Is the Stock Market Calling a Democratic Win in November?

If true, the implications for your stock portfolio could be momentous. So why is the stock market REALLY going down?

The oil industry would far and away be the worst affected. That explains why big companies such as Exxon Mobile (XOM) are hitting new one-year lows, even though the price of Texas tea has risen by an impressive 50% since the summer.

Also taken out to the woodshed for a spanking have been steel and coal. It is fascinating to note that the shares of the supposed beneficiaries of the trade war, coal (KOL) and steel (X), have on average dropped twice as much as the victims, such as technology, since the correction began in February.

China buys some 70% of all US coal exports, which is why the principal US rail routes have shifted from going from North-South to East-West.

Tape readers believe it is a direct outcome of the tit-for-tat trade war with China. But given the small numbers out so far I believe this is being vastly overexaggerated by the media.

The $100 billion out of $1 trillion in two-way trade, generating a total of $25 billion in new tariffs between the two countries, is too small to even affect the GDP numbers.

Academics and Fed watchers argue that the infinitesimal rate of interest rate hikes by our central banks, six in three years, is finally starting to bite. It's just a matter of time before the frog realizes that it has been boiled.

Technology is the lead sector in the market, and it doesn't borrow AT ALL, accounting for 25% of market capitalization, funding growth entirely through cash flow.

In Washington there is a different view.

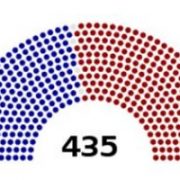

Plunging share indexes, bringing the biggest intraday swings seen in a decade, can only mean one thing. The Democrats may be about to retake Congress.

The Democrats only need to seize 24 seats in the House and two seats in the Senate to achieve a simple majority.

So far, some 38 House Republicans have announced they are not running for reelection. It's not because they are tired of exercising power. It's because they don't believe they can survive either a Democratic onslaught, or a primary challenge from the far right wing of their own party.

They also are facing the lowest presidential popularity ratings ever seen for a midterm election. Until a few weeks ago, Trump was scraping the basement with a 36% approval, also it has ticked up recently.

So if the Dems take control, what are the investment implications?

A president from one party and a congress from the other is a fairly common occurrence. That was the state of affairs during the past six years of the Obama administration, and the past two years of George Bush's.

In other words, it's a survivable situation.

It has long been said that markets love gridlocked government. At the end of the day, they wish Washington would go away so everyone can get on with the important business of making money.

For a start, a Democratic win would assure that no important legislation would be passed into law for two years.

But it goes beyond that. Majority control means that the Democrats would get control of the chairmanships of every committee. That means that the investigation of Trump's various actions would escalate from a slow burn to a full-fledged flash fire.

While this may occupy the headlines of newspapers, it will have minimal impact on the markets or the economy. Only the hard cases will even notice.

And now for a quickie civics lesson, which I understand they don't teach in high school anymore.

A Democratic win in the Senate would almost certainly bring an impeachment trial, where only a simple major majority of 51 is required. That would stall markets for about three months.

And no matter how rosy the prospects are for Democratic gains, they are unlikely to reach the two-thirds majority needed for an actual conviction.

For that the Dems would have to win 94 seats, a near impossibility in this heavily gerrymandered country. Just to get a simple majority in the House, the Democrats have to win 58% of the popular vote. But they could reach a tipping point.

In short, it's all looking like 1975 all over again. What happened after 1975? After collapsing 45%, then rallying from a Nixon resignation low of a Dow Average of 550 to 1,000, it then took EIGHT YEARS for stocks to rally another 1,000 points.

Wall Street shrank dramatically, and many brokers become taxi drivers. It's not a pleasant prospect, except that today they would become Uber drivers.

I remember it like it was yesterday.

The endless bear market was a major reason why I started my career as a financial journalist for The Economist magazine in London rather than heading straight for Wall Street.

Once the new bull market started in 1983, I was inside Morgan Stanley (MS) within a year, while it was still private.

And thanks to Bob Baldwin for the job, a Navy man and Ivy Leaguer who lived to 95!

If the election was held tomorrow, the Democrats would almost certainly get control. But the election is not tomorrow, it is in seven months, and in politics that could be seven lifetimes.

Polls could improve for Trump. But then they could get a whole lot worse, too. And then there is Robert Mueller constantly lurking at the periphery.

In the end, markets might not do much of anything in a gridlocked government.

Much of the prosperity of America has occurred independent of the goings on in the nation's capital. It has taken place in spite of, not because of government policies.

Technology companies, now 25% of the economy (it was 26% two weeks ago) will continue to push the envelope forward at a hyperaccelerating rate, creating trillions of dollars in new shareholder value.

Thank goodness for that!

However, the volatility to get to nothing could be extreme, as we now are witnessing.

Dow Average 1972-83