January 20, 2010

January 20, 2010

Featured Trades: (BIDU), (GOOG), (RESIDENTIAL REAL ESTATE), (SHORT CANDIDATES), (CBS), (SIRI), (HTZ), (RAD), (M), (LVS), (AMR), (CAL), (S), (AMD)

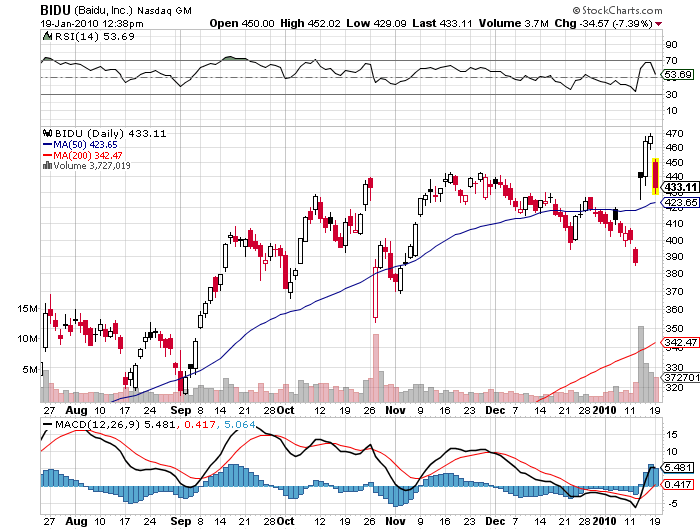

1) Long time readers of this letter know that I have been a huge fan of China?s premier Internet search engine, Baidu (BIDU), recommending it back when it was $120/share (click here for the call). To me, buying into the dominant provider in the world?s fastest growing market seemed like a no- brainer. But even I was taken aback when the stock popped $85 to $470 when Google (GOOG) announced it would no longer censor searches in the Middle Kingdom. Has it gone too far too fast? The shares now boast an incredible 76 times 2009 estimated earnings of $6.15/share and 53 times 2010 estimates of $8.38/share. How much do you pay for revenues that could potentially double overnight? BIDU is certainly rich compared to GOOG?s 38 multiple, but GOOG has an unbelievable $22 billion in cash stashed in the mattress, compared to only $400 million for BIDU. Fascinating to me is how the whole GOOG-China war has morphed into a general debate on doing business with China, which is never easy on a good day, and your worst nightmare on a bad one (just ask the companies that saw contracted deliveries turned away at dockside after prices dropped by half en route in 2008). Do a Google search today, and you are greeted with an image of determined marchers with arms linked in solidarity. Whatever your conclusion, BIDU is definitely an E-ticket ride. GOOG and China could kiss and make up tomorrow, or come up with some kind of fig leaf compromise, sending BIDU tumbling, but I wouldn?t hold my breath. I know how stubborn and nationalistic the Chinese can be from hard earned experience. Ask me what to do tomorrow. I?m having dinner with China?s ambassador to the US tonight.

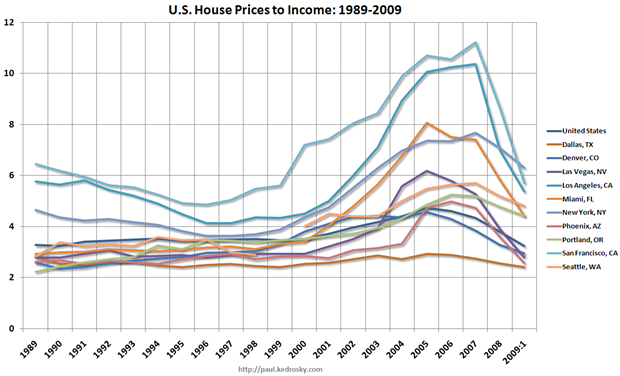

2) As much as I would love to tell my friends to rush out and how a house now, I just can?t bring myself to do it. Take a look at the chart below of US house prices relative to incomes showing that homes are still expensive, and that prices continue to fall. On this basis, Los Angeles, San Francisco, and New York are the most costly markets in the country that are falling the fastest. Bank analysts and lenders take note. Home sales figures are turning soggy again, 25% of homeowners are underwater on their mortgages, a new wave of foreclosures is imminently going to slam the market, and one out of? six Americans are jobless and absent from the economy. That eliminates 40% of the buyers from the get go. There is also the mother of all demographic problems overhanging real estate, which no one seems to see but me. If you absolutely have to buy a home, make sure that you pick up one of those once-in-a-lifetime deals where you are taking it off a bank, or out of foreclosure, at 20% below the appraised value. I know these deals are happening. Buy it because you need a place to live, not an investment, and don?t count on selling it for a decent profit this decade. And also don?t expect to get the first born child you are putting up for collateral back until they are a teenager.

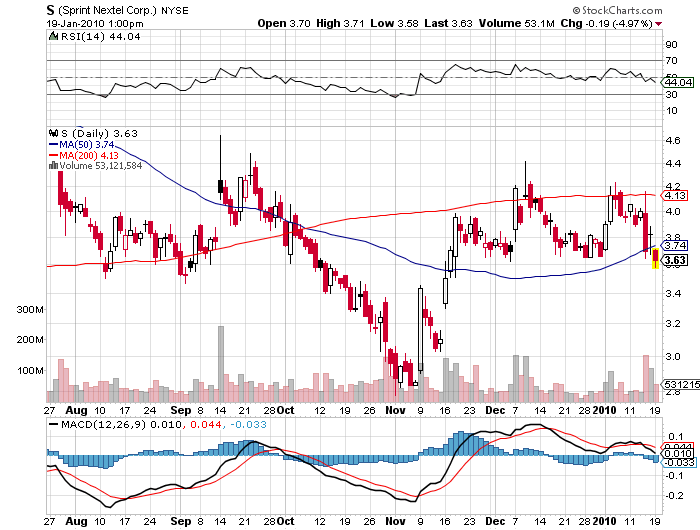

3) Fear of law suits prevents most analysts from publishing lists of short selling targets. But the Audit Integrity Co., a forensic accounting firm,?? regularly posts lists of public companies they believe may go bankrupt (see http://www.auditintegrity.com). Many of their picks reflect the accelerating shift from the old economy to the new economy. With offices in New York and Los Angeles, they look at leverage, market position, debt, and their own proprietary indicators. Another red flag are the legal shenanigans that companies resort to when coming out of a recession, like writing off large amounts of good will. In the media space CBS (CBS), Sirius XM Radio (SIRI), and Hertz Global (HTZ) are at risk. In the consumer field, Rite Aid (RAD), Macy?s (M), and Las Vegas Sands (LVS) made the list. Advanced Micro Devices (AMD) is the largest tech company to warrant scrutiny. Airlines, always a favorite of bankruptcy mavens, include American Airlines (AMR), and Continental (CAL). Sprint Nextel (S) tops the list of telecom companies. With the stock market looking very toppy here, better take that portfolio out and give it a good scrubbing.

?Buy when everyone else is selling, and hold until everyone else is buying. This is not merely a catchy slogan. It is the very essence of successful investing,? said oil billionaire,?? Jean Paul Getty, the founder of Getty Oil, a pioneer in the Neutral Zone, and once the richest man in America.