It’s Time to Start Looking at Emerging Markets

With major moves down across the entire commodity space this year, it’s time to take another look at emerging markets (EEM).

Buying low and selling high is what the Mad Hedge Fund Trader service is all about. The natural tendency of individual investors is the opposite. Emerging markets are now approaching decade lows.

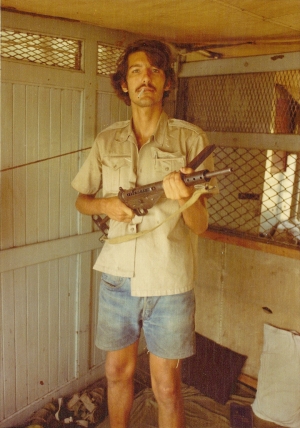

The worst-performing asset class in the world from 2014-2018, emerging stock markets were certainly taken out to the woodshed for a severe thrashing, just like my grandfather used to do when he caught me shooting at the local stop signs with my .22.

The problem is that a strong dollar is causing the debts of most private companies in these countries to increase dramatically. They usually borrow in dollars because of the lack of local currency indigenous debt markets. When the dollar is weak the math works in reverse, decreasing their debts.

All it would take is a weak dollar and a rebound in commodity prices and it will be off to the races for emerging markets once again. So, it is time to start putting emerging markets on your radar once again.

I managed to catch a few comments in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the “BRIC” term, and who recently retired from the chairman's seat at Goldman Sachs International (GS) in London.

O'Neil thinks that it is still the early days for the space, and that these countries have another 10 years of high growth ahead of them.

I have spent the past half century traveling in emerging economies, starting in 1968 when I spent a summer hitchhiking around Tunisia, Algeria, and Morocco.

To keep from getting bored in college (the advanced math classes were too easy), I took a course in tropical diseases. I then spent the next decade catching them all in Southeast Asia.

As I have been carefully monitoring emerging markets since the inception of this letter in 2008, this is music to my ears.

The combined GDP of the BRICs, Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), is rapidly approaching that of the U.S. China alone has already surpassed one-third of the $20 trillion figure for American gross domestic product.

“BRIC” almost became the “RIC” when O'Neil was formulating his strategy a decade ago.

Conservative Brazilian businessmen were convinced that the newly elected Luiz Inacio Lula da Silva would wreck the country with his socialist ways.

He ignored them and Brazil became the top-performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

Still, with growth rates triple or quadruple our own, (EEM) will not stay “resting” for long.

You can start scaling into the broad iShares MSCI Emerging Markets (EEM) ETF now. Or you can take a rifle shot with the PowerShares India Portfolio ETF (PIN), which has the brightest outlook of the bunch.