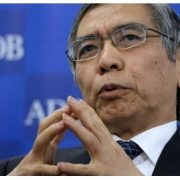

New BOJ Governor Crushes the Yen

Wow! What a day! In perhaps the most dramatic policy move by any central bank, anywhere in history, the Bank of Japan pulled out all the stops to stimulate its moribund, demographically challenged economy. Japan is now lapping its competitors in Europe and the US in the international race to the bottom.

The markets certainly got the memo. Japan?s beleaguered currency collapsed nearly 4% over night, one of the biggest single day moves ever. The ten-year Japanese government bond yield plummeted to a breathtaking 44 basis points, another record low, making our own Treasuries look positively high yield. The Japanese stock market rocketed.

I was busier than the proverbial one-handed paperhanger. There?s nothing like waking up early in the morning and finding that your largest short position has just enjoyed one of the sharpest falls on record. It doesn?t get any better than that in hedge fund land.

So I shipped out the Trade Alerts as fast as I could write them, burning up the national broadband covering those shorts. I also took profits on my short in United Continental Group (UAL). I then turned around and plowed some of my profits back into an increased short position on the S&P 500 Index.

The actions on the new BOJ governor, Haruhiko Kuroda, who only moved into his office on Monday, were nothing less than mind blowing. He plans to double the money supply in two years. He broadened the range of instruments it plans to buy to cover everything from 20 year government bonds to equity ETF?s. No time wasted getting one?s feet under the desk here!

Quantitative easing will be increased to $82 billion a month, nearly the same as Ben Bernanke?s munificent efforts. Keep in mind that Japan?s economy is only one third that of the US. It is the most inflationary and currency depreciating set of policies since Indonesia?s hyperinflation of the 1960?s. All of this, just to get the country?s inflation rate back up to 2% after decades of negative real numbers.

While the yen made it back up to ?95.6 this morning, we are clearly targeting ?100 in coming months. That has the ETF (FXY) falling from today?s $101.60 to $96, and the leverage short ETF (YCS) rising from $61.4 to $67. Use every two-point rally to slam the daylights out of the yen on the short side. That has been my advice for the past six months, and I?m going to stick with it as long as it is working.

Get to 100, and the international community will rise up against Japan?s obvious efforts to grow its economy at their expense. Korean companies are getting slaughtered by the six-month, 20% devaluation of the yen against the Won, rendering their exports prices uncompetitive. China is also pretty unhappy, and could well step up their military posture as a way of expressing its displeasure. Then, watch the fur fly!