January 26, 2010 Featured Trades: (HEDGE FUND RADIO), (TRADER MARK), (ATHR), (ASIA), (DRWI), (BRF), (RSX), (IDX), (EWA), (VNM), (JAL), (NISSAN MOTORS), (NSANY), (NISSAN LEAF)

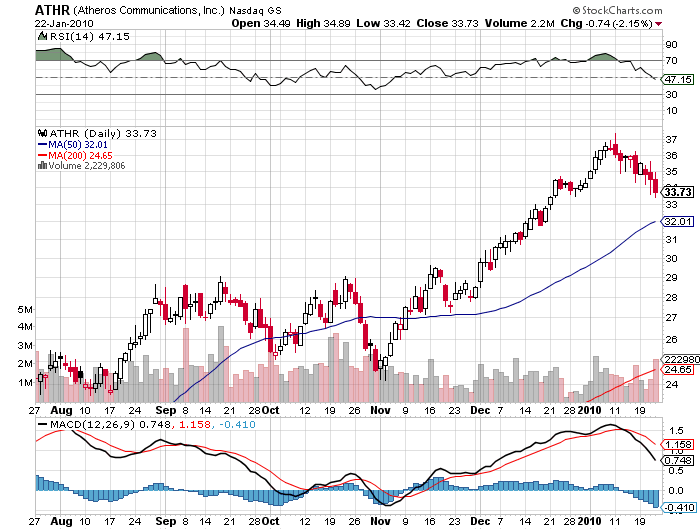

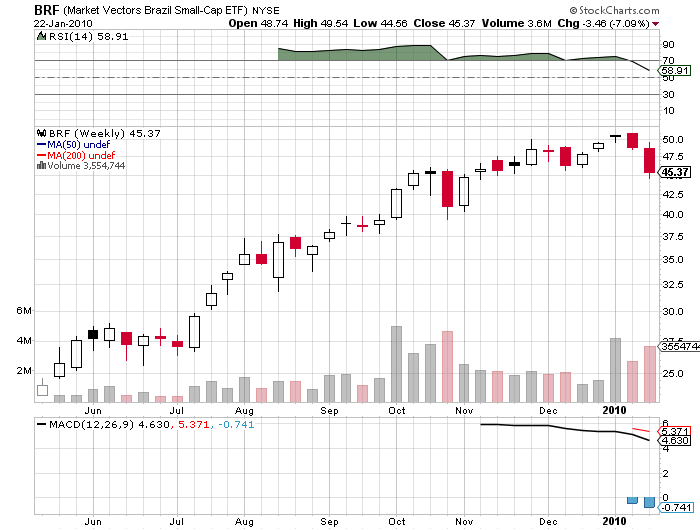

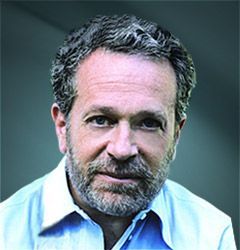

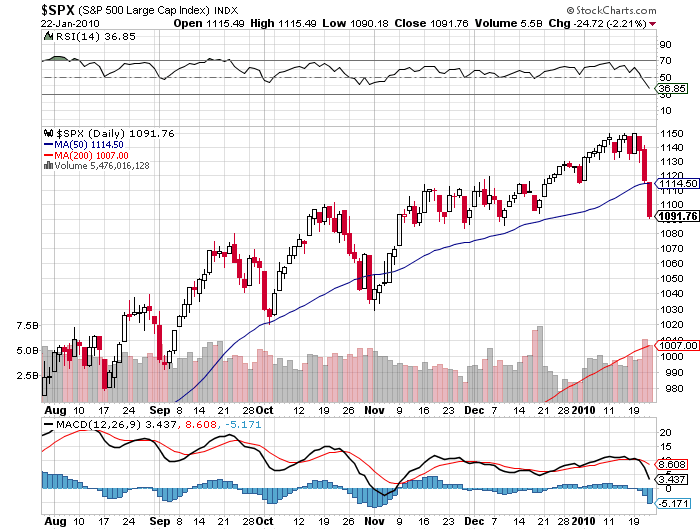

1) My guest on Hedge Fund Radio this week was Mark Hanna, publisher of the wildly popular, www.fundmymutualfund.com investment website, who believes that the US economy is in a ?drugged pleasure dome that kicks the can down the road,? and will bring ?another ugly episode in the market.? If the S&P 500 breaks the 200 day moving average, which is looking increasingly likely by the day, he?ll turn on a dime and bail on his longs. ?Trader Mark,? as he is known on the Internet, employs a hybrid fundamental/technical, long/short approach to the market which he has developed through trial and error over the last 15 years. His record enabled him to build a readership of 150,000 a month at his website, and brought him an impressive 13,482 followers at blog aggregator www.seekingalpha.com . Mark has delivered a 77% return through model portfolio tracker, Investopedia, that has brought him $7 million in commitments for a mutual fund he plans to launch this summer. Mark likes the small cap mobile technology area, and has traded in Atheros Communications (ATHR), Asia Info Holdings (ASIA), and Dragon Wave (DRWI). China and India have great fundamentals, even though they are getting overhyped. More attractive is Brazil, which offers a small cap ETF (BRF). In the BRIC complex, he?d take Russia (RSX) out, which presents unquantifiable country risks, and substitute in Indonesia (IDX), another resource exporter with a growing middle class that is close to China. Also on his horizon are Australia (EWA) and Vietnam (VNM). To listen to my interview with Trader Mark in its entirety, please go to Hedge Fund Radio at my website by clicking here

2) I have to admit that I was stunned and then saddened when, as a four decade long customer of Japan Airlines, I heard that the national flag carrier had filed for bankruptcy. The airline will keep flying, but only after wiping out shareholders, cutting a third of its 52,000 employees, telling its banks to write off $4 billion in debt, and taking another $6.6 billion in bailout money from the Japanese government. It seemed like only yesterday that the company?s spanking new 747?s ferried camera toting tourists around the world en masse, offering the epitome of service, my own sister-in-law escorting them along the way as a stewardess. But the sins that felled the big American carriers 20 years ago (remember Pan Am, National, and Braniff?), those of back breaking legacy costs, powerful unions, an aging fleet, and horrific price competition, finally caught up with JAL. It didn?t help that it is thought to have hedged several years of fuel costs at the 2008 market top when crude was trading around $125/barrel. A never ending deluge of retiring government officials (a practice known in Japan as amakudari, or descent from heaven), assured a perennially weak management. In the end, it was the ousting of the Liberal Democratic Party in last year?s election and the crucial support that went with it that did it in. It is symptomatic of much of what is wrong with Japan today that it took this long to happen. I hope that JAL can cut a deal to provide either American or Delta Airlines new routes in exchange for $1 billion in cash to stay in the air, or I shall miss the hot sake in first class dearly.

3) It looks like Nissan Motors (NSANY) is going to win the race to bring out the first mass market all-electric sedan in the US with the introduction of its ?Leaf? model later this year. The company is now conducting a national road show enabling potential buyers, some of whom have developed a cultish interest in this product,?? to test drive the futuristic vehicle. The five passenger, front wheel drive, five door Leaf will get 100 miles per charge, which will accommodate the needs of 95% of American drivers? daily needs. At $2.75 per charge, the Leaf will get price equivalent mileage of 110 miles per gallon. Maintenance will be incredibly cheap, as the car will have no oil, antifreeze, transmission, cylinders, or tailpipe. If this technology takes hold, tens of thousands of local mechanics will become the unemployed buggy whip makers and carriage designers of our age, as there will be nothing for them to do but repack wheel bearings in grease. This is a mode of transportation with virtually no moving parts. The car will offer impressive acceleration and handle like any six cylinder engine vehicle. A full 220 volt charge will take eight hours, or 26 minutes if you are happy with an 80% quick charge. Nissan will be offering some cool features, like drive by wire, rear view cameras, regenerative braking to extend battery life, and IPhone apps to monitor battery status. The 24 kWh induction motors will run off of lithium ion batteries with a life guaranteed at five years, and possibly extending to ten years. Every buyer will get a free home inspection to assess charging options. Nissan is rushing to build a national infrastructure of public charging points at service stations and shopping malls that the car?s GPS can find on its own. The first cars will be manufactured in Japan, but Nissan anticipates bringing a Tennessee factory online down the road. The company is being cagey on pricing, hinting that it might come in at a competitive $25,000-$35,000, with a $7,500 federal tax credit. Beam me up, Scotty.

QUOTE OF THE DAY

?If you want to succeed, double your failure rate,? said Thomas Watson, the CEO who built IBM into a global force from the twenties to the fifties. He also said, ?I think there is a world market for maybe five computers.?

Global Market Comments

January 25, 2010

Featured Trades: (SPX), (TBT), (GLD), (FXA), (UNG), (WHEAT), (CORN), (SOYBEANS), (CYB), (OAKLAND BAY BRIDGE)

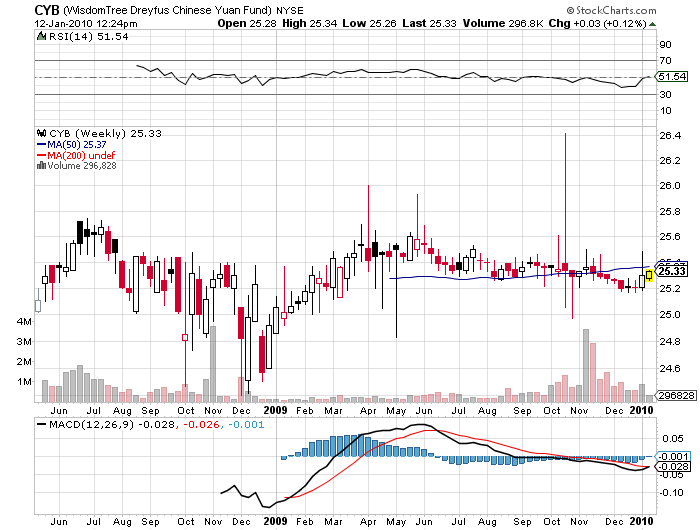

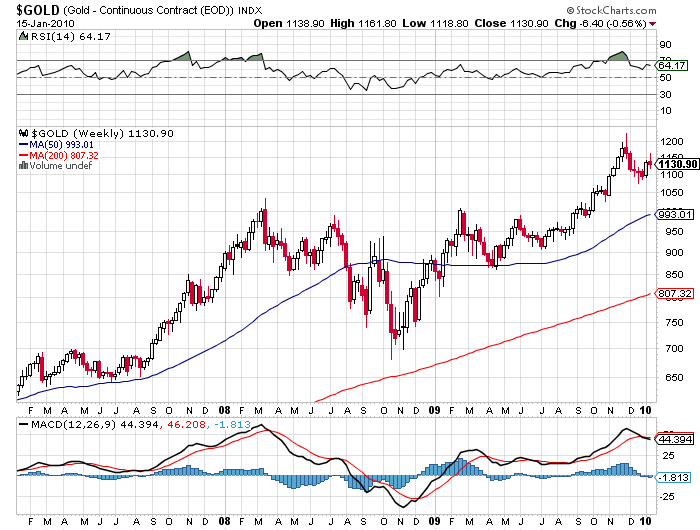

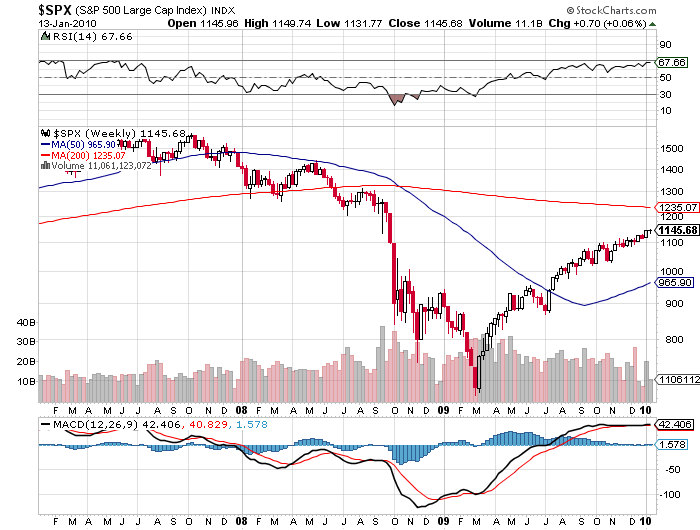

2)Friday lunch had me sharing a cold, congealed chicken salad with Bill Clinton?s Secretary of Labor, Robert Reich at San Francisco?s Fairmont Hotel, who says that easy money is creating new bubbles around the world, especially in China and commodities, that will only end in tears. The Middle Kingdom is the first country where inflation may break out to the upside. There is also a new form of protectionism that has emerged under the guise of competitive devaluations, where counties printing paper money are racing to the bottom, which will eventually force a revaluation of the Chinese Yuan (CYB). A US GDP that is 71% dependent on consumer spending is unsustainable, since they can no longer afford it, can?t get credit, no longer have a personal ATM in the form of home equity loans, are worried about losing their jobs, suffer under a huge debt burden, and are now unexpectedly having to save more for their retirement since their houses have dropped in value by half. Scott Brown?s surprise win for the Massachusetts senate seat will only cause uncertainty in Washington to explode, not exactly a stock market friendly development. The Obama administration committed a major error by devoting one third of its massive $870 billion stimulus program to tax cuts, which in this environment, will get saved, not spent. The TARP money, while succeeding in rescuing the financial system, only ended up in Treasury bills and never made it to Main Street. The best way to revive the economy is to give money to the states directly, which, unable to run deficits, can only cut spending and raise taxes. This will create a $350 billion drag on the economy during 2010-2011, in effect an ?anti stimulus? that cancels out a third of the federal government?s reflationary efforts. I took two of Bob?s economics classes at UC Berkeley, and know too well his wry humor, acid wit, and preference for backing up arguments with mountains of empirical data. Bob warned his guests not to take his investment advise, as he bought his home in Berkeley at the 2006 market top, and has since had to to eat a 10% cut in his Berkeley professor?s salary forced on him by state budget cutbacks. A Rhodes Scholar who dated Hillary Clinton at Yale and ran for governor of Massachusetts, Bob is never without an original thought, nor a stranger to controversy.

3) The first 300 foot, 6,800 ton segment of the new approach to the Oakland Bay Bridge was delivered this week. This massive wing shaped piece of steel is the first of 28 to be delivered that will be used to rebuild the 73 year old symbol of the Foggy City. Out of towners may recognize this as the bridge that terrified motorists by partially collapsing during the 1989 Loma Prieta earthquake, paving the way for a ground up seismic retrofit. Where was it built? You guessed it, China, where inferior steel, shoddy welds, and poorly translated plans caused a 15 month delay in the fabrication, pushing completion of the new structure off to 2014. Despite delays caused by an El Nino winter, the new component made it over from Shanghai on a specially designed ship in only 22 days. Local unions bitterly opposed the offshoring of the project to the Middle Kingdom, even though a wholly American made bridge would have more than doubled the anticipated $6.3 billion cost. Looks like I?ll still have to hold my breath while driving over to San Francisco, even after it?s finished. It says a lot that the Chinese can rebuild one of America?s greatest engineering icons, ship it across the Pacific Ocean piecemeal like a giant Lego set, and erect it here at half the cost of the local help. It?s another ominous ?tell? on the future of the global economy.

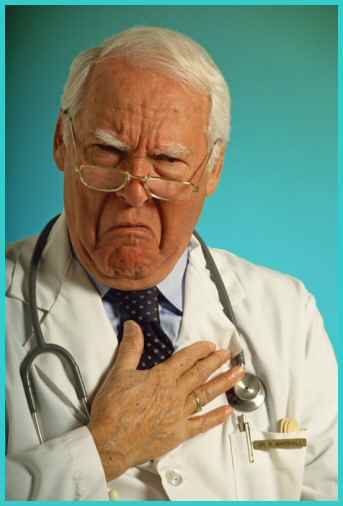

?Isn?t it funny when you walk into an investment firm, and you see all of the financial advisors watching CNBC??that gives me the same feeling of confidence I would have if I walked into the Mayo Clinic or Sloan Kettering and all of the doctors were watching the TV soap opera General Hospital,? said a bond manager friend.

January 22, 2010

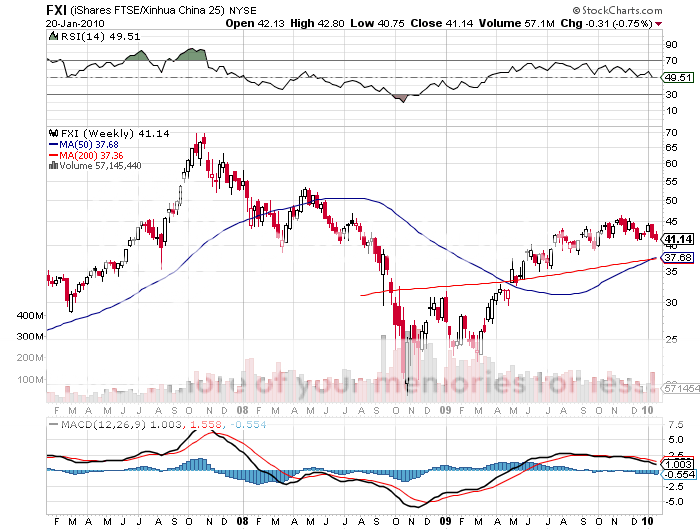

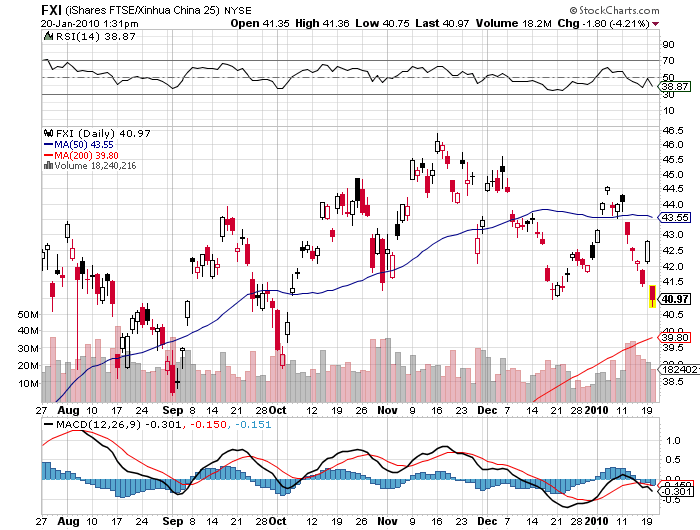

Featured Trades: (FXI), (GOOG), (WFC), (EL NINO)

?

?

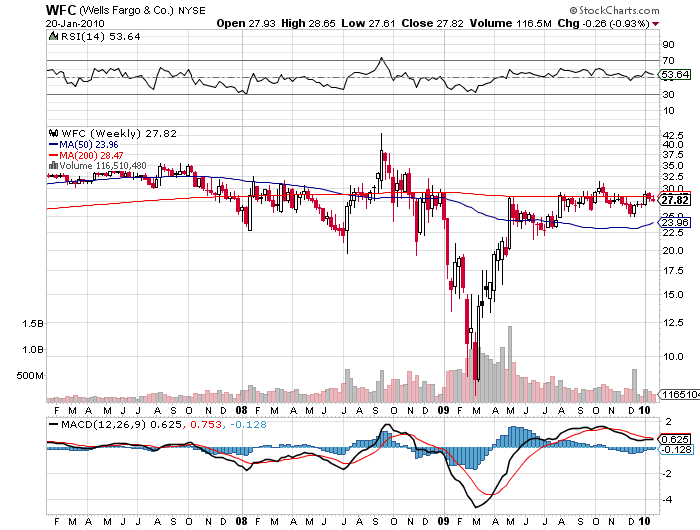

2)I caught an interesting interview with Howard Atkins yesterday, the CFO of Wells Fargo (WFC), gaining some insight into what is probably the best run big bank in the US. Profits soared to a record $12.9 billion in 2009, thanks to top line? revenue growth across the board in an incredibly well diversified portfolio of businesses, including insurance, brokerage, investment banking asset management, credit cards, consumer lending, and of course, home mortgages. The bank originated a breathtaking $94 billion in mortgages in Q4 alone, giving it a 25% share of the total US market. It basically stole Wachovia Bank at the height of the financial crisis, and immediately wrote down its loan book to a fraction of its face value. Loan losses in Q4 jumped from $2.9 billon to $5.4 billion, and that number will taper in 2010. But the bank is fortunately making money fast enough across all its businesses to healthily write off future losses. That eliminates the need for any further capital raises in the foreseeable future, with key ratios stronger that pre crisis levels. I am avoiding the financial sector for all of the abundantly obvious reasons. But if I had to own one big American bank, WFC would be it. I also like the cute little stage coaches they have on their checks, and a TV add program that rides out of a Louis L?Amour novel.

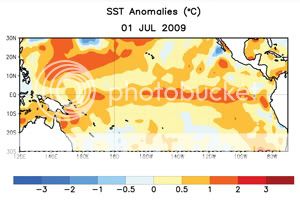

3) You?ll have to excuse me, but I?m sending my letter out early today so I can go over to my kids? elementary school and help fill sandbags to keep at bay the flooding brought on by California?s torrential rains this week. This morning I checked in with some old friends at the National Oceanic and Atmospheric Administration (NOAA) in Tiburon, California, located at the abandoned Navy base that was home to the Golden Gate Bridge?s antisubmarine net during WWII.? They warned me that our El Ni??o winter (check their site ) could deliver a drenching 10 inches of rain this week, in a state that normally sees 20 inches a year. So named because all of the fish disappeared off the coast of Chile one Christmas years ago, El Ni??o?s are caused by a sudden warming of ocean temperatures in the Central and Eastern Pacific, which lead to unusual weather patterns here. During the last El Ni??o in 1998, the rainfall in San Francisco soared from 20 inches to 100 inches, the American River dykes broke, railroads were destroyed beyond repair, the Sierras got pelted with 40 feet of snow, and species of fish like mahi mahi normally found in Hawaii suddenly hit the hooks of delirious fishermen in San Francisco Bay. Australia endured a terrible drought. This could all be great for wheat prices and bad for insurance companies, and no doubt this is one of the painful dividends of global warming.

?Easy money is the mother?s milk of speculation,? said ?Trader Mark,? publisher of the hugely successful investment website www.fundmymutualfund.com

Global Market Comments

January 21, 2010

Featured Trades: (FXI), (CYB), (BRK/A), (BNR), (BTU), (ANR)

Note to Readers: Anyone interested in joining me for lunch in San Francisco on Friday, April 23 or New York on Friday, May 7, please email me at mhftorders@yahoo.com to indicate potential interest. I?m currently building a book.The cost will be $95 for a three course sit down meal to be followed by a Powerpoint presentation updating my current global strategy.

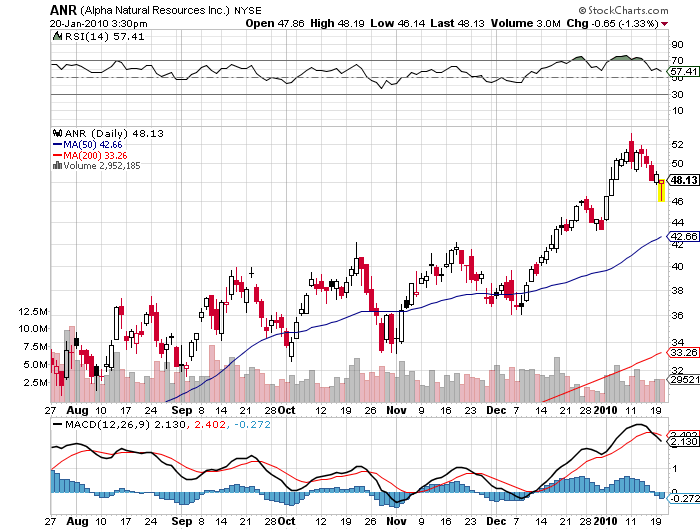

2)If you are looking for a third derivative beneficiary of the surprise Republican win in Massachusetts yesterday, look no farther than King Coal. Now that the Obama is going to have to step back from his most aggressive and expensive policies, you can kiss Cap & Trade and Carbon Capture and storage goodbye. New environmental restrictions that had the coal industry squarely in their sites may also take a back seat. As you recall, President Bush virtually shut down the Environmental Protection Agency as a pandering gesture to libertarians. The timing is fortunate, as China has recently begun gobbling up the world?s coal output. Since 2007, the Middle Kingdom?s coal trade has flipped from exports of 5 million tons to imports of 100 million tons last year. As the former coal correspondent for the Australian Financial Review during the seventies (no kidding!), I can tell you that these numbers are nothing less than breathtaking. Another ?tell? is Berkshire Hathaway?s (BRK/A) takeover of Burlington Northern (BNR). As I live only a short distance from this road?s tracks, Buffet?s latest acquisition keeps me awake at night with an endless clickety-clack, enabling me to calculate that 70% of its business is shipping coal from the Midwest to China via San Francisco. I wouldn?t rush out and buy coal on day one of a global commodity melt down. But when we enter the next inevitable up cycle, keep Peabody Energy (BTU) and Alpha Natural Resources (ANR) on your short list, which exports the metallurgical coal the Chinese favor.

?

?

3) My guest on Hedge Fund Radio this week will be Mark Hanna, publisher of the wildly popular, www.fundmymutualfund.com investment website, which he pens under the nom du guerre ?Trader Mark.? Mark parlayed a degree in economics at the University of Michigan into a successful career as a day trader during the dotcom boom of the nineties. He launched his website in 2007, which sought to educate investors about his own methodology, provide readers with successful trading ideas, publicize his track record, and ultimately raise money to launch his own mutual fund. Today, Mark?s site attracts 150,000 readers a month, and his new mutual will begin accepting clients this summer. Mark correctly called the real estate bust, and the outpouring of debris that followed. It?s really been a pioneering, guerilla, viral, bootstrap effort, which may provide a model for other aspiring mangers in the future. Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.?? For archives of past Hedge Fund Radio shows, please go to my podcast page.

QUOTE OF THE DAY

?Products go from innovators, to imitators, to idiots,? said Warren Buffett in his down-to-earth explanation of the economic cycle.

January 20, 2010

Featured Trades: (BIDU), (GOOG), (RESIDENTIAL REAL ESTATE), (SHORT CANDIDATES), (CBS), (SIRI), (HTZ), (RAD), (M), (LVS), (AMR), (CAL), (S), (AMD)

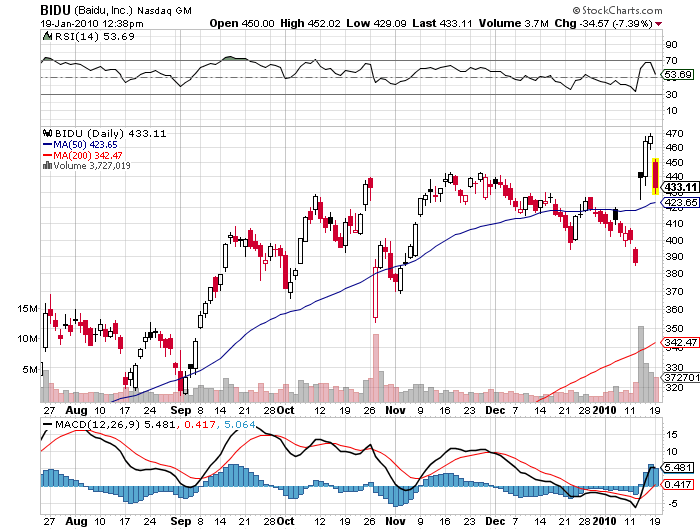

1) Long time readers of this letter know that I have been a huge fan of China?s premier Internet search engine, Baidu (BIDU), recommending it back when it was $120/share (click here for the call). To me, buying into the dominant provider in the world?s fastest growing market seemed like a no- brainer. But even I was taken aback when the stock popped $85 to $470 when Google (GOOG) announced it would no longer censor searches in the Middle Kingdom. Has it gone too far too fast? The shares now boast an incredible 76 times 2009 estimated earnings of $6.15/share and 53 times 2010 estimates of $8.38/share. How much do you pay for revenues that could potentially double overnight? BIDU is certainly rich compared to GOOG?s 38 multiple, but GOOG has an unbelievable $22 billion in cash stashed in the mattress, compared to only $400 million for BIDU. Fascinating to me is how the whole GOOG-China war has morphed into a general debate on doing business with China, which is never easy on a good day, and your worst nightmare on a bad one (just ask the companies that saw contracted deliveries turned away at dockside after prices dropped by half en route in 2008). Do a Google search today, and you are greeted with an image of determined marchers with arms linked in solidarity. Whatever your conclusion, BIDU is definitely an E-ticket ride. GOOG and China could kiss and make up tomorrow, or come up with some kind of fig leaf compromise, sending BIDU tumbling, but I wouldn?t hold my breath. I know how stubborn and nationalistic the Chinese can be from hard earned experience. Ask me what to do tomorrow. I?m having dinner with China?s ambassador to the US tonight.

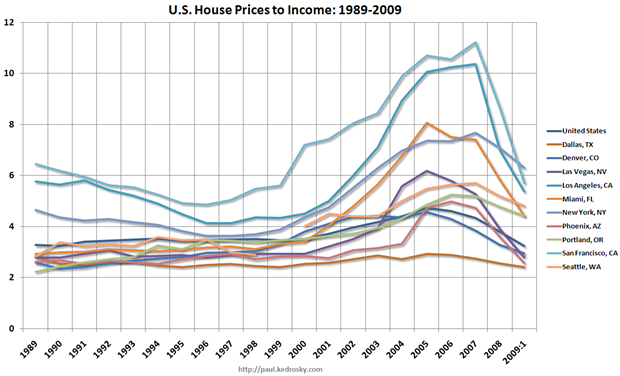

2) As much as I would love to tell my friends to rush out and how a house now, I just can?t bring myself to do it. Take a look at the chart below of US house prices relative to incomes showing that homes are still expensive, and that prices continue to fall. On this basis, Los Angeles, San Francisco, and New York are the most costly markets in the country that are falling the fastest. Bank analysts and lenders take note. Home sales figures are turning soggy again, 25% of homeowners are underwater on their mortgages, a new wave of foreclosures is imminently going to slam the market, and one out of? six Americans are jobless and absent from the economy. That eliminates 40% of the buyers from the get go. There is also the mother of all demographic problems overhanging real estate, which no one seems to see but me. If you absolutely have to buy a home, make sure that you pick up one of those once-in-a-lifetime deals where you are taking it off a bank, or out of foreclosure, at 20% below the appraised value. I know these deals are happening. Buy it because you need a place to live, not an investment, and don?t count on selling it for a decent profit this decade. And also don?t expect to get the first born child you are putting up for collateral back until they are a teenager.

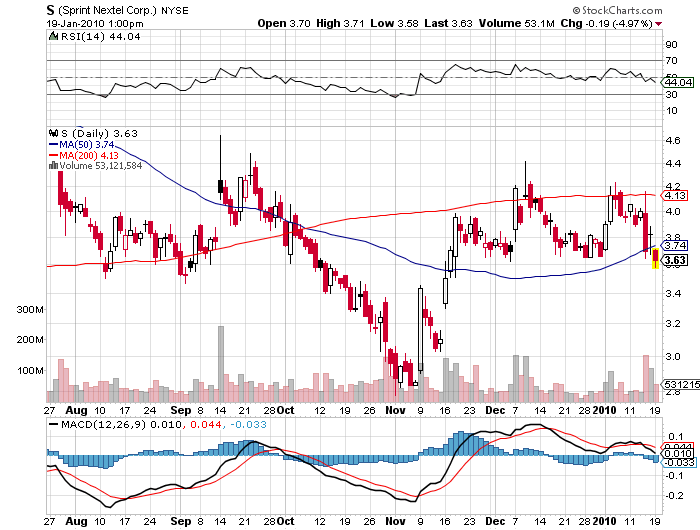

3) Fear of law suits prevents most analysts from publishing lists of short selling targets. But the Audit Integrity Co., a forensic accounting firm,?? regularly posts lists of public companies they believe may go bankrupt (see http://www.auditintegrity.com). Many of their picks reflect the accelerating shift from the old economy to the new economy. With offices in New York and Los Angeles, they look at leverage, market position, debt, and their own proprietary indicators. Another red flag are the legal shenanigans that companies resort to when coming out of a recession, like writing off large amounts of good will. In the media space CBS (CBS), Sirius XM Radio (SIRI), and Hertz Global (HTZ) are at risk. In the consumer field, Rite Aid (RAD), Macy?s (M), and Las Vegas Sands (LVS) made the list. Advanced Micro Devices (AMD) is the largest tech company to warrant scrutiny. Airlines, always a favorite of bankruptcy mavens, include American Airlines (AMR), and Continental (CAL). Sprint Nextel (S) tops the list of telecom companies. With the stock market looking very toppy here, better take that portfolio out and give it a good scrubbing.

?Buy when everyone else is selling, and hold until everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investing,? said oil billionaire,?? Jean Paul Getty, the founder of Getty Oil, a pioneer in the Neutral Zone, and once the richest man in America.

Global Market Comments

January 19, 2010

Featured Trades: (T), (VZ), (HYG),

(JNK), (CRUDE), (OIL), (NATURAL GAS),

($WTIC), (USO), (UNG)

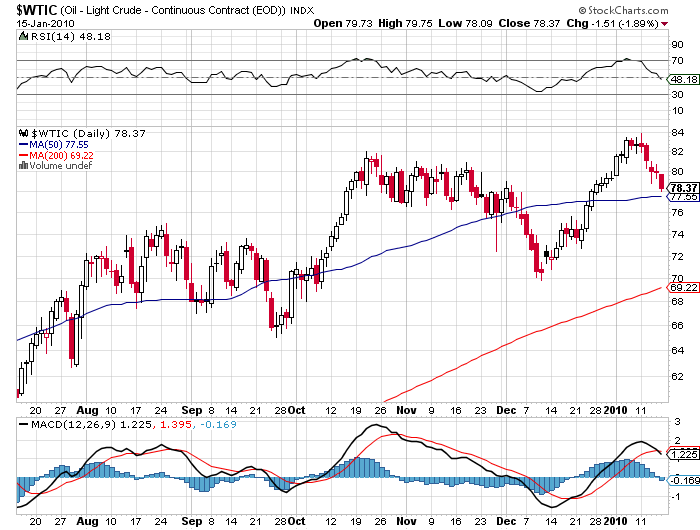

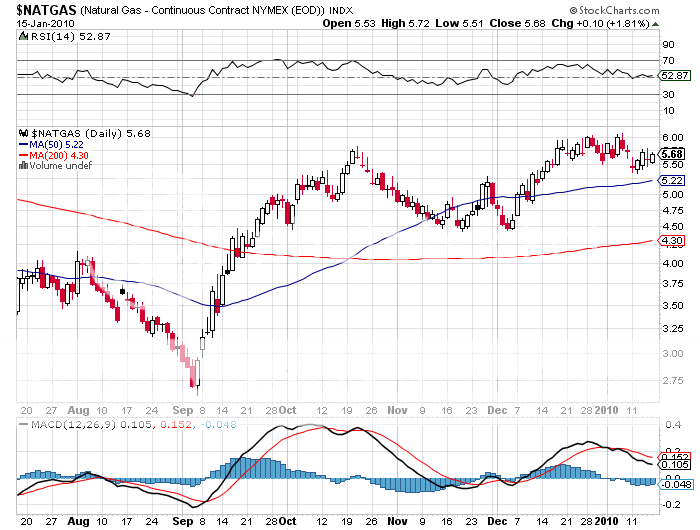

2) I got a call from my friends at the International Energy Agency in Paris warning me that all was not good in oil land (USO). The short term prospects for crude prices are poor, and this bodes ill for all other beneficiaries of the global carry trade, which at this point, is virtually everything. OPEC?s surplus oil production, a great leading indicator for future oil process, has rocketed to a 5 year high of 4.7 million barrels/day in recent months. Some 3.8 million barrels a day of unused production is in Saudi Arabia. The March/August contango has widened out to an annualized 10.6%, allowing hedge funds with access to credit to buy spot, sell forward, and reap a handy return. There is now so much oil in storage ?on the water? in over 100 tankers that you can almost walk from Galveston to Aruba and not get your ankles wet. If there is the slightest sign that stock markets are topping, the dollar continuing its strength, or the economy slowing from the current torrid 5% rate, crude could revisit the $50 handle in a heartbeat. I would not recommend an oil short to my worst enemy, as flocks of black swans (Iran, Israel, Yemen, Somalia, Nigeria) can poop on you from above at any time, delivering a price spike. Long term, oil price still have to go up a lot. Natural gas (UNG) is another story which has been recently laboring under the $6/MBTU level. We are going to come out of the winter with the highest in-the-ground-storage on record, currently at a staggering 2.85 trillion cubic feet, despite one of the coldest winters in history. It?s going to take a decade to get the infrastructure in place to use all of this, no matter how cheap it is.

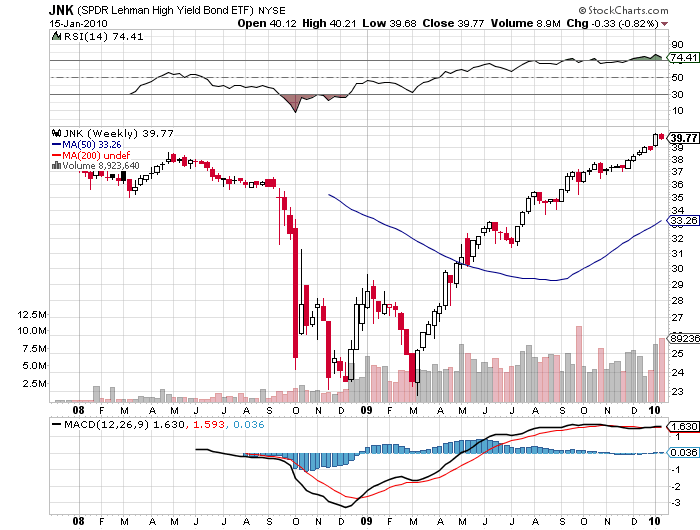

3) As I am in a mood today to dump copiously on the new crop of bubbles, let?s take a look at the junk market. I have been a huge fan of the high yield market since early last year, when the market was discounting an Armageddon type default rate that was never going to happen, and aggressively pushed high yield ETF?s like (JNK) and (HYG) (click here ). I still liked junk in my January 4 Annual Asset Allocation Review. But this is getting ridiculous. The average junk bond now yields 8.7%, down a whopping 100 basis points in a mere six weeks. It is now the lowest since October, 2007, when the credit crisis was just a theory espoused by a few crackpots, permabears, and ?end of the world? sandwich board types. If the global carry trade suddenly goes into hibernation, or if economic prospects transition from a 5% to a 2.5% world, which I believe will happen sometime this year, the resulting carnage could be the goriest in the high yield area.

?I don?t know where the next 1,000 points is coming from, but I know where the next 10,000 points is coming from,? said Sir John Templeton, when he was playing chess with me at his home at Lyford Cay in the Bahamas.

January 15, 2010 Featured Trades: (BILL MILLER), (JPM), (IBM), (VENEZUELA), (US TREASURY)

1)?Keep your friends close, and your enemies closer,? said the ancient Chinese general Sun Tzu. I read the diminutive book, Art of War, written in 400 BC, every year and am always astounded by how much applies to trading the markets. So when Legg Mason?s Bill Miller outlined his wildly bullish case for equities this year, I was all ears. You know Bill, the brilliant value manager who beat the S&P 500 for 15 consecutive years until 2006, who clocked a sizzling 80% return last year, and who now runs $16.9 billion. Bill believes that US GDP growth will surprise to the upside at 3.5%-4.5% this year, versus a consensus 2.7%, taking corporate profits up 25%. The financial crisis is over. The top ten stocks in the index traded at a 30 multiple in 2000, and are down to a 12 multiple now, but should be trading at 14-18 times. Dividend restoration will be an important feature of the bull market going forward, since the healthiest firms overdid it in cutting payouts in the dark days of last winter. His favorite stocks are JP Morgan (JPM), regional banks, and big global technology stocks like IBM. I totally agree with the last pick, as it is a wonderful back door emerging markets play, with more than 50% of its earnings coming abroad. Bill is clearly no dummy. I would love to sit down with him and discover what I am missing. Maybe I?m just a naturally cautious guy, and maybe Bill is just talking about his value universe. When refining a global view across 100 markets, you always have to keep an open mind and consider all alternative scenarios, whether you agree with them or not.

2) I was shocked when I saw Venezuela announce a surprise 50% devaluation of the Bolivar against the dollar last week. You would not normally expect a country that is the third largest foreign supplier of oil to the US to have a plunging currency. Mismanagement of the country?s economy on a massive scale is to blame, with socialist leader Hugo Chavez rapidly earning a reputation as the Robert Mugabe of Latin America. Nationalizations of key companies have been rampant, capital is fleeing the country, and foreign investors are staying away in droves. Despite incredible oil riches, production is falling through mismanagement. The middle class promptly emptied out their bank accounts on word of the devaluation, and splurged on any consumer goods they could get their hands on before prices doubled. GDP fell 2.9%, inflation came in at 25%, and is now expected to soar to 40% in 2010, the second highest in the world after Robert Mugabe?s Zimbabwe. Chavez responded by threatening to seize any business that raised prices. Recovering oil prices and inflationary expectations helped the Caracas IBX Index nearly double in local currency terms since the March lows. I mention all of this because oil should make Venezuela one of the wealthiest countries in South American, on par with Brazil. It clearly isn?t now, but could in the future. Voters will get their first chance to dump Chavez in the September elections, unless some generals get impatient first. Latin leaders who thumb their noses at the US as frequently as Chavez has have notoriously short lifespans. Just ask Noriega. Buy Venezuela when Chavez is hanging by his heels from a tree in the Caracas? Parque Los Caobos.

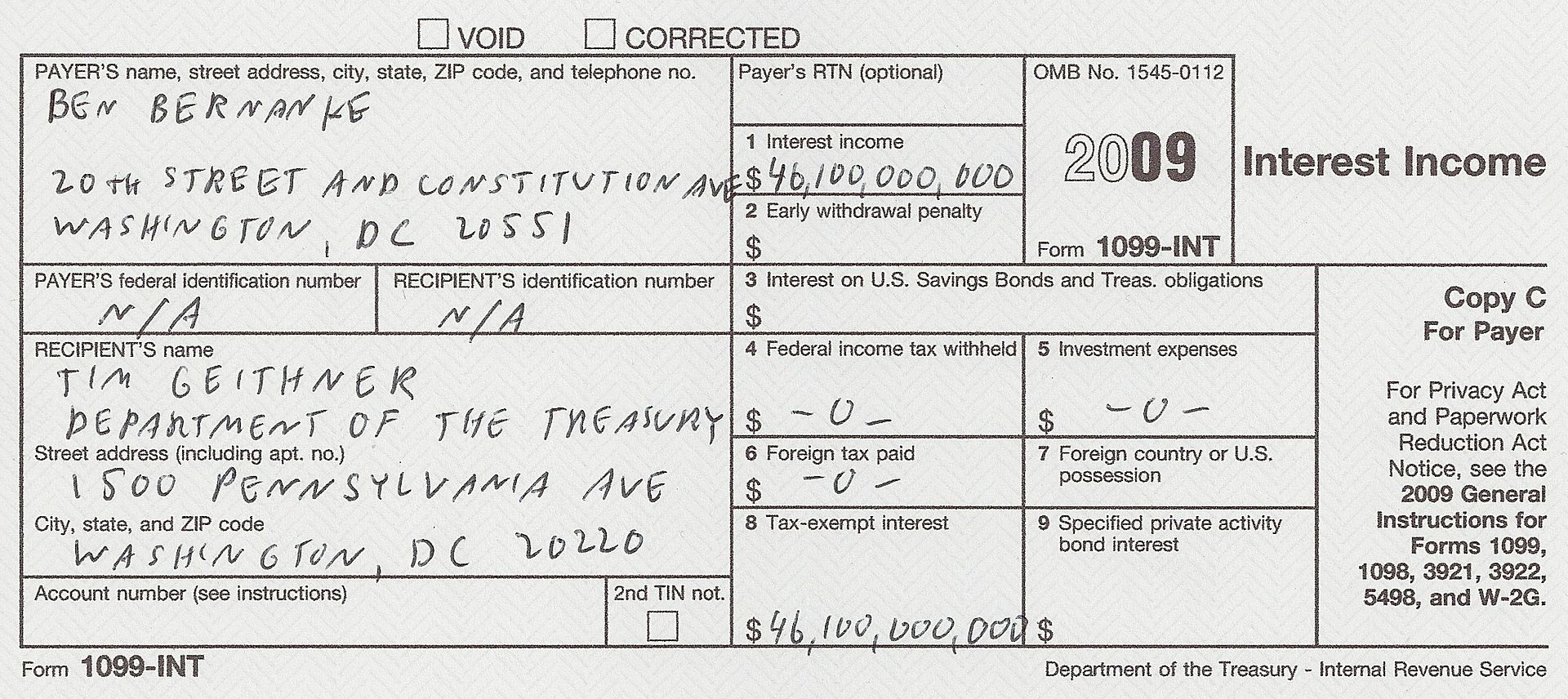

3) The world?s largest hedge fund, the Federal Reserve, earned a profit of $46.1 billion on the many bail out programs it carried out in 2009. That is the interest on $175 billion in government backed mortgage companies, $300 billion in straight government debt, and a whopping $1.25 trillion in mortgage backed securities. Also contributing are other instruments invented by Ben Bernanke to stave off the collapse of the financial system, which are too complex to describe here. Sure, interest rates were low last year. But the Fed made up for this like any good hedge fund would, with tons of leverage. Even Maiden Lane LLC, which holds securities from Bear Stearns and AIG, made $5.5 billion. This is a return far in excess of what Pollyanna?s were predicting when these safety nets were put out. That works out to $153 per person in the US. If you toss in unrealized capital gains and mark these positions to market, the unrealized paper profits would be several times larger. Of course, this will ultimately all get wiped out when General Motors and AIG submit their final bills. I wonder if the Fed owes the Treasury a 1099? Do you suppose they pay any taxes?

4) My guest on Hedge Fund Radio this week is Yra Harris, a global macro hedge fund manager who has been a fixture of the futures community for over three decades. Yra cut his teeth in the foreign currency markets during the violent days of the seventies, just as that industry was entering a period of explosive growth. His career took him though Solaris Capital, Praxis Trading, and James Sinclair & Co., among others, and has served on several committees at the Chicago Mercantile Exchange. Yra writes a daily blog on macro investing called Notes From Underground, which you can find at www.yrah53.wordpress.com?? . Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.? For archives of past Hedge Fund Radio shows, please go to my website by clicking here.

?The error of optimism dies in the crisis. But in dying, it gives birth to the error of pessimism, and that error is born not as an infant, but as a giant,? said Cambridge neoclassical economist Arthur C. Pigou.

Global Market Comments

January 13, 2010

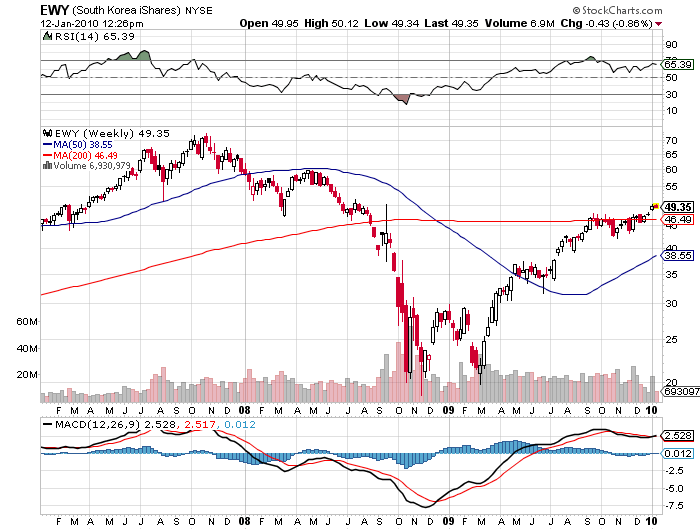

Featured Trades: (HYUNDAI), (KOREA), (WON), (EWY), (CYB), (REI)

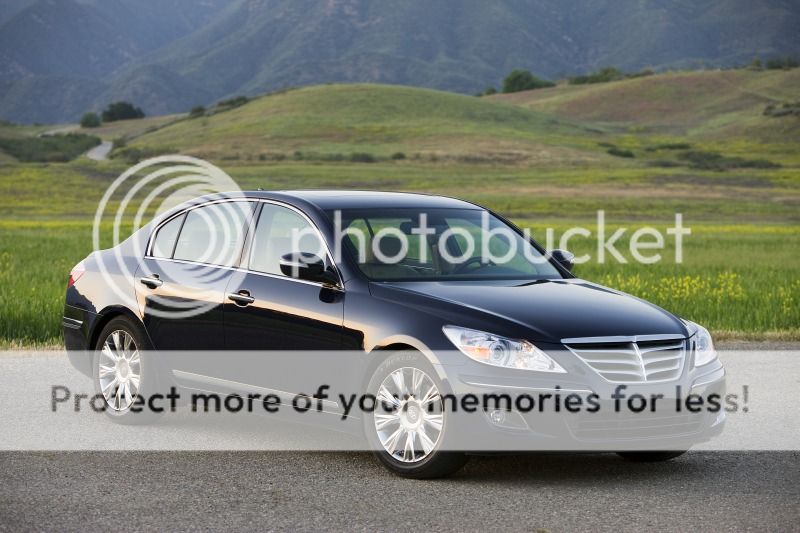

1) I watched with both amazement and foreboding Japan's share of the US car market grow from 1% in the seventies to 40% in recent years. General Motors made excuses all the way up, as the Japanese ate an inexorably larger share of their lunch, until they went bankrupt. I see history about to repeat itself, but it's not American car makers' market share that is on the menu, but Japan's. South Korean auto makers Hyundai and KIA stunned industry experts when they, along with Japan's Subaru (Which is Japanese for the constellation Pleiades. Go figure), emerged as the only three auto firms to see sales increase in 2009. Hyundai's sales rose 8%, boosting its market share by 40%. The company got a lot of mileage when its elegant new $30,000 sports sedan, Genesis, was named 'Car of the Year,' becoming the first gasoline powered car to get an EPA rating over 30 mpg. New generations of the crossover SUV Tucson and midsize Sonata sedan promise to take the marque forward. The company will make its first foray into the hybrid space with a 'green' Sonata powered by a third generation lithium polymer battery pack. I rented a Hyundai a few weeks ago, and it took me back to my youth, reminding me of the Toyota Corolla I drove in Japan 25 years ago. You can buy Hyundai stock directly, which owns KIA, thanks to some financial indiscretions a few years ago. The hardier may also take a look at Samsumg, which is part owned by Renault, and Daewoo, which has a partial ownership by none other than GM. Consider it the same as buying Toyota in 1980, but with a lot more leverage, and a nice currency play on the side. For a broader view, look at the South Korean ETF (EWY), a country that seems to be doing everything right.

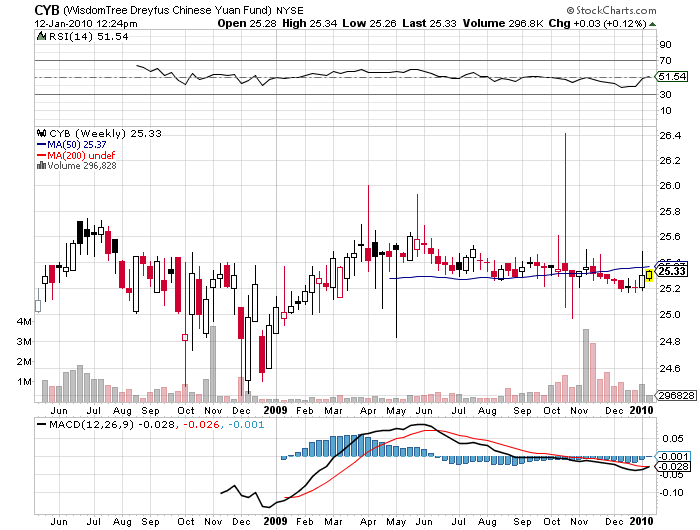

2) With much fanfare, China announced that it became the world's largest exporter last year, a humongous $130 billion in December shipments taking the annual figure up to a staggering $1.3 trillion. The Middle Kingdom also became the largest car market last year, and is set to surpass Japan to become number two in GDP this year. It remains to be seen whether there are buyers for all of these shoes, toys, clothes, furniture, and consumer electronics. The country's $586 billion stimulus package has proven so successful, about triple our package on a GDP basis, that the People's Bank of China has already started throttling back with the first two of, no doubt, many interest rate hikes to come. Ben Bernanke take note. This amazing performance makes a long Yuan position one of the great no brainer trades out there. Until now authorities have permitted a slow, controlled creep up in China's currency to the present 6.8270 to the dollar rate, or 14.6 cents. But with China's surpluses growing at a bat out of Hell rate, it's just a matter of time before that breaks. The fixed rate essentially lets the Federal Reserve set China's monetary policy, a central bank with a notorious reputation for inflating bubbles. It's the classic irresistible force meeting the immovable object scenario. Either China floats, or its domestic inflation will explode. When it does so, the Yuan will rocket, possibly by as much as 50%, as every hedge fund, their fraternity brothers, and their distant second cousins, dog pile in. In the meantime, noted short seller Jim Chanos is banging his drum about imminent economic collapse in China, claiming that it is manufacturing a mountain of goods that no one will buy, and that its real estate market is Dubai times 1,000. Right idea Jim, but wrong timing. I think you're early, way early. Sure there's a bubble in China, but these things can run far longer than you can possibly imagine. Having traded through the great Japanese stock market bubble of the eighties, I know. Better look at the Chinese Yuan ETF (CYB).

3) A year ago, I spent a shivering Saturday morning lined up for Recreational Equipment Inc.'s (REI) monthly members' only used equipment sale. Outdoor enthusiasts were joined by the newly jobless and homeless, who were hoping to pick up deeply discounted equipment so they could live out of their cars. They were not disappointed. I picked up a pair of Asolo heavy mountaineering boots, list price $280, with tax, for $5! I guess the size 13's don't fly out the door. It did not bode well for the economy when retailers were selling boots for the value of their laces. Since I hike about 1,000 miles a year on Sierra granite that eats up the thickest Vibram soles, I went back to the same sale last weekend for another pair. There were fewer homeless people this time, and more fitness fanatics. Identical boots were again on offer, this time for $27. I guess that says it all for the economy. We're off the bottom, but not off to the races yet. See you on the John Muir Trail.

'If you have been playing poker for a half an hour, and you don't know who the patsy is, it's you,' said Warren Buffet.

January 12, 2010

SPECIAL ETF ISSUE

Featured Trades: (ETF?s), (EEM), (EEG), (VWO),

(GLD), (SLV), (QQQQ), (XLK), (PPLT), (PALL)

1) Exchange traded funds (ETF?s) could soon replace traditional mutual funds as the primary investment vehicle for individuals because of the huge cost, tax, and liquidity advantages they offer. That?s the opinion of Tom Lydon, publisher of www.ETFTrends.com (click here) , a snappily designed site that I constantly refer to on all things related to this highly efficient trading instrument. Tom?s site offers updates on new ETF launches, research tools, and a free newsletter presenting a half dozen investment ideas a day. He finds ETF?s so attractive that he has converted his own management practice for high net worth individuals at www.globaltrend.com (click here) from one focused on mutual funds, to an ETF orientation. ETF?s enable rifle shots at specific, countries, industries, currencies and commodities on the cheap without having to wade through a morass of complicated settlement details. You can buy ETF?s on 50% margin, go short, and with the larger ones, like the S&P 500 (SPY), deal with only a penny spread, plus a token commission.

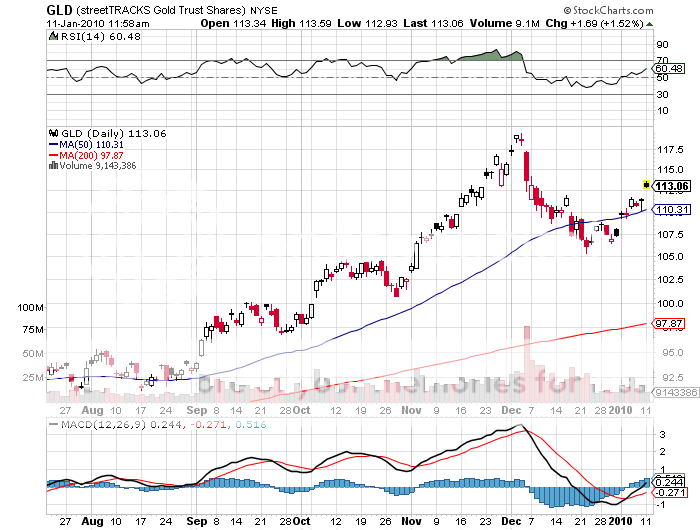

2) The ETF industry has exploded since the March bounce, and there are now 836 such instruments issued by 35 providers with a total market capitalization of $782 billion. Just last Friday, the first ETF?s for platinum (PPLT) and palladium (PALL) were launched. Some have grown so large they have become major influences on the market for their underlying commodities, as with the one for gold (GLD), which has $40 billion in assets, making it the world?s fifth largest holder of the yellow metal. The bigger ETF?s are now resorting to swaps to sidestep CFTC position limits on options and futures contracts. Since most of the current ETF?s mimic indexes, daily buying and selling is minimized, creating fewer taxable events for American investors. Low turnover also helps keep operating expenses down. These quasi index funds confined to narrow groups of stocks can offer better liquidity than any single security. Individual investors can?t put ETF?s into their 401k yet, but that is expected to change soon. More controversial are the leveraged ETF?s offering 200% and 300% long and short exposure, which because of their heavy cost of carry, can diverge substantially from their underlying markets. Better to use these only as short term trading vehicles. Other strategies generating debate are funds of funds holding ETF?s with much higher cost structures, and actively managed ETF?s, which cede their index qualities, for better or for worse. Hedge fund ETF?s can?t be far behind.

3) ETF?s are much more attractive than mutual fund competitors, with their notoriously bloated expenses and spendthrift marketing costs. You can?t miss those glitzy, overproduced, big budget ads on TV for a multitude of mutual fund families. You know, the ones with the senior couple holding hands walking down the beach into the sunset, the raging bulls, etc. You are the sucker who is paying for these. Sometimes I confuse them for Viagra commercials. I once did a comprehensive audit on a mutual fund, and a blacker hole you never saw. There were so many conflicts of interest it would have done Bernie Madoff proud. Any trainee assistant trader can tell you that more 90% of all mutual fund managers reliably underperform the indexes, some grotesquely so.?? Published performance is bogus, they show a huge survivor bias, not including the hundreds of mutual funds that close each year. And there?s always that surprise tax bill at the end of the year. If there was every an industry crying out for restructuring, consolidation, and price competition, and ultimately a whopping great downsizing, it is the US mutual fund industry. ETF?s may be the accelerant that ignited this epochal sea change, with the number of mutual funds recently having shrunk from 10,000 to 8,000. It?s still early days, with ETF?s only accounting for 5-6% of trading volume, even though they have been around for a decade.

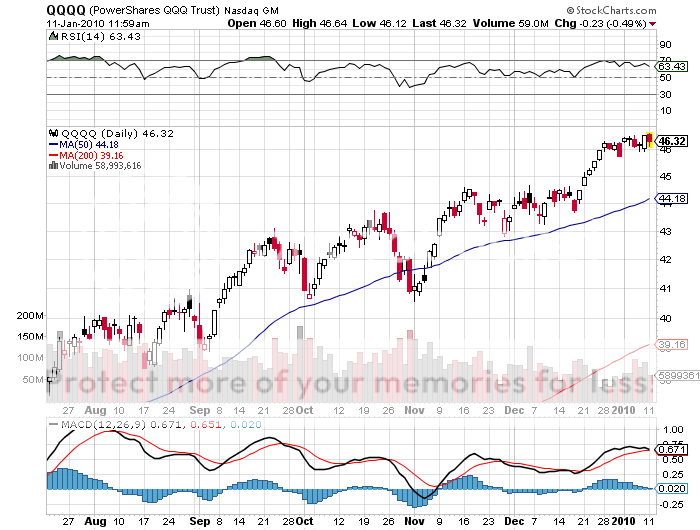

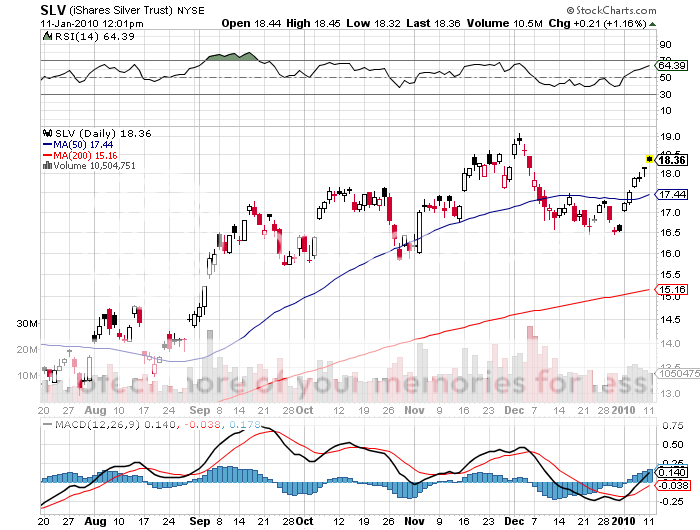

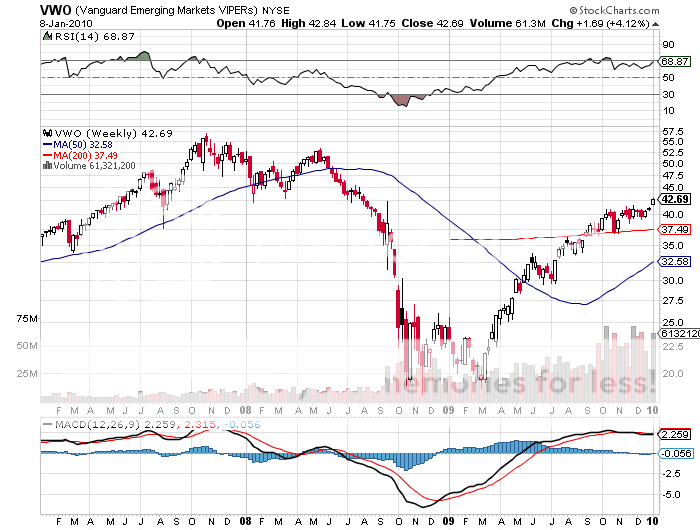

4) ETF maven Tom Lydon?s favorite ETF?s include the ones for emerging markets (EEM), (VWO) and (EEG), gold (GLD), silver (SLV), and technology (QQQQ) and (XLK). No great surprise that these are the funds seeing the biggest investor cash inflows. They also happen to nicely mesh my own view of the world.?? I wish they had invented these things 40 years ago. It would have made my life so much easier. The potential performance of a Japanese small cap ETF bought in 1969, a gold ETF launched in 1971, or a Chinese technology ETF investment in 1978 would have been positively exponential. To listen to my complete interview with Tom Lydon, please go to the Hedge Fund Radio page at my website by clicking here.

January 11, 2010

Featured Trades: (NONFARM PAYROLL), (THE OPTIONS WHISPERER), (CHINA'S ONE CHILD POLICY)

1) President Obama could not have looked more morose in reacting to the news that the December nonfarm payroll showed a further loss of 85,000 jobs, taking the unemployment rate to 10%. It's really tough to put lipstick on this pig. Some 4.2 million have lost jobs on Obama's watch, and 7.2 million since the recession began in December, 2007. Total unemployment now stands at 15.3 million, and 25 million if you used the U6 figure that includes discouraged workers. Some 661,000 dropped out of the workforce, the duration of unemployment lengthened, and what real hiring did occur, was only among temporary workers, who gained 47,000 jobs. These are not exactly the sort of numbers that are going to send you shooting out of the blocks in the sprint towards the midterm elections. It is screamingly obvious now that while big business has stopped large scale layoffs, they are just plain not hiring. Perhaps they see the same thing as me, the deadening impact of a slowdown in government spending, or worse, a double dip recession, that would kill them if they started adding overhead now. They have also probably figured out that starving, bankrupt consumers don't buy much. Perversely, this means that productivity will keep soaring, as will corporate profits, which is how the stock market was able to hold its own today, despite the dismal figures. There is no doubt that the administration will take the message home that not only was the last Keynesian inspired stimulus package too small, another one is needed immediately. But you can bet the next one will be far more jobs focused than the last, which had more pork than a Chicago slaughterhouse. How about a new interstate system? That would be nice. Conservatives will be outraged, insisting that the only way to economic salvation is to put more money in consumers' pockets though tax cuts. This will certainly mean bigger deficits, followed by more borrowing, and then higher taxes. It also makes the Fed's public discussion about winding down quantitative easing a bit awkward. Expect zero interest rates to take on a new lease on life. To support the piece I wrote on January 7 claiming that job growth has been zero (click here for the story)for the last decade, check out the table below.

2) I am the options whisperer. They talk to me, and I listen. At the end of 2009, enormous selling of near money calls and buying of out-of-the-money puts meant that the sophisticated investors who do this stuff, like hedge funds, were expecting the market to fall. To drill down further, REIT's saw some of the most bearish bets, a sector that inhabits my own list of short selling candidates. Unfortunately, they generated such a large short interest, they created a self fulfilling prophecy for the opposite. That's what's delivering the daily rises in the indexes so far this year. The dynamic hedging these positions demand might be just enough to squeeze the last ten percent out of this move up. The average bull market is 17 months, and we are 10 months into this one. But if last year is any guide, history is worthless and will only get you in trouble. Retail participation in this rally has been absolutely zip, all their money pouring into bond funds instead. No one yet knows what the 'new' normal is. I'd hold back before piling on any shorts of real size. Just thought you'd like the heads up.

3) Thanks to China's 'one child only' adopted 30 years ago, and a cultural preference for children who grow up to become family safety nets, there are now 32 million more boys under the age of 20 than girls. Large scale interference with the natural male:female ratio has been tracked with some fascination by demographers for years, and is constantly generating unintended consequences. Until early in this century, starving rural mothers abandoned unwanted female newborns in the hills to be taken away by 'spirits.'.Today pregnant women resort to the modern day equivalent by getting ultrasounds and undergoing abortions when they learn they are carrying girls. Today millions of children are 'little emperors,' spoiled male-only children who have been raised to expect the world to revolve around them. The resulting shortage of women has led to an epidemic of 'bride kidnapping' in surrounding countries. Stealing of male children is widespread. The end result has been a barbell shaped demographic curve unlike that seen in any other country. The Beijing government says the program has succeeded in bringing the fertility rate from 3.0 down to 1.8, well below the 2.1 replacement rate. As a result, the Middle Kingdom's population today is only 1.2 billion instead of 1.6 billion. Political scientists have long speculated that an excess of young men would lead to more bellicose foreign policies by the Middle Kingdom. But so far the choice has been for commerce'?to the detriment of America's trade balance. Economists now wonder if the practice will also understate China's long term growth rate. Parents with boys tend to be bigger savers, so they can help sons with the initial big ticket items in life, like an education, homes, and even cars. The end game for this policy has to be the Japan disease; a huge population of senior citizens with insufficient numbers of young workers to support them. The markets won't ignore this.

'Direction comes from America, leadership comes from abroad,' said Jordan Kotick, a technical analyst with Barclays Capital.