Mad Hedge Technology Alerts!

Automation is taking place at warp speed displacing employees from all walks of life.

According to a recent report, the U.S. financial industry will depose of 200,000 workers in the next decade because of automating efficiencies.

Yes, humans are going the way of the dodo bird and banking will effectively become algorithms working for a handful of executives and engineers.

The x-factor in this equation is the direct capital of $150 billion annually that banks spend on technological development in-house which is higher than any other industry.

Welcome to the world of lower cost, shedding wage bills, and boosting performance rates.

We forget to realize that employee compensation eats up 50% of bank expenses.

The 200,000 job trimmings would result in 10% of the U.S. bank jobs getting axed.

The hyped-up “golden age of banking” should deliver extraordinary savings and premium services to the customer at no extra cost.

Mobile and online banking has delivered functionality that no generation of customers has ever seen.

The most gutted part of banking jobs will naturally occur in the call centers because they are the low-hanging fruit for the automated chatbots.

A few years ago, chatbots were suboptimal, even spewing out arbitrary profanity, but they have slowly crawled up in performance metrics to the point where some customers are unaware they are communicating with an artificial engineered algorithm.

The wholesale integration of automating the back-office staff isn’t the end of it, the front office will experience a 30% drop in numbers sullying the predated ideology that front office staff are irreplaceable heavy hitters.

Front-office staff have already felt the brunt of downsizing with purges carried out in 2018 representing a fifth year of decline.

Front-office traders and brokers are being replaced by software engineers as banks follow the wider trend of every company transitioning into a tech company.

The infusion of artificial intelligence will lower mortgage processing costs by 20% and the accumulation of hordes of data will advance the marketing effort into a smart, hybrid cloud-based and hyper-targeted strategy.

Historically, a strong labor market and low unemployment boost wage growth, but national income allocated to workers has dipped from about 63% in 2000 to 56% in 2018.

Causes stem from the deceleration in union membership and outsourcing has snatched away negotiating power amongst workers and the implemented mass automation has poured fat on the fire.

I was recently in Budapest, Hungary on a business trip and on a main thoroughfare, a J.P. Morgan and Blackrock office stood a stone’s throw away from each other employing an army of local English-proficient Hungarians for 30% of the cost of American bankers.

Banks simply possess wider optionality to outsource to an emerging nation or to automate hard-to-fill positions now.

In this race to zero, companies can easily rebuff requests for higher salaries and if they threaten to walk off the job, a robot can just pick up the slack.

Automation is getting that good now!

The last two human bank hiring waves are a distant memory.

The most recent spike came in the 7 years after the dot com crash of 2001 until the sub-prime crisis of 2008 adding around half a million jobs on top of the 1.5 million that existed then.

The longest and most dramatic rise in human bankers was from 1935 to 1985, a 50-year boom that delivered over 1.2 million bankers to the U.S. workforce.

This type of human hiring will likely never be seen again in the U.S. financial industry.

Recomposing banks through automation is crucial to surviving as fintech companies are chomping at the bit and even tech companies like Amazon and Apple have started tinkering with new financial products.

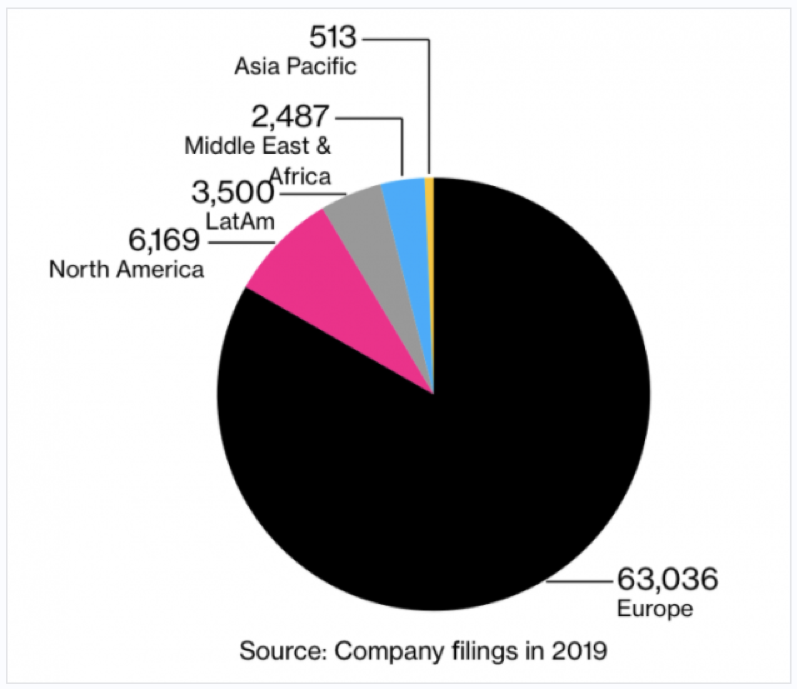

And if you thought this phenomenon was limited to the U.S., think again. Europe is by far the biggest culprit by already laying off 63,036 employees in 2019, more than 10x higher the number of U.S. financial job losses.

In a sign of the times, the European outlook has turned demonstrably negative with Deutsche Bank announcing layoffs of 18,000 employees through 2022 as it scales down its investment banking business.

Germany banks are also passing on the burden of negative interest rates to their clients.

A recent survey by Deutsche Bundesbank shows that 58% of banks are charging all savers negative interest rates while others only target wealthy and corporate clients.

If the U.S. dips into negative rates in the future, expect the same nasty effect on job force cuts that Europe has experienced.

Either way, don’t tell your kid to get into banking because they will most likely be feeding on scraps in the future.

2019 GLOBAL JOB LOSSES IN FINANCE

Mad Hedge Technology Letter

December 20, 2019

Fiat Lux

Featured Trade:

(THE BIG TECH TRENDS OF 2020)

(AAPL), (GOOGL), (FB), (AMZN), (NFLX)

The year is almost in the rear-view mirror – I’ll make a few meaningful predictions for technology in 2020.

Although iPhones won’t go obsolete in 2020, next year is shaping up as another force multiplier in the world of technology.

Or is it?

A trope that I would like to tap on is the severe shortage of innovation going on in most corners of Silicon Valley.

Many of the incumbents are busy milking the current status quo for what it’s worth instead of targeting the next big development.

Your home screen will still look the same and you will still use the 25 most popular apps

This almost definitely means the interface that we access as a point of contact will most likely be unchanged from 2019.

It will be almost impossible for outside apps to break into the top 25 app rankings and this is why the notorious “first-mover advantage” has legs.

The likes of Google search, Gmail, Instagram, Uber, Amazon, Netflix and the original list of tech disruptors will become even more entrenched, barring the single inclusion of Chinese short-form video app TikTok.

The FANGs are just too good at acquiring, cloning or bludgeoning upstart competitors.

It’s the worst time to be a consumer software company that hasn’t made it yet.

Advertising will find itself migrating to smart speakers

Amazon and Google have blazed a trail in the smart speaker market but ultimately, what’s the point of these devices in homes?

Exaggerated discounting means hardware profits have been sacrificed, and the lack of paid services means that they aren’t pocketing a juicy 30% cut of revenue either.

These companies might come to the conclusion that the only way to move the needle on smart speaker revenue is to infuse a major dose of audio ads to the user.

So if you are sick to your stomach of digital ads like I am, you might consider dumping your smart speaker before you are forced to sit through boring ads.

Amazon’s Alexa will lose momentum

In a way to triple down on Alexa, Amazon has installed it into everything, and this is alienating a broad swath of customers.

Not everyone is on the Amazon Alexa bandwagon, and some would like Amazon’s best in class products and services without involving a voice assistant.

Privacy suspicion has gone through the roof and smart speakers like Alexa could get caught up in the personal data malaise dampening demand to buy one.

Your voice is yours and 2020 could be the first stage of a full onslaught of cyber-attacks on audio data.

Don’t let hackers steal your oral secrets!

Cyber Warfare and AI

Hackers have long been experimenting with automatic tools for breaking into and exploiting corporate and government networks, and AI is about to supercharge this trend.

If you don’t know about deep fakes, then that is another thorny issue that could turn into an existential threat to the internet.

Not only could 2020 be the year of the cloud, but it could turn into the year of cloud security.

That is how bad things could get.

A survey conducted by Cyber Security Hub showed 85% of executives view the weaponization of AI as the largest cybersecurity threat.

On the other side of the coin, these same companies will need to use AI to defend themselves as fears of data breaches grow.

AI tools can be used to detect fraud such as business email compromise, in which companies are sent multiple invoices for the same work or workers duped into releasing financial information.

As AI defenses protect themselves, the sophistication of AI attacks grows.

It really is an arms race at this point with governments and private business having skin in the game.

Facebook gets out of the hardware game because consumers don’t trust them

Remember Facebook Portal – it’s a copy of the Amazon Echo Show.

The only motive to build this was to bring it to market and expect Facebook users to adopt it which backfired.

Facebook will find it difficult convincing users to use more than Facebook and Instagram software apps.

Don’t wait on Facebook to roll out some other ridiculous contraption aimed at stealing more of your data because there probably won’t be another one.

This again goes back to the lack of innovation permeating around Silicon Valley, Facebook’s only new ideas is to copy other products or try to financially destroy them.

China continues to out-innovate Silicon Valley.

The rise of short-form video app TikTok is cementing a perception of China as the home of modern tech innovation, partly because Silicon Valley has become stale and stagnated.

China has also bolted ahead in 5G technology, fintech payment technology, unmanned aerial vehicle (UAV) and is giving America a run for their money in AI.

China’s semiconductor industry is rapidly catching up to the US after billions of government subsidies pouring into the sector.

Silicon Valley needs to decide whether they want to live in a tech world dominated by Chinese rules or not.

Augmented Reality: Is this finally the real deal?

Augmented reality (AR) is still mainly used for games but could develop some meaningful applications in 2020.

Virtual Reality (VR) and AR will play a big role in sectors such as education, navigation systems, advertising and communication, but the hype hasn’t caught up with reality.

One use case is training programs that companies use to prepare new workers.

However, AR applications aren't universally easy or cheap to deploy and lack sophistication.

AR adoption will see a slight uptick, but I doubt it will captivate the public in 2020 and it will most likely be another year on the backburner.

Apple’s New Projects

Apple has two audacious experimental projects: a pair of augmented-reality glasses and a self-driving car.

The car, for now, has no existence outside of a few offices in California and some hires from companies like Tesla.

And, at the earliest, the glasses won’t hit shelves until 2021,

The car is likely to fizzle out and Apple will be forced to double down on digital content and services to keep shareholders happy which is typical Tim Cook.

The 5G Puzzle

Semiconductor stocks have been on fire as investors front-run the revenue windfall of 5G and the applications that will result in profits.

Select American cities will onboard 5G throughout 2020, but we won’t see widespread adoption until later in the year.

5G promises speeds that are five times faster than peak-performance 4G capabilities, allowing users to download movies in five seconds.

With pitiful penetration rates at the start, the technology will need to grow into what it could become.

The force multiplier that is 5G and the high speeds it will grace us with probably won’t materialize in full effect until 2021.

Each of the nine tech developments in 2020 I listed above negatively affects US tech margins and that will follow through to management’s commentary in next year’s earnings and guidance.

Tech shares are closer to the peak and the bull market in tech is closer to the end.

Innovation has ground to a halt or is at best incremental; companies need to stop cloning each other to death to grab the extra penny in front of the steamroller.

Profit margins will be crushed because of heightened regulation, transparency issues, monitoring costs, and the unfortunate weaponizing of tech has been a brutal social cost to society.

Tech is saturated and waiting for a fresh catalyst to take it to the next level, but that being said, tech earnings will still be in better shape than most other industries and have revenue growth that many companies would cherish.