, coal, uranium, and the equities Transocean (RIG), ExxonMobile (XOM), Occidebtal Petroleum (OXY), Joy Global (JOY), and Cameco (CCJ). Crude (USO) has in fact become the new global de facto currency (along with gold), and probably $30 of the current $75.50 price reflects monetary demand, on top of $45.50 worth of actual demand from consumers. That will help it spike over $100 sometime in the next year.

Don't forget alternative energy, which will see stocks dragged up by the impending spike in energy prices. My favorite here is First Solar (FSLR). Skip natural gas (UNG), because the discovery of a new 100 year supply from fracting and horizontal drilling in shale formations is going to overhang this subsector for a long time.

The food commodities are probably among the cheapest resources around, with corn, wheat, and soybeans coming off the back of bumper crops in 2009 that absolutely killed prices. But growing emerging market appetites for more and better food will send demand soaring, just as the benefits of the 'green revolution' peter out. These can be played through the futures or the ETF's (MOO) and (DBA), and the stocks Mosaic (MOS), Monsanto (MON), Potash (POT), and Agrium (AGU).

Through an unconventional commodity play, the impending shortage of water will make the energy crisis look like a cake walk. Who will need new fresh water supplies the most? China. You can participate in this most liquid of assets with the ETF's (PHO) and (FIW).

The Hard Stuff is in Your Future

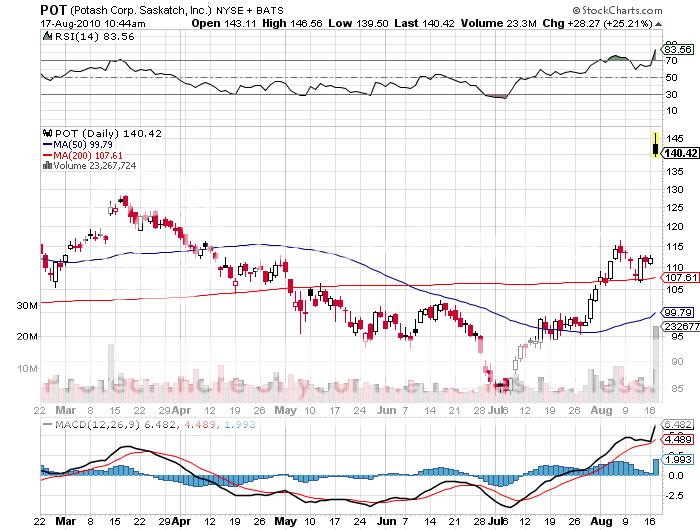

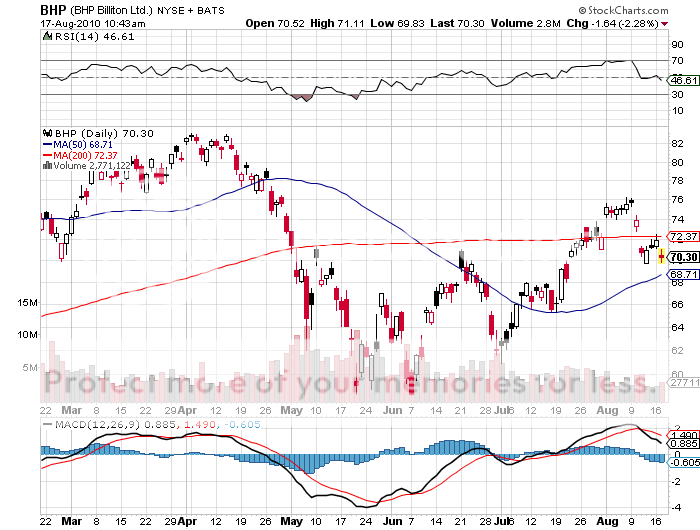

Featured Trades: (POT), (BHP), (VALE), (MOS), (AGU)

1) BHP Billiton Develops an Appetite for Potash. BHP Billiton's (BHP) low key, South African CEO, Marius Kloppers, has announced that he is making a hostile takeover bid for Potash (POT) for $39 billion, or $130 a share, a multiple of a mere 13 times earnings. POT immediately shot up to $147, a 32% premium to yesterday's close. POT's CEO described the bid as grossly inadequate, which it obviously is, and said he would take whatever measure necessary to deflect the bear bug.

BHP follows Vale (VALE) as the world's second largest iron ore producer, and is attempting to use a cash mountain earned from its massive and hugely profitably sales to China. Why not buy another product that the Chinese are voracious consumers for? POT is the world's largest fertilizer producer, and with the global population expected to grow from 7 billion to 9 billion over the next 40 years, they decided this would be a great area to diversify into.

BHP is no doubt attempting to position itself for the secular long term bull market in food which I have been detailing at great length in these pages (click here for 'The Bull Market in Food is Only Just Starting' ). The recent doubling of the price of wheat in a mere eight weeks has been a shot across the bow of investors everywhere that it is time to get on the train before it leaves the station (click here for 'Going Back Into the Ags' and click here for the follow up piece 'The Best Trade of the Year').

During economic downturns, people don't need to buy steel, but they still have to eat. BHP actually explored setting up its own potash operation in Saskatchewan next door to POT, but decided that buying the Canadian company was the cheaper and faster route. At the height of the last commodity boom, POT peaked at $240.

I have mixed feelings about the deal. I have been recommending POT since the inception of this letter, and it's always nice for the old P&L to get a shot in the arm in an otherwise dull summer. On the other hand, it means that BHP is going to make all the money going forward, robbing me of a core holding. POT is probably going to be worth $1,000/share someday.

BHP's move suddenly makes other ag companies I have been recommending takeover bait, like Mosaic (MOS) and Agrium (AGU), which have both seen serious pops today. Expect BHP to raise their bid, and everyone else to raise their exposure to this key sector. Hey, Marius, why don't we split the difference and pay to $185 for my POT shares?

Is it Worth $130 a Share, $185, or $1,000?

Featured Trades: (FRONTIER MARKETS), (GXG), (FRN), (FFD), (TFMAX)

Claymore/BNI Mellon Frontier Markets ETF

Global X Interbolsa FTSE Columbia ETF

2) Hedge Fund Managers Head For the Frontier. No, they are not donning a Stetson, cowboy boots, and a six gun to fight Indians in the Wild West, where I live. Their never ending reach for yield is taking them beyond junk bonds and high dividend stocks to small, sub-emerging markets so far off the radar that many don't even have stock indexes. Checked your weighting in the Ivory Coast lately? How about Sri Lanka, Tanzania, or Kuwait? I think not.

So far this year, frontier funds have taken in $1.1 billion in new investment, compared to the previous record of $443 million in 2007. Many of these markets are extremely cheap using conventional valuation metrics. They boast rock solid balance sheets, ironically because many never rated high enough to borrow in public markets.

In exchange for higher returns, managers are accepting higher risk, which in these places may involve the odd expropriation, government overthrow, insurrection, revolution, and terrorism.? They also don't have much liquidity to offer. They are definitely your 'Roach Motel' market; you can check in but you can't check out. Where markets exist, there are frequently heavy weightings in single sectors, like banks.

Expect a lot of volatility. The MSCI Frontier Markets Index plunged 55% in 2008, compared to 32% for the S&P 500. You can't buy these stocks online, and opening local brokerage accounts often involves wading through a morass of tedious capital and foreign exchange regulations. How many Dong (Vietnam) do you want to keep on your position sheet?

Claymore offers an ETF (FRN), while mutual fund alternatives are available through Morgan Stanley (FFD) and Templeton (TFMAX). Some countries, like Columbia (GXG) already have dedicated ETF's and have been among the best performing markets of 2010. I have written about frontier markets in the past (click here for 'Frontier Markets Beckon') and similar investment themes like the N-11 (click here for 'Goodbye BRIC's, Hello N-11'). Expect to hear a lot more from these quiet back waters of the global capital markets.

I'm Lookin' for a Few Good Longs, Pilgrim

'Bull markets are born on pessimism, grow on skepticism, mature on optimism, and they die on euphoria,' said my late friend, Sir John Templeton, over lunch at his home at Lyford Cay in the Bahamas.

Featured Trades: (FOR PROFIT EDUCATION),

(APOL), (DV), (CPLA), (COCO), (STRA),

1) For Profit Education Jumps From the Frying Pan to the Fire. On Friday, the Department of Education released data showing that the student loan repayment rate at some schools was as low as 25%, and that it would take action to disqualify these schools for future student loans. That amounts to the taking away the punch bowl from a highly leveraged, overpriced industry, a hedge fund manager's dream come true. This is turning into a major home run for those who took my advice to sell the sector on June 2 (See 'Hedge Funds Target for Profit Education' by clicking here, and my follow up "The Smoking Gun on For-Profit Education" by clicking here). I knew I was on to a great trade here because of the torrent of emails I received from these schools threatening litigation or worse. For profit schools have made a killing from naive aspiring students taking out $5 billion in Pell grants and $20 billion in federal subsidized loans. A few weeks after my initial report, the General Accounting Office reported the results of an undercover investigation showing widespread fraud and abuse in the sector, with some financial aid officers advising students to lie on their applications. Today was the day when the chickens came home to roost. Since my call, lead stock Apollo Group (APOL) of University of Phoenix fame has fallen 27%, DeVry (DV) 33%, and Capella Education (CPLA) 35%. Those who cast a wider net caught Corinthian Colleges (COCO) down a spectacular 62% and Strayer Education down 30%. The management of Strayer said they where shocked, shocked that repayment rates were so low, as Claude Raines might have said in the classic film, Casablanca. I've had some friends get their eyes ripped out by these guys through running up $50,000 in debt to obtain useless degrees, so this couldn't be happening to a nicer bunch of people. Although these stocks have already gone down a lot, there may be more to go. It is safe to say that the Obama administration hates these predatory schools, and that criminal prosecutions are certain to follow. Still, if you prefer to sleep at night, you might want to book some profits now.

I'm Shocked, Shocked, That

Student Loan Repayment Rates Are So Low!

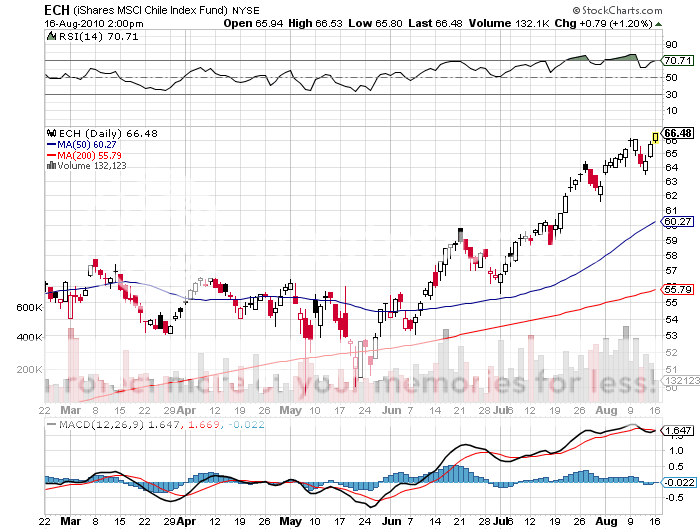

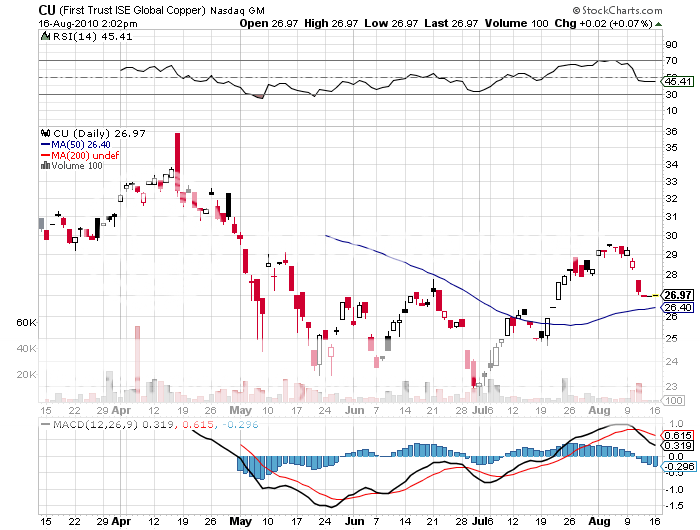

Featured Trades: (CHILE), (ECH), (CU)

iShares MSCI Chile Index Fund ETF

First Trust ISE Global Copper ETF

2) Why Can't We Be More Like Chile? I just want to pass on some data forwarded to me from my extensive band of Chilean readers in response to my recent piece, 'Chile is Looking Hot' (click here for the piece). In 2007, the government dissolved the old Copper Stabilization Fund and rolled windfall profits from sales of the red metal into a sovereign wealth fund called the Economic and Social Stabilization Fund. Today that fund has $11.7 billion, a lot for a small country like Chile, which only has a GDP of $161 billion and a population of 17 million. The fund will be used to increase government spending during economic downturns, thus eliminating the need for any borrowing during times of distress. This is one of the reasons why the Chilean ETF (ECH) never sold off in the wake of the massive 8.8 magnitude earthquake that struck in February. I had hoped to use the natural disaster to gain a good entry point to the country, to no avail. Imagine that! Counter cyclical Keynesian spending financed out of savings, instead of debt. Too bad they didn't think about that here! If I've piqued your fancy, another way to play Chile is to buy the copper industry ETF (CU), which has extensive holdings in this incredible well managed country. Since I recommended Chile only two weeks ago, the ETF has risen by 5% during otherwise dismal global trading conditions. And my American Chilean readers, who thank the heavens the day they decided to retire there, also recommend long positions in the country's outstanding wines, including a mature Viva Almaviva, a Carmin de Peumo, and a Viva Concha y Toro.

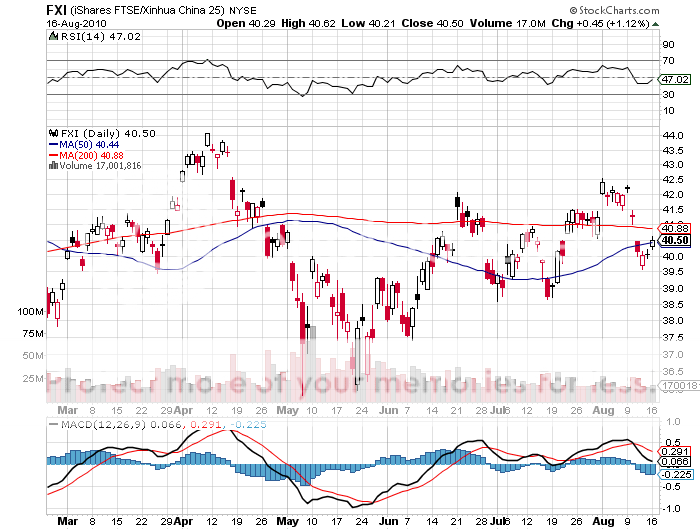

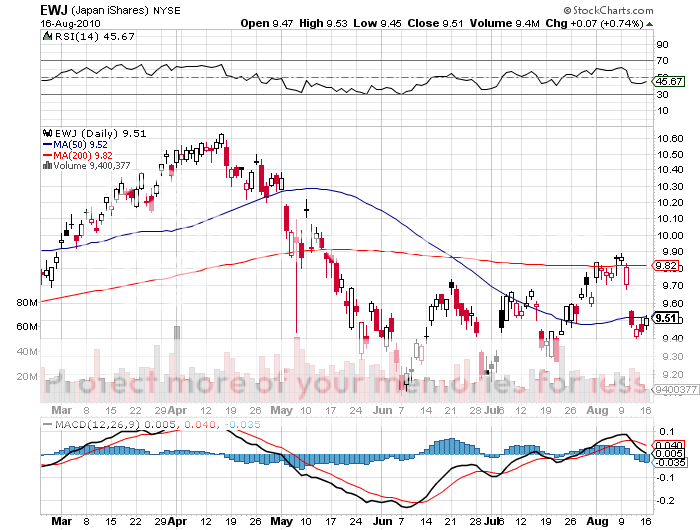

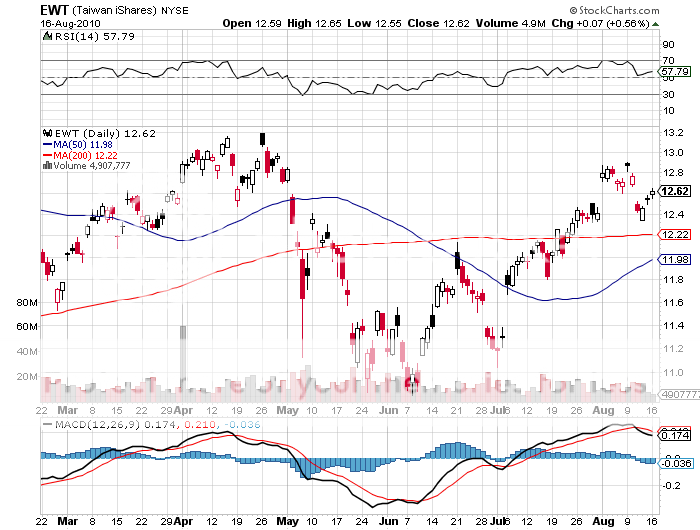

Featured Trades: (CHINA), (TAIWAN), (JAPAN), (FXI), (EWJ), (EWT)

iShares FTSE/Xinhua China 25

Japan iShares ETF

Taiwan iShares ETF

3) It's Official: China is Number Two. With China's (FXI) economy rocketing at 8%-13% quarterly growth rates, and Japan (EWJ) plodding away with meager 1%-2% rates, it was only a matter of time before the Middle Kingdom bumped the Land of the Rising Sun from its number two position in national GDP rankings. Chinese officials will be quick to point out that, according to IMF figures, their $3,600 per capita nominal GDP still qualifies them for emerging market status, compared to $39,731 for Japan, $46,381 in the US, and an amazing $104, 512 for Luxembourg. It is highly unlikely that China's standard of living will ever approach that of the US, although it will narrow the gap, possibly rising to $20,000 over the next 20 years in today's dollars. One country that might pull this off is?? Taiwan (EWT), which offers investors a way to play China though the back door, and already has a per capital GDP of $16,392. China bumped its errant, breakaway province closer to achieving this last week when its Taiwan Affairs Office said it will honor Taiwan's bilateral trade agreements for the first time. One is already in the works with Singapore, and deals with others in the Asian region are expected to follow.

Japan is Not Carrying Its Weight Any More

Featured Trades: (CNBC SPOOF)

4) Trashing CNBC on a Slow Day. With trading volume dropping through the floor the market has gotten so boring that I have run out of things to write about. So I can either pump out a mediocre piece of crap that you will probably lose money on, like the other newsletters do, or I can give you something frivolous and useless, but really funny. I vote for the latter. Below find a link to a YouTube video of a bizarre spoof of CNBC listing the countless shortcomings of its personalities, as seen in an imaginary interview between Larry King and Sarah Palin. My apologies in advance to Bob Pisani, Rick Santelli, Erin Burnett, Mark Haines, Trish Regan, Melissa Francis, Jim Cramer, Larry Kudlow, Sue Herera, John Maynard Keynes, and Michelle Caruso-Cabrera's breasts. Yes, I know, don't shoot the messenger. And don't miss the shameless plug for Zero Hedge at the end. Hurry up and watch it before the libel lawyers take it down. Here it is at http://www.youtube.com/watch?v=T9CEqhmU0Pg

'A slave with three masters is a free man,' said guru, Peter F. Drucker, in his classic tome on management, The Essential Drucker.