January 8, 2010

January 8, 2010 Featured Trades: (GLOBAL GDP GROWTH),

(FXI), (IDX), (EWZ), (EWH), (EWY),

(SPAIN), (BILL FLECKENSTEIN), (TBT),

(GOLD), (WHEAT), (DIN), (JWN), (RIMM),

(HEDGE FUND RADIO)

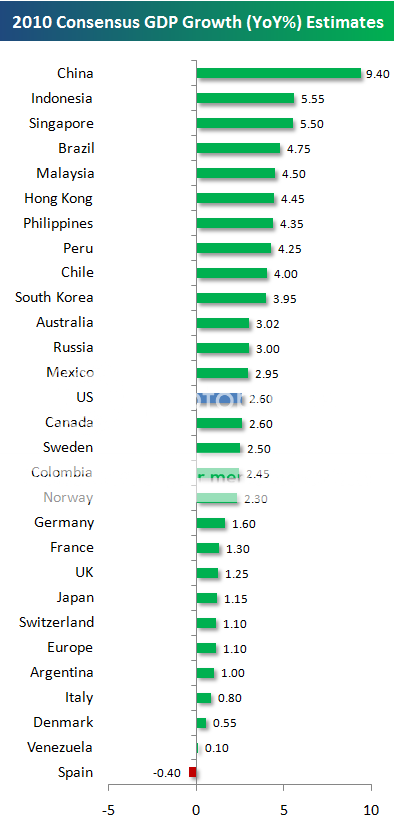

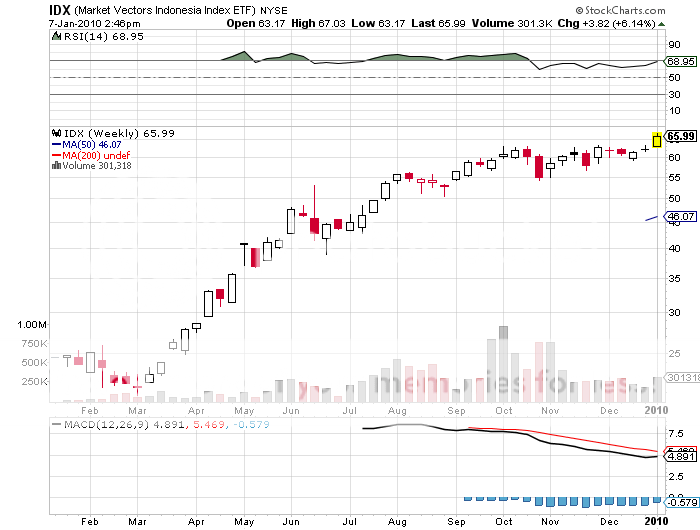

1) If you want to know who is going to win the international investment sweepstakes, take a look at the table of 2010 consensus GDP Growth Estimates below. The ranking, prepared by the good folks at the Bespoke Investment Group, is very crowded at the top with countries I have been banging the table about for the last year. The odds on favorite is China (FXI), coming in at a breathtaking 9.4% forecast. The truly amazing thing is that China continues delivering blistering growth, while having the fourth largest GDP in the world ($4.3 trillion), after the EC ($18.4 trillion), the US ($14.4 trillion), and Japan ($4.9 trillion). That?s why it is my lead canary in the coal mine for the global risk appetite, which at the moment is expanding. Next comes Indonesia (IDX), an emerging market oil and LNG exporter, and one of the top performing stock markets last year, boasting a 5.55% forecast. Brazil (EWZ), the country that does everything right and will host the 2016 Olympics (look at the astronomical move China?s market delivered in the eight year run up to their Olympics), could bring in a 4.75% rate. Hong Kong (EWH) comes in at 4.45%, no doubt benefiting from proximity to the Middle Kingdom. South Korea (EWY) is expected to bring in a 3.95% growth rate. The US (SPX) growth forecast is at 2.6%, very close to my own. Skip Spain, which is enduring a subprime induced real estate meltdown that makes ours look like a walk in the park, and suffers the only negative GDP forecast for 2010. It is no revelation that you should be shoveling money into high growth countries, and passing on the also rans, like the US.

2) I have worshipped legendary hedge fund manager, Bill Fleckenstein, as the God that he is for decades. So I thought it was time to catch up with the noted bear to get his take on the New Year. The sky high expectations for 2010 now endemic will disappoint, with the year ending substantially lower than we are now.?? In a stroke of genius, Fleck, as he is know to his friends, closed his short only fund in March ahead of the coming onslaught of stimulus he saw. When the Dow popped above 10,000, Fleck took out his ?Dow 10,000? hat and symbolically placed it on top of the six foot tall stuffed grizzly he keeps in his office. The same idiots who sold the bottom in March are now buying the top, and some fantastic short selling opportunities are setting up. He is in no rush, though, as it is tough to short against zero interest rates. This could be the year when serious money is once again made on the short side. His favorite targets will be technology companies, where double ordering of components is now rampant, as Kool-Aid drinking managers rush to replenish depleted inventories. Research in Motion (RIMM) is a train wreck where he already has a big short position. Retailers like high end department stores with weak balance sheets, such as Nordstrom (JWN), are also in his cross hairs, as are restaurant chains like IHOP (DIN). ?Anything with a bad balance sheet will get clubbed,? said Bill, with the subtlety of a 20 pound sledge hammer. Big banks are one big fantasy in a world of make believe, but are really more of a macro call here. With the government changing the rules every day, he?ll stay away. Long Treasury bonds are a bubble waiting to burst, and the TBT is a home run staring you in the face. He can understand why the low end in residential real estate is holding up, since the government is offering a tax free bribe of $8,000 to all comers. But the high end is in serious trouble, and it is raining McMansions in tony neighborhoods.?? The nightmare won?t end until the banks foreclose on everything and then puke it all out, putting in the real bottom. This could be a long time off. He doesn?t see any way commercial real estate can avoid disaster. Commercial REITS are a screaming sell, which are falling off a cliff but haven?t felt any pain because they haven?t hit bottom yet. The current stock market bubble could continue for a few months, with Congress passing more stimulus projects to save their own skins in November. The bell will ring that the top is in when foreigners take away our printing presses by boycotting Treasury auctions, sending stocks bonds, and the buck into a simultaneous tailspin. That will be the time to get aggressive. What Fleck does like is gold and silver. To meet the big increase in demand, either production or prices have to go up, and he votes for the latter. Fleck congenitally despises all fiat currencies, but hold a gun to his head and he?ll tell you to buy the Canadian dollar (FCX), where a wealth of energy, metal, and food exports will enable the looney to outperform the others. Buy wheat. Traders were transfixed by last year?s huge American crop, when in reality, 40% of the wheat producing areas of the world are suffering prolonged droughts, and $8/bushel is not out of the question. Heavy autumn rains caused much of that to rot in the field, and now a horrific winter auguring for even higher prices.

For more on Fleck?s views, go to his insightful and informative blog called the ?Daily Rap? by clicking here , which is literally worth its weight in gold. You can also catch Fleck?s weekly view at MSN by clicking here . To listen to my interview with Fleck in its entirety, where he offers a wealth of trading tips and insights please go to Hedge Fund Radio by clicking here .

3) My guest on Hedge Fund Radio this week will be Tom Lydon, editor and publisher of ETF Trends, the go-to website for all things about the ?exchange traded fund,? or ETF industry. Tom is also president of Global Trends Investments, an investment advisory firm specializing in high-net worth individuals. Tom has been involved in money management for more than 25 years. He began his career with Fidelity Investments,?? and was a founding member of Charles Schwab?s Institutional Advisory Board. Tom is the author of two books, The ETF Trend Following Playbook, and iMoney: Profitable Exchange-Traded Fund Strategies for Every Investor. You can learn more about Tom by visiting his website http://www.etftrends.com/ . Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com or click here , click on ?Listen Live!?, and click on ?Houston 1110 AM KTEK.??? For archives of past Hedge Fund Radio shows, please go to my website by clicking here .

?Never short valuation

. I?ve got the scars on my back to prove it,? said Doug Kass of hedge fund Seabreeze Partners.