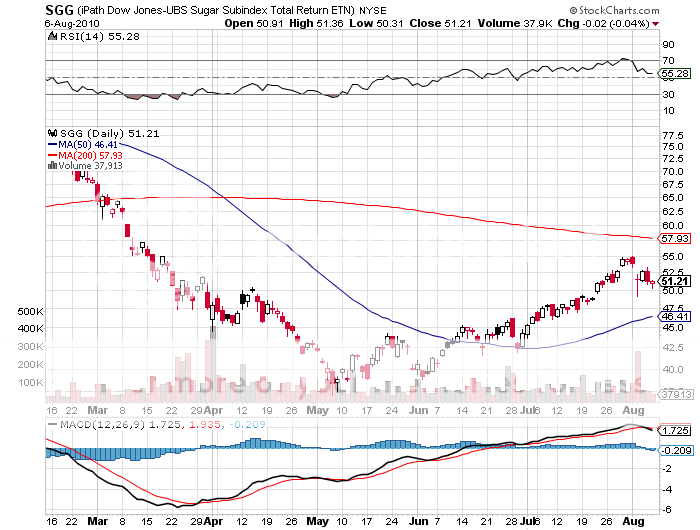

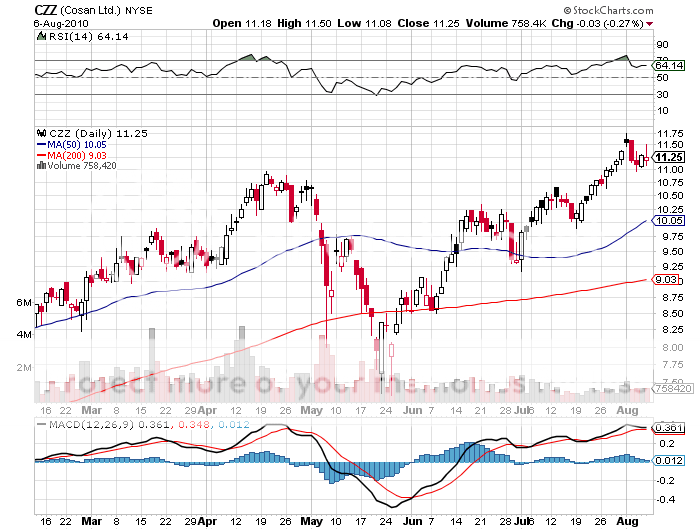

Featured Trades: (SUGAR), (SGG), (CZZ),

iPath Dow Jones-UBS Sugar Subindex Total Return ETN

3) I'll Take Two Lumps, Please. It's just a matter of time before global buying of the grains spills over into the sugar market. A combination of torrential rains in Brazil, the source of 54% of the world supply, and draughts in India, sent prices to a 35 year high of $31 cents a pound last year.

Since then, prices plunged by 52% to 14 cents on rumors of new bumper crops, making sugar the world's worst performing asset. But new shortages are looming on the horizon. It's raining again in Brazil, causing a major shipping bottleneck. Thailand, the world's second largest exporter, will flip to a net importer. Blasting heat in Europe is killing off a large part of the sugar beet crop there.

The International Sugar Organization says that global supplies are at a 30 year low, while the US Department of Agriculture claims our stockpiles are at a 40 year nadir. Major consumers, like the soft drink and food industries, are already marking up product prices. To top it all, China is developing a sweet tooth, a rising standard of living enabling them to increase their own consumption of richer, higher calorie foods.

When I get involved in this commodity, I do so through the sugar contract on ICE or NYBOT. There is also an exchanged traded note for sugar to look at (SGG). Equity investors should study Cosan ADR's (CZZ), Brazil's top cane producer. While it's clear that the train has already left the station, we're already back up to 20 cents a pound, it is something to entertain on dips. It certainly beats the hell out of buying ten year treasury bonds at a ridiculous 2.88% yield.

Featured Trades: (HIROSHIMA ANNIVERSARY)

4) A Hiroshima Memorial. Friday was the 65th anniversary of the Hiroshima atomic bomb, an event that that has touched me in many ways.

I never had any doubt for the need to use the bomb in 1945. My father had orders to join his third marine division in Okinawa for the invasion of Japan when it was dropped. If the plan had gone ahead, I would not be writing this letter today. My biochemistry major and math minor at UCLA landed me a summer job as a research assistant at the Nevada nuclear test site in the late sixties where I got to know the men who worked with Dr. Robert Oppenheimer to build the bomb. There, 'yields' meant millions killed, not interest paid.

When I first landed in Japan, I made a beeline straight to the Atomic Bomb Victims Hospital to interview survivors 30 years after the attack. I listened to stories about people vaporized, but whose image was etched into solid granite, and the rivers that were choked with countless bodies. Textile patterns were permanently burned into human skin, the light colors reflecting radiation, while dark ones absorbed it. Some 50 of the city's 150 doctors were killed instantly, and the rest were seriously injured. They were futilely left to treat gamma rays and beta particles with only mercurochrome, or traditional Japanese folk remedies like moxabustion. Tens of thousands showed up at hospitals with no visible injuries, only to die agonizing deaths within the day.

Two weeks after the bomb, everyone's hair started falling out and immense welts called keloid tumors appeared, classic symptoms of then unknown radiation poisoning. American scientists descended on the city by the hundreds measuring every imaginable parameter with grim precision, such as the heat at ground zero that reached an unbelievable 6,000 degrees, and the melting of ceramic roof tiles to a radius of 1,300 yards. They told the Japanese that no one could live there for 20,000 years. The residents ignored them and moved back in to rebuild as soon as the fires abated.

I met one spry Japanese American woman who grew up in Fresno, California and spoke perfect 1930's English, but was sent home to Hiroshima to avoid the war. I'll never forget the massive scars on her forearms where her summer yukata cut off. A barking dog caused her to briefly look away from the curious descending parachute from a lone B-29 overhead, thus saving her face and her eyesight. Her three young children didn't make it.

For me the experience converted an interesting physics experiment into the greatest source of human misery of all time. As the years went on I met many more Hiroshima survivors, known as bakusha, who after a third shot of Suntory whiskey would talk about the artificial weather the bomb created, the gale force winds and the black rain. Every type of plant strangely flourished after the bomb, but men and women were left sterile, and birth defects skyrocketed. In later years I attended memorial ceremonies where 140,000 candlelit paper boats were placed in the Motoyasu River at night to symbolize the lost souls.

Ironically, those who survived the bomb now have the greatest lifespan of any group in Japan. I guess that if you can survive an atomic bomb, you can handle anything. I'm sure free health care for life and pensions helped too. There was also that one dose of radiation treatment, courtesy of the US government.

Today Hiroshima is a major focus of international pacifist and disarmament groups. The effort is being led in the US by former secretary of state, George Schultz, who has played a key role in cutting American nuclear stockpiles by 75% to 5,113 today. Some 20% of America's nuclear power is currently generated by plutonium from recycled warheads from the former Soviet Union.

You can learn more about his efforts by visiting the Plowshares Fund at http://www.ploughshares.org/ .To buy John Hersey's Pulitzer Prize winning Hiroshima, which describes the doomed city immediately after the attack in all its horrific detail, please click here. It is not a light summer beach read, but is enlightening and sobering.

'There is no fuel left in the tank' said Carter Worth, a technical analyst about the likely failure of the stock market rally.

Featured Trades: (THE SACK OF ROME), (TBT), (TMV)

ProShares Ultra Short Lehman 20+ Year Treasury ETF

Direxion Daily 30 Year Treasury Bear 3X Shares ETF

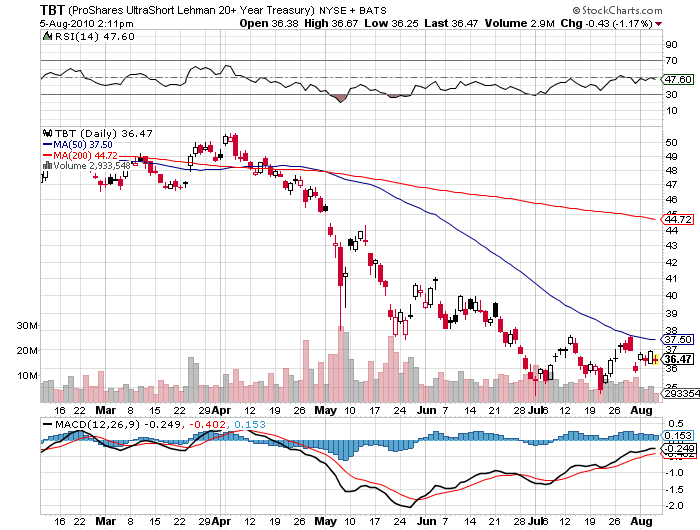

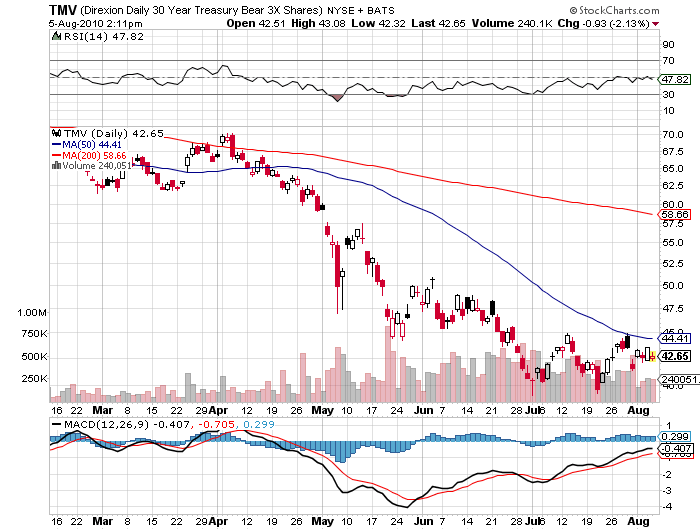

1) Get Ready for the Sack of Rome. I traded the great Japanese bull market during the eighties at Morgan Stanley, from the very bottom all the way up to the peak. The firm's fundamental analysts railed against the tide for years, claiming that stocks were liquidity driven, overvalued, and headed for a huge fall. Every time they made that call, their offices got moved ever closer to the elevator, and eventually, the men's bathroom. When the turn finally came, I had already taken off on an extended vacation, and the ignored analysts had moved on to hedge funds, where they proceeded to make vast fortunes. When someone at last threw the switch on Japan, it got dark amazingly fast. Tokyo went out at an all time high of ?39,000 on the last day of 1989, and then dropped a staggering 45% in January. Yesterday's close, 21 years later, was ?9,489. These days, I feel like those Japanese analysts, except the market that is driving me nuts is the one for US Treasury bonds (TBT), (TMV). The more arguments I find that they should fall, the faster they go up (see charts below). I probably would have fired myself by now, if I weren't my own boss, as nepotism is always a powerful force. Now I hear that PIMCO's Mohamed El-Erian says that there is a 25% chance of real deflation hitting the US, after telling us it won't for so long. Again, this reminds me of Japan, where the higher it went, the more imaginative the explanations became as to why it should continue. Ignore those 100 PE multiples, just focus on the damn Q-Ratios! I believe that we are witnessing the final blow off top in the great 30 bull market in bonds. A decade from now, it will not be stock investors complaining about a lost decade, but owners of bonds. Could it go on for another six months or a year? Sure. Like gold in 1979, technology stocks in 2000, the absolute tops of these parabolic moves are impossible to predict, both on a time and price basis. But when the turn comes, it will resemble the Sack of Rome.

Featured Trades: (EMERGING MARKETS ARE HOT),

(EPOL), (IDX), (ECH), (EWS)

iShares MSCI Poland Investable Market ETF

Market Vectors Indonesia ETF

Singapore iShares ETF

iShares MSCI Chile Fund Index ETF

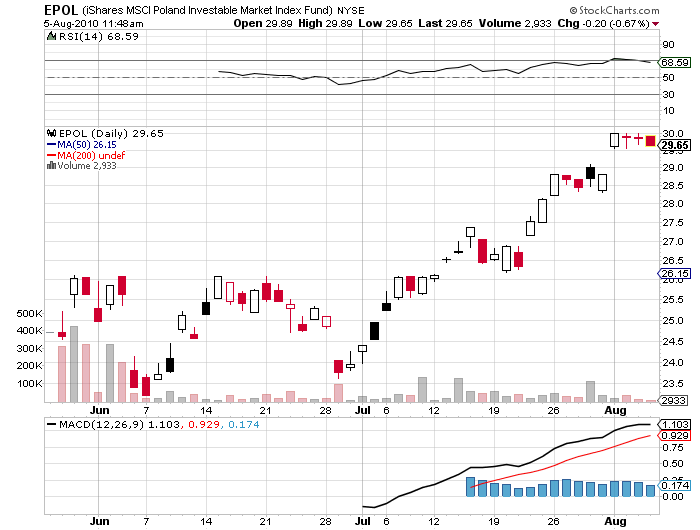

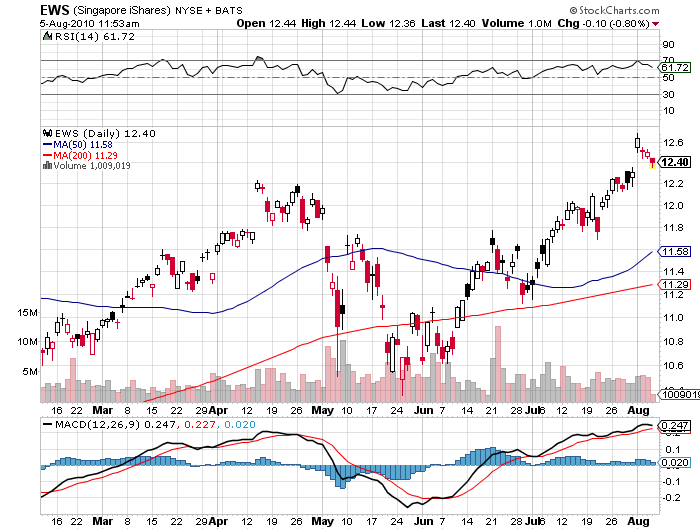

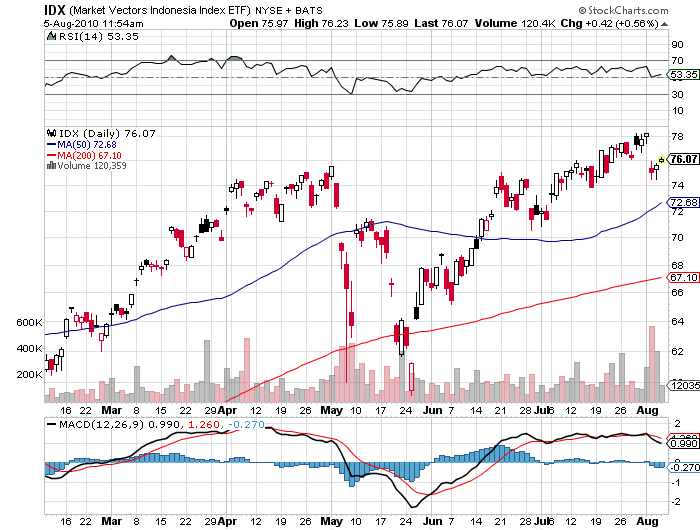

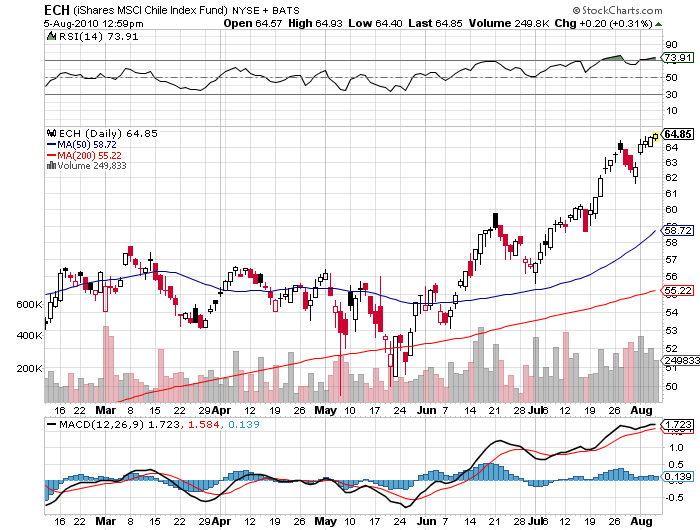

2) Emerging Markets Are on a Tear. Regular readers of this letter know that I have been going on about emerging markets like a broken record (as my kids ask 'What's a record?'). My favorite investment targets have been on an absolute tear lately. In July, Poland (EPOL), (click here for 'Where to Play the Dead Cat Bounce in Europe' ) soared by 25%, Chile (ECH) rocketed by 17% (click here for 'Chile is Looking Hot"), Singapore popped 13% (click here for 'Singapore Sizzles'), and Indonesia jumped 11% (click here for that call). Portfolio managers are voting with their feet, unsurprisingly choosing to invest in the portion of the global economy that will account for 90% of growth for the next decade, and giving a cold shoulder to the home market that will only provide 10%. They are capturing a double whammy in that appreciating currencies and rising share prices create a leveraged, hockey stick effect on trading profits. If you want to run with the bulls, make sure your passport is current.

Keep Your Passport Current if You Want to Run With The Bulls

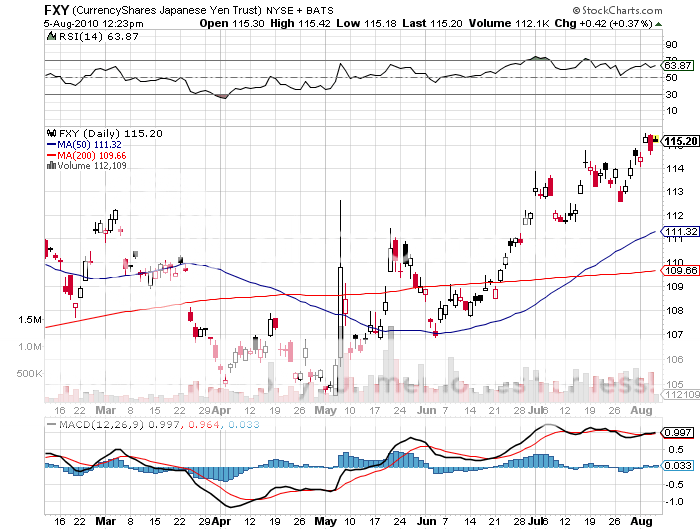

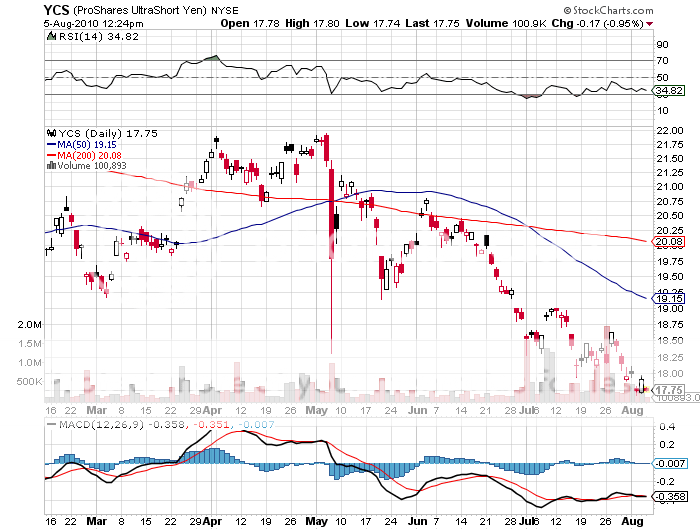

Featured Trades: (YEN), (FXY), (YCS)

Currency Shares Japanese Yen Trust

ProShares UltraShort Yen ETF

3) What's Behind the Yen Strength. My old friend Peter Tasker (we both wrote for the late Far Eastern Economic Review in the seventies), ran an interesting editorial in the Financial Times today (click here for the piece). He examines the only two assets that have gone up in price over the past three years, gold (GLD) and the yen (FXY), (YCS). While clearly not a gold bug, he does advance some interesting arguments on the Japanese currency. If the ten year JGB is at a 1.1% yield, and the deflation rate is 1.5%, then the real rate of return for investors is a mostly tax free 2.6%. But government statistics understate the case, as usual, and the real deflation rate is probably closer to 3%, taking the real yield to 4.1%, among the world's highest. Nobody owns yen and therefore can't sell it. Ditto also for JGB's, which are almost entirely held by Japanese institutions because they have been so low yielding for so long. This is why a recent miniscule redirection of new reserve purchases away from US Treasuries into JGB's cause bond prices there to rocket, and the yen to take a run at a 15 year high at ?84.8. A new all time high at ?79.8 is not out of the question. The yen strength will eventually end, because while gold cannot be created out of thin air, currency can, through a massive quantitative easing that sends the printing presses into triple overtime.

'People are finally starting to realize that 'extended period' means 'extended period,' said former University of Chicago professor and former Fed governor Randall Kroszner, about future interest rate expectations.

Featured Trades: (FOR PROFIT EDUCATION),

(APOL), (COCO), (ESI)

2) The Smoking Gun on For-Profit Education. When I recommended the for-profit education sector as a potential short (click here for 'Hedge Funds Are Targeting for Profit Education'), I didn't know that the General Accounting Office was conducting an undercover investigation of several schools. Since then share prices have fallen off a cliff, with lead stock Apollo Group (APOL) of University of Phoenix fame at one point underwater by 20%, and smaller Corinthian Colleges (COCO) down a gut churning 37%.? The GAO report that was released to congress today alleged that all 15 schools studied engaged in deceptive marketing practices, and that four advised students to lie on their loan applications. The schools examined included Apollo, Corinthian, the Washington Post's Kaplan unit, and ITT Education Services (ESI). Hedge fund manager Steve Eisman of FrontPoint Partners has described this industry as the next subprime crisis, and has been amassing a considerable short position for some time, which is now paying off handsomely. These companies are about to enter a world of hurt, as a boatload of regulation, and possible criminal prosecution, is heading their way.

Steve Eisman is Looking Good

Featured Trades: (THE NUCLEAR COMEBACK), (CCJ), (NLR)

3) Nuclear Energy Makes a Comeback. Better drag your leisure suits, bell bottoms, and Bee Gee's records out the attic. The seventies are about to enjoy a rebirth.

The nuclear industry, which has been comatose since the accident at Three Mile Island in 1979, is gearing up for one of the greatest comebacks of all time. There is absolutely no way we can deal with our impending energy crunch without a huge expansion of our nuclear capacity, which sits at a lowly 20% of our total power generation. France has already achieved 85%, followed by Sweden at 60% and Belgium at 54%, and the last time I checked, none of these Europeans were glowing in the dark. The BP disaster only brings the day of reckoning closer.

Unless you're an underpaid nuclear engineer toiling away in total obscurity at some university, you are probably unaware how far the technology has moved ahead in the last 30 years. Generations I and II produced the aging 'joint use' behemoths we now see on coasts and rivers, which generated both electricity and atomic weapons, but could potentially melt down if someone forgot to flip a switch. Think Chernobyl. Generation III has spent decades trapped on the drawing board.

There are over 100 Generation IV designs, and many are certain to get built. The most popular is known as a 'pebble reactor,' which relies on a new form of fuel embedded in graphite tennis balls cooled with helium that is just hot enough to generate electricity, but too weak to allow a disaster. Also known as a Very High Temperature Reactor (VHTR), these plants enable a 50% increase in thermal efficiencies. The built-in safety of the design let's you eliminate many redundant backup systems, cutting costs. No surprise that the only operating prototype is in China. Low grade waste can be stored on site, not shipped to Nevada or France. Other feasible designs include using thorium fuels, fast neutron reactors, and liquid lead, sodium, or salt cooling variants. Plants are also about to get a lot smaller too.

Speeding the resurrection of this once dead industry is some cheerleading from none other than the same demonizing, apocalyptic environmentalists that shut the industry down thirty years ago (remember Jane Fonda in The China Syndrome?) That is helping shorten the permitting process from 15 years to four by confining new construction to existing facilities instead of green fields.? Nuclear power generates no carbon dioxide, an important consideration if we're all about to suffocate on the stuff. Each new nuclear plant will take one or two of our 400 coal fired plants offline. Do you think they noticed that there has not been one nuclear death in the US since the sixties, while tens of thousands died globally in coal mining disasters or from the black lung that follows?? And I'm not even counting millions of respiratory illnesses brought on by ubiquitous air pollution. That's why at least 30 new reactors are expected to start construction in the US over the next five years, and over 100 in China.

There is a great equity play here, and I would use any substantial dip in the market to scale in.? The Market Vectors Nuclear Energy ETF (NLR) is the easiest way in. You can also buy its largest components, like Cameco (CCJ) (click here for their website at http://www.cameco.com/investors/ ), the world's largest uranium producer.

And while you're at it, you might start practicing your 'hustle' once again.

' The oil era will end in 30 years, as it is replaced by alternatives, offshore, and tar sands,' said Ahmed Zaki Yamani, the former Saudi oil minister, who invited me on his private jet for a trip to the kingdom so I could conduct an exclusive interview during the seventies.