It?s All About the Euro

Wednesday will be all about the Euro. That is the day that the European Central Bank announces the result of the next tranche of its quantitative easing program, the LTRO, or Long Term Financial Reorganization policy.

This is the program that allows European banks to borrow unlimited funds at 1% with no questions asked. This is very important for all asset prices worldwide, since the cash pouring out of the continent has been the primary driver of asset prices skyward since December.

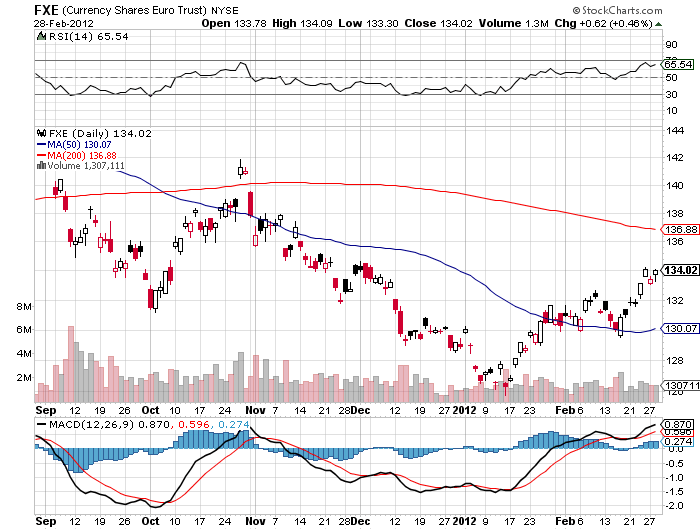

It is safe to say that ?500 billion is in the price. That is what the beleaguered currency?s rally from $1.26 to $1.35 has been all about. The unwind of Euro shorts in the sterling and yen crosses have also been a factor. If the ECB delivers ?1 trillion instead, the Euro will pop to $1.37 and risk assets everywhere will rally. If they don?t, expect a low volume bleed off in prices, and the long awaited correction to begin. It is a coin toss which way it will go, so I shall watch from the sidelines.

Anticipation of more sugar infusions from the government has sparked the monster rally in the sovereign debt markets that I predicted last month. Spanish ten year bonds have fallen from 5.8% to 5.5%, while similar Italian yields have made it all the way down from 6.0% to 5.4%. That is quite a long way from the 8.0% peak we saw as recently as December.

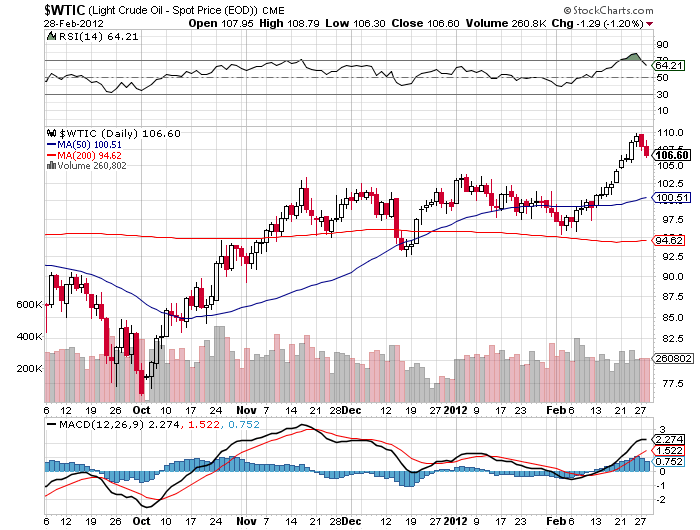

Oil has been another new assist juicing the Euro. If the Euro falls, then the local cost of fuel in Europe would rise sharply, as oil is prices in dollars. This would exacerbate the recession already in progress on the continent. These concerns could prompt ECB president Mario Draghi to delay further interest rates cuts, generating more Euro strength.

If we do get the move to $1.37, that should clean out a big chunk of the remaining shorts, which have dropped recently, but are still huge. Since January 24, total shorts have fallen to 142,000 contracts, down from the all-time high of 171,000 contracts. That works out to $17 billion of underlying remaining on the short side.

Get the Euro back up to $1.37 and it might become an attractive short again. It?s just a matter of time before the market refocuses on Europe?s underlying fundamentals, and those are dramatically worsening by the day.